Warren Buffet's Still Buying U.S Treasuries

Reviewing the Fitch downgrade, how this affects the LCR requirement for institutions and today's NFP print.

Hey all,

Quick update.

Tuesday was great.

I held a live macro webinar for the MMHPro community.

I discussed the current macro picture, what’s currently catching my attention and where opportunity may lie ahead for us.

We even ended up opening the floor for discussion amongst those who attended.

The feedback was great considering this was the first of many, and honestly, I usually shy away from prolonged periods of speech.

The game plan is simple.

Provide the most value per word in macro, and in the process, make it simple.

As such, I will share the webinar recording with the first 100 people who reach out to me via Instagram and Twitter for free.

(P.S. You must be following so I can message back)

Oh yeah, we’re officially over 1,500 subs, thank you all, you’re the true MVP!

Back to macro. Fitch downgraded US Treasuries to AA+ from AAA, but that’s insignificant according to Buffet so let’s dive into the truth behind that and how markets digested today’s NFP print.

When The Oracle of Omaha Speaks, We Listen

If you don’t know who the ‘Oracle of Omaha’ is, it’s Warren Buffet.

Arguably one of the most sound investors of our lifetime and contrary. He’s managed to average an annual return rate of 18.6% from 1965 to 2022.

Most don’t actually understand the business Buffet is in, this isn’t the article for it but to put your questions to bed Buffet and world-renowned investor, Charlie Munger, run Berkshire Hathaway a holding company that buys equity in hundreds of companies on the premise of future value.

Buffet has reason to believe that Fitch downgrading the credit rating of U.S Treasuries is not something “people should worry about”, as Berkshire continues to buy $10 billion in T-bills each week.

Let’s first look at what this credit rating nonsense means and why Fitch downgraded U.S government credit.

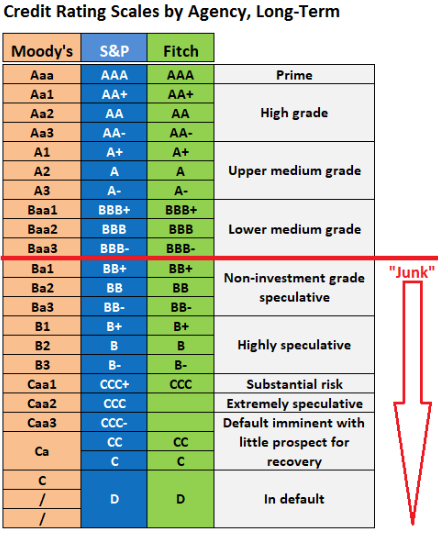

As you can see, a triple AAA credit score is the highest any government or company can have. There are only 11 countries globally with the triple AAA rating after the downgrade of the U.S government, but here’s why this rating downgrade isn’t actually significant.

Let’s take a look at the LCR requirement which was birthed from the Basel III agreements after the 2007 GFC crisis exposed flaws in the liquidity risk profile of major banks. The LCR (Liquidity Coverage Ratio) requires banks to hold a large enough stock of HQLA (High-Quality Liquid Assets) in the case of stressed bank outflows for a period of 30 days.

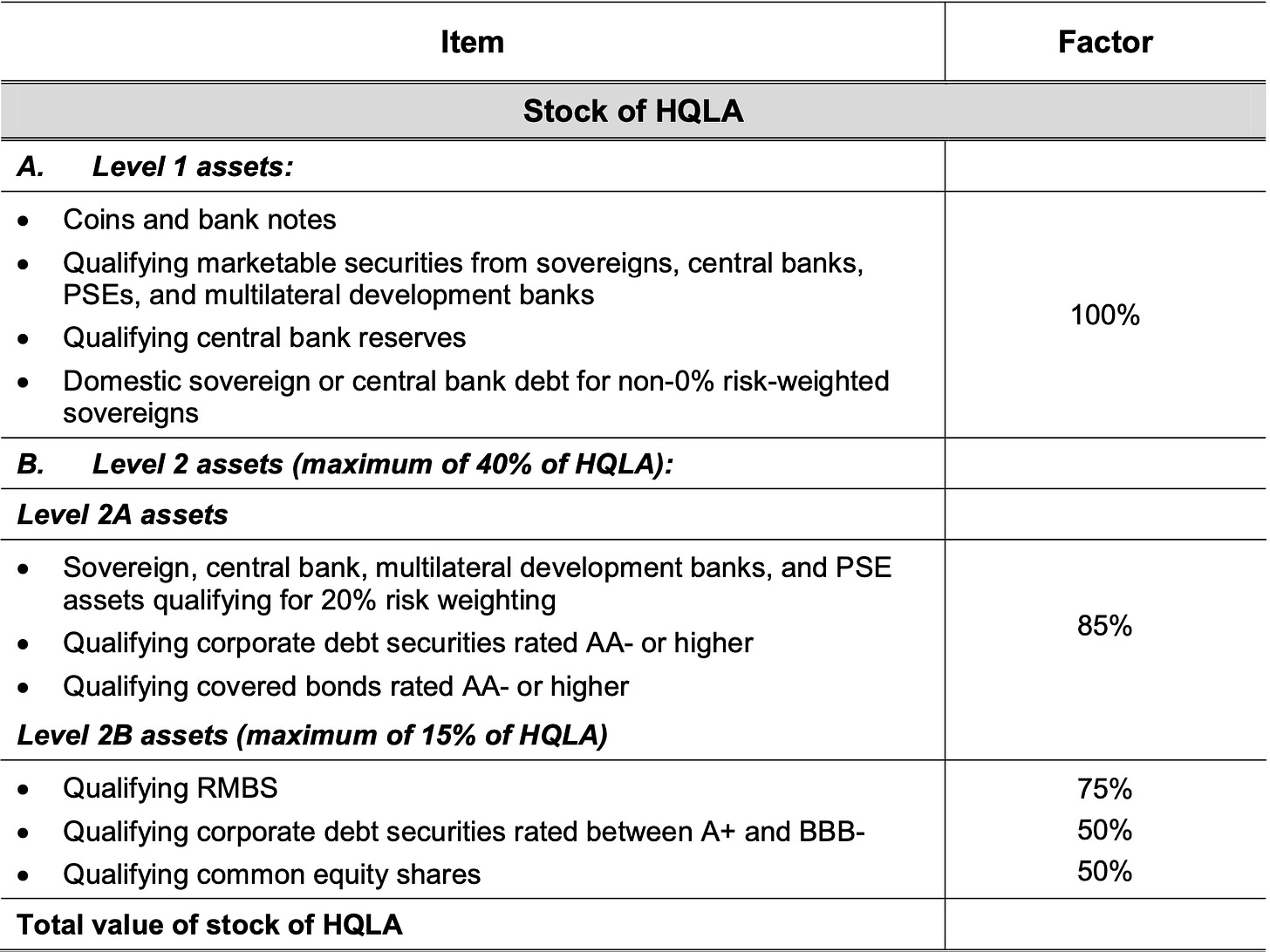

The LCR splits HQLA into three categories of assets:

Level 1

Level 2A

Level 2B liquid assets

The aim of each of these three liquidity levels is to promote the holding of highly liquid assets as supposed to assets of lower quality.

The way the LCR works is that for each tier in liquidity, we go down, the asset has lesser and less quality. So banks, pension funds, and insurance funds must adhere to this requirement. I’ll give you an example so it makes sense.

Let’s say pension fund A holds $100m in securities, let’s assume $60m of that is in U.S Treasuries, $30m is in AA rated corporate debt which is a Level 2A asset, and the final 10m is in RMBS (Residential Mortgage Backed Securities) Level 2B asset here’s what would qualify out of that towards the HQLA amount.

Since $60m is in government Treasuries 100%, as shown in the factor header, 100% of the $60m would qualify so there would not be any reduction, or haircut in the amount that qualifies. That’s simply because the quality and liquidity of government bonds are of the highest level.

Now for Level 2 assets a maximum of 40% of your assets are allowed to be allocated to these quality assets, and since Pension fund A has allocated $40m they have maxed out allocation towards this level asset. Starting with Level 2A, because there is an additional risk with the quality of assets being a corporate bond, only 85% of the value of the asset is acceptable towards the HQLA calculation, so out of the $30m in AA Corporate debt only $25.5m would count towards the HQLA calculation (30 * 0.85 = 25.5).

Lastly, we have Level 2B which is our residential mortgage-backed securities and that has a $10m allocation, however, due to the quality of the asset, only 50% would count towards HQLA calculation, meaning $5m is the acceptable figure.

So out of the $100m in assets pension fund A has, only $90.5m would be considered HQLA under the LCR.

The issue with Fitch downgrading the U.S is that the rating is still AA, meaning U.S Treasuries still qualify as level 1 assets so that has no implications on the bank, pension funds, insurance fund balance sheet or collateral requirements.

Was there any market reaction to this?

Whether you’re looking at bond market volatility (LHS) or movements on the 2Y (RHS), 10Y, or along the UST curve, markets have shown no care for Fitch’s downgrade.

Now it’s not like Fitch decided to just discredit the Treasury credit rating for no reason, their reasoning for the downgrade was this:

“the expected fiscal deterioration over the next three years, a high and growing general government debt burden”

“ lack of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

— Fitch Ratings Agency

These points here are 100% on the money. The issue remains the solution, the U.S is the world reserve currency, which means? So is their debt market, if there was any panic or frenzy, investors would still flock and buy U.S Treasuries in such a scenario, which is essentially why investors like Buffet have simply shrugged off this rating downgrade.

I hope I’ve simplified this for you.

US Non-Farm Payroll, much of the same?

Today we had non-farm data out.

In all honesty, there wasn’t much to take away from this reading aside from the face value of the data print.

U.S unemployment dropped to 3.5%, a (-0.1%) decrease from a month earlier showing once again the resilience in the U.S labour market.

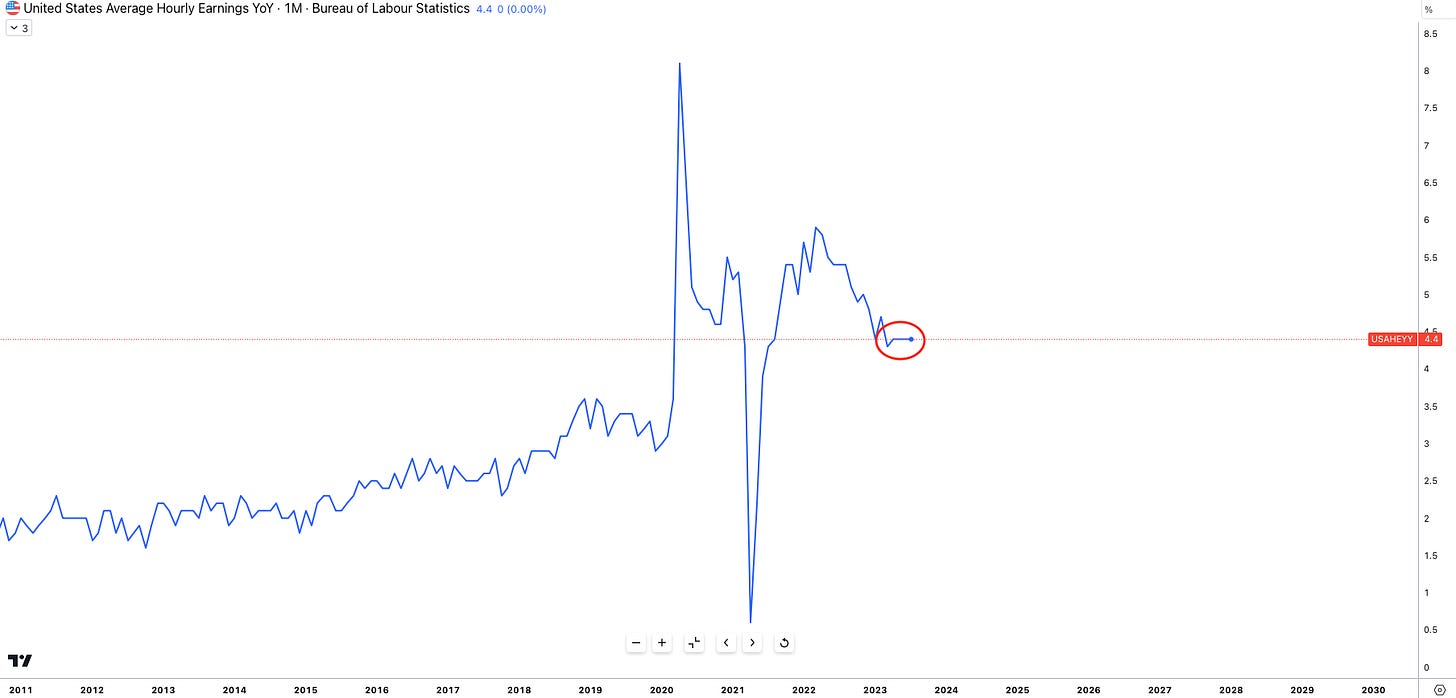

Average hourly earnings flatlined at 4.4%, whilst the total non-farm payroll came below expected at 187k vs 200k.

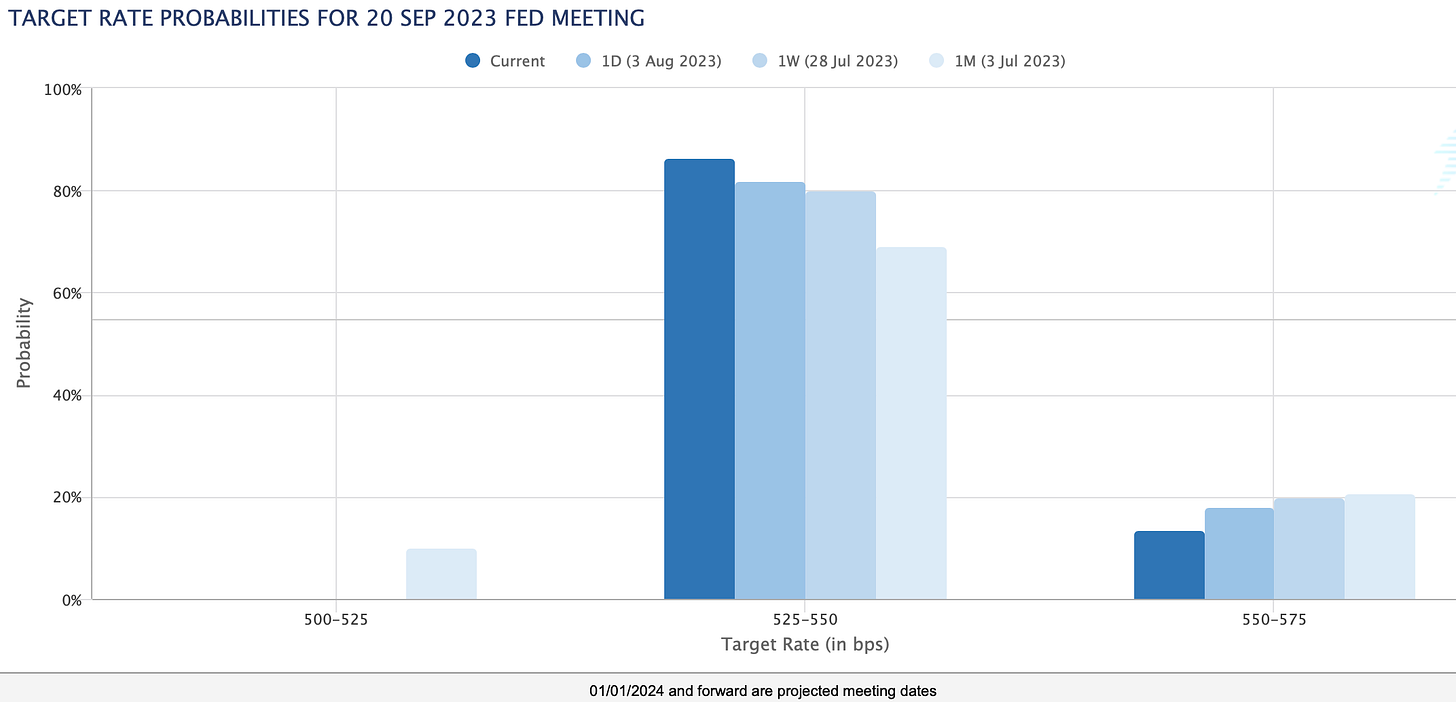

This can be taken as either positive data or mixed. For me, I’d lean towards the middle and call it a mixed print since there’s no real change in the expectations for the Fed Funds rate with the large consensus expecting a pause at the upcoming meeting with the probability now exceeding 80%.

As for now crew, that’s enough from me.

A review of the credit downgrade by Fitch and the non-farm data.

For those of you still reading this, I appreciate you.

Until next time