Who said inflation wasn't transitory?

Reviewing the FOMC conference, the markets reaction & market liquidity!

Hey crew,

I’m back.

Words once said by MJ after retiring with 3 rings, then coming back to the game.

Lucky for us, there’s no retiring in this game only seasonal holidays.

Quick life update.

I’m in an extreme phase of focus right now.

Zero distractions. Complete discipline.

Some call it monk mode.

Point being, there comes a time in life where you realise that nothing else matters except for that one thing. And when you find out what that is, go all in.

Enough life stuff, the Fed met on Wednesday to deliver what markets are pricing to be the last hike of the year, and we’re seeing some promising signs in the bond vol market.

So without further adieu, lend me your attention:

Stick to the script Jay

Coming from someone who has read countless FOMC conference transcripts, I can say this meeting ranks last for new information available for us to interpret.

However, there were a few things I was able to grasp in the midst of Jay Powell’s swerving and manoeuvring of questions in the form of repetitive answers we’ve heard time and time again.

The Fed raised rates 25bps on Wednesday to 5.50%.

To sum up Jay’s 1.5-hour press conference, his overall tone was to not “provide a lot of forward guidance” (a policy tool used to communicate central bank activity to markets) and to continue being “data dependent”.

Out of what he said, there are still some key concepts we can dig up.

Labor Tightness

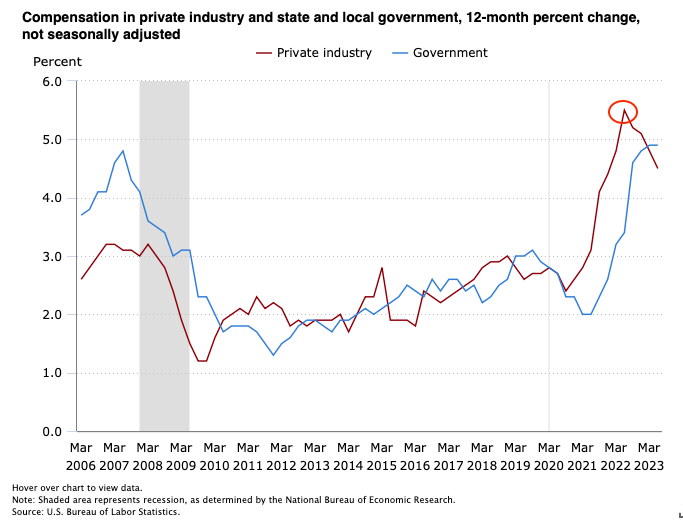

Let’s take a look at the ECI index (Employment cost index) something the Fed look at.

For those who haven’t seen this chart let me explain in simple terms what this represents.

According to the BLS, the Employment Cost Index (ECI) measures the change in the hourly labor cost to employers over time. It’s produced quarterly, and as you can see private sector hourly labour costs have shown disinflationary pressures with the compensation costs increasing by just 1.0% from March-June 2023, YoY that figure is 4.5%.

When looking at the U.S economy here’s what’s truly shocking for the most part. Unemployment in March 2022, when the Fed first started its hiking cycle was 3.6% fast forward 16 months and 500bps of interest rate rises, and the unemployment rate is still 3.6%! If you’re wondering why the unemployment rate soo low? Here’s my explanation:

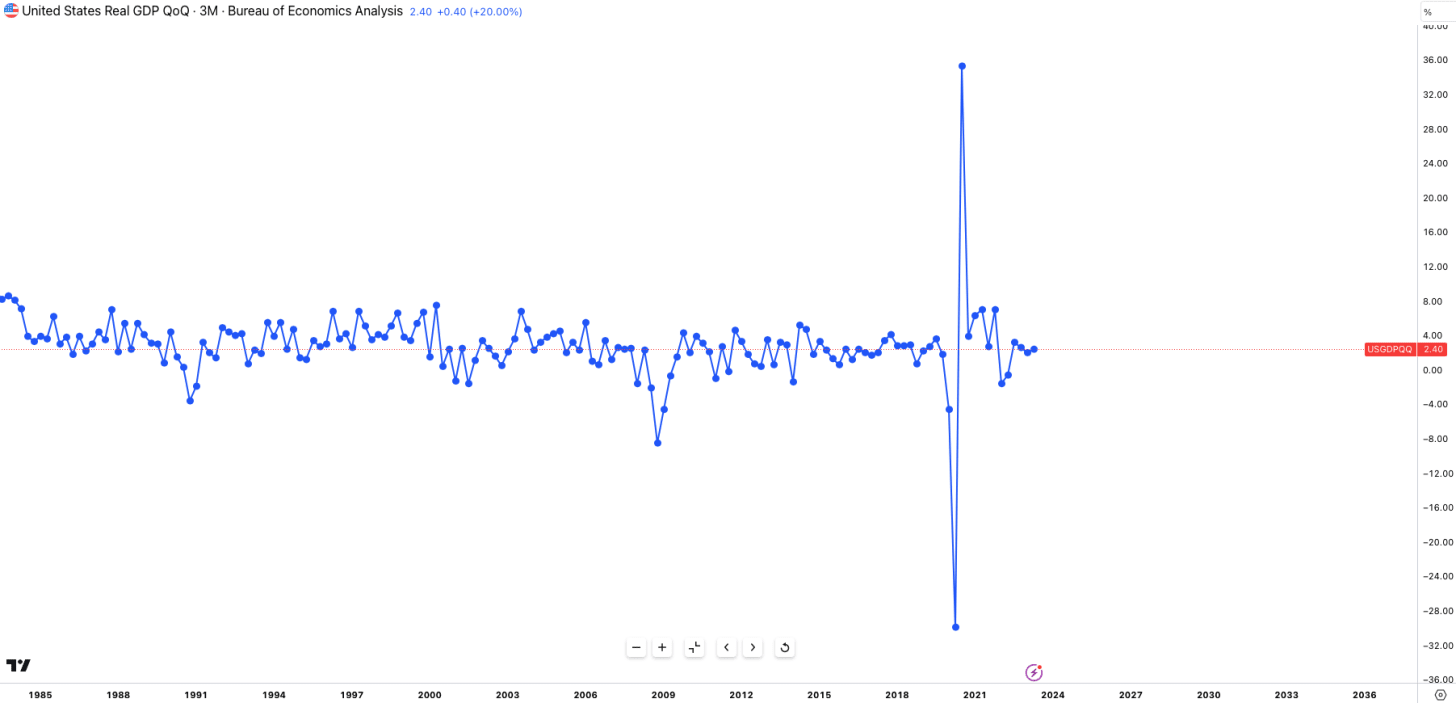

Strong U.S economy: We can’t deny the fact that the U.S has proven its resilience with strong GDP data coming out for both Q1 & Q2, with Q2 GDP beating 1.80% expectations at 2.40%. In an environment where the economy is actively growing and not experiencing the true effects of the 500bps rate increases, the unemployment rate would stay relatively low given such macro conditions.

The spike in GDP notably came from Covid.

Another notable reason why the unemployment rate is low, we’re seeing a prolonged sluggish growth in the labor participation rate. Something we saw drop drastically during covid to lows of 60%.

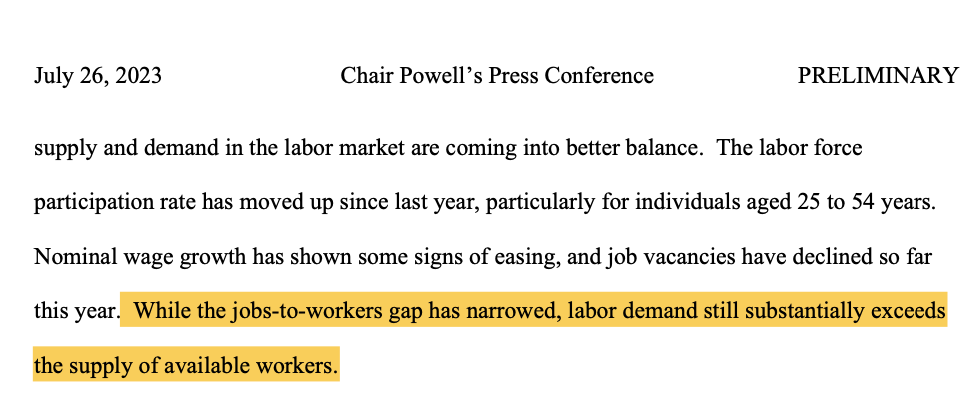

As you can ascertain, this is the percent of the U.S population that is employed or looking for employment. After 2020, the rise of the ‘gig economy’ short-term and temporary contracts, we’ve seen a large part of the U.S workforce move towards self-employed work reducing the availability of workers within an economy starving for workforce. Here’s what Powell had to say about the jobs-to-workers gap:

This leads to something Powell stated on Wednesday regarding his fellow FOMC members.

“So, the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession.”

— Jay Powell, Fed Chair, July 26

I guess there we have it.

No recession, meaning it’s a soft landing. The reason why this is significant is very simple, in history, the Federal Reserve has never been able to increase unemployment by 1.00%, which was their target according to the SEP document, without pushing the U.S economy into a recession. Lucky for the Fed, the unemployment market has remained just as tight due to the reasons mentioned.

Here’s a small annotation on the dollar moves over the past two days and the reasoning, it’s pretty straightforward.

However, like I’ve told my MMHPro community, this dollar strength is rather temporary in my view, the dollar is down just under 2% YTD, however, this is a trend I see continuing throughout the remainder of the year unless we have some form of continued robust growth from the States leading into Q4 where we can expect to see the true realisation of higher rates.

Observing Liquidity

If we now want to take it a step further and see what liquidity in the markets is doing, then let’s turn to the MOVE Index.

The MOVE index is a gauge of volatility and investor uncertainty within the U.S Treasury market. As one would expect, increased volatility in the bond market is a danger sign for investors, as that means there’s increased uncertainty in the expectations of the U.S yield curve movements usually forcing investors to seek some form of ‘risk premia’.

What we’re seeing now is a decline in the MOVE index after what would have been the most volatility in over a decade due to the SVB crisis. *Note* - During Fed tightening cycles, the MOVE index has historically declined, meaning bond volatility has dropped, but due to events within the banking sector, this time around that’s not been the case.

Anyways, with bond vol positioned to return to 2023 lows and below, liquidity in financial markets is set to remain at healthy levels even as the Fed continue its balance sheet roll-off.

Guys, that’s it for today.

I hope you’ve enjoyed this dive into the U.S & particularly a review of the Fed rate decision.

If you want to learn more about macro, be sure to visit the official Macro Hub here for free value here