Why the Hawk Lagarde?

Euro Rallies and Bunds Sell Off at Lagarde's Hawk & The US Labour Breakdown

Hey guys,

Glad to be back with another free report.

It’s been a week of central bank cuts, from the Bank of Canada to the ECB joining the SNB in the cutting cycle.

Not to mention a flurry of US labour data this week including non-farm payroll today.

Rest assured, I’ve got you covered.

So, without further ado, enjoy.

A Hawkish ECB Cut & A Mixed US Labour Print

As most would have seen, the ECB delivered their first rate cut since 2019 on Thursday, but it was delivered slightly differently than what you would expect at your normal rate cut press conference.

The ECB lowered all three key rates by 25 basis points, the deposit facility rate now stands at 3.75%, the main refinancing rate is 4.25% and the marginal lending facility is at 4.50%.

Usually after a rate cut decision, you would expect immediate weakness in the currency given the dovish rhetoric of a rate cut— but the Euro rallied just under 30 pips before giving back some of its gains on the hourly closure. If you’re not sure why let me explain.

Firstly, the tone of President Lagard’s speech almost suggested that the cut was a reluctant cut from the ECB, not a mandatory one. She provided as little forward guidance of the future policy path and quickly informed markets that “we are not pre-committing to a particular rate path”, reducing the bets of continued rate cuts at each of the remaining four ECB meetings this year.

Whilst Lagarde acknowledged the fact that inflation has fallen by more than 2.5% since September, she also pointed towards domestic price pressures remaining strong mainly due to wage growth.

The measure of inflation used in the EU is the HICP, the harmonised index of consumer prices. This inflation reading is “harmonised” because all the countries in the European Union follow the same methodology allowing inflation to be compared between different countries within the EU.

Looking closely at Figure 1 we can see that headline inflation currently sits at 2.4% whilst core HICP sits at 2.7%. Lagarde noted that the services sector was a key factor which resulted in the rebound in inflation, the services price inflation rose to 4.1% from 3.7% annualised in April ‘24.

Still, that wasn’t the catalyst for the Euro or 10y Bunds which sold off 5bps from the meeting.

It was the upward revisions by the ECB staff regarding inflation projections for 2024 and 2025.

Christine Lagarde's recent hesitancy towards rate cuts, coupled with upward revisions to inflation data, prompted a shift in market expectations. Result? Traders scaled back their projections for the number of ECB rate cuts this year. This change in sentiment led to a rally in the Euro and a sell-off in German bunds.

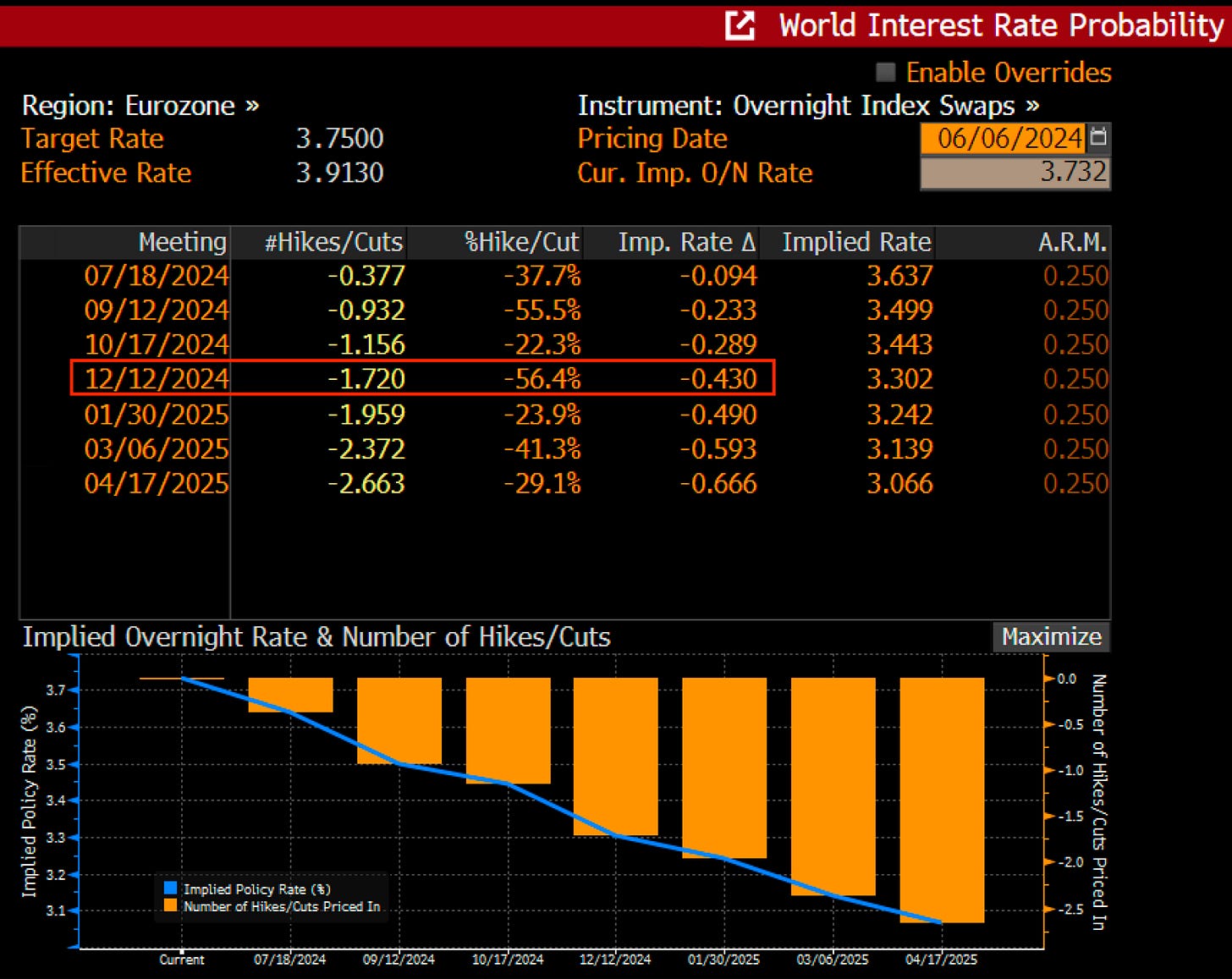

For the new subscribers/newbies to macro what you’re looking at in Figure 4 is the overnight index swaps (OIS) curve. In layman's terms, it’s a visual representation of implied (market’s expectation) interest rates over different ECB meeting dates.

Take a look at the #Hikes/Cuts column, this tells us the number of hikes/cuts expected and implied by the market.

The Imp. Rate ∆ tells us what change in overnight rates, Euro Short-Term Rate (aka €STR), the market is expecting based on market pricing for each meeting.

So, reading the OIS curve, traders are expecting the ECB to do 2 rate cuts for the remainder of this year, a decline of 43bps from the current overnight rate of 3.7% in the €STR rate.

The future path for the ECB is pretty clear. Telegraph as minimal as possible to reduce volatility in FX rates. Due to the hot non-farm data released, today’s 100pip (at the time of writing) drop in EUR/USD is a perfect example of what the ECB will want to minimise as they embark on the cutting cycle.

To briefly touch upon the data from the US as I know it’s a hot topic, this print changes little to nothing for the future policy path of the Fed.

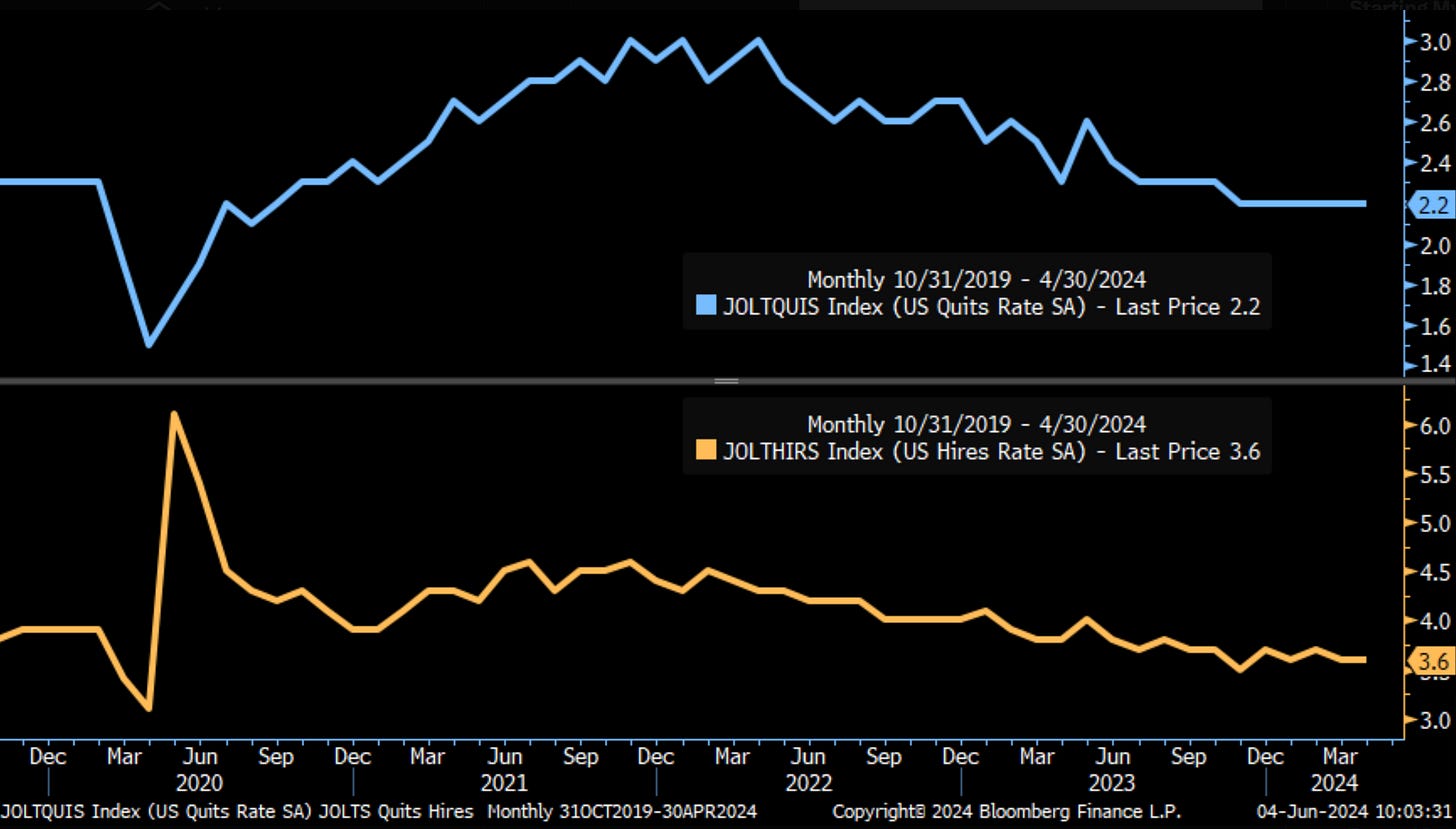

This week's economic data painted a mixed picture, but the potential for a September rate cut remains intact. The ADP payroll report surprised on the downside, and a key labour market indicator, the JOLTs job openings data, continues to hover near 2018/2019 levels. Ouch.

To gauge the health and bargaining power of US employees, I closely monitor the JOLTs data, specifically focusing on quits and hires. A rising quit rate suggests a confident workforce with ample job opportunities, usually meaning they can leave a job to get a new one, usually with greater pay. Conversely, a declining quit rate could indicate fewer available positions.

Adding to the narrative of a potentially weakening US labour market, we've seen an uptick of 8,000 in initial jobless claims. The unemployment figure rising to 4% confirms the softening trend of labour markets in the US.

Metrics to watch for policy shifts:

Wage inflation across Europe

Headline and core inflation

Services inflation trends

Signal, not noise.

You can expect further “data dependent” language from Lagarde as she eases ECB rates towards 3% which according to the OIS curve we could see as early as March 2025.

As for now, sit back and enjoy the macro show.

Thanks for getting to the end.

If this report was insightful, would you do me a favour and forward this to just one contact?

It takes hours to write a report, it’ll cost you 10seconds to forward this ;)