Growth & Liquidity Support Positioning, but Stagflation Lurks

Positioned for Flows, Priced for Risk

Hey guys,

Just a quick note, I am back to writing reports as Substack doesn’t hold the OBS input very well after a few weeks, seems to have errors.

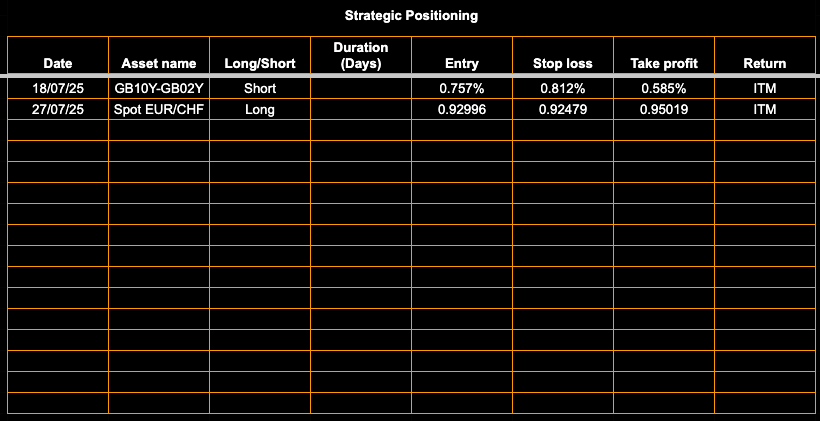

Also, you will be able to track mine and Emmanuel’s trades in our public trade tracker (at the bottom of my reports from now).

I watched a fireside chat with Bill Ackman and UBS, I took something great from it:

"Everything you need to know about investing is free and totally accessible. It's just a question of how much energy you want to put into learning"

Everything is available, it’s just how you digest the info vs your competition.

There’s no room for complacency when trying to become the best.

Let’s get into it!

Trade ideas update

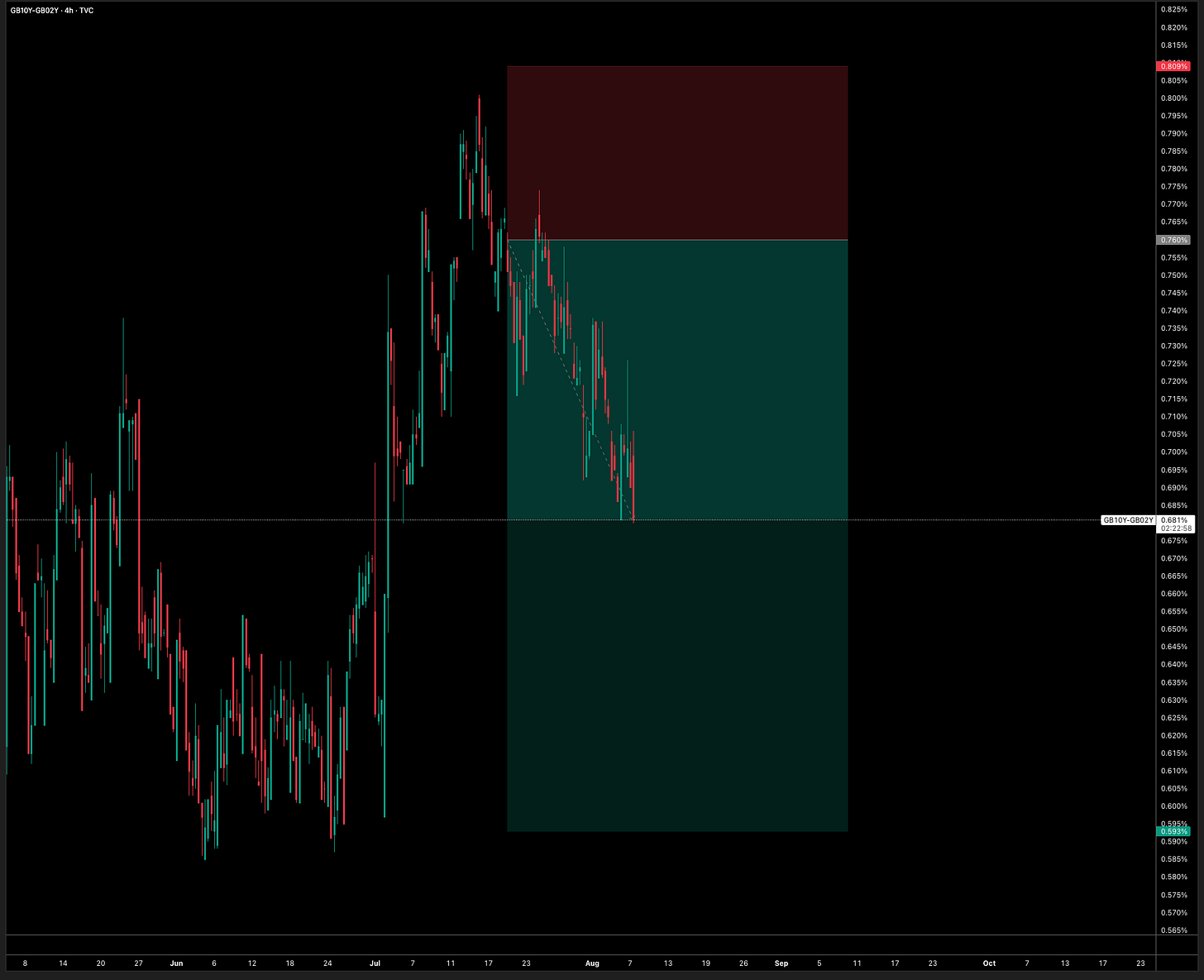

The curve flattener trade idea from a couple weeks back is well ITM, see below:

The idea is now supported by the BoE’s tone today, will likely discuss in an addition report. Trade idea report below:

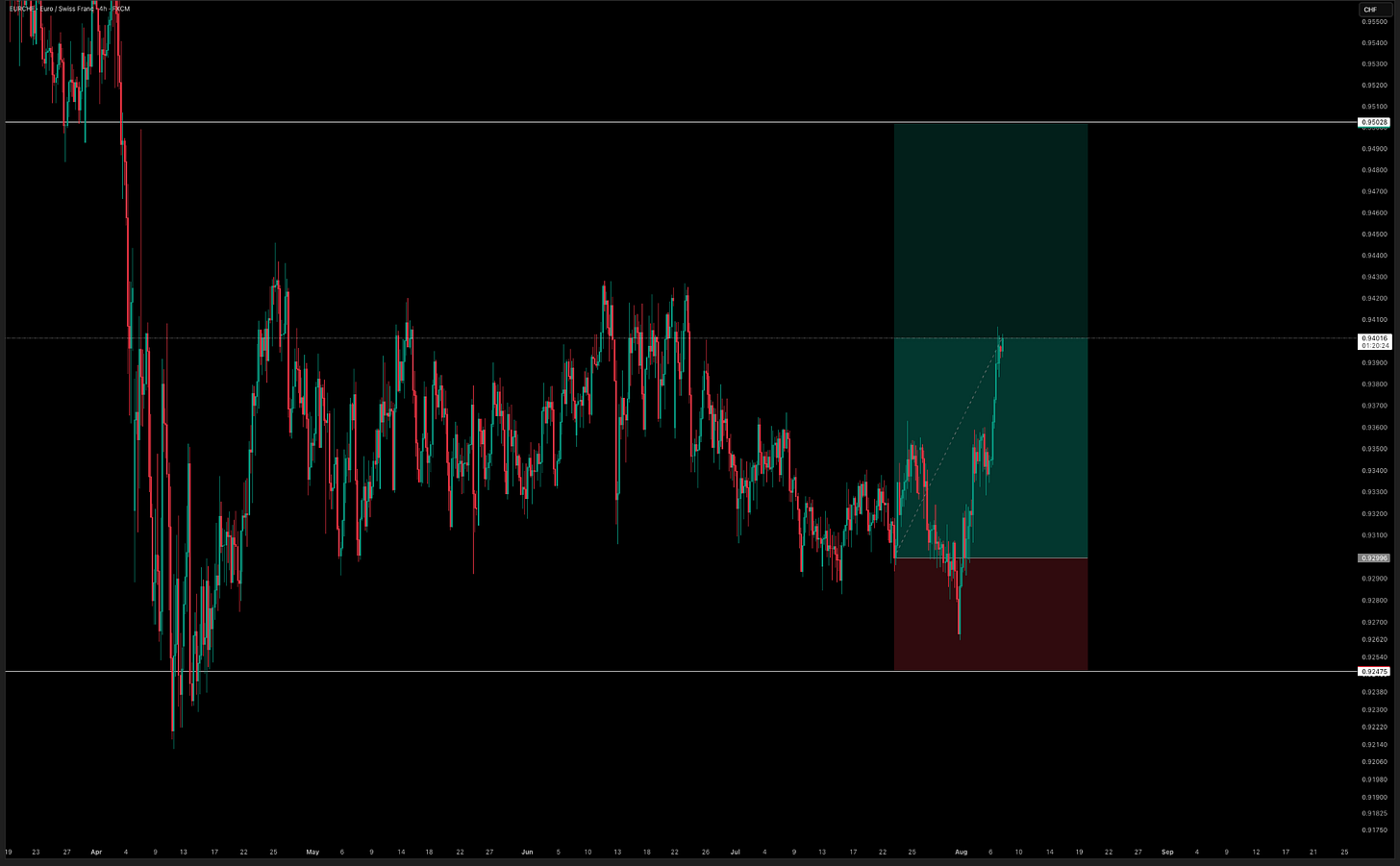

Also, Emmanuel had a great position call last week, I will leave the chart and report link below.

Liquidity & Stagflation Presence

So my idea over the last couple months has been one of a regime that is made up of some powerful moving parts that fuel growth and inflation higher. Those moving parts are predominantly the labor market and inflation data (PCE, prices paid in PMI’s, consumer spending). This has also been supported by the fact that equities are rallying through ATH’s and there’s been consistent steepening in the yield curve showing us just how strong growth is amid the Fed being “restrictive”.

So, I want to just update my stance on this regime with a few red flags beginning to show.

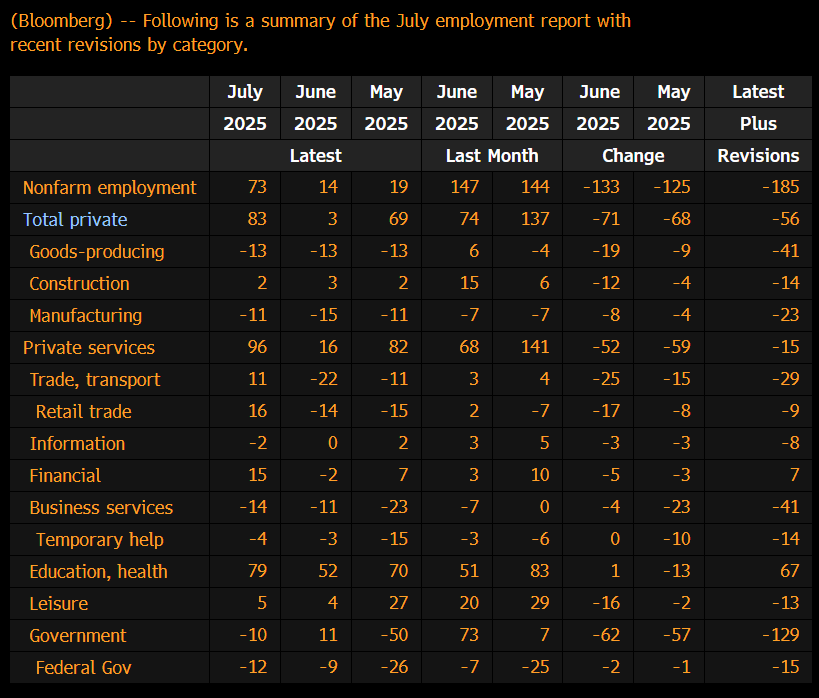

Firstly, let’s touch on the NFP revision print on Friday:

Revisions in the job market spiked lower, a lot lower. Now I don’t ever assume a regime to be over based on a couple of revisions lower, especially when growth in the economy is present (which is why we’re seeing steepening in the curve & rallying equities, this wouldn’t happen in a slow economy). But this trend in jobs data needs to be watched closely going into September’s NFP print because as I’ve emphasised before, consumer spending can act like a stimulus to inflation so if the job market begins to slow, we can see some pressures come off of growth & inflation.

ZN spiked hard on the back of the revision, but as Capital Flows spoke about in a report - “Markets immediately price extremes in this environment, regardless of outcome, because flows of capital and information are so incredibly fast in today’s world”. The reaction in ZN is definitely overblown but I’m monitoring just how much sensitivity bonds/equities have on negative labor market data (because honestly that’s where a lot of strength has been held in this cycle).

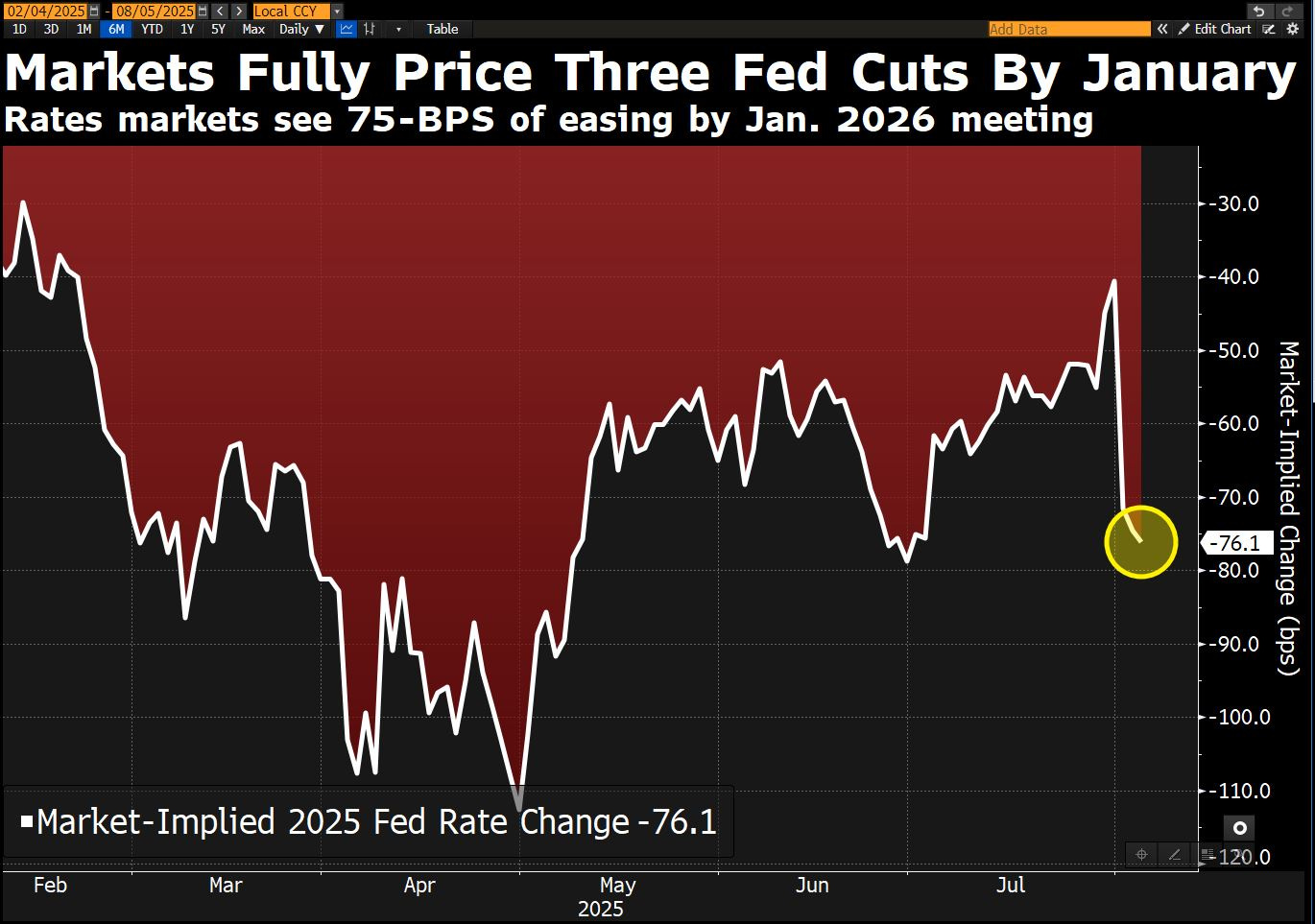

So that’s signal one, I’m cautious around the labor market data, with today’s jobless print also funnelling into this tail-risk:

So we’ve seen the NFP print and now the jobless claims print bidding ZN higher, although equities are also moving in lockstep. There’s also a full 25bp cut priced for September, which is only supported by the fact that the labor market has shown some early signs of slowdown. Keep in mind that if the labor market was printing higher recently, the Fed would be silly to cut into inflation, but their hand may be forced (as seen in rate repricing after the jobs prints). It’s not going to be pretty for the Fed regardless, cutting into inflation is a guarantee at this point.

What I find even more dangerous over the next 12 months, is that the Fed will become increasingly dovish as Trump begins to “build his team”. We’ve already seen one member leave, who is almost definitely going to be replaced by an extreme dove. The risk is apparent because of the data we’re dealing with. I’m playing with what we have now, which is strong growth but some early warnings in the labor market.

So is the labor market alone going to crush growth? No. That’s simply because the likelihood of us having a crazy downturn in the jobs market is low based on how resilient it has been with not enough structural change since then to cause that downturn (tariffs would’ve already done that imo). The last time the Chicago Fed's National Financial Conditions Index was this loose was November 2021. It’s simply too early to be pricing any more than 50bp into cuts for this year, if the Fed want to have hold of inflation (which they don’t).

I’m definitely not saying bonds will continue this bid, or equities will have a sharp downturn. But I’m pointing out the fact that the strength we’ve seen in equities over the last few months is going to be hard to replicate IF the labor market continues to print like this. So for now, I don’t see any edge being long ZN because we’re simply not near a recessionary regime. There was a tactical long position on the long-end recommended int he report below:

Has growth got the all clear? Yes, for now. We’re seeing tariffs really come back into headlines and markets will likely become more sensitive off the back of that again, watch for escalations between major US partners, that can easily slow growth (as we know, I won’t go into that again). Demand is strong and prices are rising, the question is just for how much longer?

Below, we are going to begin putting portfolio updates in every report, so that everything is easy to track

Strategic Positioning Update

Both trades are well ITM, floating (3.3% collectively)

Stay aware guys, have a great weekend ahead!