When Will the Tide Turn for Liquidity?

Assessing the restoration and effect of liquidity in global markets

Hey guys,

Another week on the MMH platform, I had great feedback from the last report which we love to hear!

From here until further notice, all reports will be free and we will be switching off the paid membership so it doesn’t charge you anymore.

A lot of the messages I got were questions about how to create depth in your macroeconomic knowledge. The steps below are the best repeatable actions:

Read reports > Note topics/key words you don’t understand and research > Read report again > Read a new report > Note topics/key words you don’t understand and research > Read report again… etc etc

Now, the key is the source of the information. Your first source is of course here at Market Macro Hub.

However, do some digging, look for bank reports, bank outlooks, senior analyst reports etc etc…. Twitter is a great source.

Anyway, let’s get into the most important thing.

Liquidity in markets… the return or was it already here?

Macro Watch

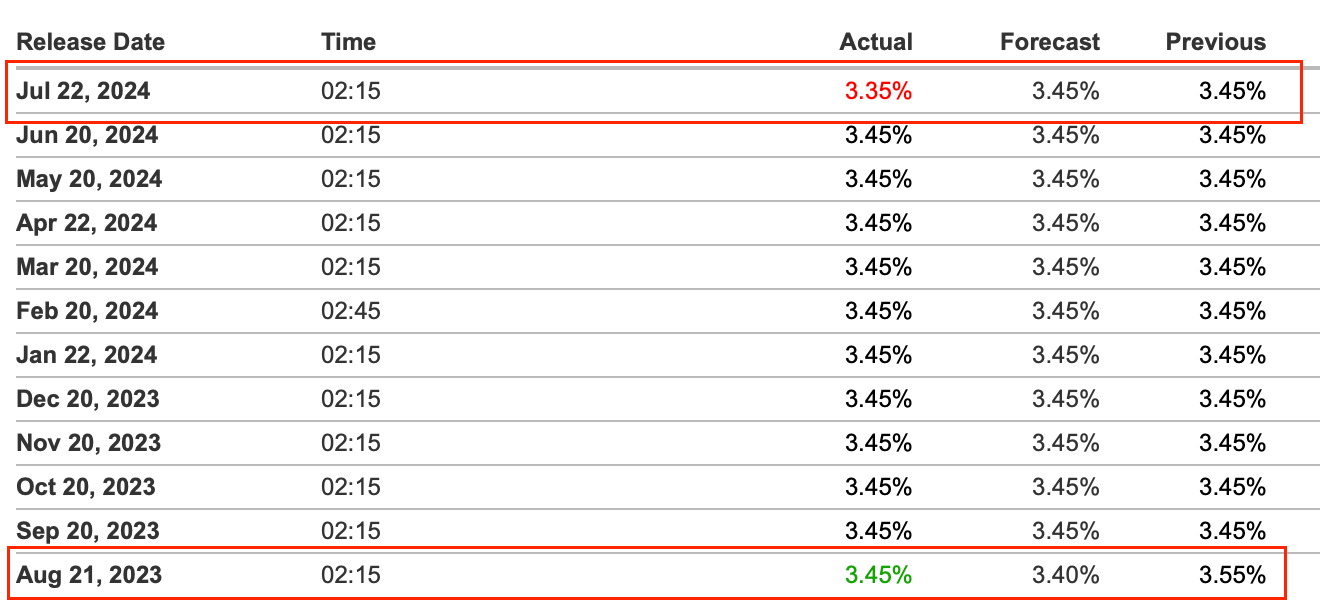

On July 22nd, The People’s Bank of China cut their key interest rate, the 1-year Loan Prime Rate 10bps unexpectedly to 3.35%. This was the first cut since August 2023 and signals an intent to boost growth in the world’s 2nd-largest economy just days after the Communist Party leadership meeting.

However, the main focus was on the 7 day reverse-repo rate which was also cut by 10bps to 1.7%, it was previously assumed that a rate cut would hurt bank profit margins too much. The reason the focus was on the 7 day reverse-repo rate is because it’s a short term lending tool, meaning that banks can now directly access capital for shorter periods at lower rates, potentially making capital more fluid in China.

As China’s standards go, the recent GDP reading for Q2 at 4.7% is nothing to brag about. To continue the domination in global trade, China needs to spark growth. There is plenty of ways an economy’s growth can be fuelled, stimulus being one of them, which didn’t do much for growth last time the Chinese government tried.

If China also wants to maintain a competitive equity market they needed to take action otherwise the S&P’s performance would be too superior in comparison to China’s benchmark index and they will naturally struggle to receive foreign direct investment (FDI).

The drop in the key interest rate in China should bring more liquidity to their economy and boost economic growth. With global rates taking a turn, the PBoC won’t be the anomaly to cutting rates, which is a positive because there shouldn’t be dramatic capital outflows from the Chinese Yuan seeking higher rates.

With the largest exporter of goods globally fuelling economic growth, the knock-on effect could be positive worldwide. Cheaper imports and higher supply are many of the reasons that global prices could drive lower, just in time for central bank rate cuts and extra liquidity entering the market.

Market Mover

The Pound has been on a bull-run, up around 5% against the Dollar since the back-end of April. As mentioned in plenty of my reports, yield differentials have a heavy influence on the FX market. With US data soft and interest rate cuts inbound, it’s clear to see why it’s losing value against the Pound.

Now to add, the UK’s CPI is at the central bank’s target of 2%, so surely they will be cutting rates faster than in the US, right?

Wrong, it all comes down to core inflation, that’s where we really identify the tricky inflation components.

A little higher than the Bank of England would want, but this isn’t the main area of concern, services inflation is.

The figure of 5.7% causes some major concern for the central bank, bringing higher for longer interest rate expectations. Services inflation is very sticky because of the components it’s made up of, including rent costs, transportation services, entertainment services, utility bills and healthcare services. Once prices in these areas are risen, they’re very hard to bring back down.

The BoE cut last Thursday has created a larger spread between the UK and US interest rate. However, in September, the Federal Reserve is set to cut rates by 50bps. This creates an equal level in rates between the UK & US, but I think investors are seeing past that and asking - Where will each rate be in 12 months time? (Most likely in favour of higher rates in the UK).

Trade Update

Below is a trade idea recommended in my report on July 11th, which has now hit target:

Gauging the Rebound in Liquidity

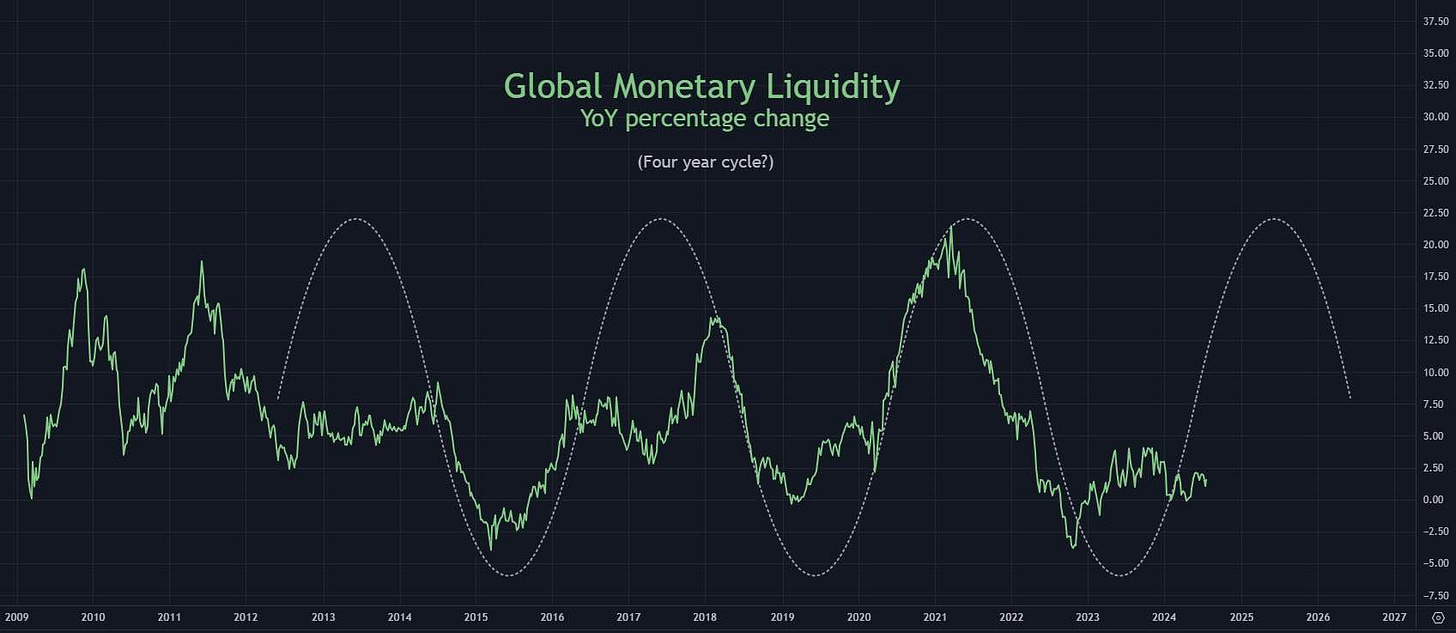

Global liquidity refers to the ease with which financial assets can be traded internationally and the overall availability of funds in the global financial system. It includes the flow of capital across borders, influenced by central banks, financial institutions, and market participants worldwide. Global liquidity is mainly driven by the monetary policy and interest rates of the largest economies globally.

As we know, monetary policies have been tight across the board, interest rates have been high and liquidity has dried, but what does lower liquidity mean for financial markets?

Naturally, risk-off sentiment will dominate meaning that there is a flight to safety when investing. The increased demand in safe-haven assets will typically drive the USD, Gold and bond prices up. The equity market typically sees losses in that environment as risk appetite declines.

With global rates still at their peak, you’d assume that the market is highly illiquid, right?

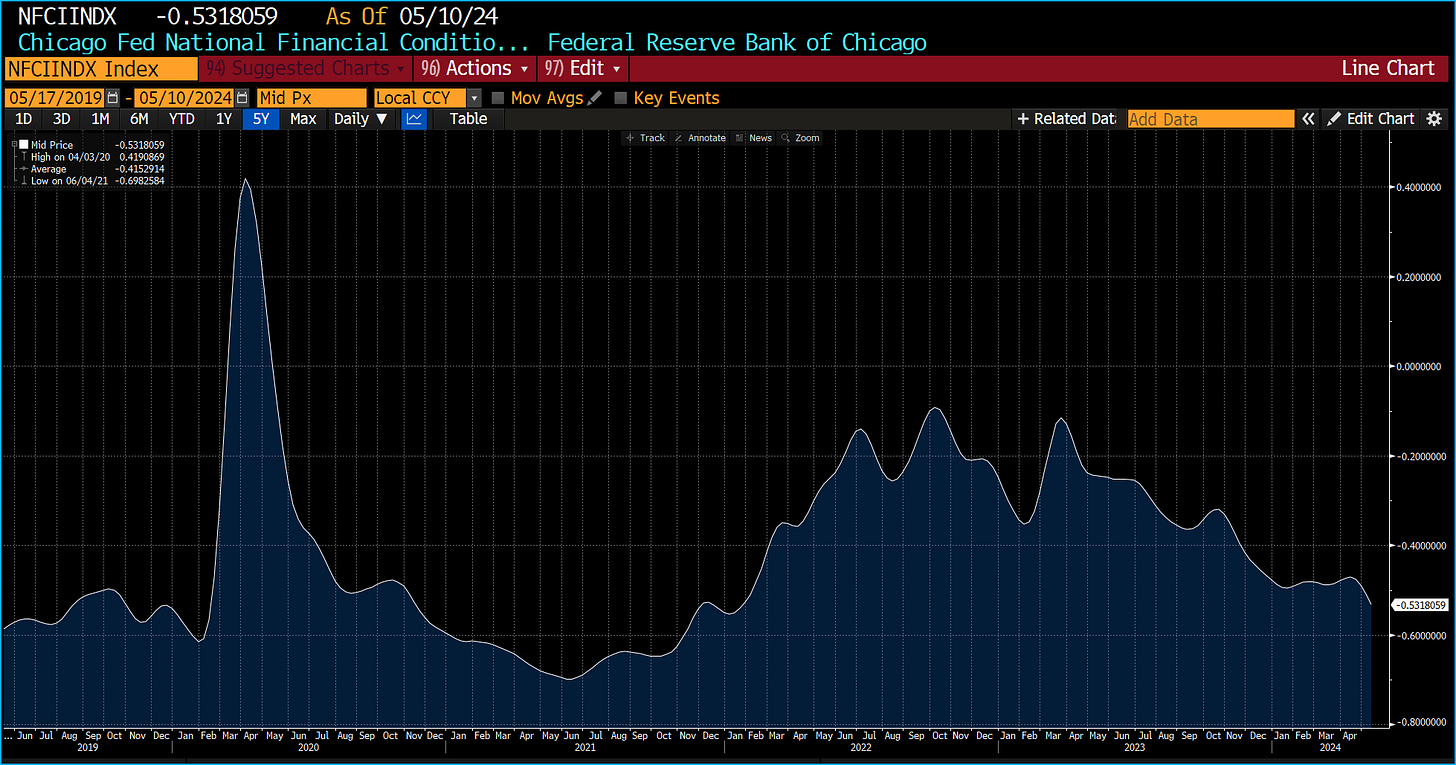

When we focus on our main gauges of how liquid markets are, they are all giving signs that liquidity has already returned, not just returning. The National Financial Conditions Index is one of the greatest insights to the tightness or looseness of financial conditions inside the US, reflecting how accessible and costly it is for businesses and consumers to borrow money and engage in economic activities. The NFCI is currently sitting at the November 2021 levels, around -0.5. Just to note, a reading above 0 in the NFCI means that conditions are tighter than the historical average while a reading below 0 means that conditions are looser than the historical average.

The reason that these conditions are greater than they should be in this tight environment is because of stimulus that was introduced, which is The Bank Term Funding Program (BTFP). This was a program introduced by the Federal Reserve in March 2023 in response to liquidity strains in the banking sector, particularly during the banking turmoil that occurred earlier in the year. The BTFP was designed to provide a backstop for banks and financial institutions facing liquidity pressures.

The BTFP allowed eligible institutions to obtain term loans from the Federal Reserve. These loans were typically issued for a period of up to one year. The loans were made available at rates below prevailing market rates, providing a source of liquidity at favourable terms. This allowed not only small banks, but large (SIB) banks to have access to more liquidity, trickling into the economy.

Since the stimulus period during COVID-19, there has not been much liquidity drained from the US even in such tight conditions.

This means two things, the markets liquidity is the same now as it was when global rates were at their lowest and also the negative figure of -0.5 shows that the overall financial environment is accommodative, with credit being more accessible and cheaper than historical average.

Regardless of what the NFCI is already showing, we do know that large amounts of liquidity will re-enter markets in the coming 12-18 months with monetary policies shifting and interest rate cuts commencing in the coming months. This will only continue to boost risk-on assets, drive up high-beta stocks & currencies, increase economic growth and so on.

Because global liquidity is typically positively correlated with equities, we know that the largest equity market is the world (the US equity markets) is a great tracker.

The S&P500 has seen more YoY gains prior to global liquidity gains simply because of the perceived monetary policy changes across the globe. Investors will position into trades early in anticipation of a future event/events, like interest rate cutting cycles. So the reason for the lag-effect between the two is because of early positing into the equity market in anticipation. Figure 9 clearly gives an insight that the rebound in global liquidity will only add to the gains of the equity market.

Higher US equities normally keep traded FX volatility levels low and support the carry trade.

Another great gauge of global liquidity is the bond market, especially the US bond market. Bonds are driven by multiple factors ranging from risk sentiment to monetary policy expectations. The 2s10s curve has been inverted since July 2022, typically an inversion means there is economic weakness, a tight economy and a potential recession on the cards.

However, Figure 10 shows the bull steepening of the 2s10s yield curve, signalling another part of the economy that is no longer as tight as it was expected to be.

So, now that liquidity is entering the markets and will continue to come into markets, these are the next things to watch:

Global bond yields declining

Risk-on environment - High beta assets performing well

Lower perceived risk of recession as growth will naturally incline

Second-round effect on inflation could be negative, extra liquidity resulting in ease of access to credit can fuel the inflation trend again

The liquidity rebound won’t be immediate, it’ll trickle into the economy but I do believe the rebound has already began. The higher global liquidity will bring stability into larger economies and balance the labor market because borrowing for businesses will be more affordable and easier to access. This stability in the global labor market will reignite growth and potentially save some economies like the US from having a hard landing (a recession). Couple the liquidity introduction with multiple global events such as presidential optimism in the US, Chinese stimulus and slowly accommodating monetary policy, inflation close to central bank targets and the global cutting of interest rates, there is plenty of reversal points across assets in the near future.

Extra liquidity globally

The ECB are also in the same boat as the UK and US when it comes to rate cuts. Adding onto the large signs of liquidity spark in the US, we could also definitely see the Eurozone support this.

Second order thinking is crucial. Easier access to credit and cheaper borrowing in the Eurozone will naturally ramp up the demand for Chinese goods. Europe is one of China’s largest trading partners and their trade includes a wide range of goods, from machinery and electronics to textiles and chemicals.

But Europe aren’t just large importers from China…

Foreign direct investment from the Eurozone to China is large, European companies invest in Chinese manufacturing, technology, and services sectors, while Chinese companies invest in European infrastructure, real estate, and businesses. This trend has seen a large decline since China’s weak growth and the ECB’s tight monetary policy.

This theory leads me onto an actionable idea:

Actionable Idea

As China should have increased levels of growth, demand and FDI, companies there should receive major support and higher earnings. I’m very bullish on the Chinese economy as a whole and I believe the best way to express the theories explained above is positioning long on the Hang Seng Index from the current price, 16,700, with the invalidation point at 15,330. For ease, I will summarise the idea based on the topics above:

Global liquidity to surge higher in the coming months based on monetary policy changes

Growth in China being re-lit by easier credit access in Europe and also a 10bps decline in the 7-day reverse-repo rate in China

Optimism surrounding the US presidency, turn in inflation and lower rates will invite a risk-on mood, where investors will seek higher beta assets like equities

Thanks for reading until the end guys, I hope it was a valuable one!

Keep the reports coming Alfie ! solid stuff