Week Ahead: G4 Market Outlook

Euro Futures Under the Lens

U.S. data risk is about to collide with a curve already inching toward a full December cut, and with breadth thinning again, even small wobbles in big tech are dragging the tape. Policy signals across Japan, the UK and Europe only add to the tension.

Let’s get into it!

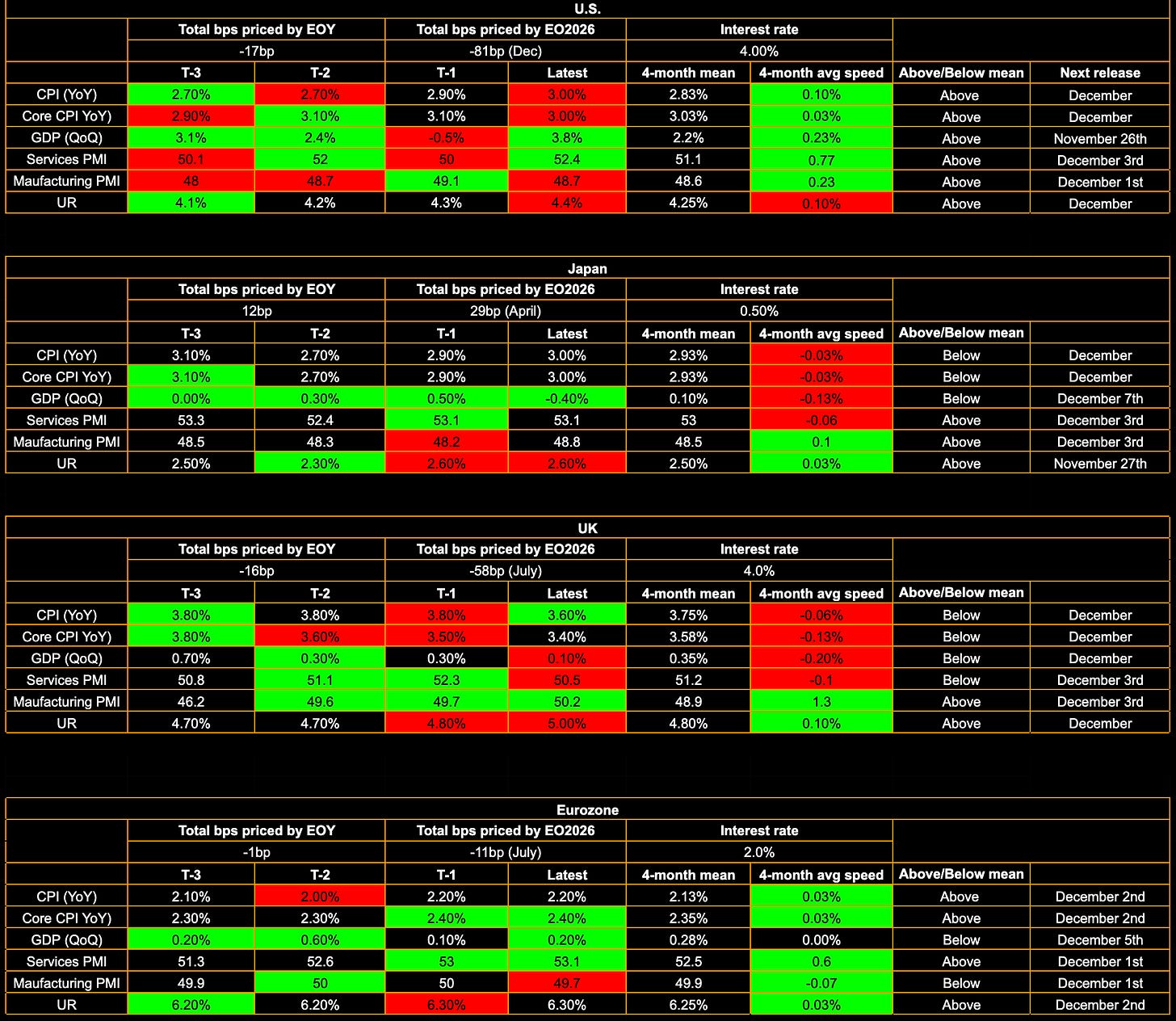

G4 Tracker

Week Ahead

This week in the U.S., my eyes are glued to the big September readings on PCE, retail sales control and PPI… even though weekly jobless claims still matter. I’m watching how these releases actually hit the OIS curve, which is currently pricing about 17bp for the cut in December meeting. That one is worth paying attention to because the recent shift in equity positioning and the unwind we’ve seen basically came from the Fed taking a relatively more hawkish tone compared to previous speeches and meetings.

If the curve starts drifting closer to a full 25bp cut for December, that would probably support equity positioning again. But there are still some annoyances in the way, like higher real rates dragging, endless chatter about high P/E ratios and leadership rotating out of the rate sensitive sectors that powered the move higher, all while breadth keeps tightening. Big tech is still on a ridiculous run, but since they’ve been the engines behind such a strong rally, even a tiny wobble, like the dips we’re seeing in the charts below, can pull the entire index lower even if the broader regime is still friendly for upside.

We’re only a bit over 4% off the highs, but as long as breadth is thin, real rates stay elevated, the Fed sticks to this stance and inflation comes in lower across the board (hard data + swaps + expectations), equities have downside. Last week I talked about being long equities if the pressure from those factors eased up, but those pressures didn’t ease at all, especially with the dollar catching a bid again. If nothing changes, the downside target I have for ES is around 6400, though I really don’t think this is a moment to panic or declare the regime dead. It feels more like a temporary positioning shakeout that ultimately sets up great long entries.

Over in Japan, there’s inflation, retail sales and unemployment data coming on Thursday, plus some central bank remarks. BoJ board member Noguchi is speaking, and I’ll be watching mainly to get a read on his tone. There’s a lot of talk about the BoJ skipping a hike in December, which honestly makes sense given how weak growth has been, even though they rolled out stimulus plans last week.

Japan’s government (led by Takaichi) approved a ¥21.3 trillion (roughly $135 billion) stimulus package aimed at boosting growth and easing cost of living pressures. Around ¥17.7 trillion is direct government spending and ¥2.7 trillion is coming through tax cuts. They’ve put money toward energy subsidies, household support including cash handouts for families, tax relief for lower and middle income earners and big investment in AI, semiconductors and clean energy to beef up Japan’s industrial competitiveness. Markets liked the headline boost but are still wary because Japan’s public debt is already huge, and long term yields plus the yen both reacted to the scale of the fiscal push.

Japan’s core problem is that if inflation keeps inching up but this stimulus doesn’t translate into real growth, they get stuck choosing between crushing growth even more with rate hikes or letting inflation run. And if they borrow anything from the Fed’s playbook, they’ll probably avoid reacting too aggressively to inflation and instead focus more on labor and growth. The Nikkei has popped 24% this year, but even with talk of delayed rate hikes, I think the top is probably in for the year, especially as selling vol is supporting the sell off and the 30y keeps breaking higher to levels where rates start dragging on domestic equities.

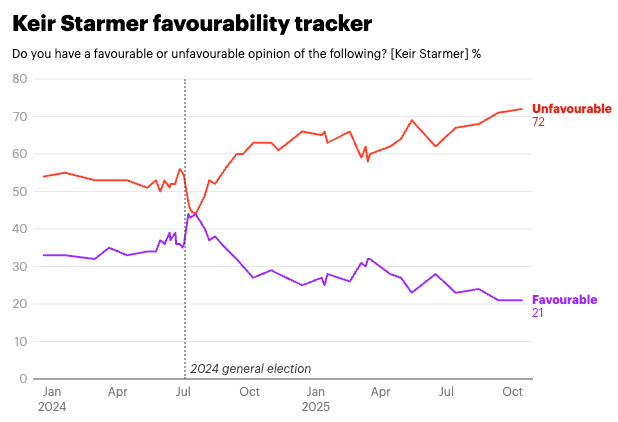

Now the UK. The big spotlight is on Wednesday’s budget. Labour has been under a cloud, ratings across the board have been pretty depressing and honestly that’s not surprising given how often their stance seems to change. They came in promising no tax hikes for working people and even pledged to cap corporation tax at 25%. But Rachel Reeves wouldn’t rule out hikes to things like capital gains tax, inheritance tax or changing thresholds instead of rates, meaning people get pushed into higher brackets as wages rise. No shock that the chart below looks like it does.

The key thing to watch is how much they walk back on their promises, because even before people panic about taxes, the real threat is the public losing confidence after yet another political U turn, assuming that hasn’t already happened. FTSE upside might be limited even if the BoE cuts 25bp in December, which is likely, because corporations will still be worried and higher taxes just add more pressure. Reeves said we all need to pull together to fix the issue, but unfortunately things could get worse if she leans too heavily on the public to raise capital instead of cutting spending. We’ve already seen more than a quarter million Brits leave permanently. The solution isn’t always to raise taxes, because people just leave and find better financial setups elsewhere.

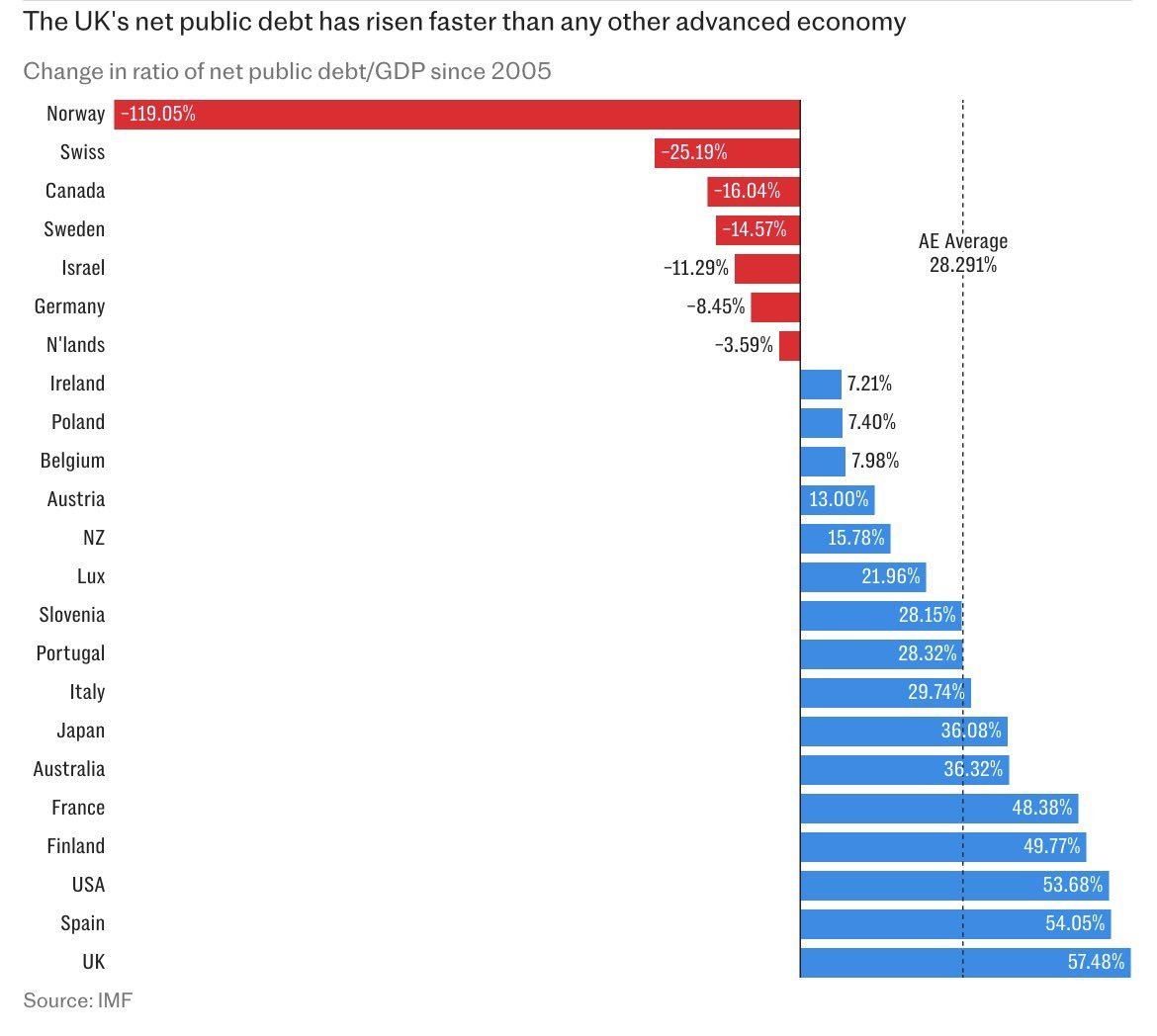

The UK’s debt ratio has surged more than any major economy, far above the advanced economy average, which shows how weak productivity and fiscal drift have piled up through multiple crises. It leaves the next policy cycle boxed in, with growth demands smashing into already exhausted fiscal space.

As for the Pound, likely further downside pressure, probably with some momentum because the combination of a lower terminal rate, earlier rate cuts and a real lack of confidence in the country will push capital away. GBP futures look great to short, but even better on my list is the Euro.

Now onto the Euro. In the report below, I laid out the idea that the Euro would rally from levels at the time I wrote it.

But we’re now at a point where rate differentials, a stronger dollar and some positive equity currency correlation are dragging the Euro lower. The ECB is in a comfortable spot, not a panic zone, and they’re definitely not facing the inflation tail winds the other G4 members are. And considering the dollar is still down over 7% this year, which fairly priced in the shift in the US OIS curve, it’s hard to see further dollar depreciation without clear evidence of policy error, a much lower terminal rate (50bp or more) or inflation and labor data falling apart at warp speed. This is my trade going into the week ahead:

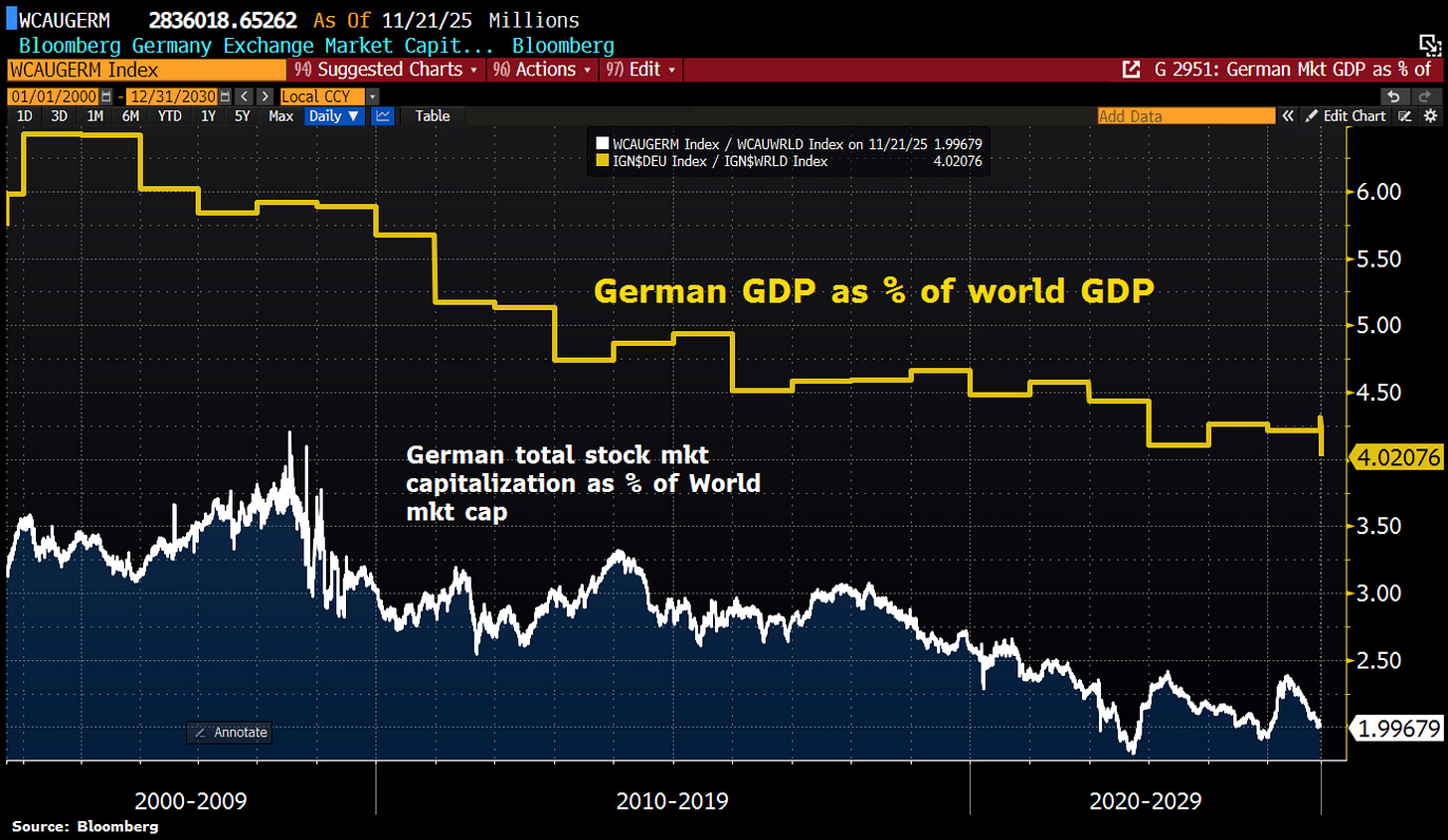

Things aren’t great for the main eurozone equity market either because Germany is losing influence on the global stage. Its share of world GDP has dropped to 4.3% and is projected to fall to 4% by the end of the decade. Germany’s footprint in global markets is shrinking too, with the market value of German stocks falling below 2 percent of global market cap again.

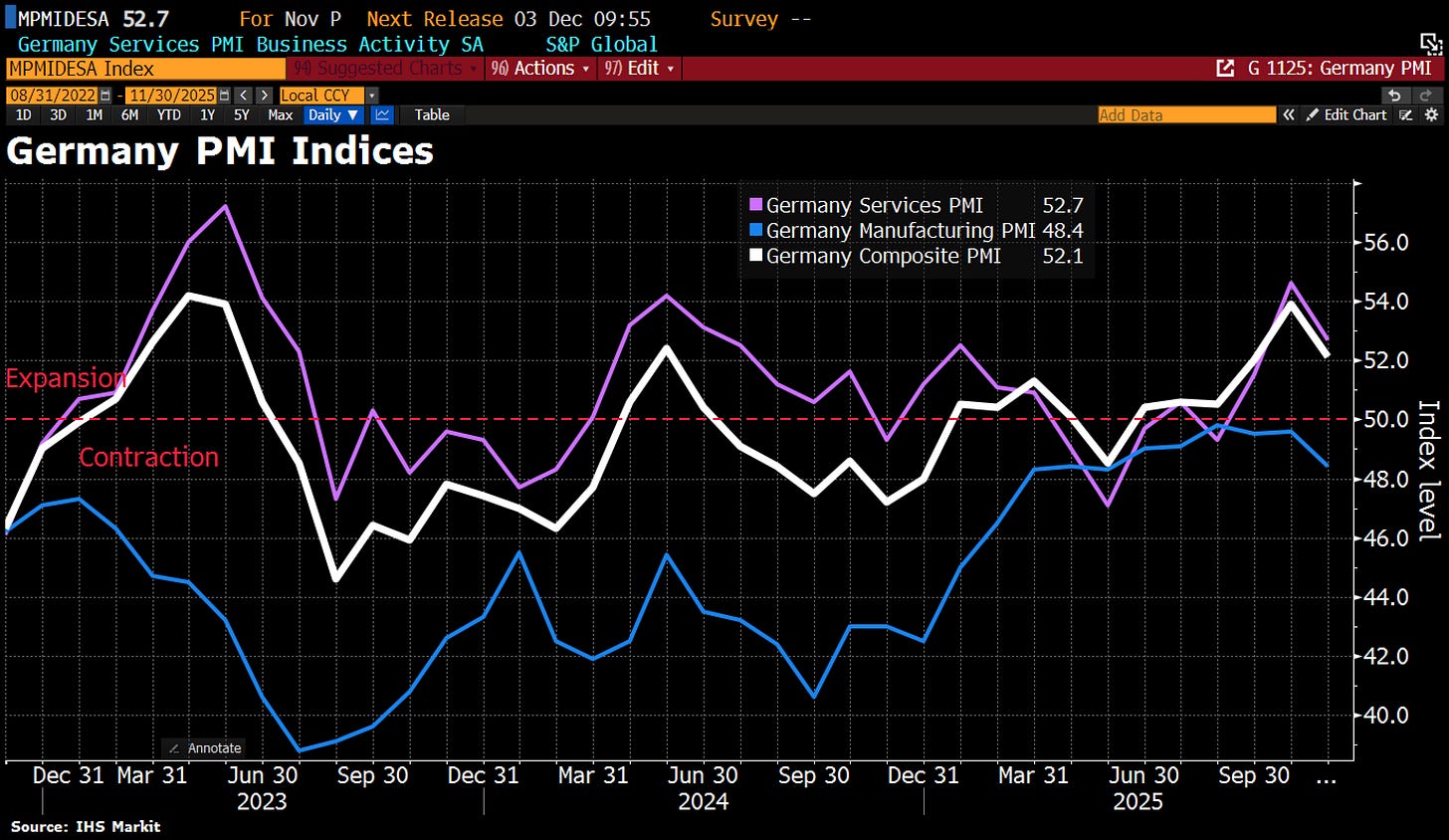

Business activity also slowed in Germany in November. The Composite PMI slipped to 52.1 from 53.9 in October, basically signalling that the German economy is barely growing and may only manage marginal expansion in Q4. Manufacturing is still the main drag, with the Manufacturing PMI dropping to 48.4 as U.S. tariffs and rising competition from China weigh on output.

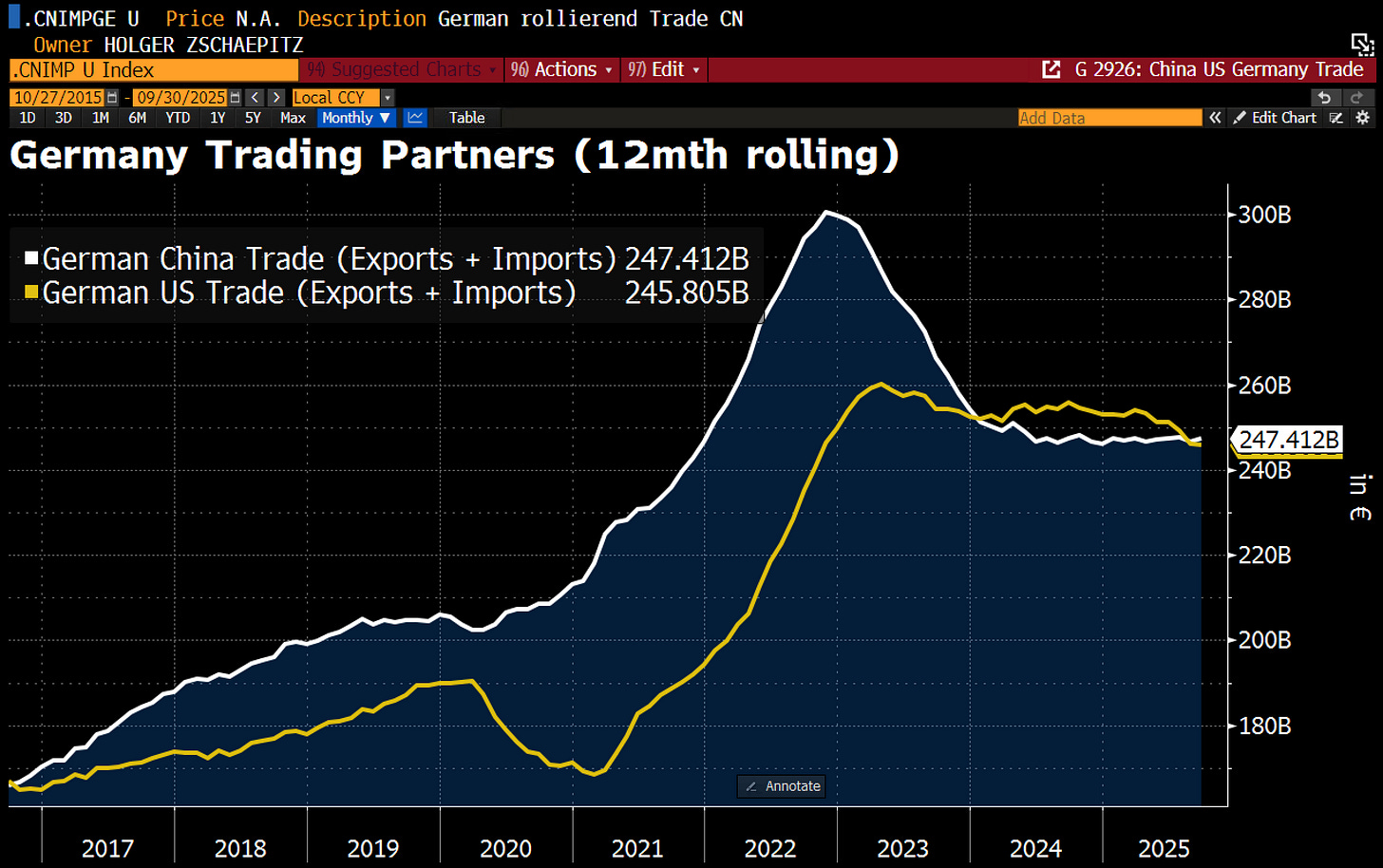

China is becoming an even bigger trading partner. Over the past twelve months, trade with China totaled €247.4bn, nudging ahead of the €245.8bn in trade with the U.S. The issue is that trade with the U.S. supports German growth because Germany runs a surplus there, while trade with China weighs on growth because Germany runs a large deficit. That deficit with China has now widened to almost €78bn over the past year.

Have a great week ahead, trade safe!