The ONE Thing That Could Reprice The Next Fed Meeting

A small shift here moves everything

Happy New Year everyone! Stay focused, stay clear on your goals, and let’s smash this year. There’s money to be made.

The last couple of weeks have been pretty quiet. Some noise here and there, but nothing that actually moved markets. And when I say noise, I’m talking about things like the brief US bank failure “scare”, rumors flying around about a major bank going bust, which ultimately didn’t even move markets. I hate to break it to the doomers, but this just isn’t going to happen. Even that 12% probability floating around is way too high in my opinion.

Now, onto what actually will move markets.

Next up on the agenda is the Fed meeting on January 28th. I might sound like a hypocrite here because I tweeted the other day saying “don’t be that guy on Fed watch.” What I meant by that is the people who rely on a cartoonishly simple framework where Fed cut equals buy equities, Fed hold or hike equals sell. If only markets were that simple… yes, I do wish they were.

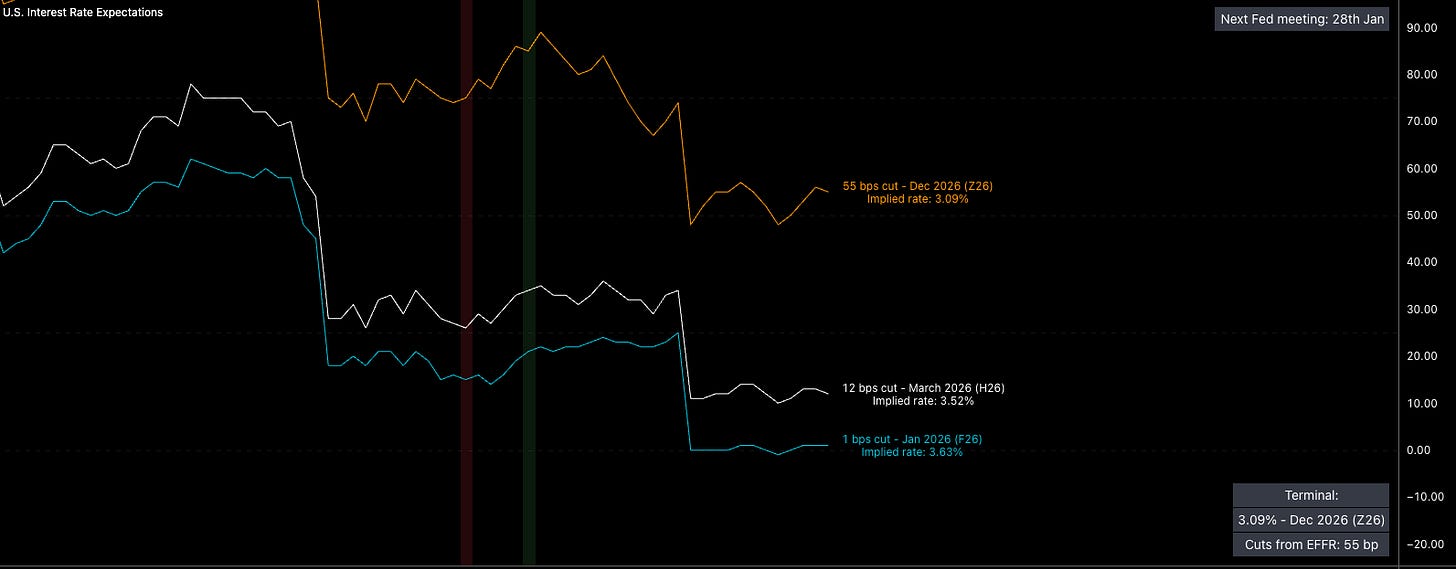

What actually matters is how many times the Fed cuts over a given period, how aggressive that policy path is, where the terminal rate sits, and just how committed they are to achieving the dual mandate (lack of discussion around this part as of recent). There is virtually nothing priced into the January meeting right now, with most expecting a hold, but there is absolutely a scenario where those odds change. The speed at which monetary policy transmits this year is way more important than the amount of cuts themsleves. Simply ask yourself: how many cuts until the terminal rate? how many meetings before then? That will literally tell you how aggressive the policy is.

I’ve explained in previous reports that even if we don’t fully reprice to outright price in a cut, any change in the Fed funds curve matters. It has a direct impact on markets because it pulls cuts from further out closer in time. That changes the speed and aggressiveness of cuts prior to terminal rate, in other words, the path.

Before I break down the one thing that could reprice the next Fed meeting, I want to be very clear about the distinction between what should happen and what will happen. One of the worst mistakes you can make in markets is assuming that your thought process, even if correct, is how the market will price it.

That one thing is NFP on Jan 9 and the knock on effect from it. Later in the report I’ll explain why growth is still strong, but it’s important to remember that the Fed has been on labor watch for a long time. I’ve broken this down multiple times. They are far more reactive to labor data than inflation data. Powell would much rather tolerate higher inflation and not throw the economy into a recession, even if recession risk is low, than bring inflation to 2% while breaking the labor market.

Because of that, another weaker jobs print would likely cause a repricing of the January meeting. That probably looks like 10 to 15 bps being priced for a cut, which effectively gives the market a 50/50 chance of a cut by the end of January. Even if it doesn’t happen on FOMC day, the repricing itself is what matters.

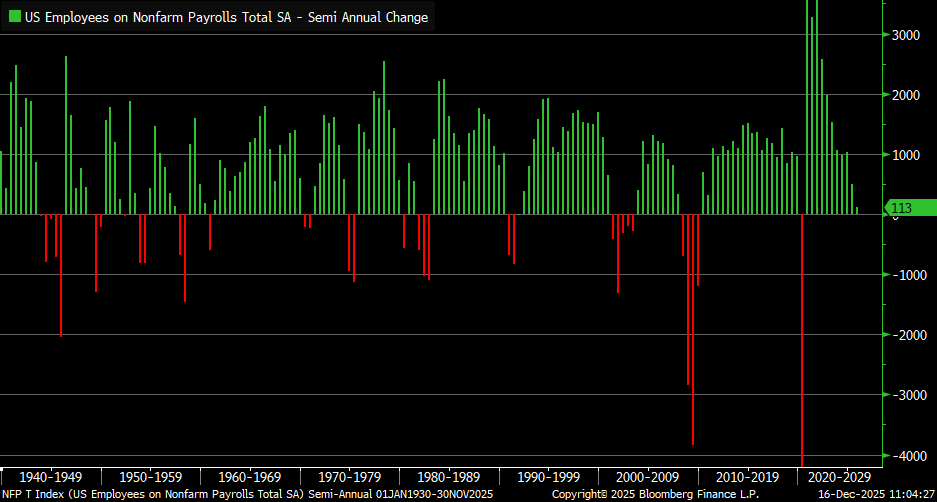

On NFP figures, zooming out a bit, headline numbers have been declining pretty heavily on a semi-annual basis.

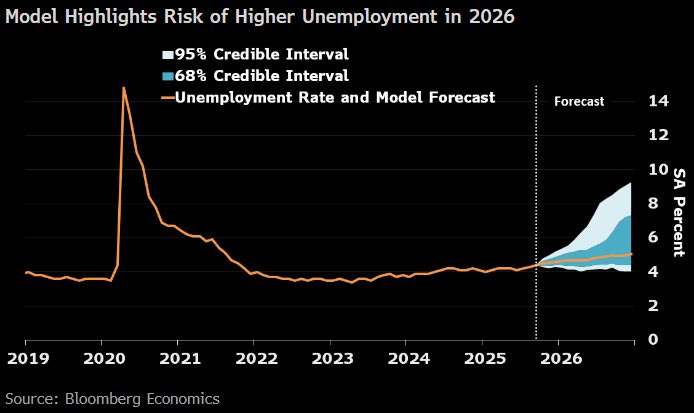

On top of that, the Fed’s focus on the dual mandate would absolutely not be comfortable with unemployment heading where it’s projected to go. A Bloomberg model shows that after incorporating the September jobs report and other October data, there’s a 1 in 3 chance of unemployment moving above 4.7%. Powell will do anything to avoid that outcome (even if the chances of getting there are low, no risks will be taken… I assume).

None of this means “the economy is doomed.” I’ll be very clear on that.

If markets truly believed the economy was heading into a labor driven recession, bonds would be rallying and definitely wouldn’t be stuck in a mean reversion regime while equities outperform them. High beta sectors (particularly industrials) also wouldn’t have lead across the last quarter, but they did.

On top of that, the S&P 500 has been underperforming RTY on a 3 month lookback. The Russell has the highest sensitivity to growth, especially labor and rates. If labor were an issue big enough to cause a slowdown, Russell 2000 companies would be trading much lower than they are right now. We’d see something very much like 2022 when equities were selling off across the board, with the Russell leading the fall quite dramatically. But instead, we’ve seen the Russell predominantly lead the S&P 500 for 182 days even as equities have ranged.

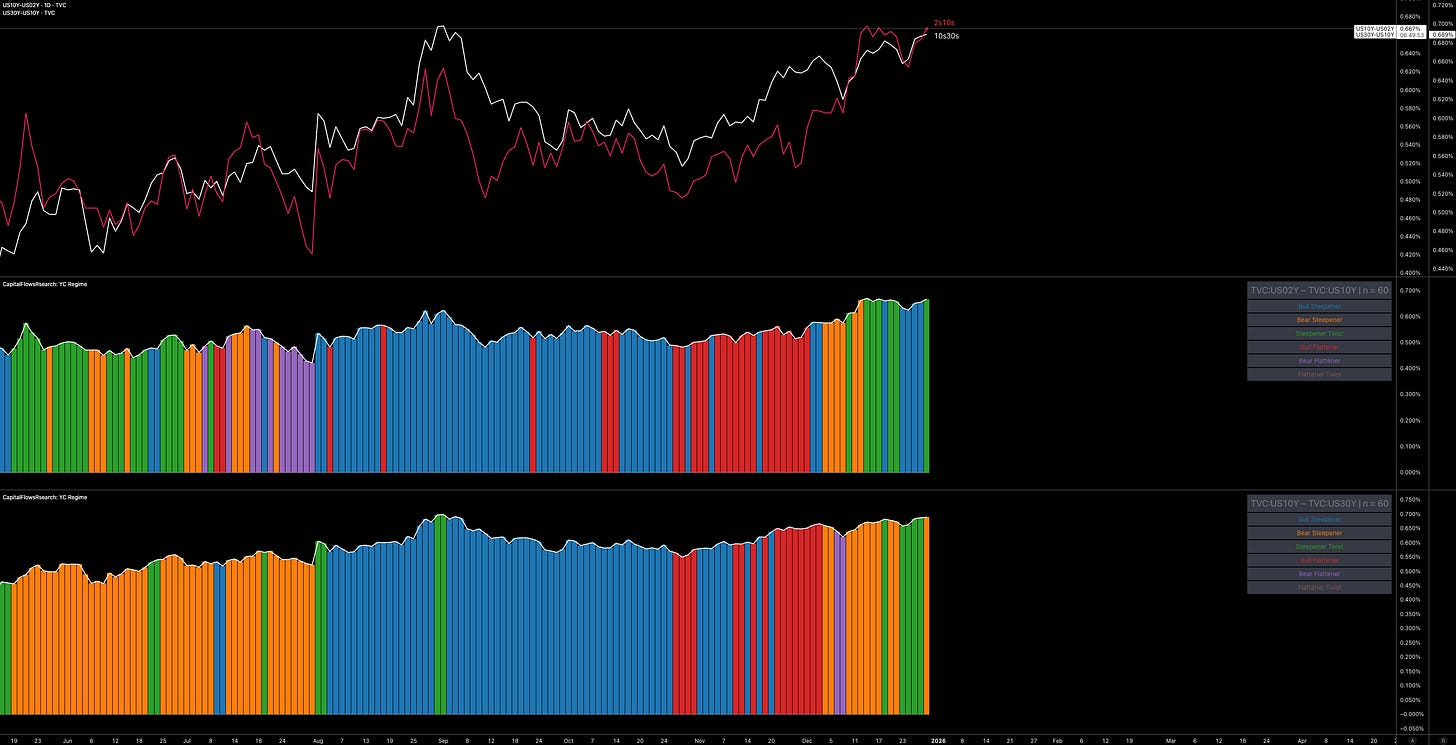

Indicator above from Capital Flows.

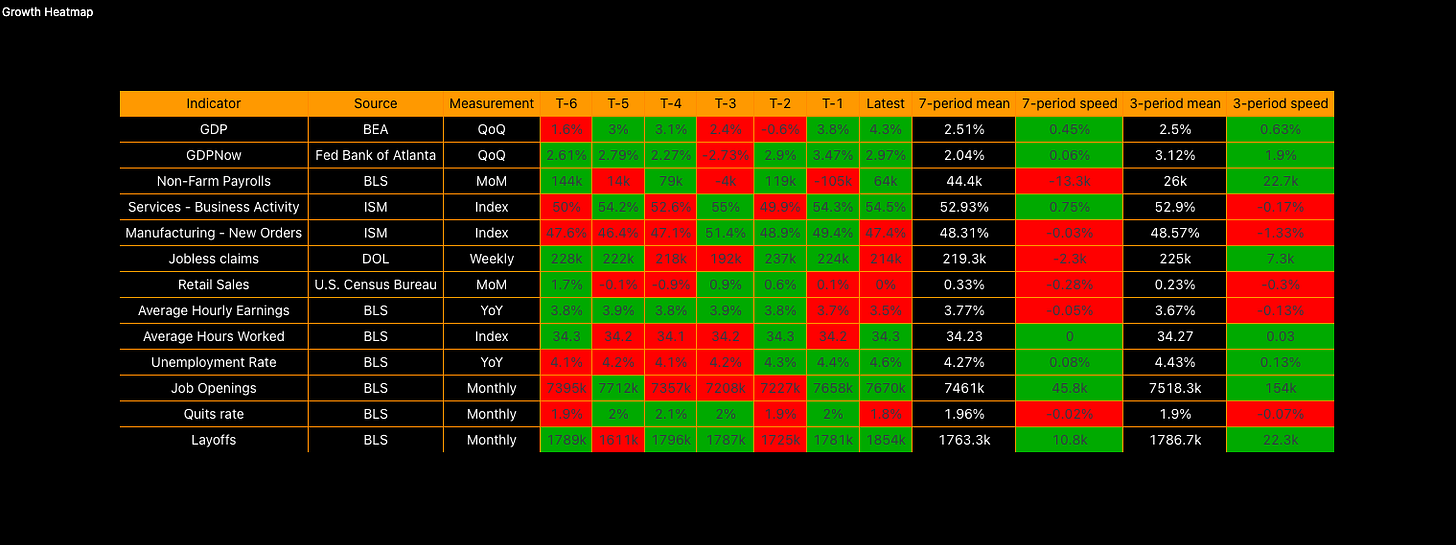

Cracks in the labor market show up at the margin first, not in headline unemployment. That’s why I focus on where stress appears early. Job openings are a great example. They’re showing positive momentum on both a 7 and 3 month basis, with the latest reading above both the 7 and 3 month means.

In a slowing economy, we wouldn’t be adding jobs... it’s simple. My thought process is that growth is strong enough to avoid recession, strong enough to support upside in equities, but labor data in isolation is not strong enough for the Fed to confidently pause across consecutive meetings. That’s the thesis I’m working with.

I honestly think the Fed holds at the January meeting, which is what’s priced in. What matters more is the repricing in the curve, especially for the March (H6) contract. If the market prices a 50/50 chance of a cut in January and the Fed doesn’t cut, the March contract likely becomes a fully priced 25 bp cut, assuming Fed communication doesn’t aggressively push back.

Once a contract is fully priced, it takes less movement in the Fed funds curve for equities to react. But as I always say, “less” liquidity from cuts being priced out or “more” liquidity from more cuts being priced in does not equal automatic positioning unwind or positioning upside. There are tons of moving parts.

Just look at how the 2s10s curve is starting to lead the 10s30s. That tells me the market is reacting more to policy and near term growth, while inflation, duration, and term premium risks are taking a backseat in the long end. What’s clear in both curves is the significant and prolonged steepening through December, after bull flattening briefly dominated as equities unwound at the margin.

As long as curves look like this, and the 10s30s doesn’t meaningfully lead the 2s10s, growth is not being crushed. Labor data in isolation, however, is enough to cause repricing in the curve. So to be clear, I’m not saying growth is cooked. I’ve argued the opposite. My view on growth and how the Fed reacts to siloed data like labor are two very different things.

I think the Fed holds in January, rates then fully price a cut in March, and that’s fine. I don’t care too much about being exactly right on that call in the near term. What I care about is positioning.

As I explained in my 2026 outlook report, equities aren’t positioned strongly enough, for several reasons I laid out there, for me to justify being leveraged long right now. Yes, I see more upside potential than downside risk, but that alone isn’t a reason to take leverage.

That said, this setup could eventually force positioning to favor more equity longs. My models aren’t signaling major long exposure yet, but when call skew shifts and we see some rotation in leadership, I’ll be much more confident holding long ES exposure into late January.

There are still plenty of moving parts. Unless vol blows out, ES begins to outperform Russell, cross border flow risk stays contained, credit spreads remain near cycle lows, and momentum starts climbing the factor rankings, I’m comfortable saying that long ES exposure is a position that likely gets expressed in the coming weeks.

Have a good one!

How do you use Excel to extract data from the BLS and the other websites

Happy new year Alfie

A great report to get stuck into and kick off the new year 🫡