Easing Into Heat: Fed Cuts With Inflation Still Alive

The Paradox of 2025: Cutting Rates Into Sticky Inflation

Hey guys,

Quick one - I have taken out headlines/sector performance/data summary simply due to requests preffering the central bank tracker tables & US data tracker.

Efficiency is about energy, not just time.

When you channel your energy into the right places, everything feels lighter.

Let’s get into the report.

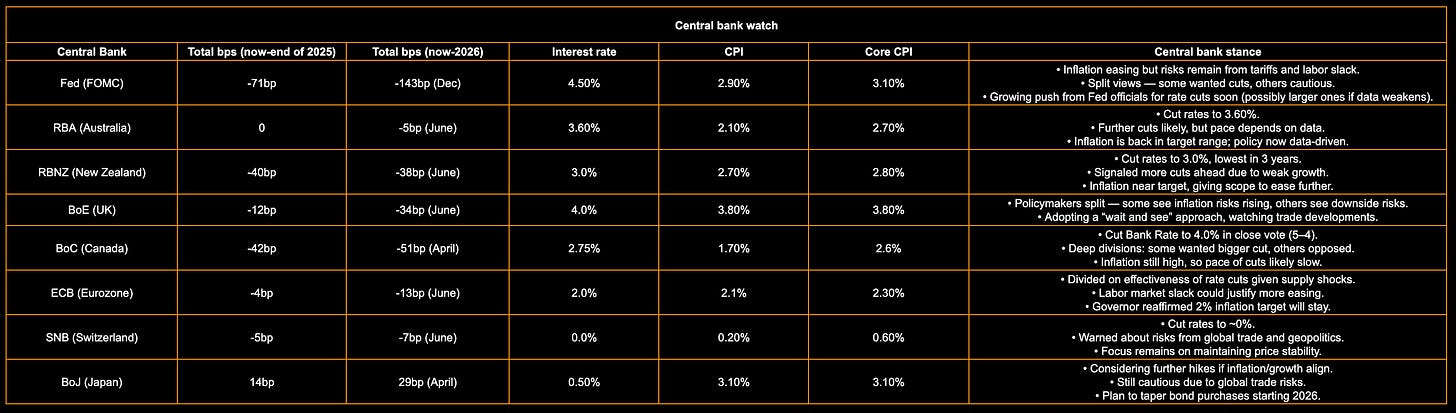

Central bank tracker

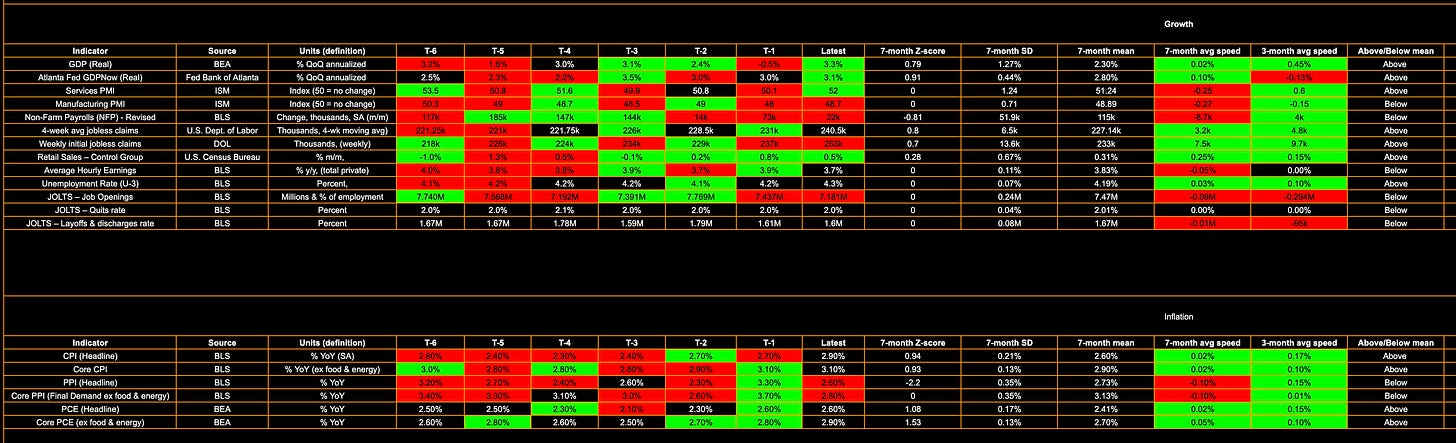

US data tracker

The regime shift playbook

As you can see in the table above, US CPI came in yesterday broadly in line with expectations (headline CPI YoY at 2.9% and Core CPI YoY at 3.1%). On the surface this looked like a benign print, but in reality it added another tail-risk for the Fed: inflation has accelerated from the prior month. The critical point here is that both headline and core are now running above their respective 7-month averages, with both showing positive speed (+0.02%). Inflation momentum is no longer decelerating, it is re-accelerating into the autumn, at precisely the moment when policymakers are under pressure to ease.

At the same time, we saw jobless claims spike above consensus, which immediately fed into fears of slowing growth. That slowdown hasn’t fully materialised yet, but directionally we are clearly heading there. Both the weekly and 4-week average jobless claims are now exerting positive speed, meaning that each week more claims are being added, while NFP itself is exerting negative speed on a 7-month average basis and remains below its mean. Taken together, the picture is one of firming inflation momentum versus softening labor momentum, a delicate setup for any central bank.

The key point is that every inflation series is now showing positive 3-month speed, while every growth/labor series is slowing on a 3-month basis (though not yet outright negative). That divergence is why the OIS market reacted so violently to the claims data, pricing in 71bp of cuts by year-end, essentially three full cuts. Yet the macro backdrop doesn’t justify such aggressive easing. This is not an economy that needs a 75bp reduction in policy rates. Inflation remains a problem, growth is not collapsing, and recession risk is not the base case.

Markets are making this abundantly clear. High-beta assets are rallying on the inflation data and shrugging off weaker labor prints. The Russell is pushing higher, showing positive momentum on inflation releases while ignoring the “negative” signals from NFP and jobless claims. That tells you liquidity and risk appetite are still firmly intact.

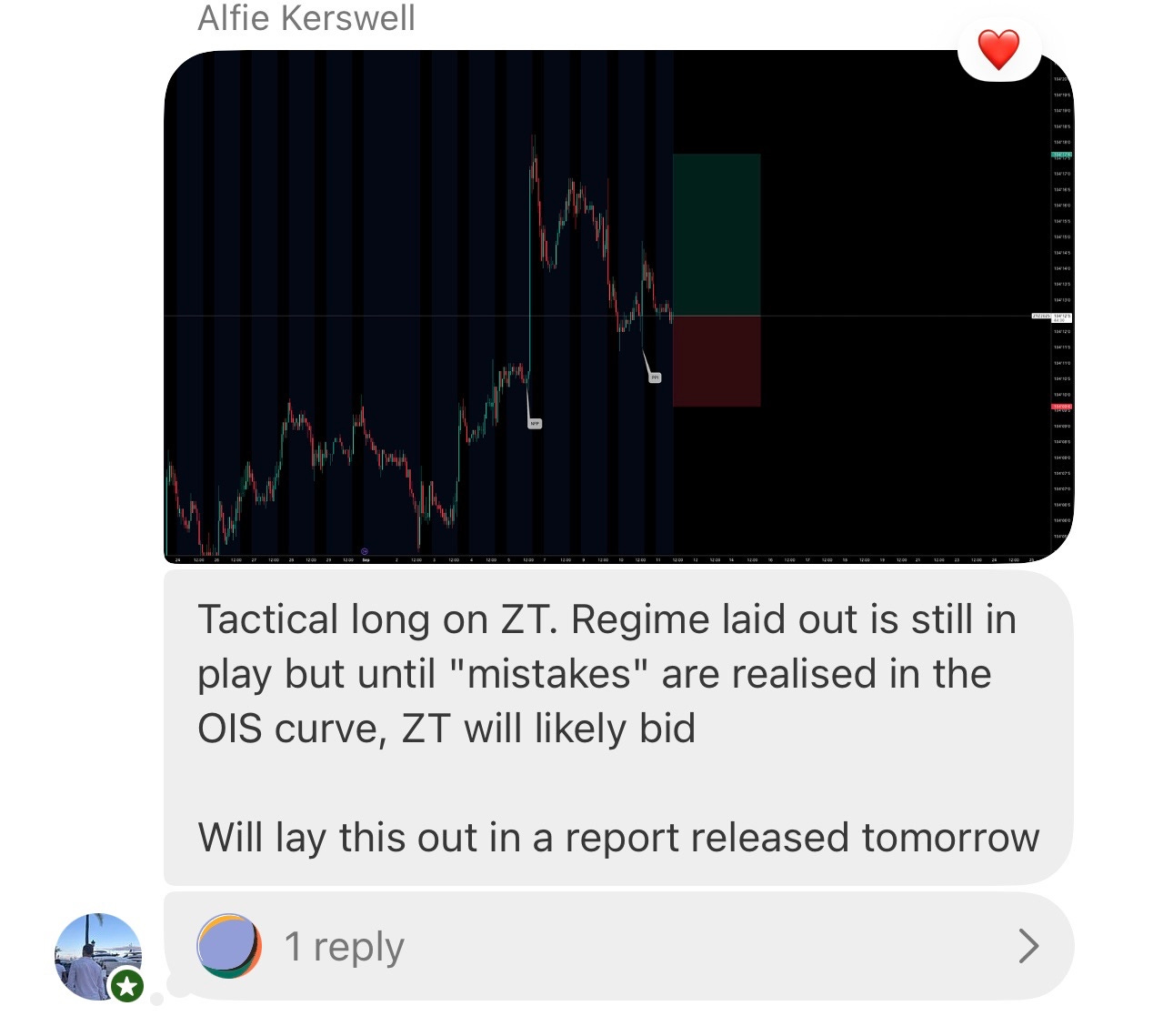

So, why was ZT the play if risk is rallying on data? (Reffering to the trade I sent to the chat):

This was a tactical trade based on how markets are reacting to negative growth prints. Every softer growth release has led to further cuts being priced on the OIS curve, especially in the front-end (lifting ZT), and that repricing has simultaneously fueled flows into high beta (Russell) because liquidity is not impaired and recession is not the base case. ZT delivered exactly as expected, and we took profit on the spike.

It’s worth noting, however, that ZT mean-reverted quickly after the initial move, while the 2025 curve has marched relentlessly toward the 75bp mark, showing how aggressively markets are leaning into this easing narrative.

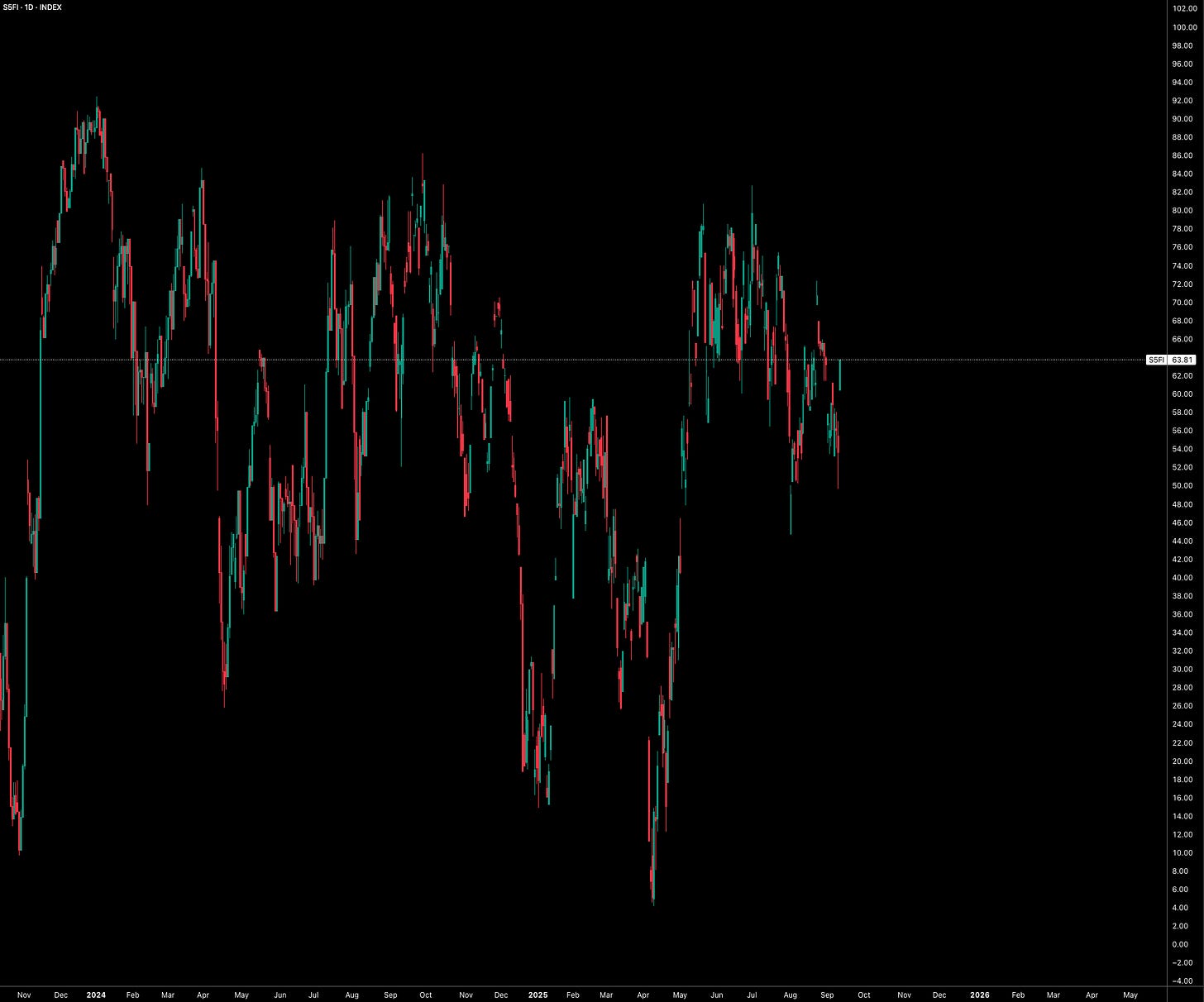

Meanwhile, equities are rallying as the 2s10s bull steepens. A textbook economist might flag a bull steepener as bearish for equities in the medium term, but context matters. A bull steepener driven by Fed cuts while inflation is still elevated and growth remains moderate is not inherently bearish. It only becomes bearish when steepening reflects outright growth collapse. What we are seeing now is very different. There have been 37 straight days of bull steepening in 2s10s as the S&P has rallied to new highs. Even at all-time highs, equities still look to have room until growth turns materially negative. Atlanta Fed GDPNow at 3.1% this week underscores the point: this is not a recessionary backdrop. The labor market remains a tail-risk because weaker labor will eventually filter into weaker inflation, but that process takes time.

Risk assets continue to react positively to downside surprises in inflation (PPI) and growth because the Fed is implicitly treating growth as the bigger risk, but it’s not. At a 4.5% policy rate, growth is still showing positive momentum on most medium-term measures, and inflation is accelerating across every 3-month series. Yet markets prefer to trade the liquidity angle. The Russell continues to outperform the Dow, a clear rotation into risk. Any Dow outperformance is limited to short, weekly timeframes and not structural. Bitcoin has resumed its outperformance versus the S&P500 after a brief period of underperformance, another clear signal that investors are reaching for liquidity-sensitive assets even in the face of softening labor data. Traders on the highest end of the risk curve are focused on liquidity and conditions, and liquidity is still abundant, supported by both growth and inflation, and reinforced by expectations of rate cuts.

Equity internals remain supportive, breadth is fine.

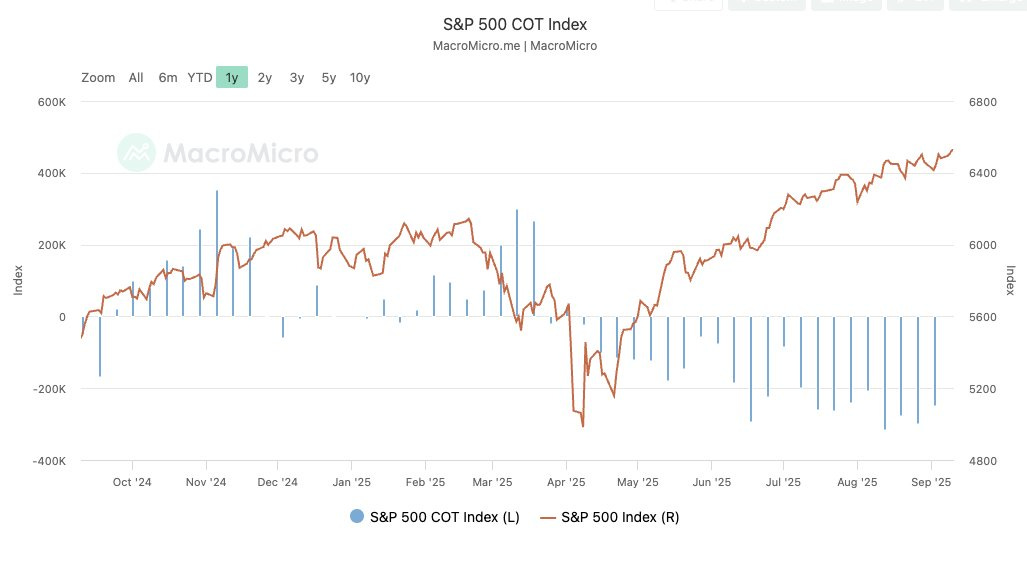

We’re still in positive territory for stocks above the 50-day MA on the S&P500, momentum continues to skew to the upside, and positioning is skewed net-short. History shows that ATHs combined with negative positioning often force aggressive covering as shorts capitulate and longs are added, leading to extended rallies.

Volatility metrics confirm this complacency: both VIX and VVIX are low, suggesting no fear of imminent recession. Breakevens are falling only modestly, which means inflation is still present but long-end rates are not yet dragging equities lower. Until the long end starts to weigh, growth is not enough of a problem to derail the cycle.

All eyes now turn to the Fed meeting next week, with 27bp of cuts already priced, essentially guaranteeing at least one move. The key will be Powell’s messaging around the growth versus inflation trade-off. My read is that the Fed still sees growth as the tail-risk and inflation as “temporary” or “transitory,” which is a policy mistake given how persistent inflation has been. If the Fed delivers 25bp, markets are already priced and equities will likely grind modestly higher, ZT will firm, and ZN will remain neutral at best (the long end could interpret it as policy error). If they surprise with 50bp, expect aggressive moves: equities surging beyond their 30-day vol momentum, the 2s10s bull steepening violently, and gold pushing further into new highs. That would be the market acknowledging a Fed mistake in real time.

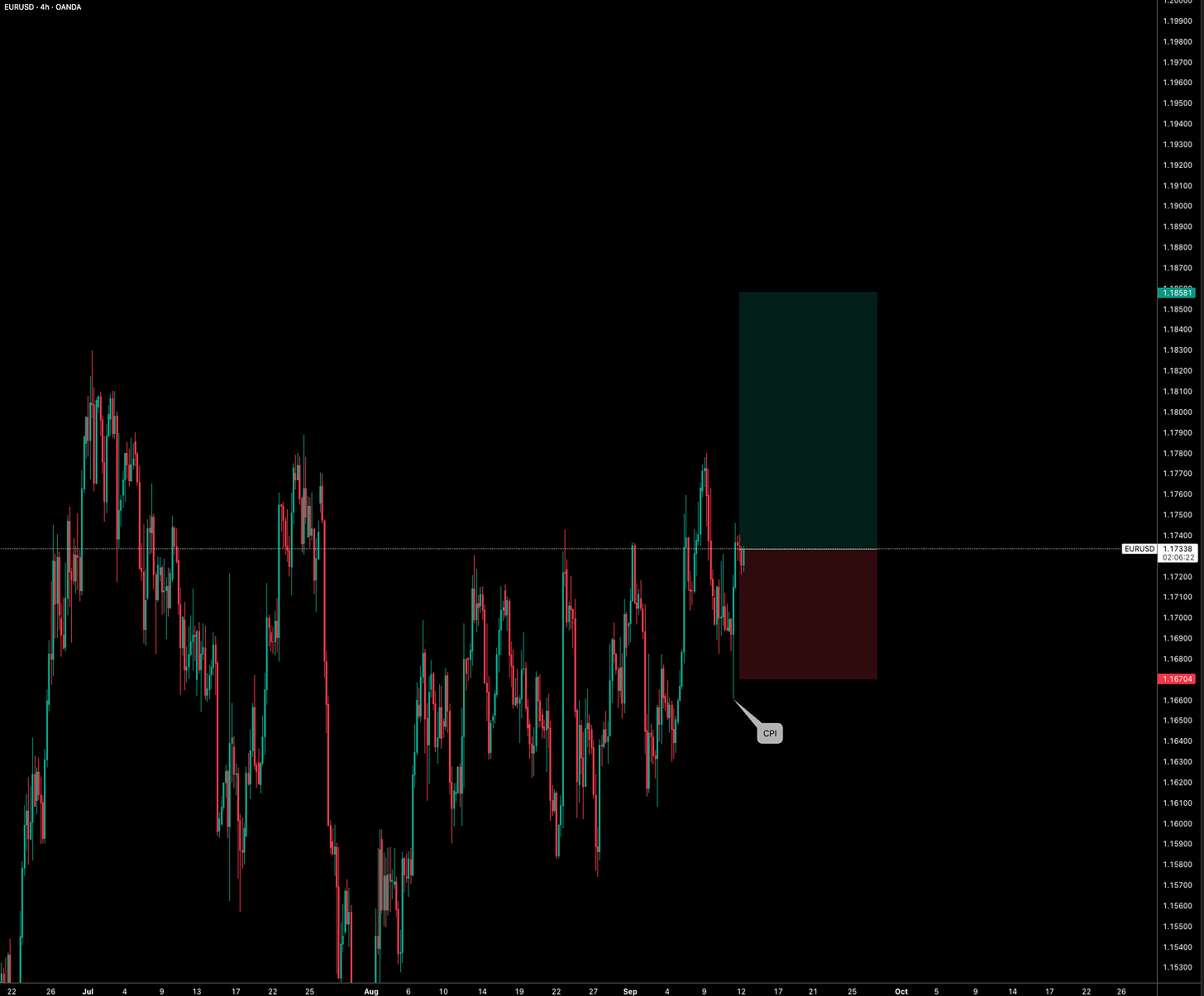

In terms of trades, equities are in extremes and the risk/reward is not compelling. The more interesting opportunities are in interest rate differentials, a theme that has been on the back burner for the past two months but looks increasingly relevant. See EUR/USD position below, that’s where I’ll be focusing into and through the Fed meeting (not financial advice, just my own ideas).

As always guys, have an amazing weekend!