Vol Shock, Equity Flush… I'm Going Long

Fear Is High & Prices Are Low, I’m Stepping In

Hey everyone,

There’s something fascinating about how markets can look calm on the surface while everything underneath is shifting.

It’s those quiet transitions that usually matter the most.

Let’s get into it.

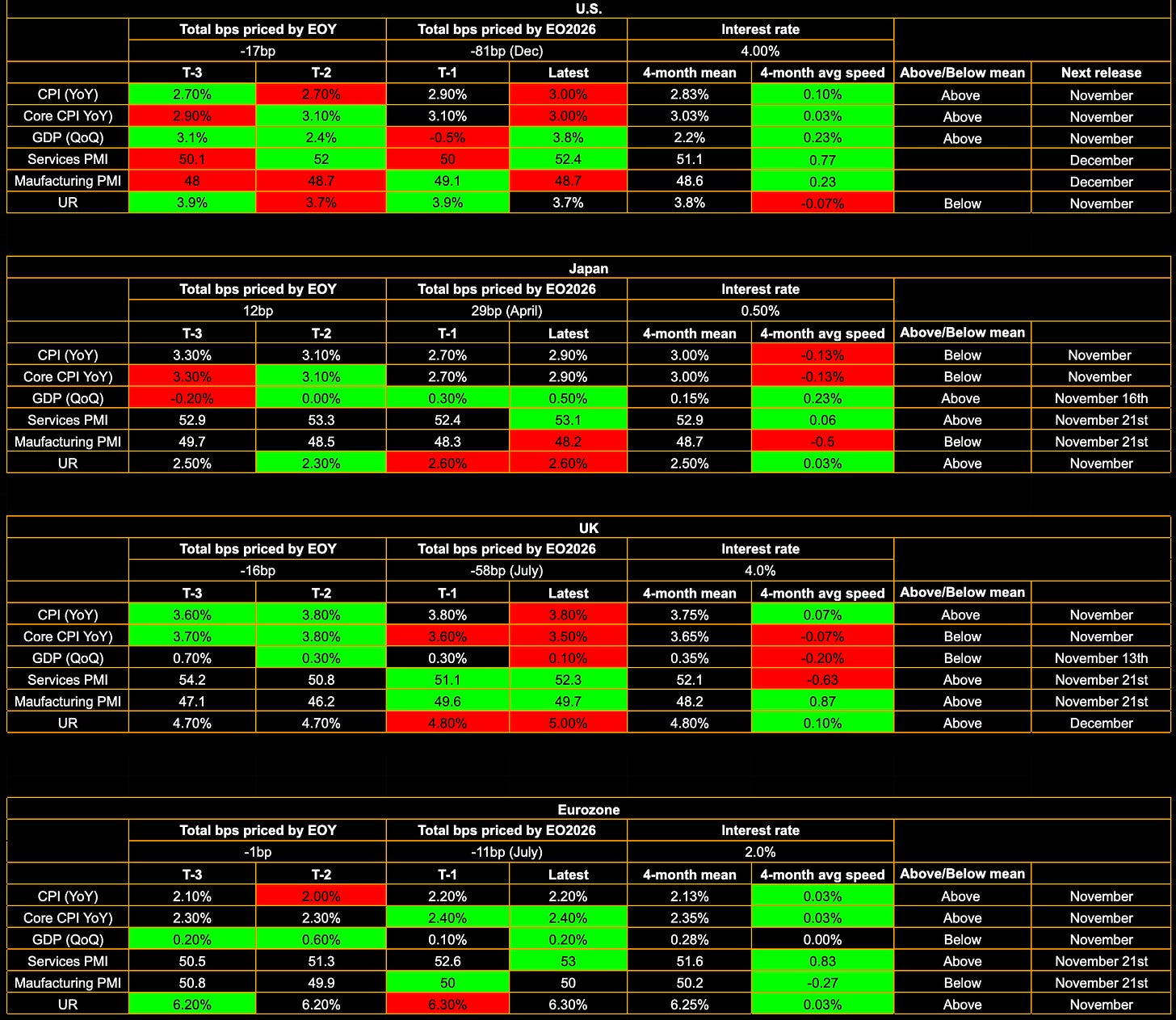

G4 tracker

U.S. tracker

So let’s get straight into the elephant in the room, equities were bleeding until Friday’s NY session. There was fear, people were calling tops and I had to sit back and cut the noise, as I like doing in these situations. I focus on market regimes, not consensus, not a single analyst, but my own deep research, I want to build conviction from inside myself, not in someone else’s ideas. I have mapped out the regime we are in with such depth that my conviction has matched my risk and trades, just as we see in the Gold trade from a couple weeks back which I’ll put below with the connected report.

Connected report:

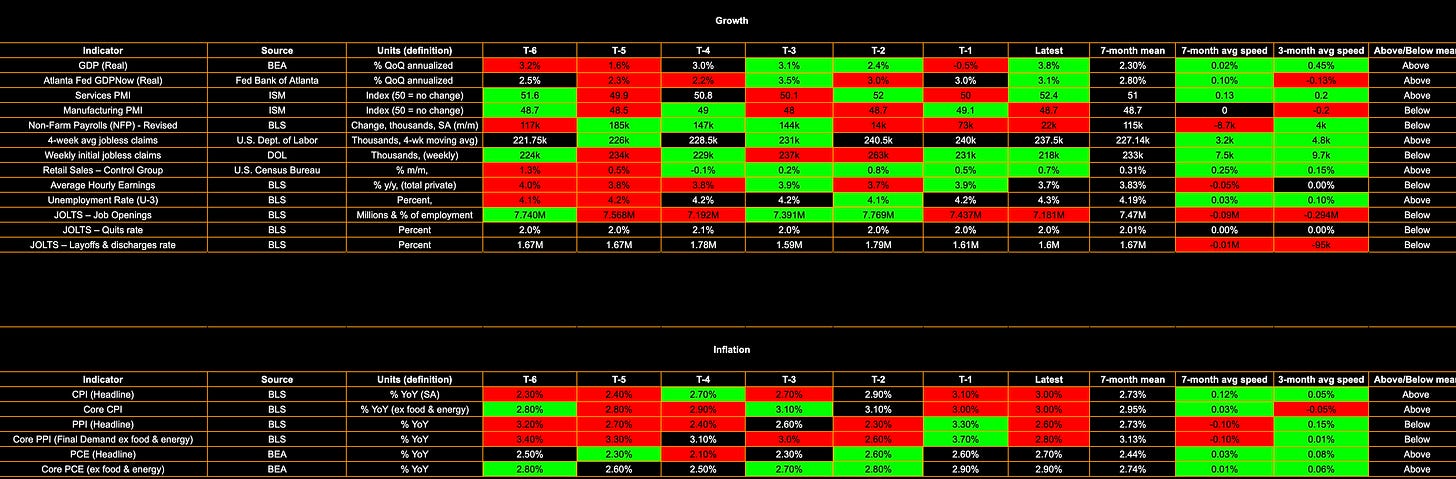

Anyway, let’s get into why equities have sold off. First let’s start with the obvious, the mildly hawkish change in stance from the Fed. As I laid out in the recent macro report, Powell simply didn’t commit to the December cut although we know he is likely to deliver on it. That re-pricing went from nearly 100% of a 25bp cut in December to now where there is a 50/50 chance… 15bp priced for December to be precise.

Ok, so if the Fed are being hawkish why do I still want to be long equities? That’s because I don’t think it’ll last long with the data that is slowly becoming worse (but not worrying) in the labor market, and although inflation is still an issue (with inflation swaps flip flopping up and down), we know the Fed are focused on labor data based on their tone in recent FOMC meetings and their reactiveness to small signs of labor slowdown, but ultimately the economy is still fine.

Now next on the list of reasons for the recent equity sell off, the so-called AI bubble. The funniest part of this selloff is that nothing broke, the AI darlings just finally looked in the mirror and realised they’d been priced like they were about to colonise Mars by Christmas. After months of straight line up, zero volatility, and every fund manager on Earth hiding inside the same seven tickers, it only took one wobble in yields and a couple of soft headlines for the whole AI complex to suddenly remember gravity exists. Nvidia, Oracle, Tesla all sold off and the Nasdaq fell like someone pressed the group exit button on the entire AI trade.

Yeah you’re probably thinking what I’m thinking, this isn’t something to write home about, they’re still well up for the year…

But this wasn’t a “tech is dead” panic. It was more like the market doing a quick reset after a summer of main character syndrome, everyone was long the same mega caps, everyone thought rate cuts were a done deal (it sort of is…), and everyone assumed earnings would grow forever with no questions asked. Then the Fed started talking tough, real yields perked up, and suddenly those beautifully polished AI multiples looked less like the future of humanity and more like a very expensive group chat of over owned tickers. So the crowd did what crowds do, they all squeezed for the same tiny exit at once. It’s a de-rating, not a doom scenario. Call it an AI ego check.

Then finally, real rates have been creeping up slowly which has put some pressure on equities because of course it negatively impacts future earnings but once again, if I expect inflation to tick up (I do) and the Fed to keep cutting aggressively (I do), then this is only temporary. All of this then caused the VIX to spike above 23, which is still very subdued in comparison to April’s spike on the tariff saga and the more recent tariff talk a few weeks back that caused a spike in the VIX to hit above 29.

Ultimately I’m fading all of this fear. I think real rates will continue to tick lower, the Fed will cut in December, the VIX will fall sharply and the AI fears will disappear.

This is the trade I currently have open (since Friday, but it’s hard to send trades out in real time) and I’ve adjusted the RR so it matches the current price and my current stop loss order, total is a 1:4 payoff:

With that, have a great week!

Great review ,enjoyed the AI humour too ha

I was short NAS last week ,caught that sell off last week from the weekly high

I couldn’t ignore the previous weekly bearish close ,the biggest bearish close in some time with Nvidia selling off too ,

The question is ,Is there enough interest to be buying up at these highs for potential new all time highs after this long rally from April ? still long but maybe deeper pullbacks into more attractive prices

We will see