The Liquidity Trap

Exploring how economies fail with too much liquidity injected.

Hey guys,

To new subscribers welcome, to the OG’s, welcome back!

This Thursday's report is for the MMHPro community, but I’ll be sharing a free report for you all tomorrow, so stay tuned.

It’s been 4 months since releasing the ‘Four Foundations of MacroFX’.

And I can only say a massive thanks to everyone who purchased it.

My aim here is to provide the most value per word in macro relating to FX.

And in the process, make it simple.

Your support goes a long way.

Trust me.

I’ll be revamping the guide to make the information easily digestible, actionable and even more connected to the world of FX so you know how to truly build your independent macro view.

As a thank you, everyone who purchased this will get the revamped course 100% free when it’s done.

More on that soon.

What Is a Liquidity Trap?

Now for most of you, this concept is going to be totally new, so I’m going to break this down to you in a way that I would explain to my 21-year-old self.

Here’s the simplest explanation:

A liquidity trap is when interest rates are extremely low yet investors and consumers choose to save cash, instead of spending it. This usually occurs in a deflationary environment, making it difficult for the domestic central bank to stimulate activity, inflation and growth within the economy.

Hopefully, some alarm bells are ringing in your head about countries which may fit into this type of regime; the truth is, this is a structural issue that can’t be fixed by a liquidity pump by the central bank. Large amounts of reserves infused into the banking system have no effect on the underlying economy simply because there’s a disconnect between consumer activity and monetary policy.

Japan is probably one of the best examples of an economy which is has been experiencing a liquidity trap for the large part of two decades. But Japan is not alone, China also is another country which is showing signs of a liquidity trap with consumer savings rates measured at 49%! Compare that with the U.S where savings rates are 4.6%.

We’ll take a look at Japan as an example of an economy which has struggled to spark strong growth and activity from both its economy and consumers.

Japan’s Liquidity Trap Explained

Since the 1990s Japan’s economy has struggled to grow, coming out of the real estate and equity bubble in Japan which led to a prolonged period of lacklustre growth and economic stagnation.

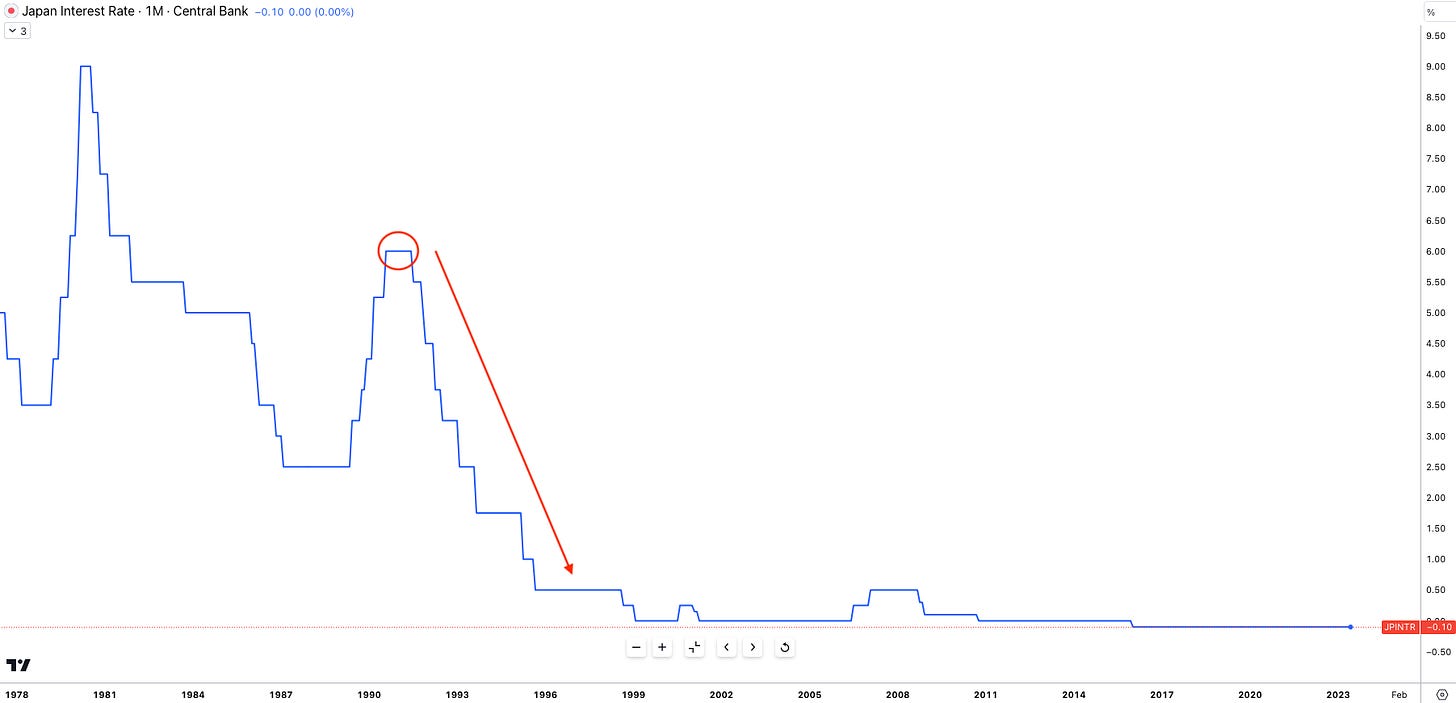

Coming out of the real estate and equity bubble which lasted from 1986-1991, the BOJ drastically cut interest rates in hopes to stimulate economic growth. Asset prices declined, and the Japanese economy began to experience deflation, a period of negative growth in inflation where purchasing power increased, up until the mid-2000s.

Before I continue, let me explain why a deflationary environment is a central bank’s worst nightmare.

In an inflationary environment, asset prices inflate, debt becomes easier to service, money is cheaper, credit usually becomes more widely available and the overall economy can grow towards its potential GDP, also referred to as the output gap, the difference between actual output (GDP) and what the economy can produce at maximum efficiency and output.

In a deflationary environment, one big concern is the increase in the value of debt. Remember, in a deflationary environment the value of money increases, meaning a $1 today would be able to buy more goods over time.

With debt, the interest payment is typically fixed, and looking at any economy the majority of private sector debt excluding corporations is mortgages, student loans, household loans and other fixed-term debt. A deflationary environment makes it more expensive for homeowners to pay because the mortgage payment has increased, in real terms, whilst their income (from a job) would decrease as companies are forced to cut pay and lay off workers.

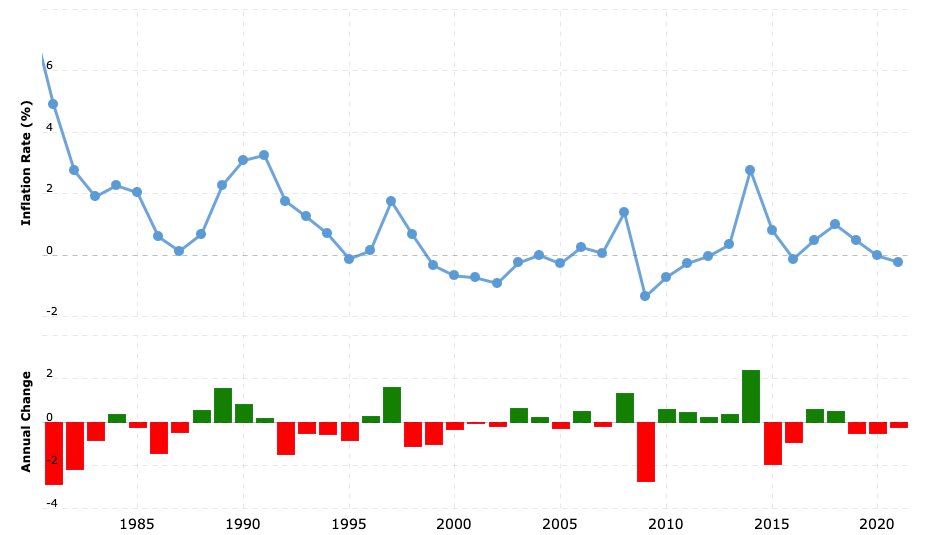

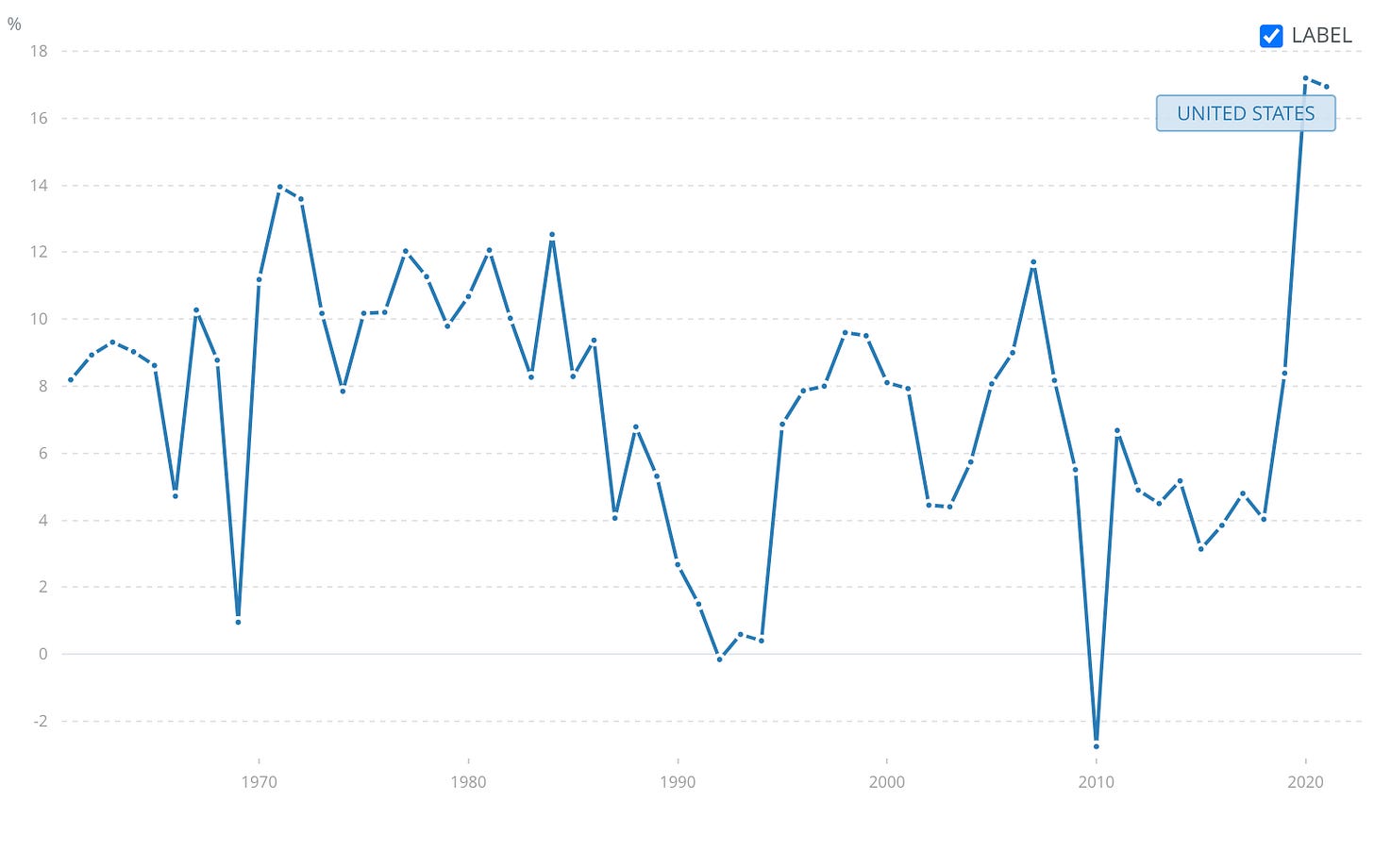

Take a look at Japan’s inflation rate from the 1990s to mid-2000s.

As you can see, for the large part Japan didn’t get out of its deflationary period up until 2011/12, yes there were a few years in between when inflation was positive but on a longer spectrum the nation struggled immensely.

But why?

What could possibly cause a whole economy to practically not only come to a halt but altogether contract?

Here’s one explanation, citizens within the Japanese economy became so pessimistic about their financial future and the health of the economy resulting in an unwillingness to invest or spend that money. They chose to hold onto the money they have and pay down debts.

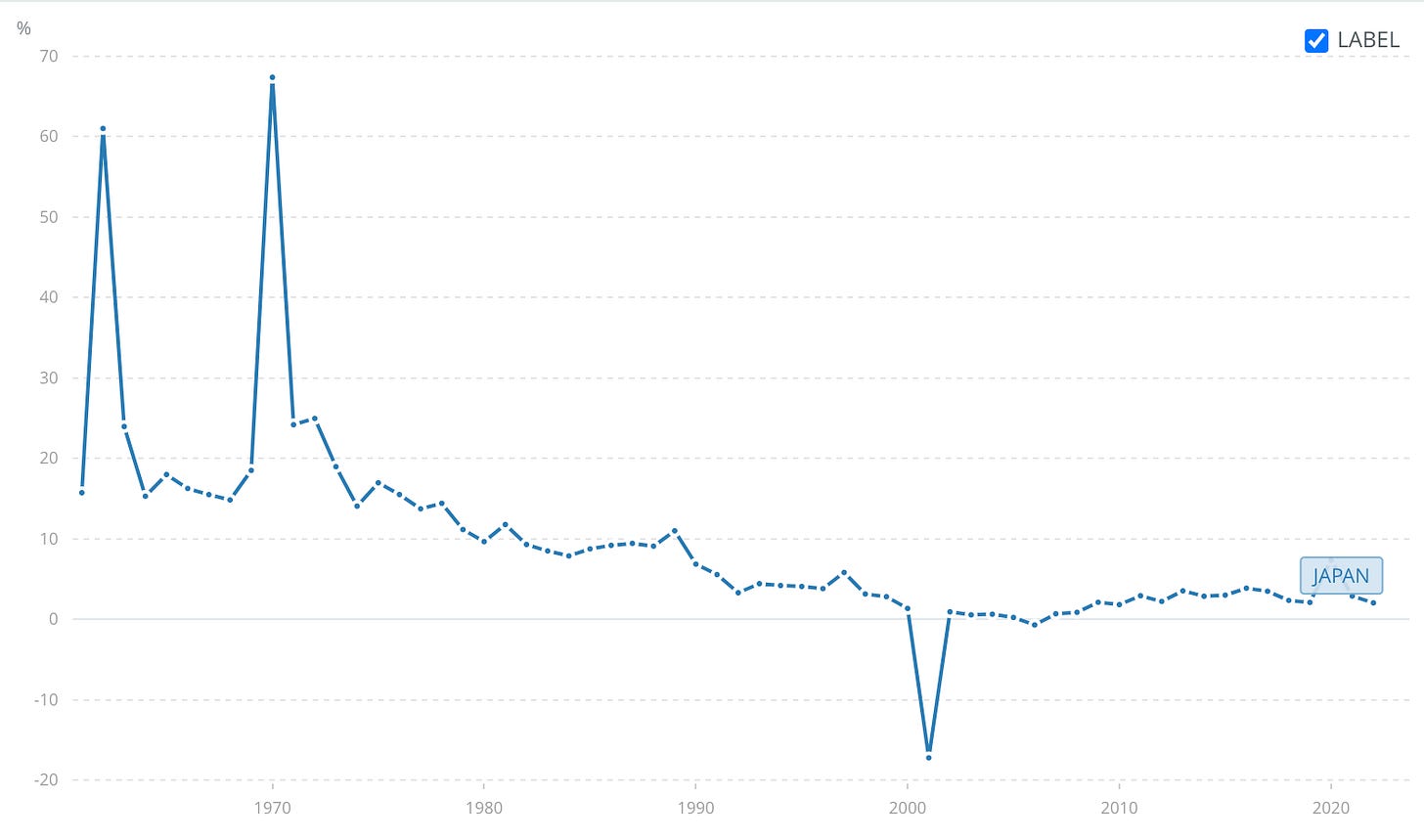

As you can imagine, if consumers are not spending, that means they’re not borrowing either, which plays a massive part in inflation. As a result, that translates into a contraction in the M2 annual % growth (money supply growth).

A zombie economy…

Compare that with the U.S.

Broad money is another term for M2, some may argue M3 but for the sake of simplicity, we’ll keep it as M2.

If this was a heart rate monitor and you saw the first chart of Japan’s broad money growth, you would instantly cue the violins, as a flatline is never a good sign of anything…

Japan’s countermeasures

Japan’s plan to restart its economy back to action is simple, and I think we all know the answer.

Ultra easy and accommodative monetary policy. I’ve explained in other articles how this has heavily cost the Japanese Yen as a result of this policy. Currency intervention has been one of the more public forms of support for the currency and economy but also the YCC policy, where the BOJ have proven to markets time and time again that they are willing to make an unlimited purchase of JGBs (Japanese government bonds) in order to protect the band and the yields the 10Y JGBs offer investors.

As you can see, getting out of the liquidity trap isn’t such an easy task and the reason why is this, in order to see the economy rebound you have to convince not only your citizens but also asset markets that the central bank tools will result in a reflationary period and increased economic activity.

Markets love an easy monetary environment, that is conducive to growth and credit creation but in the case of Japanese markets that is yet to show real signs of improvement.

Clarity on ‘pricing in’ information

I wasn’t going to miss this key information piece out.

A number of you in the group have raised alarm bells around what this whole ‘move has been priced in’ means.

So I thought to break it down in a simplified format.

A move gets priced into markets through expectation formation. This is simply when analysts, traders, and market participants form expectations about the future of the market they trade. The way I think about this is simple, so here’s my mental framework in one sentence:

Markets don’t trade at today’s price or value, they’re trading at the future expected value of the instrument. That applies to all markets, be that forex, stocks (especially) and everything else.

Remember when you couldn’t buy toilet paper in 2020?

Was that due to a real shock and lack of supply, or was that merely us, humans, our expectations of the supply/demand of this ‘commodity’? There we go.

It’s our rationale for the future expectation of what we believe will be of value. With the example of toilet paper, we believed that the scarcity would hit the market hence we all bought tonnes of toilet paper for no reason.

So the same applies to markets, the Euro may be trading 100pips higher, and that may be because markets expect that the euro area will experience a persistently high inflation number forcing them to keep rates higher for longer. So in reality, markets are already ‘pricing in’ the interest rate hike and any other data point in alignment with that.

Think back to the China re-open trade. Markets priced in what exactly?

Strong demand for global growth to rebound, and supply chain constraints to be eased, resulting in a huge rally in equities throughout Q1 and Q2 as well as a move in sentiment away from a recession happening in early 2023.

All in all, when you hear ‘this was priced in’ just think. This is the market’s expectations for the future value of this instrument, from my few years of observing macro, markets don’t trade on today’s present value, it’s all future expectations.

So, as promised in the discord I’ve got something planned for you guys later this year which I will announce closer, but the first thing I’d like to announce is next week I’ll be doing a live Zoom call with you all to go over everything macro, answer questions you have and create an environment for our community where we’re all truly growing and becoming smarter.

And if you care for the boring part, more about my journey…

It will be in the evening so I’ve put some times down so let me know when works best and I’ll share the Zoom invite with you all

Like I said, my gain is you getting the most value you can in the quickest time.

Until next time ;)

7pm my bro please