Why GBP, JGBs, and Yen Remain Shortable

Unpacking Macro Headwinds, Technical Alignments, and Factors Behind Three Macro Positions

Hey crew,

I meant to send out this report to you all yesterday, but I was under the weather trying to recover; thanks for your patience.

In this report, I’ll outline a balanced perspective on why my outlook for cable, JGBs and the Yen remains short. As always, it is an actionable piece with a balanced set of perspectives both for and against the trades.

“strong opinions, weakly held”

Sterling Shorts

Positioning: Short

Since the start of the year, I’ve been vocal about my bearish outlook on cable. The pound has stood out as a currency with great downside potential, aligned with the macro data and it becomes ever more clear as to why one would be bearish on the pound.

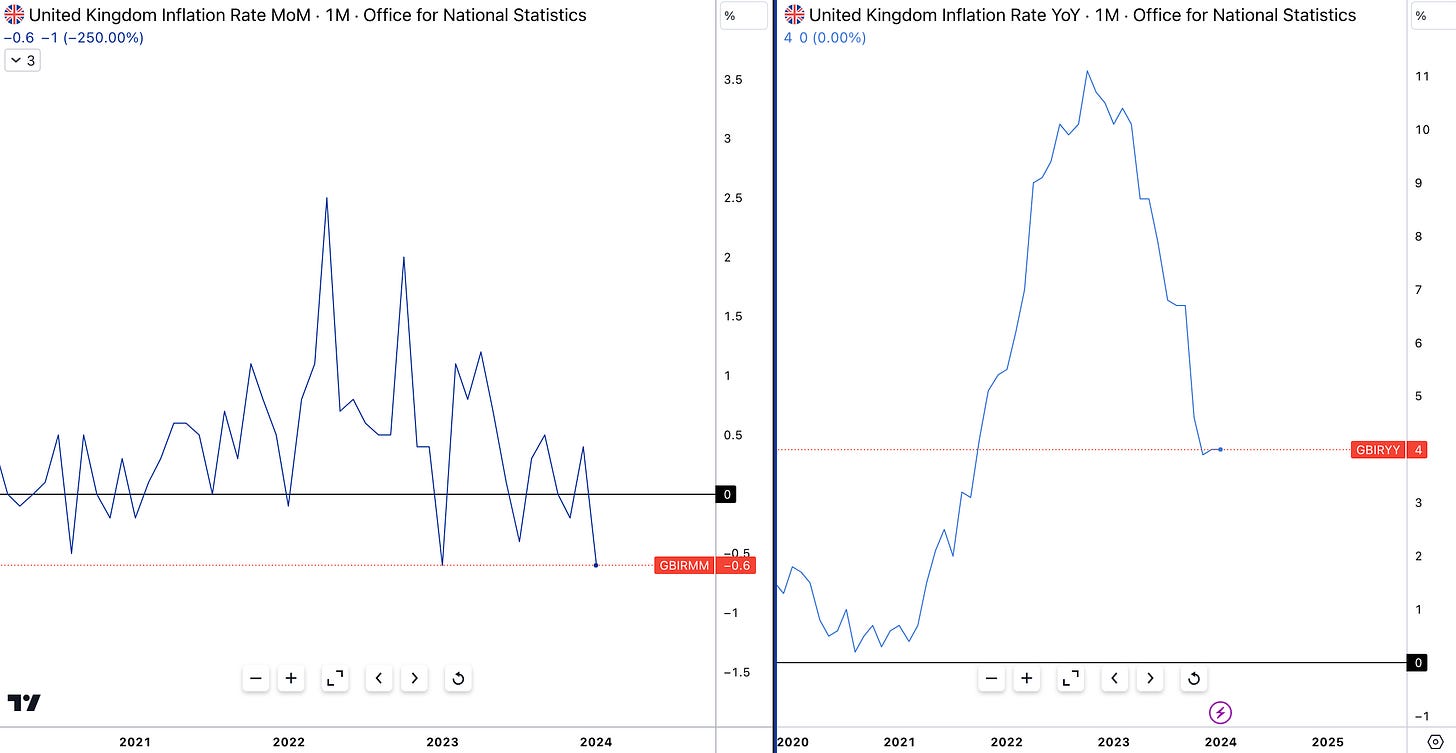

This week we received a significant set of data coming from the UK economy further confirming my positioning. Inflation in the UK remains stagnant, which toughens the situation for the BOE as GDP data disappointed to the downside confirming the UK is in a technical recession. Headline CPI was forecasted to rise to 4.1% but held steady at 4.0%, whilst the MoM reading showed a 0.6% contraction.

Core CPI remains fixed at 5.1% demonstrating the challenges the BOE faces with bringing down the services component of inflation. Unlike the rest of the economy the labour market has continued to bolster positive data with the unemployment rate declining to 3.8% and average hourly earnings + bonus increased 5.8% in December.

To anticipate future trends, we must examine leading indicators. In this case, the Producer Price Index (PPI) serves as a valuable tool to gauge potential downstream impacts on consumer inflation. While current data suggests a continued downward trend for headline inflation in the UK, potential headwinds are present. The ongoing evaluation of the Israel-Hamas conflict's economic repercussions and elevated transportation costs due to diverted naval routes remain risk factors for European energy markets. Nevertheless, it's important to note that year-end data for January 2024 revealed significant declines in gas (-26.5%), oil (-9.2%), and electricity (-13%) prices, indicating an overall bearish trajectory for energy costs.

Data released from the ONS on the 15th of February confirmed the UK slipped into a recession with GDP contracting 0.3% in Q4, YoY for Q4 GDP contracted 0.2%. The high cost of living, coupled with crippling inflation has kept the UK economy stagnating over the past 12 months.

So what does this mean for sterling?

As always it’s important to bring back each data point to the question of “Where is opportunity?”. With the UK officially in a recession, and the U.S bolstering in strength and growth shown by their latest Q4 QoQ GDP figure of 3.3%, the pound is on a perfect stage to see prolonged weakness which I believe can last right up until the general elections here in the UK.

The transmission of monetary policy on FX is very simple. The framework to understand, interpret and come to an investment conclusion must be clear.

Let’s review the factors influencing my short bias:

Declining inflation: Lower-than-expected inflation provides leeway for the BOE to not be forced to hold interest rates high for an extended period.

Weak Growth Data: Recessionary GDP figures reinforce market participants’ belief that the BOE will have to cut early and provide support to the economy now that the economy is declining in output.

Political instability/uncertainty: With the general elections set to take place no later than 28th January 2025, widely anticipated to be sometime in Q3/Q4 ‘24, the conservative party is under extreme scrutiny as after recent economic data, he has failed to deliver on one of his five key pledges which was:

“We will grow the economy, creating better-paid jobs and opportunity right across the country.”

— Rishi Sunak 4th January 2023

Instability within the political realm breeds uncertainty in the currency markets which more often than not gets expressed as fear fueling selling pressure.

US outperformance: It’s no surprise that the US are once again leading economic growth in 2024. With labour market data strong, capital markets strong and inflation trending lower but above expectations, this provides the Fed with more reason to hold onto rates as opposed to being forced into an early cut which is where my view lies for the BOE.

The BOE’s calendar for the year can be seen below. Although the UK is officially in a recession, I still believe Andrew Bailey will try and hold on at least until May’s meeting to commence the cutting cycle.

The central bank will hope that inflation continues its downward trend, which when observing PPI data looks more probable than not.

All these factors contribute to my positioning against the pound. Another classic spread trade between two economies, in this instance we’re aiming to answer the following:

Which central bank cuts first? BOE or the Fed

Which economy is able to handle restrictive rates US or UK?

Which economy is stronger and set to outperform relative to the other?

With those questions all answered we now must consider the flip side. Namely the risk analysis:

Economic rebound: A sharp rebound in economic activity would boost optimism for the UK & pound. Although very unlikely in the short term, this still poses a potential risk.

Rebound in inflation: If we see UK inflation tick up then the expectations of a BOE cut would be pushed back to the late summer

US slowdown/early rate cut: According to market probabilities, the Fed is expected to cut rates in June, however, if economic data, namely inflation significantly drops within the Fed’s target a May cut could be on the table.

While various technical analysis methods exist, I chose to focus solely on price action on the weekly chart for its simplicity and clarity. This timeframe effectively captures the recent price slowdown observed throughout December 2023 and January 2024, followed by the recent downside breakout. Notably, these technical characteristics align perfectly with the aforementioned macroeconomic fundamentals supporting my underweight position on GBP.

JGBs & Yen: Short Play

Yen: Neutral/Underweight

JGBs: Short

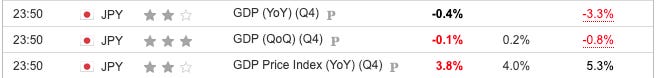

For most of us reading this report, the Yen short has been a constant theme for most of 2023, and now 2024. Timing a BOJ rate cut has proved difficult amidst weak economic data and growth signals from the world’s now 4th largest economy after the US, China and Germany. On Wednesday this week, GDP data also confirmed that Japan marginally slipped into a recession in Q4 ‘23.

Although negative, the surprise recession hasn’t deterred the BOJ’s plan to move away from negative rates according to a statement but the Governor of the BOJ, Kazuo Ueda.

While bearish on both JGBs and JPY, I favour expressing this conviction through JGBs. Shorting USD/JPY directly introduces additional complexities, including factoring in the behaviour of the US dollar, its economic data, financial conditions, and capital flows. These external factors can dampen the expected impact of the BOJ's potential move to positive rates, potentially resulting in a muted reaction in the FX market compared to the larger move anticipated for JGBs in the futures market.

On the other hand, trading the futures contract for JGBs would limit and cut down the points of influence for a trade like this based upon an expectation the BOJ will raise rates resulting in the yields floating slightly below, if not above the 1.00% strict cap.

The Yen is once again within intervention territory so there is some extra fuel to the short perspective of this position giving the backing the MOF would provide when strengthening the Yen in the currency markets.

From the start of 2022, until Japan’s FX reserves declined by more than $100bn, the 33% loss in value of the Yen played a crucial role in the MOF’s FX reserves being crushed over 1 year. Here are two few factors that played a key role in the rundown of the FX reserves:

Intervention in FX markets: In 2022 the MOF intervened twice to stop the Yen’s depreciation. This involves selling foreign currencies it has on reserve and purchasing its domestic currency on the FX market.

Capital flights: Hot money flows where rates provide attractive yields. The story across 2022 & 2023, as a result, Yen-denominated assets become less attractive resulting in investors, mainly domestic investors, searching internationally for yield. Cross-border flows.

To round up, I hope this article has been informative and timely for you all. My bearish outlook on the pound should highlight the main “macro” topics that go into creating a directional bias from macro data; from my JGB & Yen segment, I hope you understand the importance of choosing the right expression for your trade idea. You may have a great idea, but is the market you’re trading presenting the optimal environment to express that idea?

Thanks for getting to the end, I hope you found this report as insightful as I did writing it.

Until next time ;)