5s30s Steepener: Payrolls, Wages, and the Jobs Market

Jobs Day Playbook: Mapping NFP, Wages, and Unemployment

Hey MMH readers,

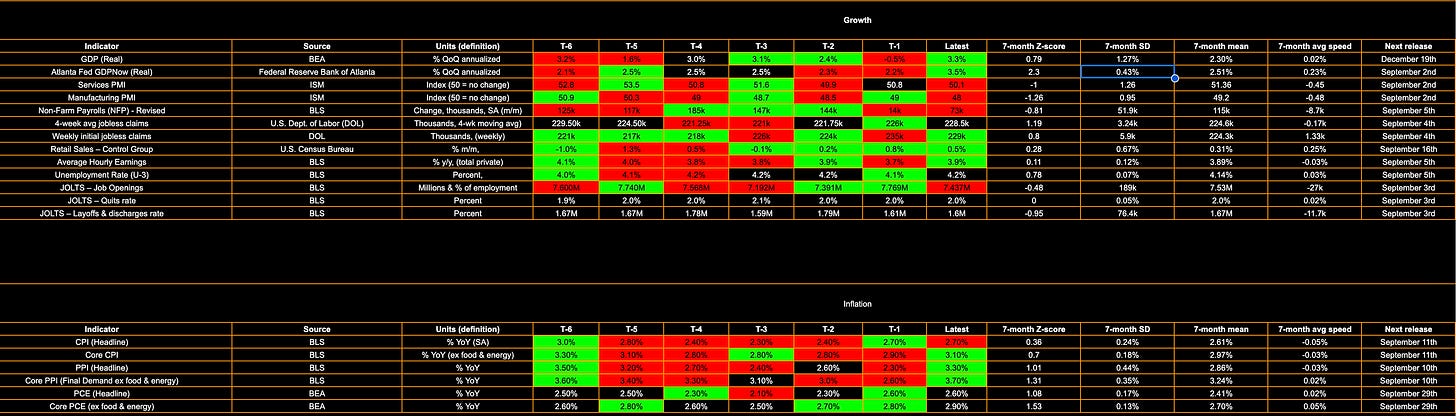

I’ve added just one more thing that I think will be very useful:

US data tracker (includes speed, Z-score, standard deviation, mean & a highlight in red/green to show whether it was below/above consensus, black represents that it was in line)

Discipline isn’t about being perfect, it’s about showing up when it matters.

The markets reward clarity, and clarity comes from cutting out the noise.

Let’s dive in.

Central bank tracker

US data tracker

Geopolitics & Headlines: Summary

Geopolitics & Security

TRUMP: US military strike on vessel carrying drugs from Venezuela killed 11 people

TRUMP on Putin: “Very disappointed in him” / “May take a different stance if nothing comes”

Bessent accuses India and China of fueling Russian war machine in Ukraine

US holds back China trade threats as it weighs Russia sanctions

United States Politics / Trump Administration

Trump: “We need a very serious rate cut”

Trump: “Thinking about addressing housing emergency, need a little help from the Fed”

Trump: They have no legal basis whatsoever on tariff ruling

Trump: Mentions “emergency meeting” on tariff ruling, will appeal ruling

Trump: On India’s tariff offer: “They should have done so years ago” / “It’s getting late” / “India offered to cut tariffs to nothing”

Trump: Drug companies must justify success of COVID drugs (Pfizer, others)

Federal Reserve / Policy

Bessent to start Fed Chair interviews Friday (WSJ)

Bessent: Other statutes could justify tariffs but weaker

Bessent: Not concerned about USD vs EUR strength

ECB’s Lagarde: Watching French bond spreads closely

Markets & Economy

Spot gold hits record $3,510/oz (+1%)

UK 30Y yield 5.64% (highest since 1998)

Germany 30Y yield 3.377% (highest since 2011)

Argentina’s Treasury to intervene in FX market

Corporate / Tech

Google monopoly case: Judge rules Google won’t need to sell Chrome/Android, but bars exclusive contracts

GM: August EV sales hit record high

Nvidia rejects rumors of GPU (H100/H200) shortages, denies H20 supply impact

Data: Summary

China

Composite PMI (Aug): 50.5 (prior 50.2) → expansionary, slight improvement.

Manufacturing PMI (Aug): 49.4 (exp 49.5, prior 49.3) → still contractionary.

Non-Manufacturing PMI (Aug): 50.3 (exp 50.3, prior 50.1) → marginally expansionary.

Caixin Manufacturing PMI (Aug): 50.5 (exp 49.7, prior 49.5) → stronger than expected, into expansion.

Caixin Services PMI (Aug): 53.0 (exp 52.4, prior 52.6) → healthy expansion.

Australia

Judo Bank Manufacturing PMI (Aug): 53.0 (exp 52.9, prior 51.3) → improving.

MI Inflation Gauge (Aug, MoM): –0.3% (prior +0.9%) → disinflationary.

GDP (Q2, QoQ): +0.6% (exp 0.5%).

GDP (Q2, YoY): +1.8% (exp 1.6%).

Japan

Manufacturing PMI (Aug): 49.7 (exp 49.9).

Services PMI (Aug): 53.1 (exp 52.7).

New Zealand

NA

Eurozone / Germany

Germany Manufacturing PMI (Aug): 49.8 (exp 49.9, prior 49.1).

Eurozone Manufacturing PMI (Aug): 50.7 (exp 50.5, prior 49.8) → back in expansion.

Unemployment Rate (Jul): 6.2% (exp 6.2%, prior 6.3%).

Eurozone CPI (Aug, YoY): 2.1% (exp 2.1%).

Eurozone Core CPI (Aug, YoY): 2.3% (exp 2.2%).

Eurozone CPI (MoM): +0.2% (prior 0.0%).

UK

House Prices (YoY): +2.1% (prior +2.4%).

Mortgage Approvals (Jul): 65.35K (exp 64.0K).

Manufacturing PMI (Aug): 47.0 (exp 47.3, prior 48.0) → contraction.

Switzerland

Retail Sales (Jul, YoY): +0.7% (exp 3.6%, prior 3.9%).

Manufacturing PMI (Aug): 49.0 (exp 46.9, prior 48.8).

United States

S&P Global Manufacturing PMI (Aug): 53.0 (exp 53.3, prior 49.8) → solid expansion.

ISM Manufacturing PMI (Aug): 48.7 (exp 49.0, prior 48.0) → contraction persists.

ISM New Orders (Aug): 51.4 (exp 48.0) → expansion, strongest since Jan.

ISM Employment (Aug): 43.8 (exp 45.0).

ISM Prices Paid (Aug): 63.7 (exp 65.1).

GDPNow (Q3 estimate): 3.0% (prior 3.5%).

Sector Performance: So Far This Week

Utilities: +0.04%

Consumer staples: -0.32%

Consumer discretionary: +0.55%

Energy: +0.44%

Healthcare: +0.49%

Financials: -0.22%

Industrials: +0.10%

Tech: +0.81%

Materials: +0.09%

Real estate: -0.82%

Communication services: 1.12%

NFP Scenario Analysis

A quick touch on the forecasts heading into Friday:

NFP: 74k expected (73k previous)

Unemployment rate: 4.3% expected (4.2% previous)

Average hourly earnings: 0.3% expected (0.3% previous)

The broader thesis I’ve been laying out across recent reports remains unchanged: growth, inflation, and liquidity are still present in the system even as the Fed moves into a cutting cycle. The one tail risk to that bias has been the labor market. To date, we haven’t seen a true break, though cracks have started to show, most notably in the revisions to prior payroll prints.

It’s important to remember that macro regimes are driven by the broad interplay of growth, inflation, and policy, not by one-off micro data points. That said, cracks in the micro eventually create cracks in the macro. The key is not to overreact to a handful of softer labor market readings and abandon a regime prematurely, but instead to contextualize them within the bigger cycle.

That’s the framework I’ll be applying to Friday’s release. See the full scenario analysis below:

Labor is a tail risk to the regime because the job market strongly influences consumer spending, which drives both inflation and growth, and it also shapes liquidity conditions. The key questions are: what do I expect to happen, and how should positioning reflect those expectations?

Growth and inflation are already running hot. A strong NFP tilts the market toward fewer cuts and a stickier “higher-for-longer” regime, with term premium likely to keep grinding higher. The first-order expression is a bear-steepening bias, higher real yields, a firmer USD, cyclicals over duration, and pressure on precious metals and long-duration tech. Positioning should therefore center on a rates-led “re-acceleration” book, with the left tail hedged via cheap convexity in duration, gold, and tech in case payrolls disappoint.

Scenarios

If NFP lands in the strong bucket, think 100k or more, unemployment steady or lower, and AHE at 0.4% or above, the front end sells, real yields push higher, the dollar firms, and the curve tends to bear-steepen in 5s–30s. An inline print in the 50–100k range with wages at roughly 0.3% is more noise than signal: vol sellers fade the move and equities rotate toward value without a broad trend shift. A bad print, sub-60k or a 0.2–0.3pp rise in unemployment with soft wages (<0.2%) flips the tape: the front end rips, the curve bull-steepens, the dollar softens, and duration assets (including mega-cap growth) catch a strong bid.

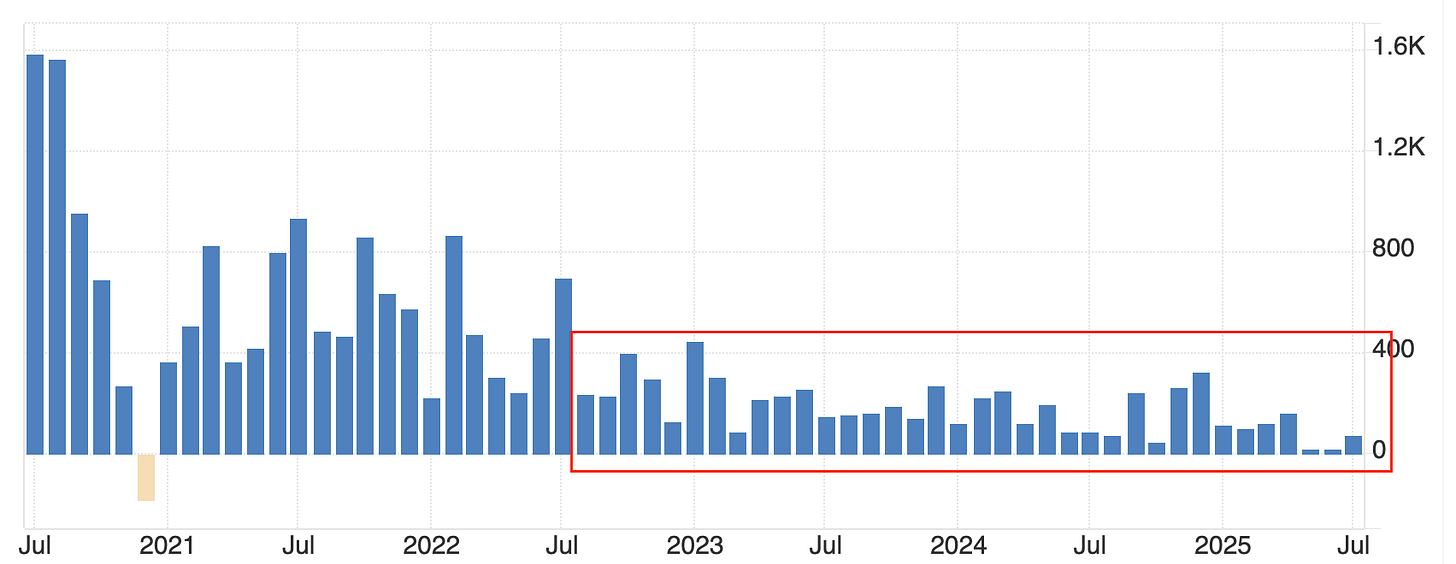

Jobs have been added to the system, all while rates were hiked. You compare this to 2019 (rates at 2% avg), we’re only just below those numbers on average but the difference… rates are 250bps higher on avg.

Base case logic (strong NFP)

A hot labor tape sidelines “calibration” cuts and leaves the door open, at least rhetorically, to further tightening; markets re-price the front end higher while supply and nominal growth keep the term premium bid. If the move is growth-led rather than pure hike risk, 5s30s should bear-steepen; an outsized wage surprise can trigger a bear-flattener impulse initially, but the long end typically follows higher as term premium asserts itself. Breakevens should hold or widen modestly while real yields do the heavy lifting, which is why duration-heavy assets underperform. Cross-asset confirms show up as USD strength against JPY and CHF, outperformance of banks, energy, and industrials over utilities, REITs, and long-duration tech, a softer gold tape, and firmer crude on the demand impulse layered onto tight supply discipline.

5s30s spread has 8bps upside potential, RR as followed:

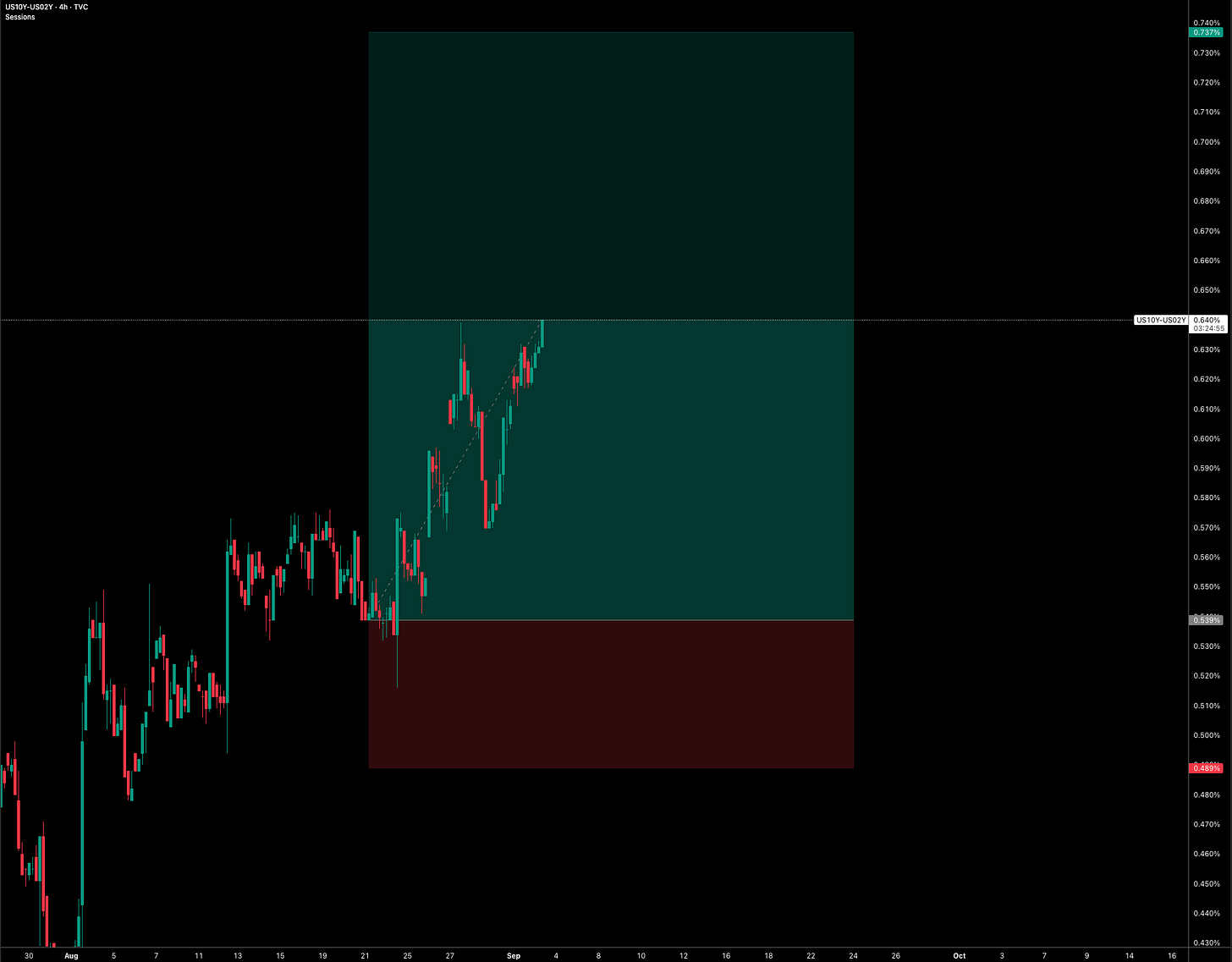

The 2s10s steepener trade that was given out in the previous macro report is well ITM and I expect 5s30s to follow (based on strong data Friday). See 2s10s below:

Positioning (the re-acceleration book)

This is not financial advice, simply my expressions. I’ll be running a short-belly/long-end stance to express steepening through a 5s30s steepener (receive 30y vs pay 5y in DV01-neutral size) or you can make a futures expression via short ZF versus a long 30y leg. The belly bears the brunt of policy re-pricing while growth and term premium pressure the back end. If wages print 0.4% or higher with tight unemployment, options on futures look good (SR3 payer spreads or payer ladders for cheaper convexity expression). In equities, positioning will rotate toward cyclicals and value, overweight financials, energy, and industrials, underweight long-duration tech, utilities, and REITs.

Direct ZF play (vs spread trade if you wanted directional exposure, which I’m not looking for):

Pair trades like SPX equal-weight over NDX and US banks over utilities sharpen the factor bet. Small caps benefit from growth but are rate-sensitive, so express them via call spreads rather than outright. In credit, stay neutral IG carry but hedge HY spreads can look resilient at first while higher real yields quietly tighten financing conditions, CDX HY protection or 2–3% OTM HYG put spreads over the next one to two months are efficient. Commodities lean long crude via call spreads as I laid out in my last report (tight balances plus demand). In vol, I’m looking to own rates convexity through payers, fade broad equity-vol spikes after the first move unless wage/unemployment dynamics clearly resurrect “hike risk.”

Hedge package for a bad NFP

The simplest convex way to hedge is with 10-year Treasury (TY) call spreads, targeting a sharp rally in duration if payrolls disappoint. Buy near-the-money calls and sell higher strikes 2–4 weeks out, this captures the bulk of the upside move while keeping option premium contained. I am personally not hedging this event as I am already hedged via previous positions that are ITM.

Triggers, confirmations, invalidations

Lean in if payrolls clear 100k with unemployment no higher and wages 0.4% or better, add to steepeners and USD longs and fade gold bounces. If wages scream (>0.5%) and unemployment dips, respect the risk of a bear-flattener and bolt on a 2s10s flattener. Invalidate the re-acceleration book if payrolls sink below 60k or unemployment rises 0.2–0.3pp with wages at <0.2%, in that case, cut cyclicals and steepeners and pivot to duration and gold hedges.

This scenario could easily see Z6 price 25bps of cuts out, moving down as laid out:

Rate cuts pushed back, Z6/Z7 drop off:

Sizing, mechanics, and the day-of checklist

On print day, read wages first, headline next; watch 5s30s versus 2s10s to diagnose steepen versus flatten, take your gold/tech toggle from the direction of 10y TIPS real yields, let DXY confirm the cross-asset story; and monitor HY CDX, if it widens 15–20 bps on a strong print, the market is flirting with “policy mistake” rather than clean re-acceleration, and cyclicals deserve a trim.

Scenario: Lower Unemployment (4.1% vs 4.2% expected)

If payrolls come in only modestly positive (say 70–90k), but the unemployment rate dips to 4.1% instead of ticking up to 4.2% as expected, the market will likely interpret the labor market as tighter beneath the surface. Participation quirks aside, the Fed’s reaction function skews hawkish when both jobs and inflation prints are running hot and unemployment doesn’t rise.

Market reaction

The immediate takeaway is “still no slack.” Even without a blockbuster jobs headline, a lower unemployment rate implies continued labor tightness then the policy cuts path looks shallower, and “higher-for-longer” gets reinforced. In rates, that’s a bear-flattener impulse at first as the front end sells harder (the jobs number looks soft, but the UR/wages combo says policy has to stay tight). The back end can later drift higher too, but the shape depends on how AHE comes in. Real yields rise, breakevens hold steady, and duration-heavy assets stay under pressure.

Cross-asset expression (lower unemployment focus)

Rates: Tactical 2s10s bear-flattener

FX: USD likely catches a hawkish UR bid, especially vs JPY and CHF. Even if the headline jobs number looks soft, the UR surprise lower keeps USD supported.

Equities: Rotation to cyclicals/value still favored over duration assets. Tech relief is unlikely to last if real yields are rising on the UR dip.

Credit: IG holds, but HY spreads risk widening later if higher real yields persist.

Positioning (lower unemployment focus)

If you see a “soft-ish NFP but unemployment down,” fade the initial bond rally, it’s a trap. Stick with front-end payers and USD longs rather than flipping into duration or gold. In other words, this is not the same as a true weak NFP scenario, the unemployment rate decline keeps the “re-acceleration” book alive.

I hope you guys enjoyed, as always.. Trade safe!