Time to Ride the Long End?: The Fed Review

Fed on Hold: Does Duration Finally Deserve a Bid?

Hey guys,

I’m sorry this is a typed report - I’ve just had two wisdom teeth extracted so I can’t speak, nothing like trying to break down global macro on a video with impaired speech.

I just want to assure you all that this is the very start for MMH, I was less active last week because all of my hours wer spent reading papers and improving.

The value is only up from here.

Emmanuel done a great report a couple of days ago - I hope you all read, there was a lot of value in it.

So, it seems like the regime may have been put on pause after the Fed meeting last night.

Let’s get into that…

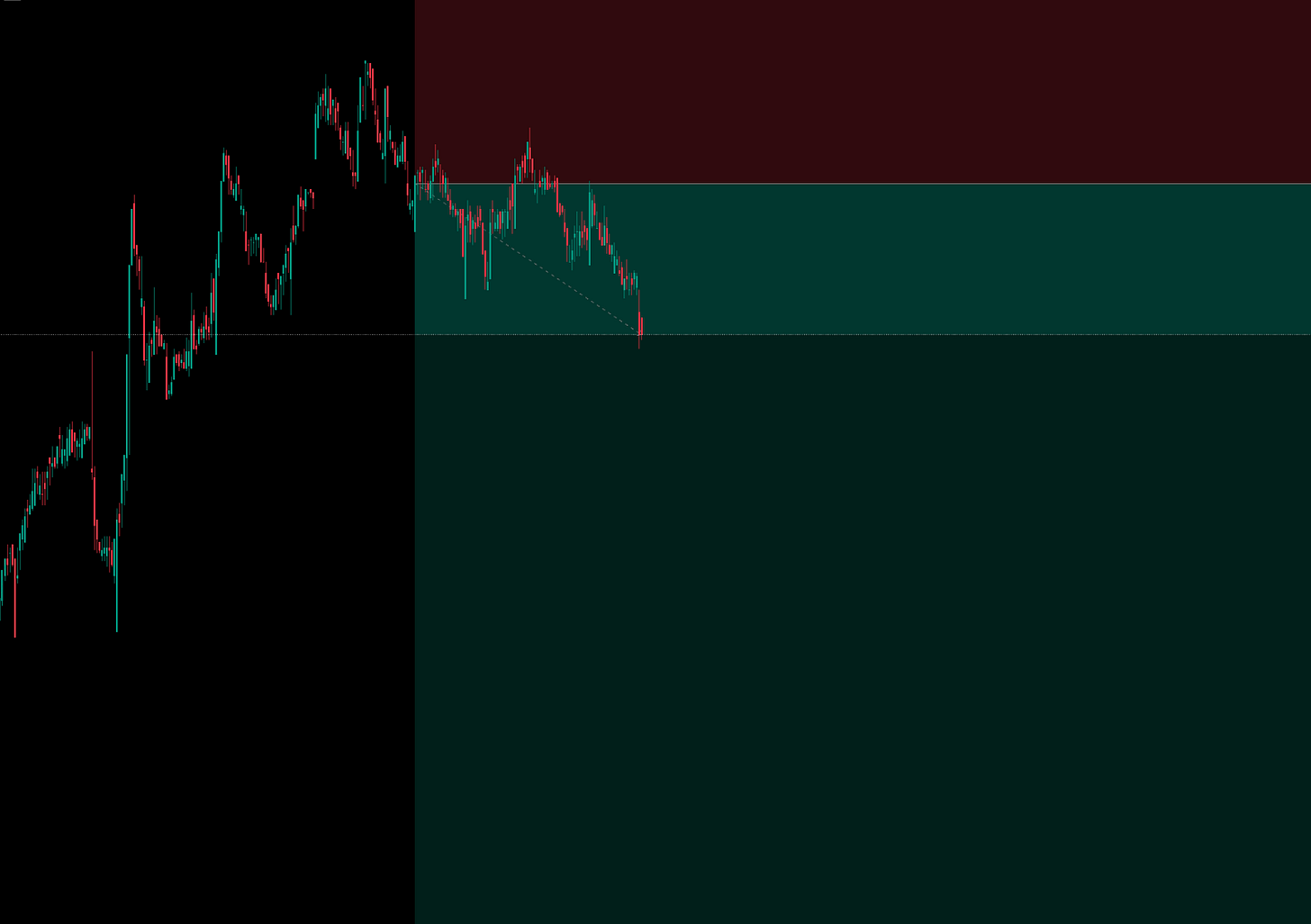

Curve Flattener Update

We are beginning to move ITM on this trade idea I shared just over a week ago.

I’m expecting that August will be the beginning of the real move here, as always I will keep you guys updated.

The Fed Meeting

The Fed held rates steady at 4.25%–4.50% last night, maintaining their cautious stance as inflation slows but remains sticky. Notably, two Fed governors (Waller and Bowman) dissented, voting for a rate cut—signaling a growing internal divide on the path forward. A rate cut makes no sense with how present inflation and growth still are (although I am bearing in mind that Fed member Waller is just acting in favour of Trump as he wants to be the next Fed chair).

Key notes from Powell:

“The economy remains in a solid position overall.”

“Inflation is still running above target, but progress has stalled somewhat.”

He acknowledged tariff-related price pressures as a possible headwind to disinflation.

Powell said the Fed needs “more good data” before easing policy, calling the two governor dissents "constructive."

So to keep it simple, Powell pivoted. We’ve had a series of meeting where his stance is neutral at best which has fuelled the rally in equities but now that idea has some downside risk with the Fed acknowledging (finally) that the economy has still got growth and inflation tail-risks!

There’s now 45-50bp priced in for a cut in September, which is more in line with where rate expectations should be (see my report below):

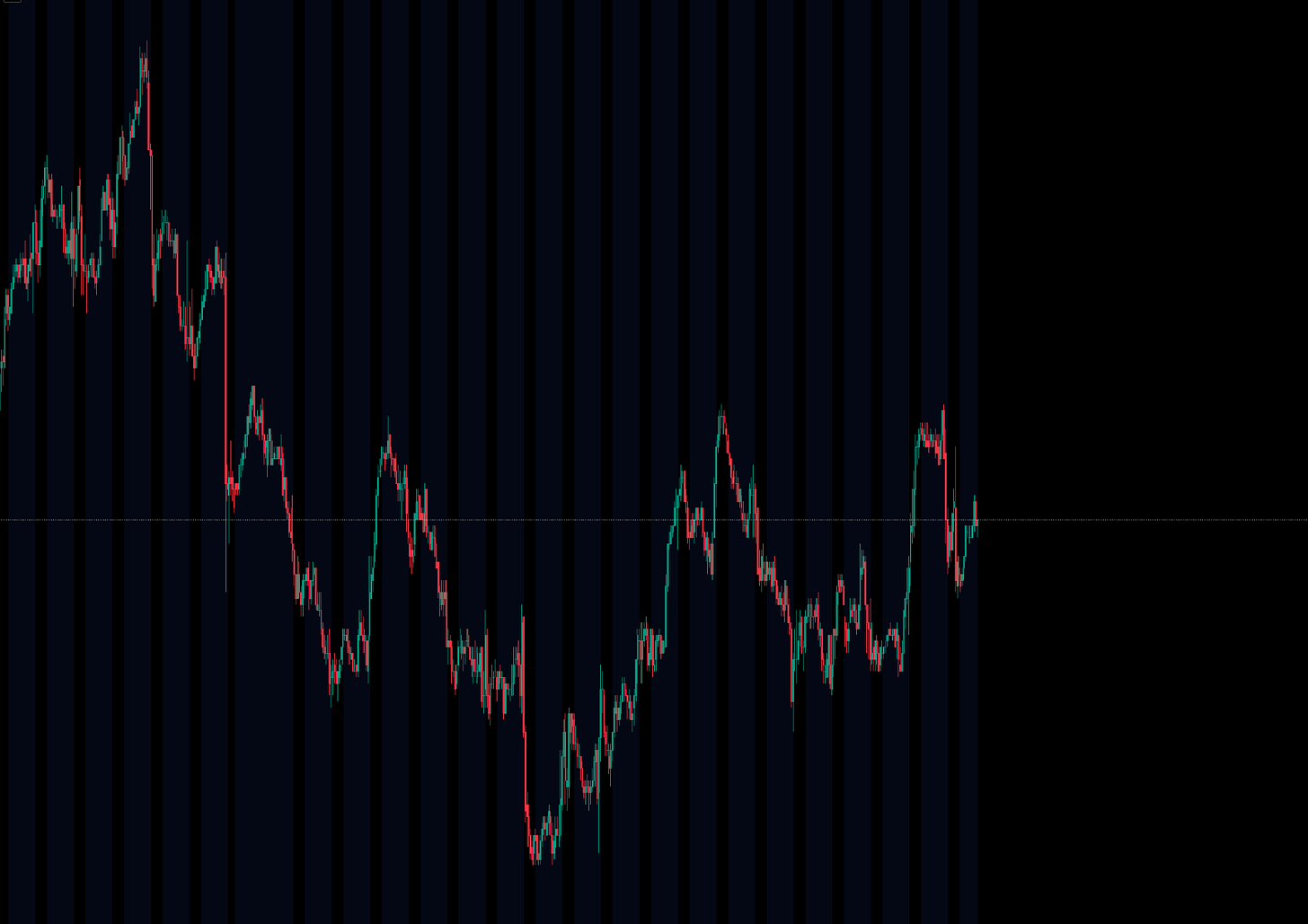

The 10Y note told us everything we needed to know, a small sell-off to then mean revert back to previous pricing. If the Fed were neutral/dovish, this would’ve sent duration through the floor but we can see evidently in price that the Fed’s stance is to step back onto the curve, take control of inflation and growth finally. The 10Y is below:

We’re seeing company’s earnings above consensus, PCE at 2.5% YoY, NFP adding jobs every month (147k prev), jobless claims at their lowest since April, it’s an economy that is simply not restrictive enough. But now there lays a big change, a change in stance from Powell, what does this mean though?

Equity rallies are likely going to slow and bonds will likely trickle up higher based on cuts being priced out for this year meaning that this will be the bias going into at least the next meeting. This doesn’t mean that equities won’t continue higher, but now there is just no edge in being exposed mega-long. You can still run small on long posiitons but honestly when there is no edge, what is the point?

So now we have more clarity, the focus switches back to tariffs (yet again). I couldn’t write a report wihtout including the madness of copper pricing yesterday, headlines below:

COMEX COPPER FUTURES DROP AS MUCH AS 16%

WHITE HOUSE: TRUMP PROCLAMATION IMPOSES UNIVERSAL 50% TARIFFS ON IMPORTS OF SEMI-FINISHED COPPER PRODUCTS AND COPPER-INTENSIVE DERIVATIVE PRODUCTS EFFECTIVE AUGUST 1

-23% later..

The copper move wasn’t isolated. Broader tariffs targeting India and Brazil were also rolled out, with the White House citing “strategic and political concerns” rather than just economic competition. These tariffs are raising global tensions and injecting fresh uncertainty into equity and commodity markets.

On a more positive note, a US–EU trade agreement was struck, capping mutual tariffs at 15%. This has been viewed as a stabilising factor, temporarily easing transatlantic tensions and helping lift futures markets in both Europe and the US. Still, the IMF issued a warning this week, stating that the fast presence of tariffs remains a global inflation risk and may dampen global growth even if US markets appear resilient for now.

So our bias played out and the S&P 500 continues to push record highs, powered largely by mega-cap tech names and AI-linked earnings from firms like Nvidia. However, market euphoria is starting to trigger concern on Wall Street. Multiple analysts (including those at major investment banks) have raised red flags about overstretched valuations. Sentiment indicators are now flashing warning signs similar to previous speculative peaks, suggesting traders should remain cautious even as indexes climb. This narrative (although I dislike sell-side bias) actually fits the Fed’s stance.

At the same time, recent positioning data shows many formerly bearish investors being forced to unwind bets against US equities and the dollar (we see this reflected in the price with aggressive rallies). In fact, the dollar is now on pace for its first monthly gain of 2025 as investors rush back into US assets on relatively strong macro data and tech optimism. This positioning reversal is providing added fuel to the market’s upside but it also sets the stage for potential sharp pullbacks if the data disappoints.

Watch out for correlations, the last thing an equity market wants to see is bonds moving higher with it.