Rates, Equities & FX: The Road Ahead

Rates Are Talking, Equities Are Listening

Hey everyone,

We’re heading into the final stretch of the year which means it’s the last two months where focus, discipline, and conviction really count.

This is when traders either drift or lock in, and I’m determined to do the latter.

Let’s get into it.

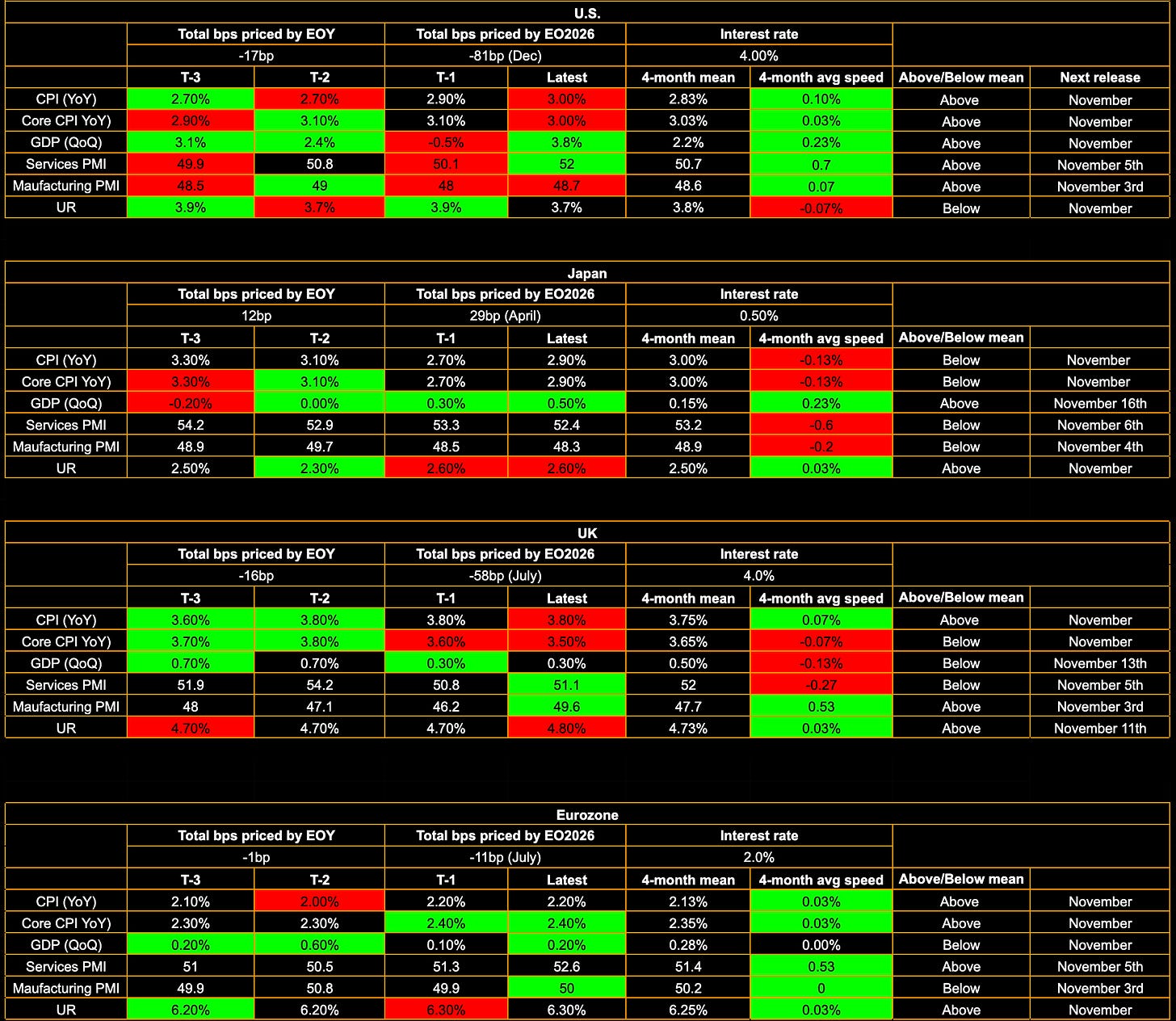

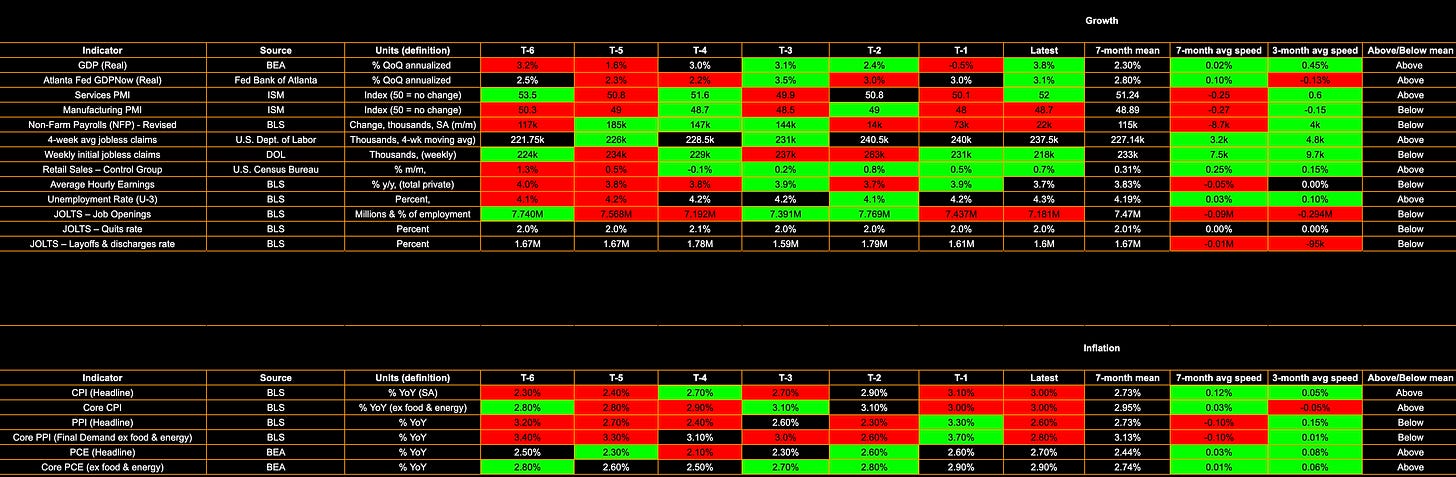

G4 tracker

Let me know what you think of the updated tracker!

U.S. tracker

Rates, Equities & FX: The Road Ahead

The FOMC voted to cut interest rates by 25 basis points to 4%, a decision that was already fully anticipated by OIS markets. In its statement, the Committee noted that economic activity continues to expand at a moderate pace, while job growth has slowed, unemployment has risen slightly, and inflation remains elevated amid ongoing uncertainty about the economic outlook.

Despite the rate cut, the Fed made clear that further easing is not guaranteed. Powell underscored that the December decision “is not a foregone conclusion,” highlighting that policy remains data-dependent and that the Committee is divided on the path ahead. The Fed also announced plans to end quantitative tightening on December 1, marking a shift in focus toward supporting employment and balancing risks beyond inflation alone. Market reactions were generally muted, though the key takeaway was that...

What we’re seeing is the early phase of a policy transition, the Fed is moving from a “higher for longer” stance toward a conditional easing approach. However, this shift is unfolding in an environment where both growth and inflation remain resilient, creating a degree of narrative risk. Each new data release now carries outsized market significance, as the Fed’s bias toward easing is contingent on incoming data rather than being pre-determined.

That combination creates a volatile backdrop for short-term rate expectations, forcing investors to continually reassess whether the economy is heading for a soft landing or a potential policy misstep. The Fed’s sensitivity to incoming data has become clear, whenever inflation or growth readings come in softer, policymakers respond quickly. Any further downside in these metrics would likely see the market price in additional rate cuts.

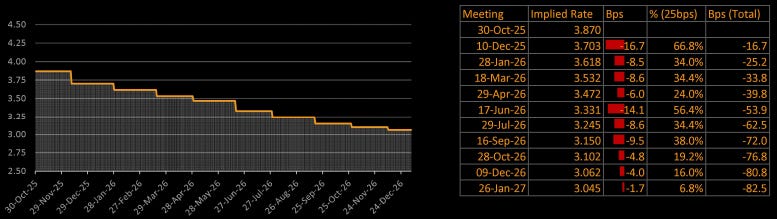

Looking at the OIS curve, rate cut expectations have been pared back, though only modestly. Markets now assign about a 65% probability of a December cut, down from what was an almost certain 25bps move before Powell’s remarks.

Chart below from Capital Flows (Substack/X):

This re-pricing matters because it introduces greater uncertainty for both equities and bonds heading into year-end, something I’ll expand on later in the report. It’s also worth noting that, while inflation swaps have moved lower, they remain well above the Fed’s 2% target, with the 1y at 3%, the 2y at 2.7%, and the 5y at 2.5%. In theory, this would justify pricing out at least one rate cut, but given how the Fed has consistently responded to softer data, I don’t think that will happen. At this stage, the December cut still looks set.

Inflation swaps may be edging lower, but they remain well above target, and that’s a crucial distinction. It suggests that inflation expectations are still not fully anchored, and confidence in a smooth disinflationary path remains fragile. The Fed is acutely aware of this, which is why it continues to emphasise a “data-dependent” stance. Any renewed acceleration in CPI or PCE momentum could swiftly reprice the OIS curve and trigger further selling at the front end of the curve.

The terminal rate remains anchored around 3%, and if the policy path unfolds as currently priced by OIS, markets are anticipating roughly four cuts over the next seven meetings, an aggressive trajectory given that inflation data is still showing positive momentum (see the “Tracker” tables). Bonds reacted by selling off, with the 2y rates rising more than the 10y, leading to a flattening of the 2s10s curve. Equities initially followed with a brief pullback but quickly reversed, retracing most of the move.

The 2y was hit harder than the 10y for a simple reason: even though the Fed delivered a 25bps cut, Powell pushed back on expectations of further easing, emphasising that December is not a “foregone conclusion.” It was effectively a hawkish cut, signaling that the Fed is no longer validating the degree of easing markets have priced in, as it once did. As a result, traders reduced bets on near-term cuts, pushing up 2y rates up (and driving ZT lower), since that part of the curve is most sensitive to the expected path of Fed Funds over the next few meetings.

So why is the 2s10s curve flattening even though growth and inflation remain strong while the Fed is cutting into that strength? The answer lies in the front end holding firm as OIS reprices slightly after Powell’s hesitation to confirm a December cut. At the same time, inflation has been easing, and although it’s still expected to stay above the Fed’s target, markets are responding to softer inflation swaps and metrics across the board. There’s also an element of policy risk being priced in: if investors believe the Fed may be making a policy mistake that could require re-tightening later, longer-term growth expectations begin to weaken, pulling 10y rates lower and contributing to the flattening.

The 2s10s flattening, despite solid growth, highlights a deeper market concern which is the risk that the Fed may be cutting into strength and ultimately need to reverse course. In that sense, the curve is partially reflecting a policy error premium. The front end remains elevated as markets reprice rate expectations higher following Powell’s hesitation, while the long end captures fears that premature easing could reignite inflation and force the Fed to tighten again later. This combination keeps a flattening bias in place, even against the backdrop of a resilient economy.

Ultimately, nothing significant has changed, we remain in a regime that supports further upside in equities. Stocks are rallying broadly, and it’s not just large-caps leading the move… the Russell is trading near ATHs, earnings growth is solid, bonds are selling off, and rates are no longer weighing on equities as the Fed cuts and injects liquidity while growth momentum stays positive. The Trump-Xi meeting didn’t produce any concrete outcomes, but the tail risk of renewed tariffs for equities continues to fade. The meeting itself wasn’t negative because there were some constructive signals, though Trump’s remarks about being a “tough negotiator” tempered the optimism slightly.

Equities continue to be the clearest reflection of the current regime: liquidity conditions are improving, growth momentum remains strong, and policy is becoming less restrictive at the margin. The rally’s breadth (with small-caps catching up and cyclicals outperforming) indicates that this move is driven by more than just multiple expansion, it reflects a genuine shift in growth sentiment. As long as liquidity dynamics, such as the Fed’s balance sheet pause, remain supportive and earnings revisions hold steady, equities should retain structural support through year-end.

Another supportive factor for equities is the continued calm in volatility markets, the VIX has struggled to sustain any upward momentum and remains at subdued levels, with no signs of stress in funding or credit markets spilling over into equities. The persistence of low realised and implied volatility is telling… despite policy uncertainty, the VIX staying pinned reflects investor confidence in the Fed’s backstop. Unless we begin to see strain in funding markets, corporate spreads, or the Treasury basis, this low-volatility regime is likely to persist. That, in turn, suppresses downside convexity and reinforces a buy the dip mindset, helping equities remain resilient even as front-end rates fluctuate.

Until we see signs of funding or credit stress, a sharp decline in inflation swaps, a slowdown in earnings, the OIS curve pricing out cuts, and growth and inflation metrics turning negative (alongside a clear rotation back to large-caps outperforming small-caps), I remain confident that downside risk in equities is limited.

As for the dollar, momentum has started to turn higher as interest rate differentials once again drive FX moves. However, I still believe the dollar has more downside ahead into year-end given the scale of cuts already priced in. The current USD strength looks temporary, particularly considering its high equity beta throughout the year. In FX terms, the dollar is caught between two opposing forces: the short-term repricing of U.S. yields and the medium-term decline in real rate differentials. The post-meeting rally appears more like a tactical adjustment than a true regime shift. As liquidity conditions improve and rate cuts resume, the dollar’s structural bias should turn lower, especially against higher-beta currencies tied to global growth. In short, this late-cycle reflex rally is likely to fade into Q1.

Trades

I’ve expressed my upside view in commodities through a few small positions , a bias I’ve maintained for several months and outlined in prior reports. As we move toward year-end, market dynamics remain delicately balanced… bonds are adjusting to a hawkish cut, equities are front-running the liquidity impulse, and the dollar is caught between cyclical and policy crosscurrents. The next phase hinges on how inflation momentum unfolds over the coming months. If CPI moderates without undermining growth, we could enter a genuine Goldilocks phase, one where easing becomes self reinforcing. If not, the narrative may quickly shift toward “policy error,” with the recent 2s10s flattening having served as the early warning signal.

I’ll be closely monitoring how EUR/USD trades over the next two weeks in the box below. Ideally, I’d like to see eurozone rates start to firm into year-end. If November inflation prints in the U.S. lower again, alongside a decline in inflation swaps, I think the December and January cuts could become fully priced in. That said, I’m not abandoning my broader bias that the Fed will eventually need to step back onto the curve due to persistent inflation and strong growth; I’m simply framing this near-term view around how reactive the OIS curve has been to softer data.

The most compelling trade heading into year-end remains the Russell. Growth is solid, the Fed has multiple rate cuts lined up, earnings are strong, liquidity is improving, and credit conditions are stable. Altogether, this backdrop is highly supportive for the current regime. I would reconsider this view only if small-caps start making new lows as labor data and inflation soften in November, an unlikely, but fair, falsifier for the thesis.

The gold call from mid-August was exceptional, arguably one of the trades of the year. What’s even more interesting is that I now see additional reasons for further upside in gold. The setup below represents an optimal entry, and I opened a manual position in Friday’s NY session. If prices start trading below the stop levels, however, I’d become more cautious about the prospect of gold reaching new ATHs by year-end, as that would suggest renewed selling pressure rather than a continued unwind in positioning, which has already largely played out. The conditions outlined across multiple reports (including this one) are precisely why I remain long on gold.

If you’ve been following the trades over the past few months, you’ll know there have been some outstanding calls, well in the money for the year. I’d really appreciate it if you could share this around, it goes a long way and means a lot!

See you all next week!

Well done with these reports, very detailed, very thoughtful, and highly professional.

Keep going, I'll try to spread this around to help you grow!