Copper Is Waking Up

Copper: A Re-Emerging Long Opportunity

Happy Thanksgiving to everyone who’s currently in a food coma or on their way to one.

Let’s talk copper, because this story is turning, and it’s turning fast. Real rates are easing, Fed speak is softening, capex is perking up, China is moving in the right direction, and the metal is better supported than positioning would have you believe. The last copper trade worked beautifully, and the setup to go long again is finally back on the table.

Context on the previous trade is below, the idea was given in the Substack chat:

Some of this idea has to do with the pick-up in China, take a look at the recent report for context:

The gold trade is still doing exactly what it should. Stops rolled to breakeven, heavy profit, zero risk. Nothing more to add except that it’s behaving like a well-trained dog.

Current playbook

Why Copper Loves This Environment

Copper thrives when the macro regime shifts toward better growth, easier liquidity, and rising real-economy investment. It’s basically the world’s confidence meter. When PMIs bottom, industrial production stabilises, trade flows recover, and global growth data begins to turn up, copper is usually early, sometimes obnoxiously early.

And if you zoom out, growth has held up shockingly well considering global rates were peaking a year ago. Not only is growth still sticking, it’s sticking stubbornly.

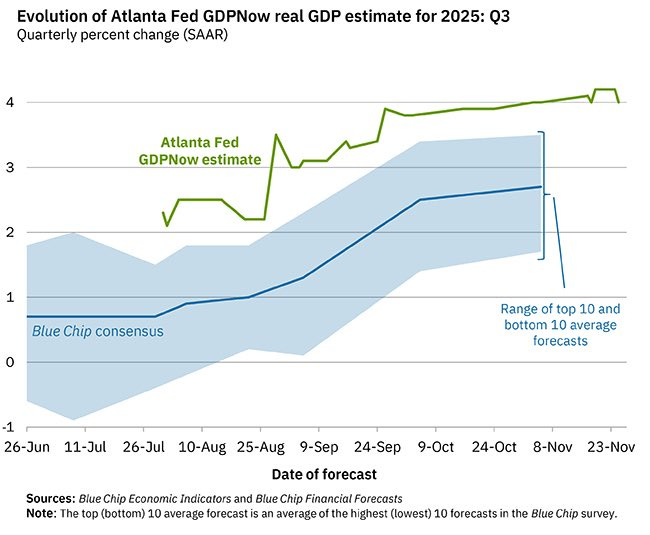

Let’s talk about the “top dogs.” Whether you believe it’s the U.S. or China, U.S. growth is strong. Headline numbers have been ticking higher. The latest nowcast real GDP estimate is at 4%, only slightly down from 4.2%.

Consumers Are Still Spending

The consumer is fine. Johnson Redbook retail sales haven’t exploded, but in a high-rate world with four years of elevated inflation, that’s normal. The important bit is that the chart is still climbing. People are spending.

Why does this matter for copper? When consumers spend, companies earn. Earnings drive production. Production drives shipping, investment, replenishment, and demand for all the stuff that uses copper, like electronics, housing, machinery, appliances, and cars. Spending keeps the industrial flywheel alive, and that’s the artery copper feeds on.

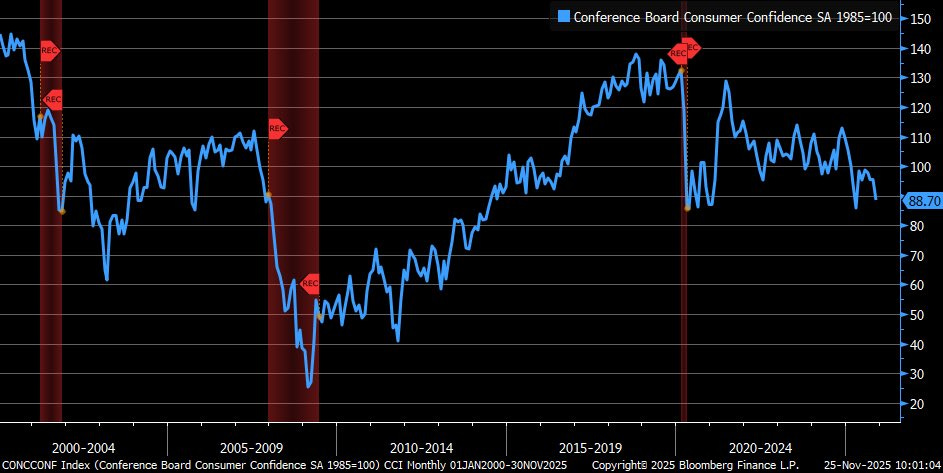

Some will point to declining consumer confidence. But confidence only genuinely matters when it spills over into reduced spending, and that isn’t happening. Context matters. Consumers were staring down multiple tail risks as Trump took office, tariffs being the big one. Yes, confidence dipped, but spending didn’t. We’re still sitting in historically normal territory.

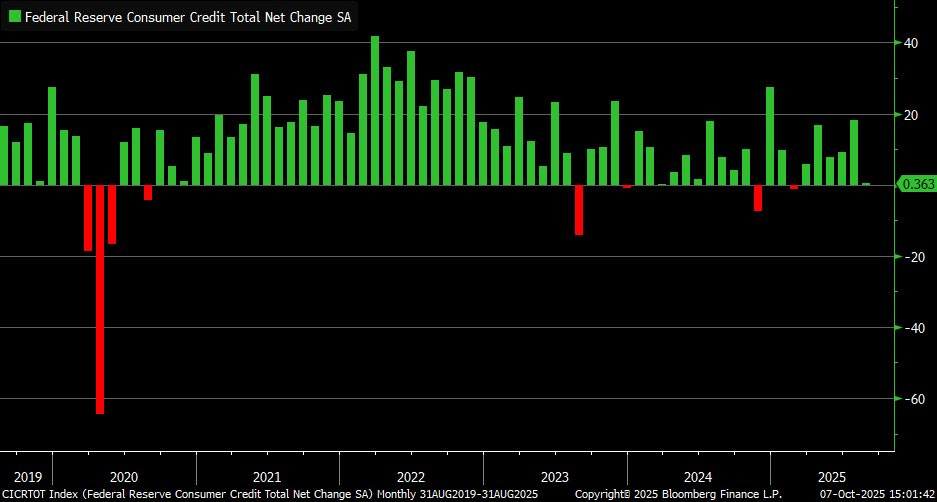

Then there’s the “consumer credit is low” argument. Again, context. People loaded up on credit during 2020 to 2022. After massive credit intake, of course MoM credit growth slows, especially with tariff uncertainty in the background. And focusing on one month is meaningless. 2025 as a whole has seen a solid increase in credit. And again, spending continues.

If retail sales aren’t your favourite indicator, you can just look at the market. Consumer discretionary is usually the first sector to take a hit when households are in trouble. Instead, it’s doing the exact opposite, which tells you everything.

Supply Is Quietly Tightening

UBS just revised up its 2026 copper forecast. Their new targets are:

• 11,500 dollars per ton by March

• 12,000 by June

• 12,500 by September

• 13,000 by December 2026

And the deficits are getting real. They now expect a 230,000 ton shortfall in 2025, up from 53,000, and a 407,000 ton deficit in 2026. This isn’t a temporary blip. Delayed recoveries in major Chilean mines, ongoing issues at Freeport-McMoRan’s Grasberg site, and political risk in Peru are all adding to structural under-supply. Even if demand cooled a bit, supply fragility alone puts a sturdy floor under copper.

Falling Real Rates

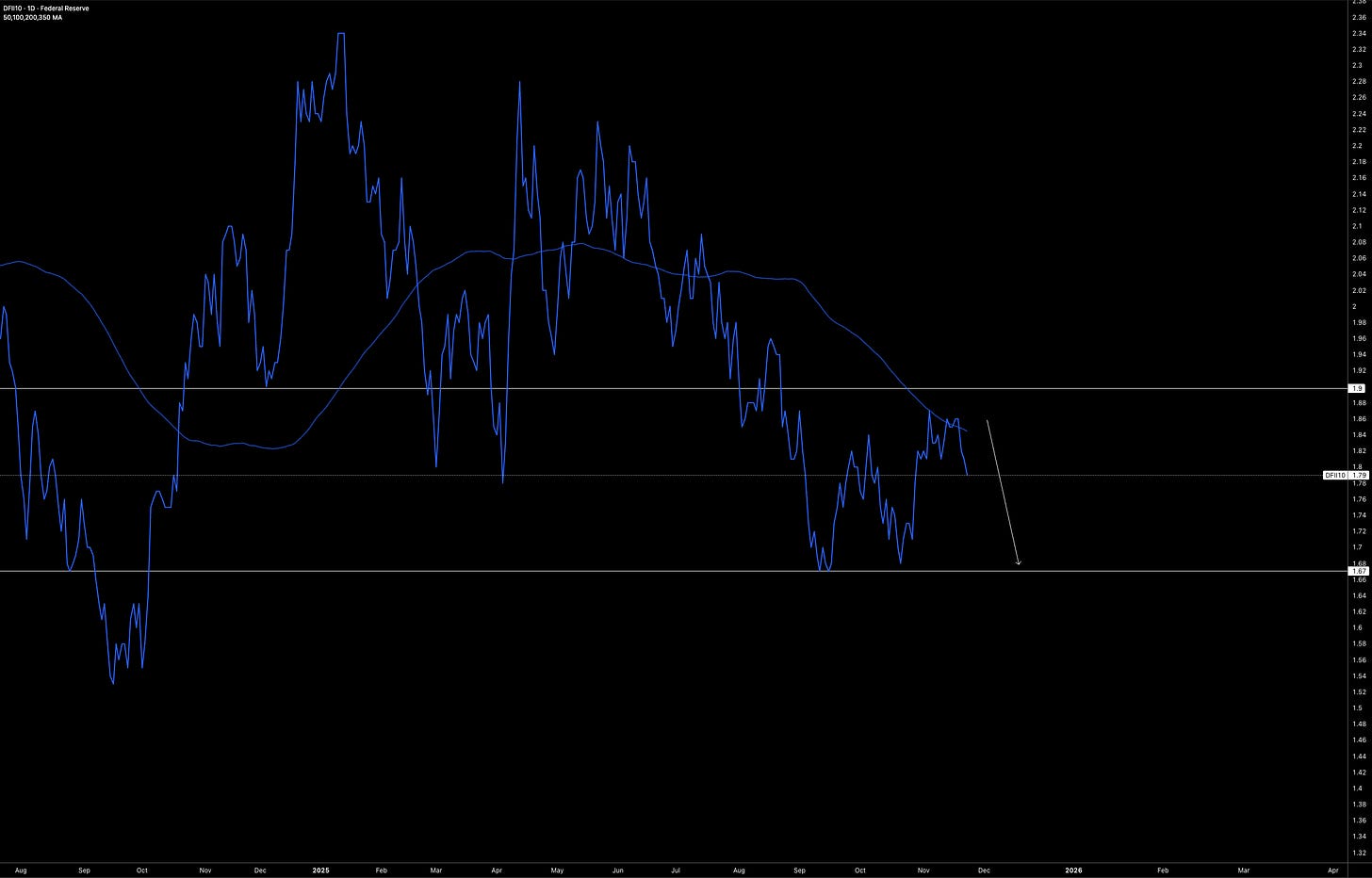

Copper loves falling real rates because easier financing and looser conditions pull forward investment. Over the past month, the U.S. rate curve created a nice little smile, bumping cut expectations all over the place. We went from a fully priced 25bp cut in December, down to 32% odds, and now back up to 84%. That kind of swing helps push real rates down.

For copper exposure, the danger zone starts if real rates grind back toward 1.9% and hold there. But the setup right now points lower, back toward this year’s floor and probably below 1.7%.

The mid-October to current-day chop in copper? That was real rates rising on hawkish Fed talk and inflation swaps ticking down after a September climb. That headwind is easing.

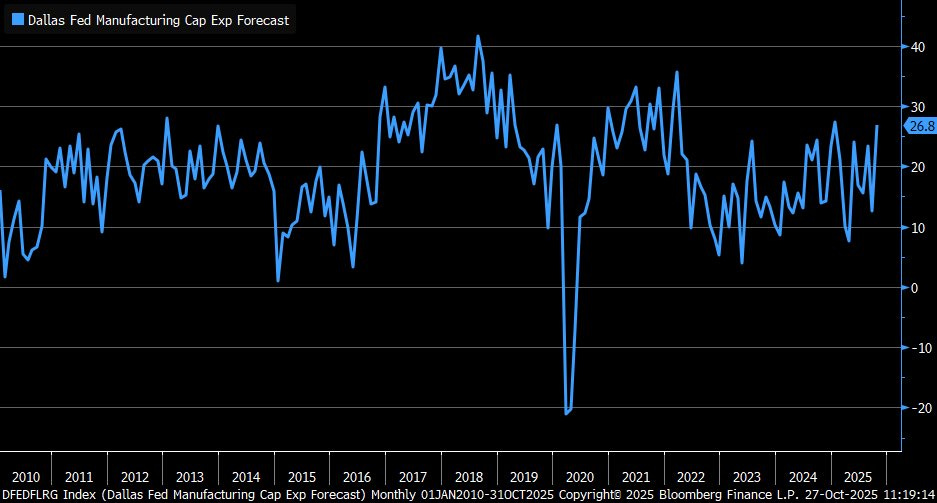

Capex

Capex cycles matter a ton for copper. Infrastructure, grid upgrades, EVs, housing, corporate investment, these flow directly into copper consumption. Any fiscal push or business-investment rebound becomes an immediate tailwind.

The six month outlook for capex rose in October to its highest level since January. Manufacturing capex is still pushing strong. Services capex is softening a bit, but copper doesn’t really care about that. It cares about the hard-asset, industrial side.

China

China remains the biggest marginal driver of copper demand. Copper performs well when the Chinese credit impulse stabilises, property stops deteriorating, and infrastructure spending picks up. China doesn’t need a boom. It just needs to stop being a headwind. The signals are improving, as discussed in my China note at the top of this report.

And looking ahead, copper demand growth becomes increasingly diversified. By 2031, China’s share of global primary copper demand is expected to drop to around 52%, down from 57% in 2026. The U.S. and India will take more share thanks to power-grid upgrades, data-centre expansion (AI is a copper hog), and India’s rapidly growing transmission build.

Positioning

I sent this out on Wednesday in the Substack chat.

Have a great weekend!