Will The Yen Retaliate?

Exploring the return of the of the stealth MOF intervention and the recent Yen movement.

Hey guys,

You’re due for an update.

It’s been another impactful and productive week.

I was at an event with Schroders and Barrington Hibbert Associates on Tuesday; the discussions were immaculate.

Connecting with accomplished black individuals within the private banking and asset management space was great.

Just more fuel to get down to the work.

As for now, the yen is currently trading at dangerous levels, similar to last year. Here is a look at the current factors affecting the yen.

Is It Time For Yentervention?

For many investors, currency traders and market participants the Japanese Yen is a market which signifies little attention and respect, from this report I hope to show you the crucial role the BOJ, and Yen play within global macro and monetary policy.

This time last year the MOF in Japan were active within currency markets trying to restore stability within its FX currency. This intervention consisted of 2 rounds of intervention, the first intervention came after the Yen breached the 145.00 level, last seen in 1998. Let me explain why this is so important. The "lost decade" was a period of economic stagnation in Japan, lasting from 1991 to 2001. It was triggered by the collapse of the Japanese asset price bubble and exacerbated by the Asian financial crisis of 1997. As a result, equity markets in Asia collapsed alongside the yen in 1998.

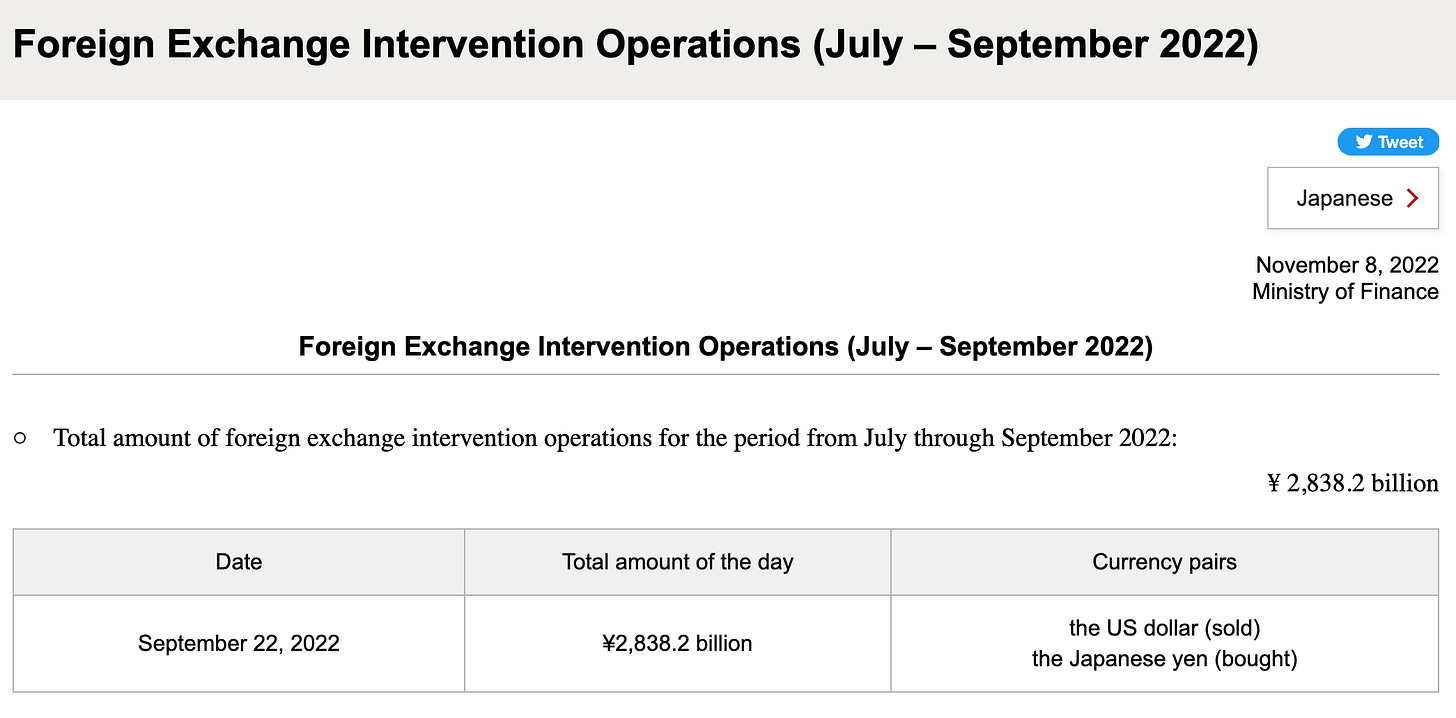

So, in September 2022, when the Yen reached 145.000 the MOF were forced to step in and strengthen its weakening currency.

As you can see the firepower was enough to cause an immediate 3% surge in the Yen’s value, but long-term macro conditions were pilled up against both the MOF and the BOJ. The MOF spent ¥2.8 trillion ($19.7bn) on the first intervention, which, unfortunately, failed.

As a rule of thumb, currency intervention is an expensive policy tool, in the space of two months Japan spent ¥9 trillion ($60bn) on their intervention programs in September and October, which is why the MOF isn’t in a hurry to step into currency markets and burn their foreign reserves.

Before we go deeper, let’s clear something up. The authority responsible for all and any Yen intervention is the Ministry of Finance (MOF) in Japan, specifically Shunichi Suzuki and Japan’s currency chief Masato Kanda. The BOJ are not responsible for initiating currency intervention, they are simply the execution arm for carrying out intervention orders once agreed upon within the MOF.

Currently, we all know what’s driving the sharp depreciation of the Yen— interest rate differentials. To avoid sounding like a broken record we’re going to observe how the recent Yen rally to 150.00 may have sparked a temporary disconnect between US10Y and Dollar correlations.

Look closely at the above figure. Observing currencies we know that yields dictate the movement and direction of the domestic currency, the higher the yield the stronger the domestic currency, but notice how once the Yen breached 150.00 before being slammed down, speculations calling the move an intervention, the DXY and US10Y stopped moving in cohesion.

As put by Weston Nakamura ex-GS covering the Asia region, when international market forces are left in “default mode” nominal yields differentials and major FX pairs move in lockstep with one another. It’s clear we’re seeing something completely different here, the dollar is now consolidating similar to the Yen’s price action as yields continue to soar to GFC highs.

Given the ongoing rally in the long end of the UST curve, now in a retracement, it is reasonable to expect that the dollar would also rally, as geopolitical risks and tensions in the Middle East are driving demand for haven assets. Not this time.

The precise reason for the decoupling of yields and the dollar is unclear, but it may be related to the extreme volatility of the yen during the New York session on Monday.

The Minister of Finance Suzuki and Currency Chief Kanda have commented on the Yen’s recent movements most notably saying:

"Excessive currency volatility is undesirable” — MOF Suzuki

The Finance Minister also stated that he will watch the Yen “with a strong sense of urgency".When the Finance Minister refers to "excessive currency volatility," he is primarily concerned with the rate and speed of the Yen's decline, rather than simply the price. This is what is meant by "volatility."

As to what is ahead for the Japanese, there’s very little outside of a clear and bold move away from it’s ultra-easy monetary policy. At the July 27th BOJ policy meeting the monetary policy committee decided to keep rates unchanged at -0.10%, and expand the YCC band to +/-1% in a sign of protecting its YCC policy.

Yields have since rallied closer to the upper limit of 1.00% as inflation in Japan settled at 3.0%, above the expected 3.2% but in line with Governor Ueda's goal of bringing inflation back into the Japanese economy.

The Bank of Japan (BOJ) meets next Tuesday (31st) to set interest rates. This time, raising the yield curve control (YCC) ceiling will not be enough to deter yen bears. Some affirmative policy adjustment will be required to stop speculators from exploiting the wide yield differentials between the US10Y and JP10Y, which currently stands just below 4.00%, the largest yield differential of any major FX pair.

One thing that deserves praise is the MOF's ability to keep its intervention intentions secret. This "stealth intervention" is evident in the recent price action of USD/JPY, as large speculators have refrained from betting against the yen for fear of a surprise intervention that could turn yen shorters into yen mourners, similar to the "widow maker" trade coined to describe the BOJ's defence of its YCC.

Since the assumed MOF intervention on the 3rd of October, the volume of trading in the Yen has significantly dropped; a testament to the Japanese silent intervention policy which is keeping speculators away from selling the Yen any higher.

This is only a temporary fix for a much larger, policy adjustment which is the only possible for ahead for the Japanese.

Thanks for getting to the end of this report.

It’s a Friday night, and we’re here exploring macro moves— for the love of the game right!