Is Inflation Shifting?

Inflation Is Repositioning as Swaps Get Ahead of the Data

The first full week of 2026 is here. This is going to be an intellectually demanding year. I’m looking forward to producing strong work, refining my process, and letting the data guide conviction rather than forcing outcomes.

In my 2026 outlook, I mentioned upside risks to inflation driven by what I would describe as exceptional growth (exceptional relative to where policy rates have been held for an extended period). That said, forecasts themselves don’t mean much. I have views on what could happen over the next 1-3 months, but they remain merely ideas. I trade what the data is showing me now.

My view on equities trading higher from late-Jan is based primarily on curve steepening dynamics, strong growth on 3- and 6-month bases, and ongoing high-beta outperformance. However, it’s also important to recognise how unforgiving this environment has been. Since early November, directional positioning both long or short has been costly unless timing has been unusually precise. That alone argues for humility.

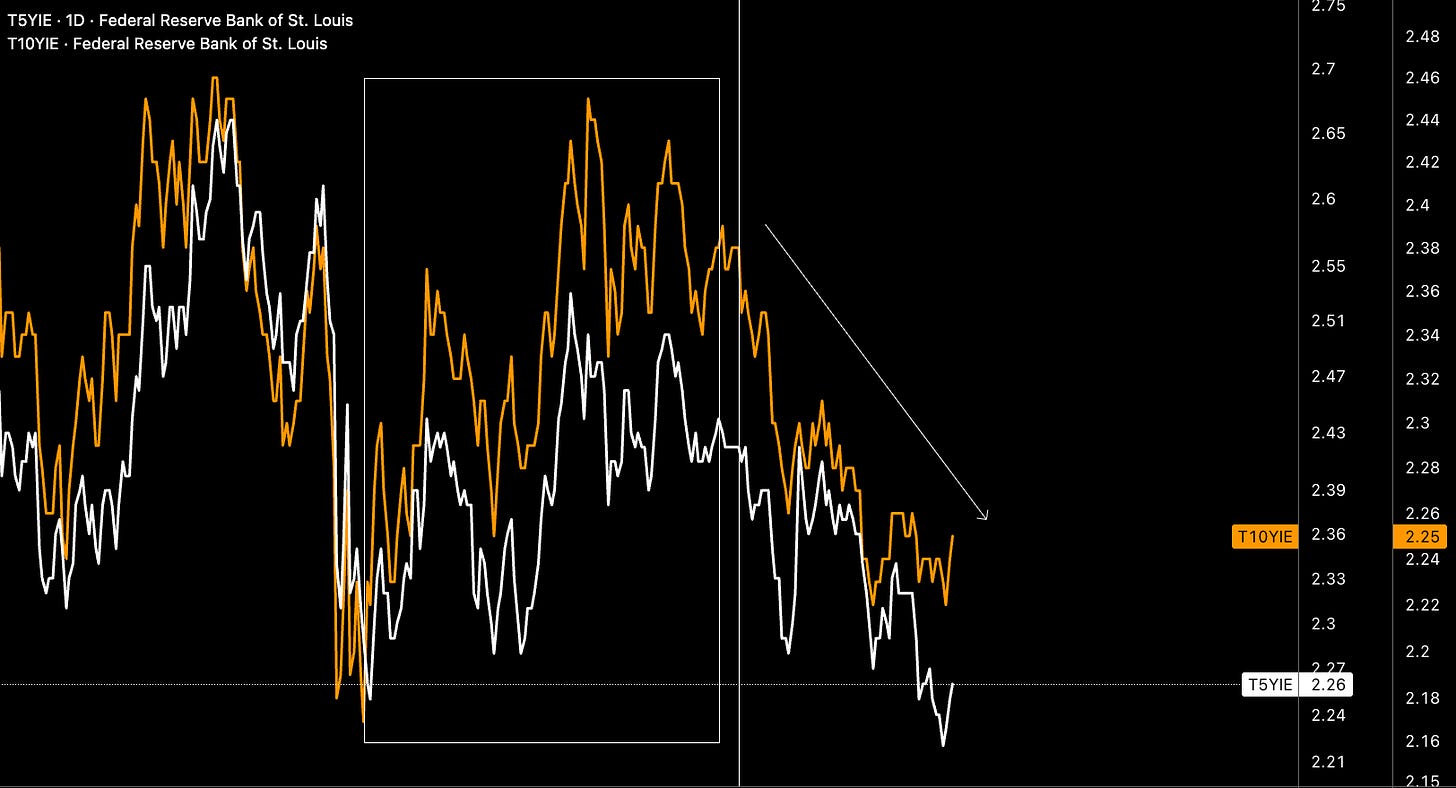

Breakevens

We have seen a meaningful shift lower in both 5y and 10y breakevens since mid-September following a sharp rally from April. Both are down roughly 30bp. This matters if the idea of inflation moving higher is going to remain viable. At the same time, breakevens are now closer to levels consistent with long run inflation targets, which complicates the upside inflation narrative.

Breakevens are also not a pure inflation signal. They embed real rate dynamics, liquidity conditions, and risk premia. Lower breakevens don’t necessarily imply that inflation risk has disappeared, only that the market is less willing to price protection against it at present. This distinction is important.

It is difficult to assess current equity reflexivity to inflation for two reasons. First, there has been limited inflation data over the past several weeks. Second, the holiday period typically dampens market sensitivity unless the data is extreme.

What remains reliable is the relationship between breakevens, real rates, equities, and bonds. Inflation swaps and breakevens remain the cleanest read on marginal inflation risk pricing, while real rates increasingly dictate equity duration sensitivity.

Directional drivers

Since the equity highs in late October, high yield and corporate credit spreads have remained relatively stable. This suggests credit is not actively forcing equity positioning in either direction. What has moved meaningfully is the relationship between real rates and breakevens.

Real rates have pushed higher while breakevens have compressed with speed. This combination is important. During the June to September equity rally, the persistent gap between low real rates and higher breakevens created a supportive environment for risk assets. Even when breakevens dipped, real rates were accommodative enough to sustain upside.

That buffer no longer exists. Marginal increases in real rates or further declines in breakevens now produce disproportionately larger equity reactions. However, recent real rate moves have not yet broken decisively higher. They remain sensitive to Fed expectations and incoming growth data, which keeps the regime unstable rather than clearly restrictive.

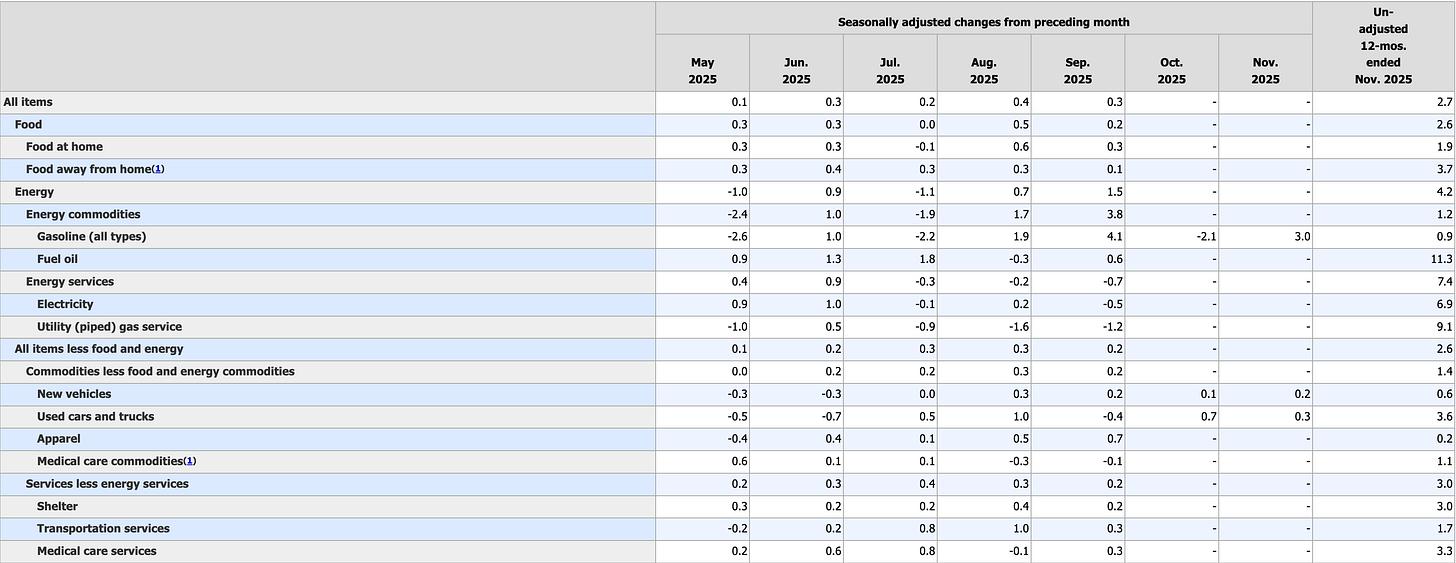

Inflation attribution

The primary driver of lower breakevens is composition. Disinflationary pressure is concentrated in goods and energy, while inflation persistence is increasingly isolated to slower moving service components.

Core goods are doing most of the disinflationary work. New vehicles, apparel, and medical commodities are flat to negative on a YoY basis, reinforcing the idea that supply side normalisation continues to feed through pricing. Used cars remain volatile, but the broader message across goods is clear. Pricing power has faded.

This disinflation is not uniform. Energy has recently shown YoY rebounds even as longer term pricing remains well below mid 2025 highs. Energy contributes asymmetrically to breakevens. Weakness pulls expectations lower quickly, while rebounds do not always reverse pricing with the same force.

Crude remains well below the highs seen during the Iran conflict in June. Policy pressure to keep energy prices low continues to cap upside, and looser discipline from OPEC has increased effective supply. Still, energy volatility remains a latent risk rather than a resolved factor.

Sticky inflation remains

Inflation pressures have not disappeared. Food away from home, shelter, transportation services, and medical services remain elevated relative to the broader basket. These categories are wage and rent driven and adjust slowly.

Markets increasingly treat this inflation as known, lagging, and unlikely to reaccelerate without a renewed growth impulse. As a result, it carries less weight in breakevens than faster moving components. That assumption may prove correct, but it also represents a vulnerability if wage growth or services inflation reaccelerates unexpectedly.

The net effect is divergence. Headline and market implied inflation expectations drift lower due to goods and energy, while underlying services inflation remains sticky but contained. Breakevens respond to marginal changes in inflation risk rather than the absolute level of prices, and that marginal signal currently points lower. This is not me discounting the significance of breakevens trading lower, but it’s just important to not take a bias in silo.

Market pricing

One divergence worth flagging is in metals. Silver has outperformed gold on a 20 day lookback even as gold continues to make new all time highs. This pattern usually aligns with improving growth, reflation, and risk on regimes.

At the same time, metals are not a clean inflation signal in isolation. Real rates (liquidity impulse), safe haven demand, and policy expectations also play a role. The signal is suggestive rather than confirmatory. It raises the possibility that inflationary pressure could still be building beneath the surface, but it does not yet force that conclusion.

Returns shading indicator above is from Capital Flows’ Substack.

What this means

We are no longer dealing with the level or speed of inflation pressure seen 3 months ago. That much is clear in the data. However, that does not mean upside inflation tail risks have disappeared.

Markets are currently pricing lower inflation swaps while asset performance still reflects an environment accustomed to higher inflation and strong nominal growth. That mismatch is the source of current uncertainty.

On a 3 month basis, most inflation components excluding core CPI are still showing neutral momentum. Because the lookback is short, January data will matter disproportionately. A shift there could materially alter the narrative.

What I am waiting for is alignment. Market pricing across breakevens, curves, real rates, and metals needs to confirm what headline inflation is showing on both 3 and 6 month horizons.

Bottom line

For now, conviction remains low in either a higher inflation or disinflationary regime. Growth still appears strong relative to expectations, but recent data suggests momentum is no longer accelerating uniformly. Inflation is the final variable needed before taking meaningful directional exposure in equities or bonds.

Until then, patience remains a position.

Have a great week.