Fed Recap: October Playbook in Focus

Fed Policy Takeaways & Regime Positioning into October

Hey team,

Global macro reminds us that every chart is just a reflection of human behavior.

When growth, inflation, and policy collide, opportunity shows up in the dislocations.

Anyway, the setup has been feeling (unfortunately not looking) like this as trades have been flowing…

Central bank tracker

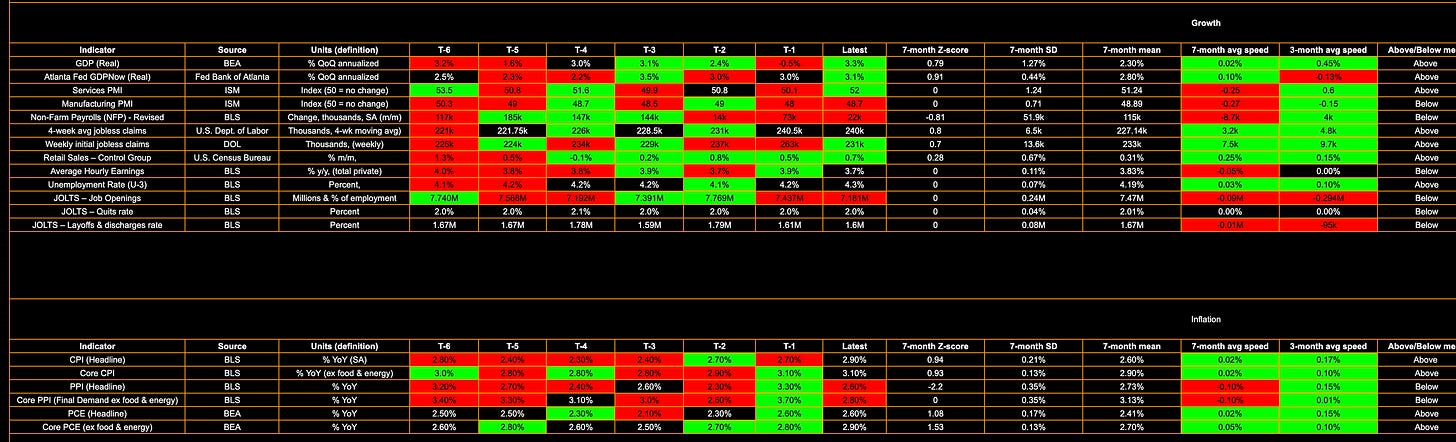

US data tracker

Trade update

EUR/USD trade below from the last report…

Connected report:

New trades are in the Substack chat so please refer to that.

Fed meeting review

First things first: the speed and aggressiveness of monetary policy always carry the biggest market impact. Rates feel it first, equities follow with a lag, and FX reacts after that. One of the best ways to keep track is by comparing how the Fed’s tone shifts from one meeting to the next, so let’s start by laying out those changes before digging in further.

Yesterday:

Powell called it a “risk-management” cut, balancing inflation risks vs weakening labor market.

Labor market softening: slower job growth, unemployment edging higher.

Inflation still elevated but Fed sees tariff-driven pressures as possibly one-time, not persistent.

Most officials expect at least two more cuts this year, but there is wide dispersion.

One dissent (Miran) who wanted a 50bps cut.

July 30, 2025:

Labor market still seen as resilient, job gains solid.

Inflation concerns (especially tariffs) were the main reason to hold steady.

Tone was “wait-and-see,” cautious about moving too soon.

Two governors dissented, pushing for an immediate cut.

Tone Shift:

From cautious/no-move (July) to action (September).

Greater emphasis now on labor market weakness vs inflation risk.

Inflation risks still noted, but Fed more comfortable seeing them as temporary.

Powell and majority leaning more dovish, though still gradual and data-dependent.

Dissent narrowed: now about how much to cut, not whether to cut.

We can see from the Fed’s commentary that they remain fixated on the emerging “crack” in the labor market while choosing to largely ignore the fact that both nominal GDP and inflation are still carrying positive momentum (see US data tracker above). This meeting also gave us a preview of what the new normal will look like: Miran breaking ranks and voting for a 50bp cut, a move that was more political than data driven. Under Trump’s rebuilding of the Fed board, these kinds of politically charged dissents will become standard in cycles to come. The whole thing feels like deja vu; last September the Fed misstepped with an early cut, and here we are again. By pulling the trigger, they’ve essentially greenlit an additional 40bp of easing, practically guaranteeing cuts in both October and December.

One point worth emphasizing is that this cut doesn’t just shift the path of rates, it shifts the distribution of risks across markets. By easing into strength, the Fed has effectively lowered the bar for what counts as a “shock.” If growth cools a little from here, markets may see it less as a downturn signal and more as vindication of the Fed’s caution. In other words, they’ve added a cushion, but one that risks amplifying volatility down the line if inflation proves sticky.

Equities caught a bid after the initial selloff as the market quickly framed this as a Fed misstep. Growth, inflation, and liquidity are all present in the system, this wasn’t a cut to “rescue” growth. If it were, we’d be seeing downward pressure on equities instead of support.

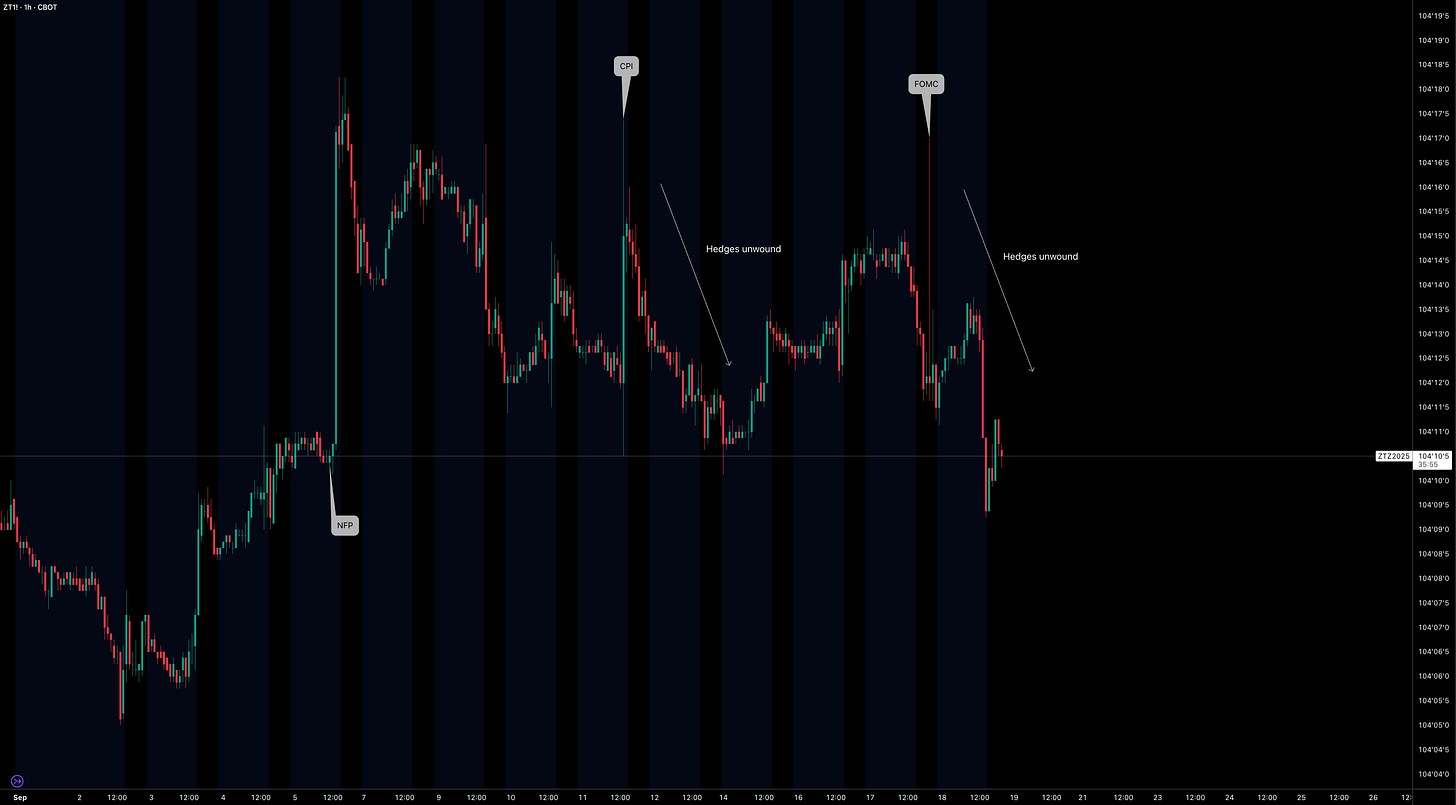

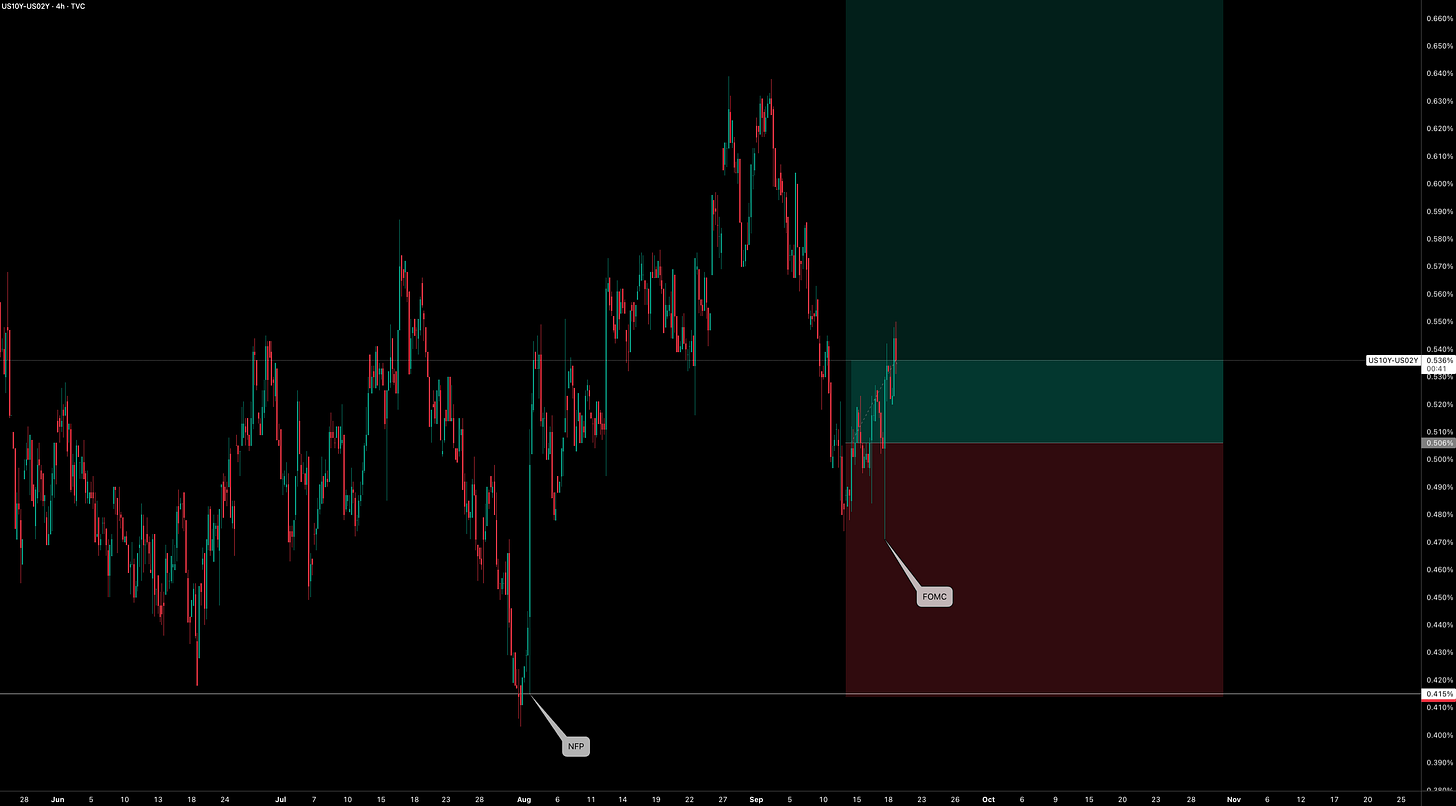

Initially, I thought the short-end could hold a tactical bid given how resilient we were above the NFP lows. My invalidation point was a break below those lows, and now that breach has happened, the story changes. Hedges have unwound with speed, and unless we reclaim those levels, the curve is set up to slowly price out cuts in 2026 as the Fed error gets digested. With both growth and inflation still running at positive speeds on a 3 and 6-month basis, there’s no recession scare or labor panic in the data.

Permabears will continue to point to weak datapoints in isolation, but that’s not how regime shifts work. It takes a cluster of negative prints across growth, inflation, or a liquidity shock to flip the backdrop, and we’re not there. Instead, the Fed’s latest move has played right into my steepening thesis (which I shared in the Substack chat). The trade is straightforward: cuts get delivered in the near term (into December) as the Fed stays stuck on labor market optics, but the curve reasserts itself once inflation and growth refuse to cooperate.

Regime going into October

First, a quick word on positioning: Copper longs flagged in the chat are still intact (based on demand dynamics), EURUSD was already broken down in a prior note, and the 2s10s steepener remains the key structural trade. The tactical long in ZT that I laid out previously is no longer valid after the NFP breach.

“When insurance cuts backfire” is how I’d summarise the October theme. Inflation and growth data are set to remind the market why this Fed move was a mistake, even as credit spreads remain pinned at cycle lows.

The Fed blinked. Whether you call it an “insurance cut,” a “policy recalibration,” or, if you’re cynical, a premature easing nobody really asked for, the fact is the same: markets immediately tested the Fed’s conviction. Across curves, equities, and FX, the price action reflected less a growth-saving pivot and more a repricing of what was, at its core, an unnecessary adjustment.

Rates gave the first tell. Post-cut, with both growth and inflation momentum clearly north of zero, the front-end sold off aggressively. The logic is straightforward: if this really was just an “insurance cut” rather than the start of a rescue cycle, then the market is going to fade those extra cuts it had penciled in.

That sets up a classic 2s10s steepener as structurally higher growth and inflation get realised in the long-end yields. Keep an eye on the 2s10s steepener already in play, I expect it to gain traction into October. The message from the curve is clear: “Thanks for the insurance, but we don’t need it.” Importantly, the trade remains above both the NFP and FOMC levels.

A less discussed but critical piece is the fiscal backdrop. Deficits remain wide, Treasury issuance is heavy, and the Fed’s cut doesn’t change the fact that duration supply has to clear. Lower policy rates might ease funding conditions at the front end, but the long end is being anchored by issuance dynamics and term premium. This is why the steepener is more than just a tactical expression, it’s structurally supported.

Credit, meanwhile, isn’t blinking. With equities catching a bid and no real liquidity stress, the signal is pro-cyclical. High yield spreads remain near their tights. A move wider by 25 bps or more would be a red flag, but as long as we’re hugging the lows, credit is flashing green.

Volatility deserves a quick mention. Implied vol in both rates and equities was well bid into the meeting as markets braced for a hawkish risk. The cut flipped that narrative, draining vol and pulling realized spreads tighter. It’s classic late-cycle behavior: policymakers suppress vol in the short term, but all that does is set up more violent bursts later. Watching MOVE, VIX, and VVIX will be key to judging whether this calm holds or whether it’s just the eye of the storm.

With no spike in issuance, no widening in IG, and no stress in liquidity, the path of least resistance is stability, and that keeps pressure upward in equities. HYG is printing fresh ATHs, underscoring that recession risk isn’t the base case right now. Liquidity remains abundant, and credit is just fine.

Equities themselves told the familiar story, a knee-jerk dip, then a buy. That reflects a market that views the Fed as slightly too dovish in an otherwise healthy nominal backdrop. Multiples still get support from easier policy, and earnings aren’t rolling over yet. Rates are a headwind, but liquidity is still a stronger tailwind.

Positioning also played a role. Hedge fund net shorts in equities had built up heading into the meeting, largely as a play on higher yields. The unwind after the cut was more about positioning relief than fundamental change. It may not last if growth data starts to disappoint, but for now it’s fuel for the equity bid. Short-term flows often matter more than clean macro logic.

That sets the stage for cyclicals, value, and banks to continue outperforming defensives and utilities. Unless growth data genuinely rolls over, the regime stays supportive for risk. ES’s reaction post-FOMC confirmed that dynamic. Until we see clear evidence of the Fed pivoting back to an inflation fight (which isn’t happening), the drivers are obvious: growth, inflation, liquidity, low vol, and a Fed cutting path. High PEs don’t matter in this context, regimes drive markets, not isolated datapoints.

On the global side, policy divergence is another overlooked factor. The ECB and BoE remain cautious, the BoJ is slowly navigating normalisation, and most EMs are already past their easing cycles. The Fed moving first only widens the gap, pulling capital flows toward the US. That’s why the dollar remains sticky at the highs, foreign investors aren’t finding the same growth-adjusted yield abroad, especially with the US still leading on momentum.

So equities got bought, the front end of the curve sold off, and credit shrugged. That triangulation makes sense: markets are rejecting the idea of a growth saving pivot and instead viewing the Fed’s move as an unnecessary dose of medicine.

Looking forward, expect further repricing higher in the front end, belly underperformance in the curve, and cyclicals keeping the upper hand until the data tells a different story.

Readers, enjoy your weekend!