Fade the FED Hunt?

Everyone Has It Wrong! {imo}

Happy Sunday, crew!

There are few things worse than trading against your core macro views just because market sentiment isn’t cooperating. Tactical positions always have their place, but when they overshadow your pillar view, that’s when trouble starts.

Another week, another test of the Fed’s independence and more…

Let’s dig in.

Japan’s Relief Rally: Trade Deal & Political Risk Linger

The long anticipated trade deal between the US and Japan is finally here. The chart above pretty much sums up my state of mind on the Japanese Yen this week. Equity traders had a different experience, with TOPIX and Nikkei responding positively to the news break.

The yen opened the week stronger, buoyed by better-than-feared results from the House of Councillors election. The ruling LDP‑Komeitō coalition fell three seats short of a majority, ending with 122 of 248 seats, but it wasn’t as bad as expected.

So what do we know about the deal, and what does it mean for the yen trade?

Reciprocal 15% tariffs on Japanese exports, down from the threatened 25%, covering general and auto imports

$550B Japanese investment in the U.S. through JBIC/NEXI, spanning energy, semiconductors, pharma, critical minerals, shipbuilding, and AI — a mix of equity, loans, and guarantees

Steel and aluminum tariffs remain at 50%, excluded from the deal

On balance, the trade deal should support a yen rally as it removes one layer of uncertainty clouding the BoJ’s path toward resuming its hiking cycle.

As traders we get paid to front run risk with the now more predominent one being the political scene in the houuse of counsilliors on the potential risk resignation of PM Ishiba.

This is an important headwind. A change in leadership could revive discussions of the famous consumption tax cut policy, but we expect fiscal austerity, or at least the appearance of it, to prevail.

A nationwide Yomiuri poll showed Takaichi leading as the most suitable next prime minister with 26% support, followed by Koizumi at 22% and Ishiba at 8%. Among core LDP supporters, however, Koizumi, a known fiscal hawk, holds a clear lead with 32%, compared to Takaichi’s 14% and Ishiba’s 15%. The split highlights a divide between the broader electorate, where Takaichi is gaining traction, and the LDP base, which still prefers Koizumi.

We still favour the longer-term view of JPY appreciation. This isn’t a contrarian stance, BoJ Deputy Governor Uchida has already flagged reduced risks to the bank’s hiking path. Timing, however, remains the challenge. This week, the calendar is packed with event risks, the most important being payroll data, which will likely set the tone for September FOMC.

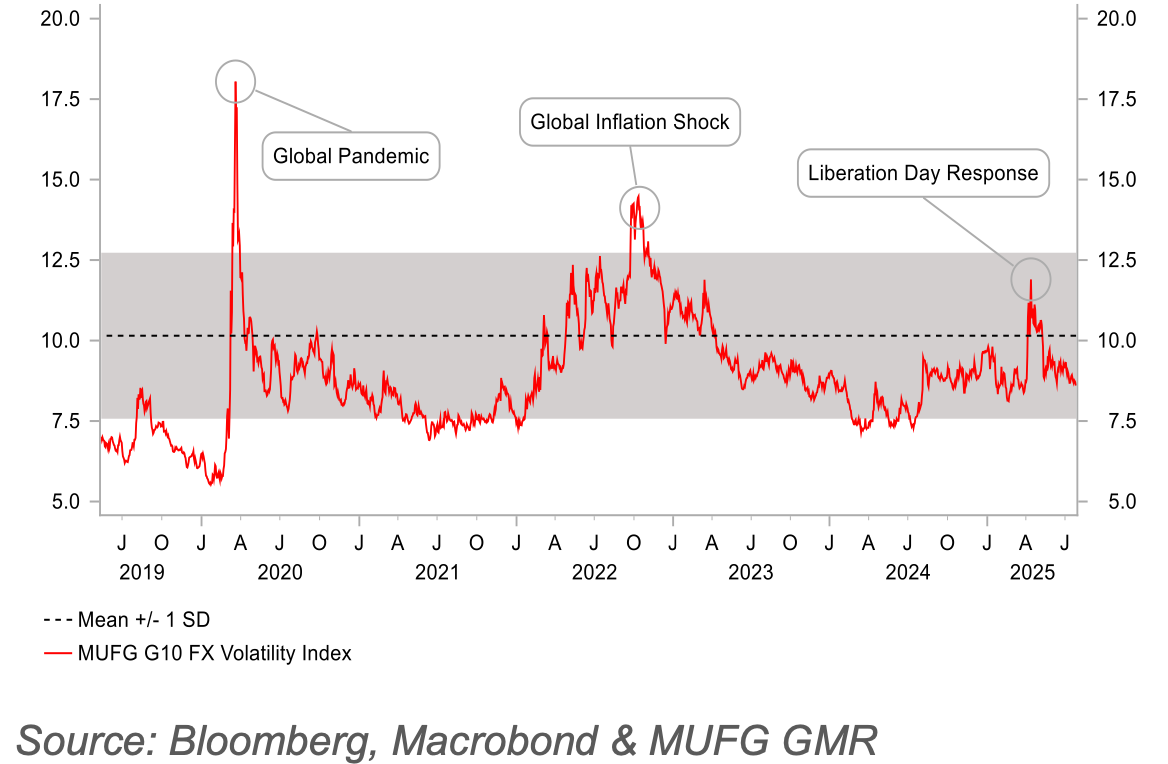

With tariff goalposts constantly shifting, implied volatility has eased (thank God!). Near-term vol is relaxed, and the dollar could trade higher against the yen on the virtue of the carry in the short term.

We however prefer to express the low-vol/carry trade elsewhere…

Macro Trade Idea: FX

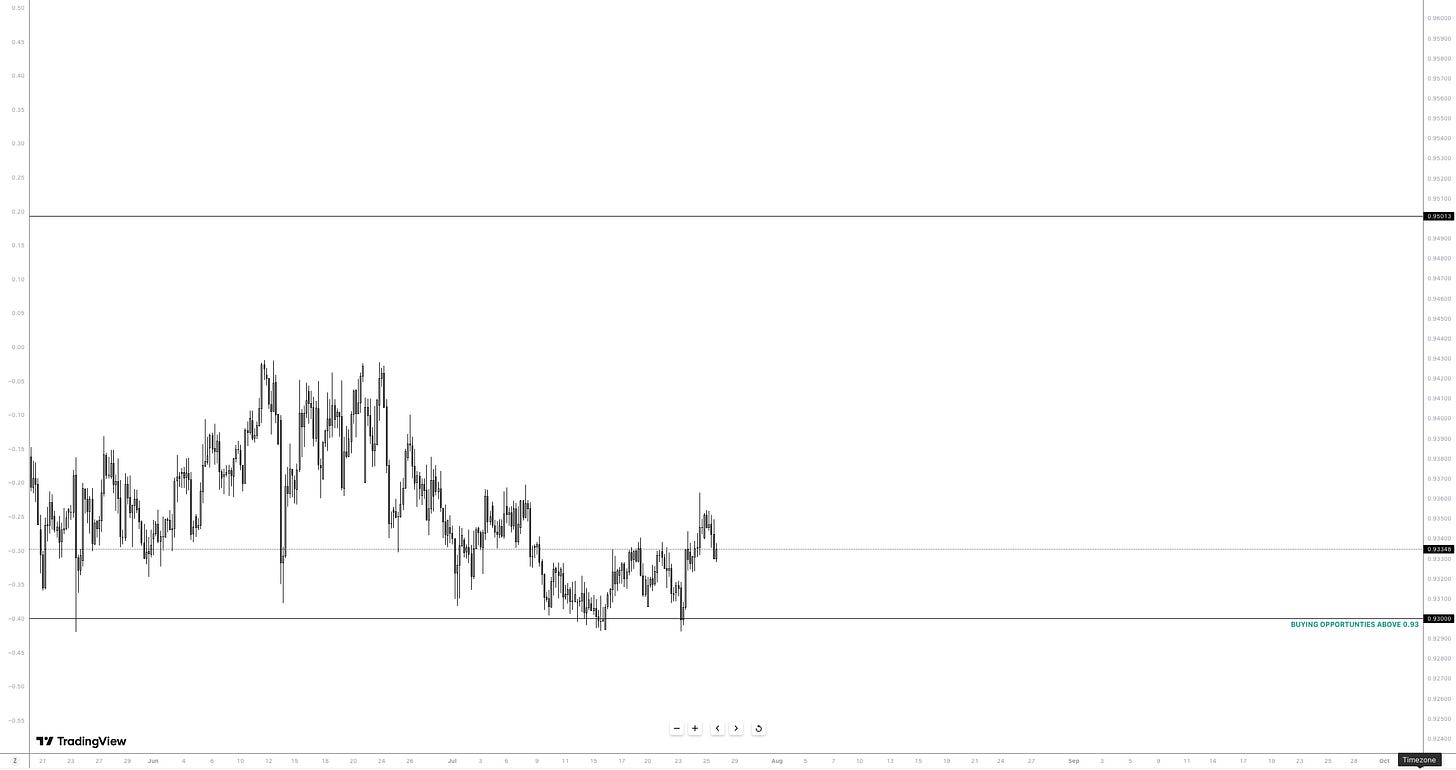

Long EUR/CHF

Optimism around a US–Euro bloc trade deal before the August 1 deadline, similar to Japan’s, combined with the ECB view on policy rates in a “good place,” makes this a relatively safe carry expression. Look for buys sustained above 0.93.

Federal Reserve Independence on Trail: Fading the Fed Hunt

Last week brought another Trump led administration attempt to oust Fed Chair Powell on misconduct of the new federal reserve building budget. Without wasting any mental faculty on this, the bottom line is JP will likely run his course as Chair. Anyway, in part, it’s now taking the same route as tariff tantrums. In his attempt to criticize Powell yet again, the US dollar was able to see past this, ending the week on a stronger foot.

Meanwhile, Trump appointees like Gov Waller and Bowman have been on the financial media circuit making the case for renewed cuts. Waller could dissent at the next meeting. Bowman, a known hawk, is less convincing, she has stressed keeping an eye on inflationary impulses

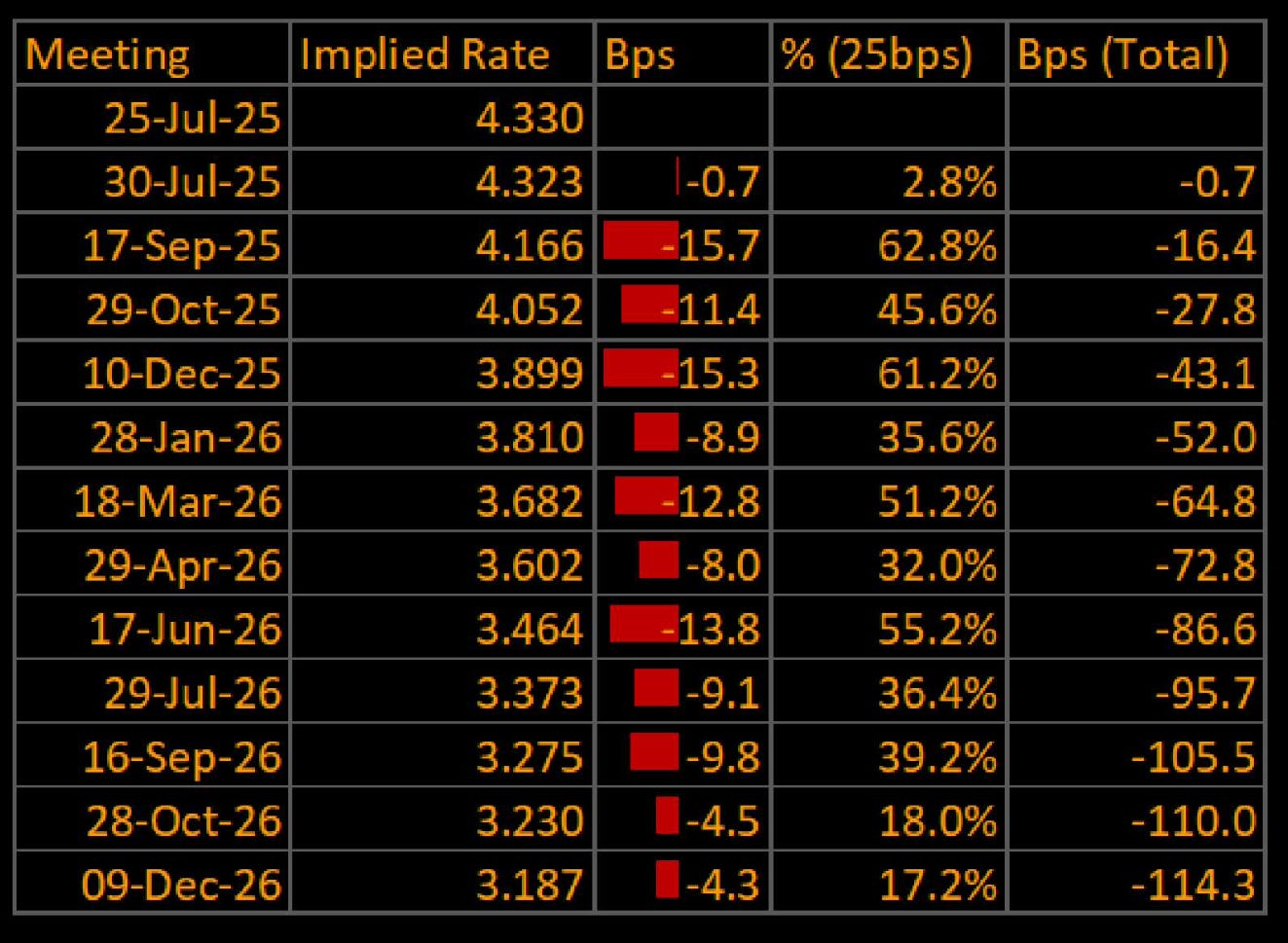

Markets seem overly optimistic, pricing in c.115bps of cuts by Dec. 2026, broadly on the assumption of a more dovish chair after Powell’s term ends in 10 months despite domestic backdrop showing early signs in tariff pass through as June core goods edge higher. Two things to note:

This isn’t Turkey

Tariffs might not be a ‘one-time increase’

Dear Trump this isn’t Turkey, where presidents dictate central bank decisions. Ironically we believe, this scrutiny only pushes the Fed to appear even more independent, not to be criticised as apolitical, the current crime the US admission currently accuses the JP of. The Fed Chair governs a committee that execute monteray policy decision on the basis of consensus vote, and most officials remain comfortable holding policy steady as they expect tariffs to lift inflation. NY Fed President John Williams recently stated that “maintaining this modestly restrictive stance of monetary policy is entirely appropriate” and that tariff-driven inflation effects should increase in the coming months. Also June’s Fed minutes noted that most participants saw a risk of tariffs having more persistent inflation impacts, through higher inflation expectations, supply chain disruption, and second-round effects.

Which brings me to the next point on why I disagree with Waller on his view of a one-time increase in tariffs. The nature of the tariffs rollout says otherwise, where agreements with these countries still come with subtle underlying conditions, subject to review and threat of diversion subject to hikes in tariffs. The UK, China, and Vietnam among the first countries to sign trade deals ended up leaving higher tariffs placed on them compared to April Liberation Day.

But don’t take our word for it. This chart above clearly shows the lag in collection rate vs policy rate. If this tracks, then tariff collections are set to go higher from here heading into August 1. It’s clear Trump needs the income from these tariffs.

…so whats the trade?

Macro Trade Idea: Rates

Calendar Spread: Buy SOFRZ5 / Sell SOFRZ6

If we think market pricing of longer term rates is too optimistic, the trade is to put on a Z5/Z6 steepener — long Dec‑2025 SOFR, short Dec‑2026 SOFR. Overnight is pricing in an additional 71bps of cuts for 2026. Should those cuts fail to materialise, SRR3Z6 has more room to adjust. As the easing path flattens, SR3Z6 futures will fall more than SR3Z5, yields at the back end will rise, and the Z5/Z6 spread should widen in your favour.

FX: Short GBP/USD

The UK may be the most insulated from the tariff storm but carries the highest risk premium which we deem as justified. Weak PMIs and soft retail sales reinforce the case for further sterling downside. With fiscal constraints already pressuring the autumn budget, we expect markets to hold the line in the BoE prioritising further easing on the back of growth prospect.

Thank you for your time, thats a wrap here!

-MMH