Q1 2025: Undervalued Cuts, Ambitious Tariffs, and China's Counterstrike

Exploring the Factors Behind U.S. Market Mispricing

Happy new year MMH readers!

I hope you all enjoyed the holidays and are ready for 2025 in the markets, there’s some big things on the horizon.

Here at MMH we’re planning to advance the research we release this year, so keep your eyes peeled. New ideas and a deeper understanding.

There’s been some focus back on the UK’s unstable Gilt market, but the main focus of on every investor’s mind, the U.S.

Let’s get into the first report of 2025!

Macro watch

The UK Gilt market back in focus, not for any great reason.

The UK’s economy is flat-lining, while the labour market is deteriorating rapidly, as employers grapple with tax rises in the Reeves' October budget, which contained the biggest overall tax increases since 1993.

The pound's weakness highlights growing investor concern over the ongoing sell-off in the Gilt market, which has drawn increased attention this week as 10Y and 30Y Gilt yields surged to their highest levels since October 2008 and August 1998, respectively. This has sparked comparisons to the market turmoil following former Prime Minister Liz Truss's ill-fated mini-Budget in autumn 2022. However, the current sell-off is notably smaller in scale. For context, the 30Y Gilt yield rose by approximately 300bp between its August 2022 lows and September 2022 highs.

In last Autumn’s Budget the government highlighted that it only had fiscal headroom of £9.9 billion which could be wiped out by higher borrowing costs.

Reeves is reportedly against further tax rises or borrowing and will cut spending if unfavourable market conditions continue. Recent price action highlights though that higher yields are not always positive for a currency if they are driven by unease over the public finances and inflation in the UK.

The BoE could also find it comes under pressure to scale back its QT programme if Gilt yields continue to rise. The BoE is currently committed to shrinking its Gilt holdings by a further £100bn in the year from October of which around £12 billion will be through active Gilt sales and the rest by allowing Gilts to mature. Short the Pound!

But even more interesting was the release of the NFP and unemployment figures from the U.S. on Friday.

Yet another hot report, wow.

NFP rose 256k in December vs 165k expected unemployment rate dropped to 4.1% vs 4.2% expected. The U.S. labor market is the gift that just keeps on giving. I personally think we are in a state where the dollar being driven by rates will no longer be the case, I think there are some serious concerns about future growth which will drag the dollar. Commodities look ripe for all time highs, the tight labor market isn’t the only factor to cause uncertainty on growth, the uncertainty surrounding Trump’s policies is bringing downside risk to the dollar in my opinion, it’s just not been realized in the market yet. The long-end treasury is also pricing this premium in heavily.

Bear steepening was seen after the NFP figures, however, not causing a concern to the progress the 2s10s curve has made this week.

Market mover

China's yuan has weakened to its lowest level in 16 months against the dollar, driven by deflationary pressures. CPI increased by just 0.1% YoY in December, while factory deflation persisted for the 27th consecutive month, with the PPI falling 2.3% YoY.

The fight back from China against the tariffs from the U.S. may be a devaluation of the Yuan which would relieve tariff pain on supply chains and keep China’s growth somewhat alive because:

Export competitiveness is boosted because goods are cheaper for foreign buyers

Mitigation of tariff costs because the weaker currency covers most of the difference between tariffed and non-tariffed countries

Underpriced cuts or reflationary pressures?

Donald Trump’s inauguration day is coming up, January 21st. After a misinformative post from Washington Post on Wednesday about Trump potentially being less aggressive with tariffs, he came out to reiterate that his tariff plans remain strong. Now, I know on the face value of the tariffs, there are inflationary pressures, but what about a scenario where they may be mitigated? If the consensus from Trump’s tariffs weakens global currencies, then foreign exports will mitigate some of the tariff costs and they may not be AS reflationary as we currently think.

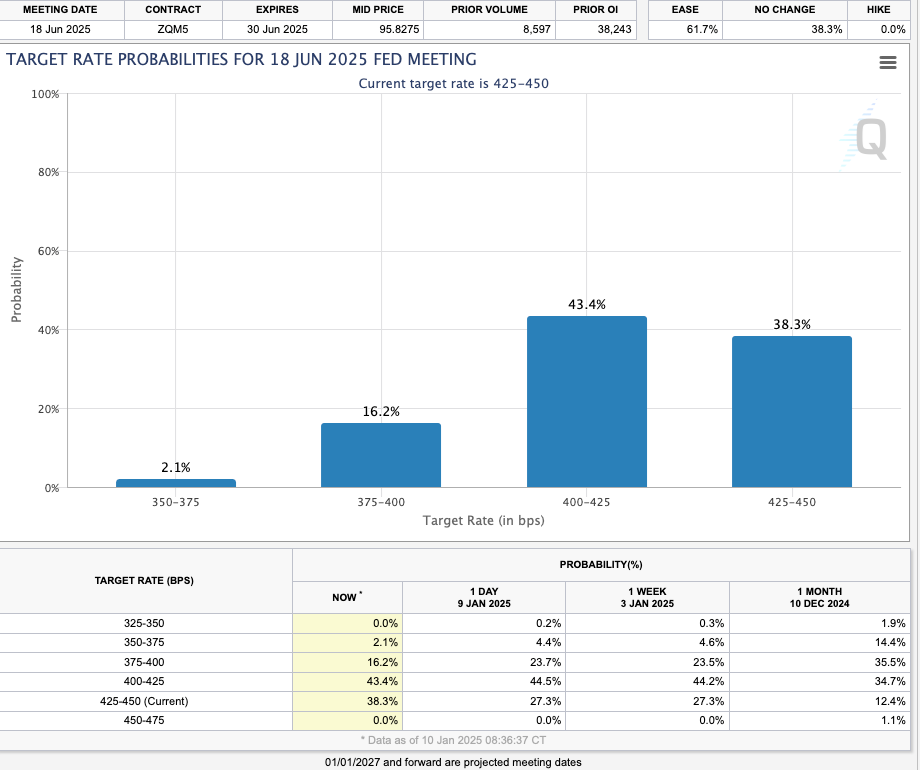

Then, if inflation isn’t going to be as much as we think, rates may be really underpriced. There’s c.47bp of cuts (2 cuts) priced in for the Fed for 2025, but if the tariffs are not AS inflationary as expected and U.S. growth takes some hit from the higher rates, the Fed may be forced to move a little quicker. Regardless of whether countries allow a devaluation vs the U.S. dollar or not, growth will still take a hit in the U.S. from such high rates which will eventually transmission in (mortgage rates are at 7%!), which also leads me to believe there will be more than 2 cuts this year and the dollar will eventually take a hit.

I’m not ignoring the fact that there is a potential that major trade partners like China don’t just simply accept the currency devaluation, and inflationary pressures may rocket, but it’s a double edged sword:

Scenario 1 - China doesn’t accept the devaluation and begins to intervene currency > Higher costs for U.S. companies who import from China > Passed onto consumers > Higher inflation > Higher rates for longer > Slower growth

Scenario 2 - China allows a devaluation in its currency VS the U.S. dollar > U.S. companies aren’t hurt too bad by tariffs > Inflation stays stagnant (not growing) as tariffs are partially mitigated > Rates are too high for the “not as strong” inflation > Slower growth

Moral of the story, rates will be too high for growth to continue firmly, in my opinion.

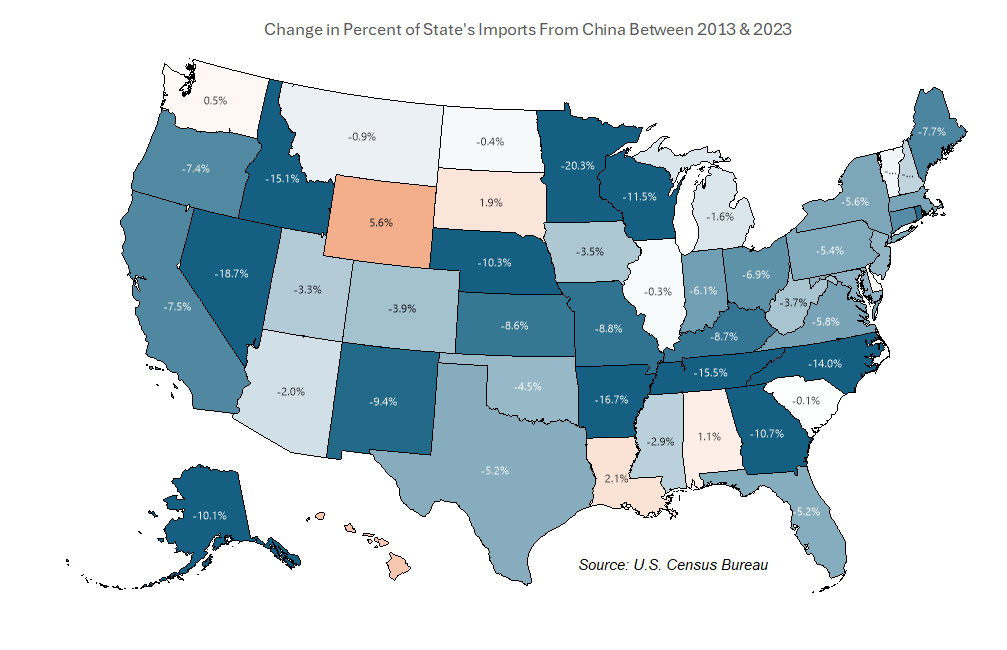

Now, what I noticed next was that there has been a trend over the last decade of lower reliance on imports from China, see Figure 6 below.

A shift away from China to EM’s like India has been seen across the last decade, less reliance on China with diversified supply chains. I’m not ignoring the fact that U.S. companies rely on China pretty heavily, but I think the move away from China after these tariffs can be smoother than anticipated, if so, inflationary pressures once again won’t be as bad as expectations are seeing them to be.

Now, onto the dollar’s valuation in the previous tariff introduction…

During the previous term, the Trump administration raised the effective tariff rate on Chinese imports by 18%. Simultaneously, the U.S. Dollar strengthened by c.14% against the Chinese currency. As a result, the after-tariff cost in USD for importing Chinese goods remained nearly unchanged, (see Figure 7).

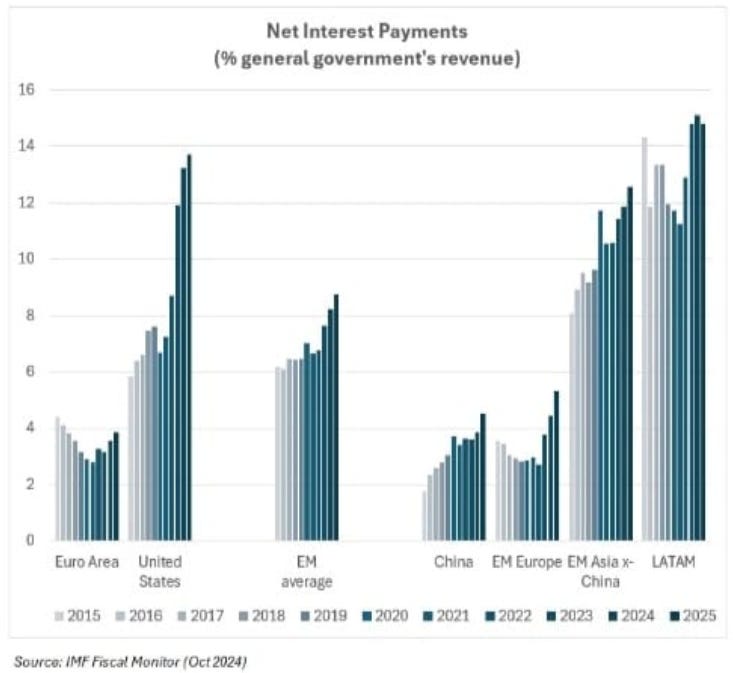

Also on the agenda for the USD (and bond market), especially as Trump is coming into his inauguration, is the significant debt (which he is trying to reduce). For every $1 of government revenue, the U.S. is set to pay $0.14 in interest on debt. Some emerging markets pay less. No, I don’t think this is a singular driver of the trend lower but it’s definitely something I’m factoring into my ideology here.

The large share of revenue going towards debt interest has increased last week, just to make things a little worse. Long-end yields are rising fast driven by uncertainty on the Fed’s future path and inflation. Although, Wednesday’s move was driven by concerns over Trump’s policies and the potential introduction of drastic tariffs targeting both the political allies and opponents of the U.S., forcing yields to their highest levels since October 2023. The 2s10s curve is moving further from inversion which restores some faith in the bond market.

Trade idea

Idea: USD/JPY - Short (the current price as I’m writing this report is: 157.873)

Time scale: 6-12 months to really see the move (it’s my main idea in the FX market for 2025, however, in the bond market I am looking to long 10Y treasuries, timing is crucial)

There are many ways you can express this trade, the FX market seems most optimal for growth as I can pair it up with the Japanese Yen (a country I am very bullish on).

Rate differentials closing in - Based on my underpriced rate expectations in the U.S. and the BoJ favouring hawkish 2025 through comments in their meetings, as well as positive data from their economy (like wage growth on the incline).

Dollar growth to take a hit on the domestic currency due to: Either tariffs being more detrimental short-term than anticipated or interest rate transmission finally speeding up (equal likeliness of either in my opinion).

Japanese fiscal stimulus is likely in 2025 (I will write a separate report on this).

Thanks for reading until the end! I hope you guys enjoyed the first report of 2025!

What do you think about going long on Chinese companies who export cheap consumer goods like PDD AND BABA? They seem pretty undervalued right now and their financials look solid.

I agree with the JPY idea. But it's not feasible to be short USDJPY for that long of a time horizon in regular FX positions given the negative carry trade. CHFJPY looks a little better, less negative swaps, SNB likely to bring rates back to 0% while the BoJ instead hikes a bit further. Better than USDJPY in my opinion, and after all if USDJPY goes down because of growth concerns in the US then that means it's a broad "risk off" macro flow and so all JPY pairs should go down with it.