Week In Focus: FX Outlook (pilot)

movers behind ccy this week

Good morning, crew!

Welcome to MMH’s flagship Week-in-Focus FX Outlook, your weekly rundown of key macro developments and policy shifts shaping the foreign exchange market.

Here, we share our perspective and highlight high-conviction, asymmetric FX trades that reflect our latest research and positioning.

As always, we’d love to hear your thoughts (leave a comment).

Without further ado, let’s attack the week!

Market Movers

Markets entered the past week flying partially blind. The usual slate of U.S. macro data, the backbone of forecasting in a ‘data-dependent’ Fed cycle, was absent due to the government shutdown, forcing investors to rely on less conventional signals.

Government shutdowns, while disruptive, are nothing new to markets. The U.S. government has shut down 21 times in modern history, with the longest stretch of 35 days occurring during Trump’s presidency in 2018/19.

Senate Democrats are seeking to extend healthcare subsidies under the Affordable Care Act, while Republicans, who hold a 53–47 majority, can’t advance a funding bill without the 60 votes needed to break a filibuster. UniCredit estimates roughly 750k federal employees (c.26% of the federal workforce) could be furloughed, shaving 20–30bps off Q4’25 GDP growth for every week the shutdown persists. Ordinarily, such episodes are seen as temporary distortions. However, Trump has openly signaled his intention to use the shutdown to pursue structural cuts to agencies, a move likely to face legal challenges.

With the usual government releases delayed, markets dialed in on the ADP private payroll report, which showed a 32k decline, partly reflecting model adjustments following the BLS annual revisions.

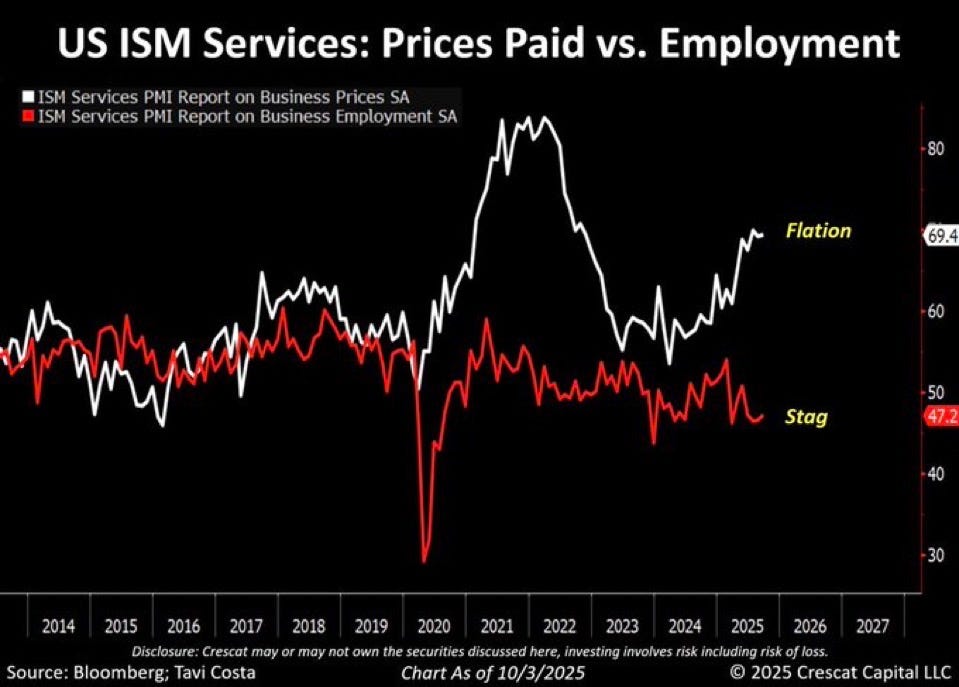

The soft print saw G10 FX catch a modest bid against USD. NZD, CHF, and GBP initially led gains before retracing as momentum faded. Sentiment took another hit with a disappointing ISM Services, which delivered a stagflationary cocktail: orders lowered, prices paid edged up, and employment, although surprising to the upside, remained below the 50 mark, firmly flirting with the contractionary or expansionary line.

Media coverage of Fed members also highlighted the widening divergence within the FOMC we saw in the September dots. Governor Mirran argued for a faster normalisation cycle to bring rates back to neutral, a clear contrast from President Goolsbee and President Logan, who cited risks to inflation in the non-housing sector and goods prices.

Across the Atlantic, eurozone inflation rose 2.2% for the month, driven by services inflation at 3.2%, while non-energy goods stayed fairly muted, suggesting that the tailwind from cheaper energy might be fading. Growth was mixed. PMI figures climbed to a 16-month high at 51.2. Germany powered ahead with a composite reading of 52.0 as services regained momentum, though job losses hit their steepest pace in over five years. Spain remained the bloc’s outperformer (53.8), while France slipped deeper into contraction (48.1) as weak demand forced firms to cut prices for the first time since May.

And west of the region, the UK’s BoE is still in wait-and-see mode, projecting peak inflation worries as we await the next round of fiscal woes from next month’s Reeves budget. In the meanwhile, services PMI figures dropped to 50.8 from 54.2, and the composite slipped to 50.1, the weakest print in five months.

In Japan, retail sales fell 1.1% y/y for the month, the first drop in 41 months. The BoJ Tankan survey showed only a modest uptick in large manufacturers’ sentiment, steady services, worsening labour shortages, and diverging capex. Inflation expectations held near 2%.

Macro watch

The week ahead is set to be defined more by what we don’t get than what we do. With the U.S. government shutdown halting most official data releases, markets will have to navigate a macro landscape with fewer signposts. The only meaningful U.S. release still on the calendar is Friday’s University of Michigan consumer sentiment index, which is expected to show another drop as households grow more anxious about inflation and job security. The Fed will publish minutes from its September meeting on Wednesday, which should shed more light on how their projection of a lower median EFFR and at the same time higher inflation and growth picture. However, those discussions have already been overtaken by events, and the shutdown itself will weigh more heavily on the October policy meeting.

In the Asia-Pacific, attention turns to the RBNZ, which is widely expected to cut rates again on Wednesday as weak growth pressures policymakers to do more. Japan’s household spending data on Tuesday should confirm softer momentum after a strong summer run, while producer price figures on Friday will offer a read on how a weaker yen is filtering through to inflation.

Europe’s calendar is relatively light, with the ECB Chair speaking today. In North America, Canada’s labour market data on Friday will be closely watched after two months of heavy job losses, while trade data earlier in the week from both Canada and the U.S. will shed light on external balances in a slowing global economy.

With fewer data points to anchor expectations and policy still in flux, this is a week where tone and positioning could matter more than the numbers themselves.

FX Outlook

USD: the worst is past us (priced in)

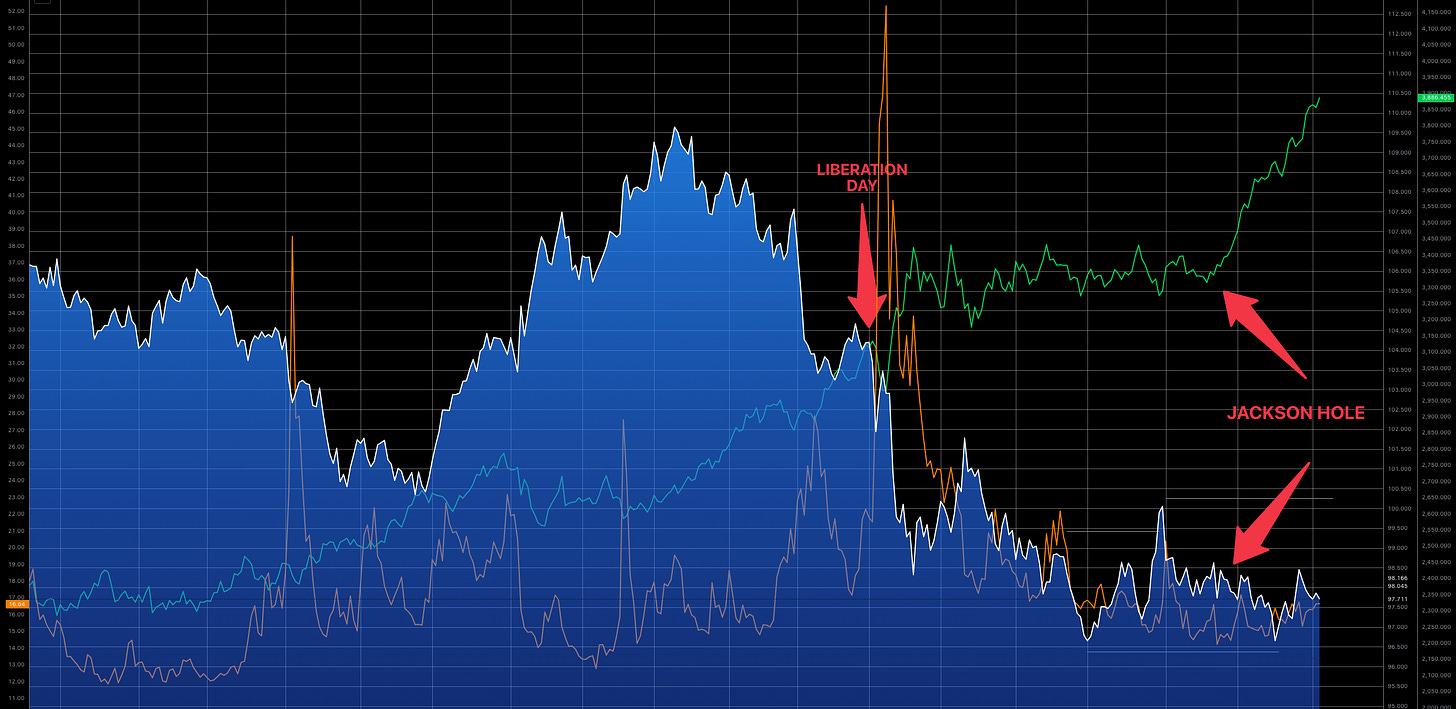

The capitulation by JP at JH has given the debasement trade another leg higher. Gold (green line) extended its rally as investors priced in more rate cuts against a backdrop of a weak labour market, fragile Fed composition and, in extension, its independence, alongside rising cost-push pressures from tariff policy. Yet, the surge has been one way. Despite gold’s rally, USD (white line) continues to hold its ground as volatility (orange line) eases back from recent highs.

For regular readers, our view on the dollar is well known, but it’s worth adding another layer of perspective here. In our view, USD bears are clinging to stale narratives. Markets are already pricing in c.113bps of easing from now through the end of next year, a far more aggressive path than the Committee’s own projections. The “worst-case” dovish scenario is already reflected in current price action.

Adding to the dollar’s resilience was a Thursday surge triggered by a private-sector employment report Revelio Labs that beat consensus expectations showing payrolls gains north of 60k. Scotiabank’s FX desk noted this as a key momentum driver for the greenback. Still, the strength is hard to fully reconcile with leading labour market indicators such as hiring and quits rates which, though balanced against each other, continue to trend lower.

The ongoing government shutdown may layer on another bout of volatility for the dollar in the short term. However, we expect the greenback to reassert itself once a resolution is reached, supported by a higher growth projection (Atlanta Fed Nowcasting GDP), loose FCI flows, a strong consumer credit cycle, improving claims data, and rising inflation, a macro landscape that remains far less dovish than markets currently imply.

“If we’re correct to see more capital flows into US equities sponsored by the AI boom and capex spend as the Fed navigates to neutral and fiscal impulse from the OBBB beginning to materialise 2026 then we expect risk allocators and investors to embrace more USD risk.”

**commentary from Markets vs Mandates: Rethinking the Easing Cycle

EUR: Chasing 1.20? I think not

SHORT EURUSD@1.171 SL 1.183 TP 1.14

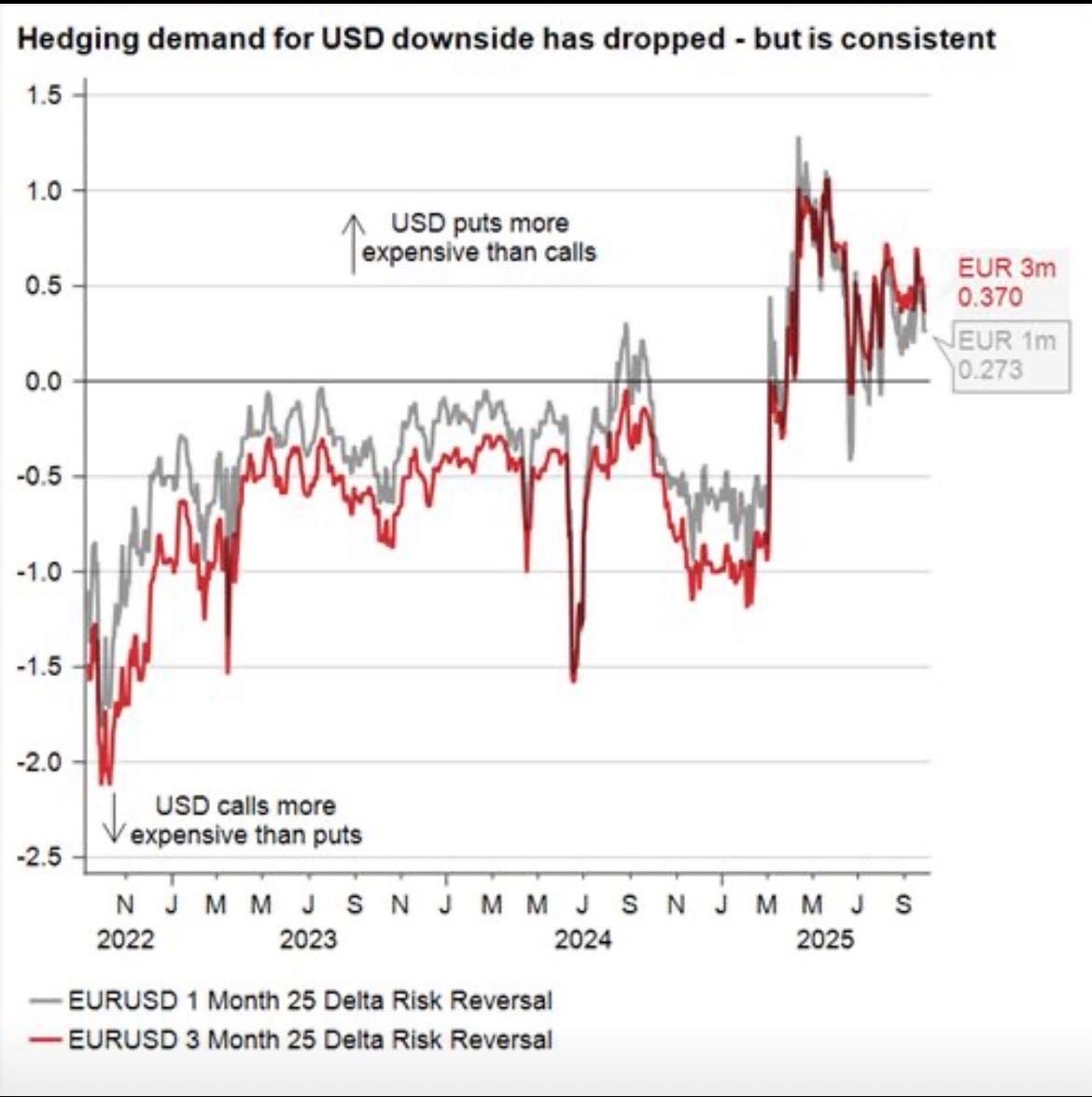

In contrast to the prevailing gloom around the dollar, much of the good news behind the euro’s rally from Europe’s fiscal impulse to shifting policy expectations and a softer U.S. growth outlook is already in the price. Political uncertainty in France remains an underappreciated risk that could further cap EUR upside, especially as investors reassess sovereign risk premia within the bloc.

At the same time, the much-hyped “sell America” narrative has failed to materialise. Foreign inflows into U.S. assets continue to hit record highs, underscoring persistent demand for dollar-denominated returns. Against that backdrop, the euro’s upside looks increasingly exhausted, and the downside asymmetry is becoming more attractive as positioning, policy, and politics align against further gains

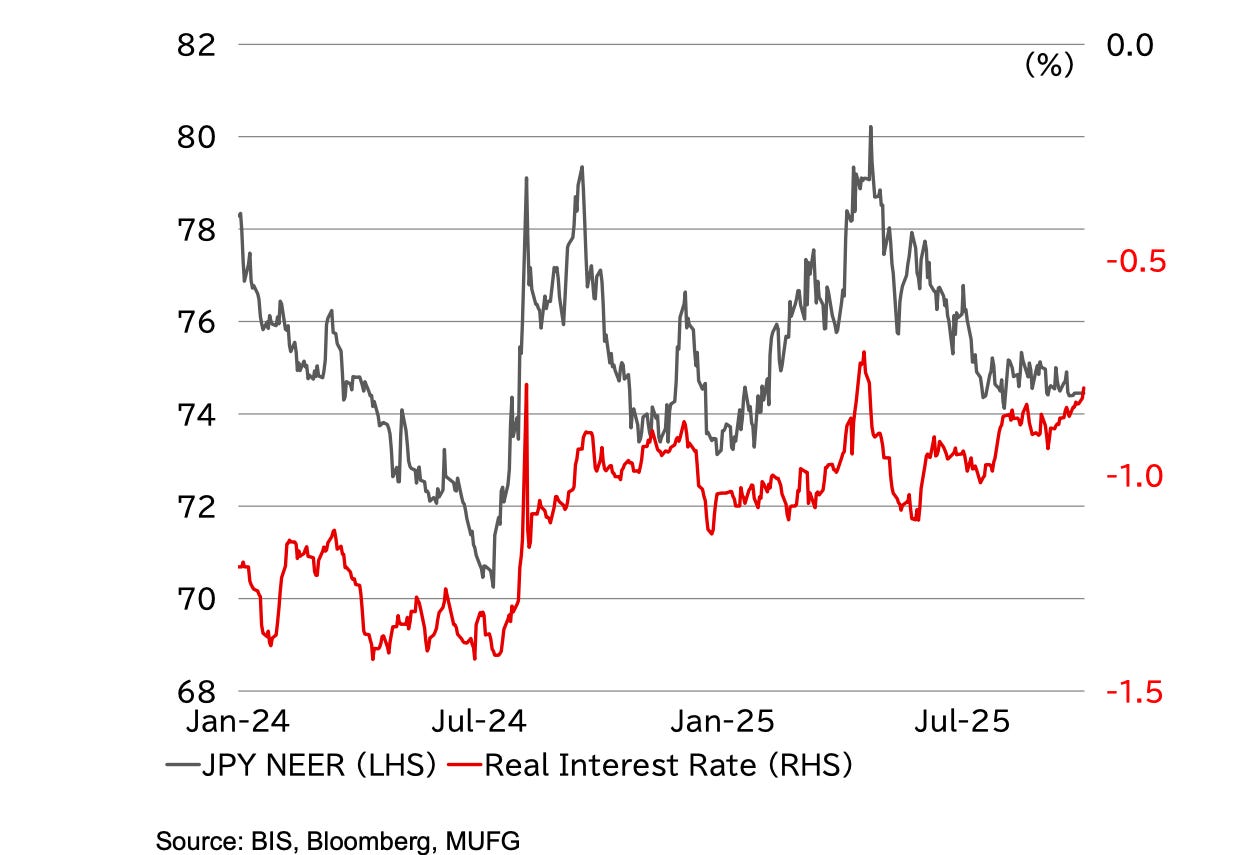

JPY: The BoJ will hike…just not this year

Over the weekend, Sanae Takaichi won the LDP leadership race, putting her in line to become Japan’s next prime minister.For the BoJ, 2025 is shaping up to be more about patience than action.

OIS pricing implies just c.21bps of tightening by the end of year. we’d gladly take the under, expecting markets to price out any odds of a hike this year.

“In our view, markets might be underpricing the implications of a Takaichi victory: her platform of a revival of Abenomics, and political pressure to keep monetary tightening at bay, creates a ceiling on yen strength as JGB yield soar higher even with a symbolic BoJ hike.”

**commentary from Markets vs Mandates: Rethinking the Easing Cycle

**IF ELECTED I WILL TURN ON ALL SWITCHES AVAILABLE, ALL AT ONCE, TO DRIVE GROWTH OF JAPAN - TAKAICHI

**GOVERNMENT BOJ NEED TO BE ALIGNED ON ECONOMIC POLICY - TAKAICHI

**JAPAN LDP PRRESIDENT TAKAICHI TO CLOSELY COMMUNICATE WITH BOJ UNTIL DEMAND-LED ECONOMIC GROWTH IS ACHIEVED

We think Takaichi’s policy approach offers the best chance to break Japan’s deflationary cycle, which is in direct contradiction with the current policy slate of the BoJ. The real story is fiscal, not monetary. The Trump-led tariff party has already led to fiscal commitment from all groups involved, and Japan is no exception. That shift is critical for escaping Japan’s deflationary trap.

A temporary pause away from inflation, with a focus on bolstering demand and driving Japan’s real rate away from negative territory.

GBP: When all else fails, the carry lives on

Sterling trading has shifted squarely into a tactical game. Softer US data is steering broader G10 FX moves, and the pound’s yield advantage remains compelling enough to keep it from sliding off a cliff , at least for now.

But that math is becoming harder to justify. Risks around the UK economy are stacking up. On Friday, the OBR submitted its latest productivity forecast a key measure of output per worker to the finance minister. That update will shape November’s Autumn budget and comes as the macro narrative turns gloomier. Early chatters are pointing to a downgrade, and any hit to productivity could erode the roughly £9 billion fiscal headroom the chancellor is working with.

we like buying sterling here aginst the yen into the novermebr budget risk event benefitting from the carry and opening a more structural postioning shorting it across MXN & AUD.

MMH