USD/JPY: Poised To Move Lower, Here's Why

Unpacking the Bearish Case for USD/JPY

Hey guys,

This is another report from Emmanuel, you’ll be seeing a lot more from him.

He will be digging into FX and providing some great insights.

Let’s see what the FX market had to unpack!

USD/JPY: Poised To Move Lower, Here's Why

JGB sell-off as yields across the longer end spike, at its recent peak 20s(2.60%), 30s(3.20%) & 40s(3.70%). These are moves not seen since 2008, leaving market participants contemplating the next move. In this report, we aim to contextualise the situation and offer a clear rationale in FX supporting a move lower in USD/JPY, highlighting yen appreciation in the midst of a broader weaker dollar.

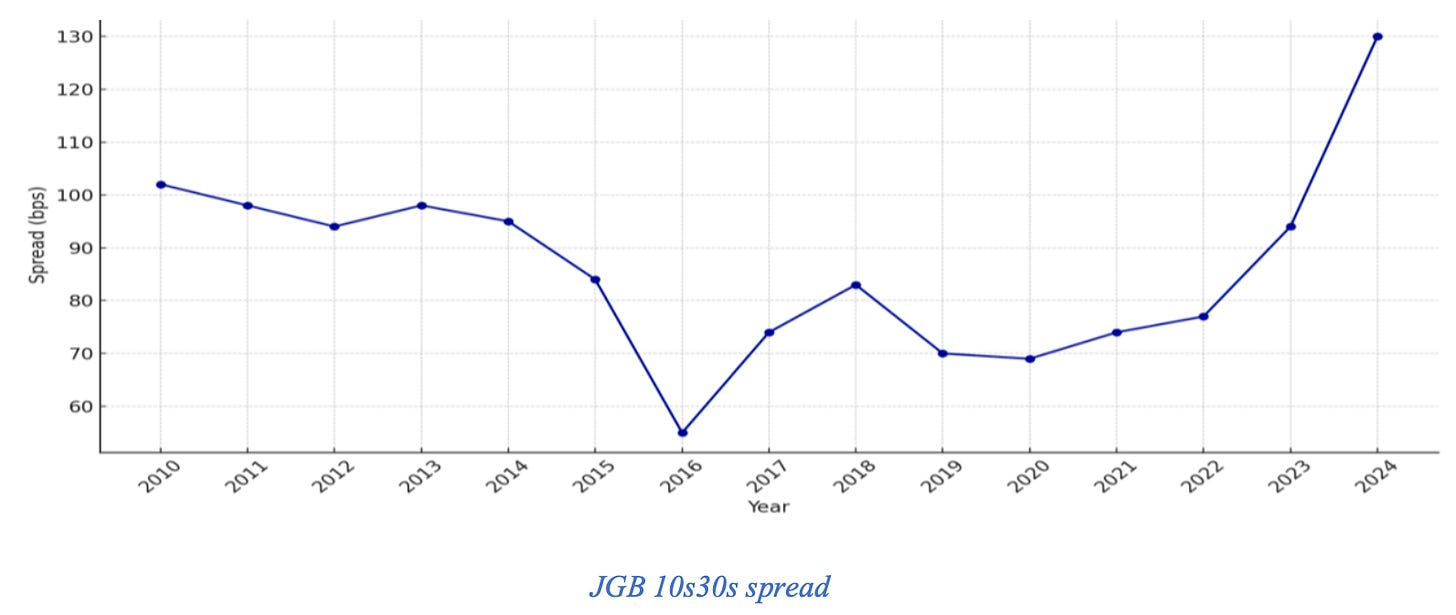

Exiting the period of ultra-low yield in the JGBs, we are now at an inflection point. Adding to this—the systematic correlation with higher yields in the UST has led to repricing of yields across developed markets, with each facing their own respective macro backdrop. The Japanese debt is the focus here, with supply and demand dynamics leading the charge to curve steepener.

Let’s unpack both legs quickly…

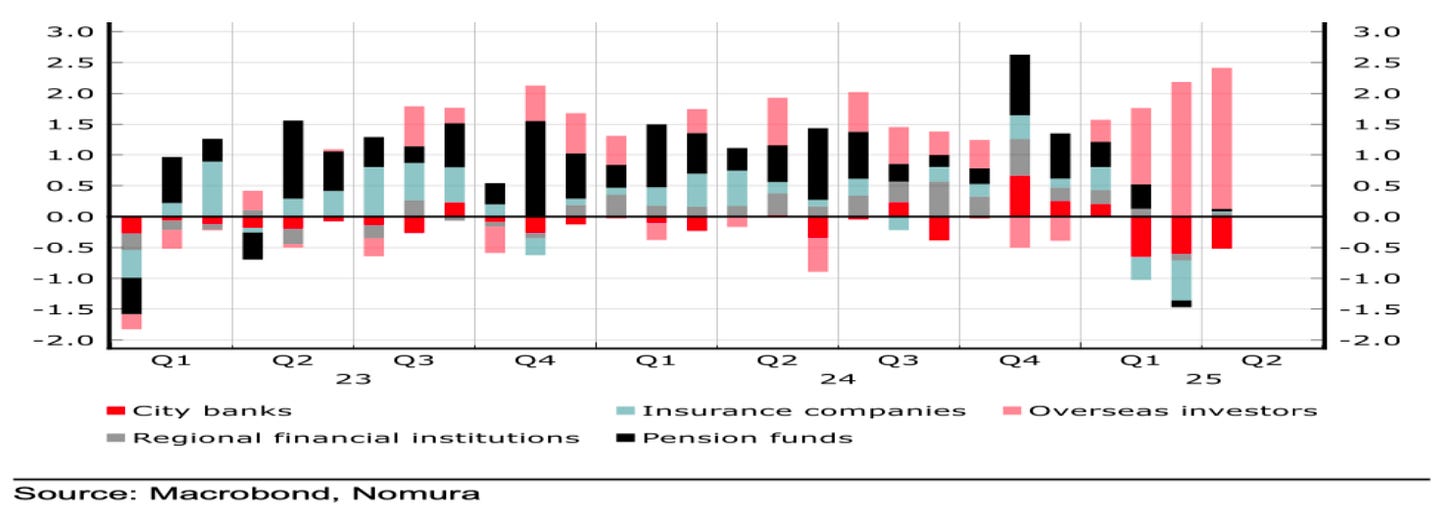

On the demand side, it’s a two-fold dilemma: less BoJ commitment & housekeeping from major whales. Quarterly reduction in size of ¥400 billion has continued in efforts to take control of the ballooning debt-to-GDP, which sits at 239%; however, as 52% of absorbers, this has added a positive supply shock. The next culprit are life insurers, as yields rise due to the nature of their business, matching duration risk in the balance sheet takes priority in compliance with the Solvency Margin Requirement, which came into effect in April this year.

Think of it this way: the super long end of the curve is where insurers conduct a larger portion of their business due to the duration of their liabilities (annuities and life insurance policies) dating 20/30 years. With yields offering that stability for decades it’s been safe, but today they're on the side-lines because the pace and volatility of the moves in yields have made asset-liability matching more uncertain. Adding the lingering tariff risk and duration risk becomes less and less appealing.

On the supply side, pretty straightforward, the super-long bond issuance did not materially decrease, hence the supply-demand mismatch, the weak (20, 30, 40) year auction attests to that. This is the makings of the classic bear steepener we see now. Here’s the caveat, though even now, increasingly in a world where active bond vigilantes become more heightened, leaving its scar in the ccy markets making reference to the classics (Truss moment) the Yen would likely have a limited impact to other markets due to large domestic presence, current account surplus & ample FX reserve.

As we advance, an important release was the minutes of the BoJ bond conference held last month, which provided insight into trying to gauge or anticipate potential policy reaction ahead of the June 16/17 monetary policy meeting. Viable alternatives examined prior were perhaps the BoJ stepping in to absorb the excess supply or alter issuance (decreasing bonds and increasing bills & notes).

The minutes caressed the former alternative laid out. Sounds familiar? Yes, Katsunobu Katō could be potentially taking a page from Yellen’s playbook. More so, there was no strong indication of Ueda-led BoJ stepping in. Rather, there was strong support in staying the course, maintaining quarterly reduction until the agreed April 2026. The scope thereafter remains largely debatable. This update has offered stability across rates.

10s & 30s down 131bps, 350bps from 1.60% 3.188% peaks.

This mixture of events has led us to conclude a higher likelihood that the journey towards policy normalisation for the BoJ continues.

Rationale

• Traditional economic indicators are supportive of more hikes in the future. Despite the latest economic outlook forecast released which downgraded growth expectation largely attributed to trade uncertainty, wages and salary payments continue to rise, up 3.6% y/y for Q1’25. In our view, the BoJ doesn’t enjoy the luxury it once had at rates near zero. Inflation at 3.7%, above the policy target, warrants commitment to the hiking path.

• Increased hedging cost could be a potential headwind here for massive domestic whales like we saw with the USD/TWD selling off c.15% in a session. Only 33% of foreign ccy exposure for insurers is hedged; a scenario where the yen continues to strengthen, hedging cost could trigger more USD/JPY selling.

• De-dollarisation trend. JGB has continued to see massive foreign inflows, supporting the broader dollar sell-off. Given US fiscal worries, alternatives and safe haven in this case, the JPY will continue to receive inflows.

• Domestic data in the US has not significantly deteriorated as suggested by past month soft surveys. Inflation appears less worrying and labour data, whilst fragile, maintains calm. However, we expect uncertainty from tariffs continues to cloud policy decisions until hard print confirms soft worries, hence we expect no cuts this year barring nodrastic deterioration in labour growth. It's also worth noting the recent pick-up in April PCE report highlighting durable goods which rose 0.478% from -0.052% (53bps).

• We are now embedded in the thrust of the dollar smile paradox, with risk with of recession continuing to get priced out, the capital flow chasing RoW growth should remain intact mirroring a neutral/bearish on USD

Tails

• Stalled US-Japan trade talks could keep the BoJ dovish, while faster-than-expected US-China progress may weigh on Japan if global risk sentiment improves making leverage on negotiations harder.

• Currently there is no FX policy signal from Kato and Bessent; if markets are priced for some premium on that in a deal, fading expectations could drive short-term JPY down.

• No doubt the short USD trade is now overcrowded and marginal surprises in US data should favour unwind of dollar shorts. Longer term move in our opinion are positioned for “sell the rally”.