US Port Disruptions, EU Trade Tariffs, and the UK's Economic Differences

Examining the Significance of the UK's Structural Differences in Comparison to Other G4 Economies

Hey guys,

I hope you have all had a great start to Q4, it’s the last lap of the year, it’s now time to crush anything you have fallen behind on.

Q4 is going to be action packed for markets, especially with the US elections approaching.

As I always say, with volatility comes opportunity.

I’ve been so busy with things non-MMH related but there’s always great joy in writing these reports.

Let’s get into it!

Macro watch

This may have slipped over some heads this week, but truly this could really cause disruption in the US, maybe even globally. On Tuesday, US dockworkers began a strike, which didn’t have a specific time-span and was in relation to port workers’ wages. This strike halted around half of US ocean shipping until Thursday.

On Thursday, the US dock workers and US port operators came to a tentative deal to end the 3 day strike that shut down shipping on the East coat & Gulf coast, key word here… tentative, nothing set in stone. The agreement would mean that there will be wages hikes of c.62% across 6 years, taking the hourly earning for a dockworker to c.$63 from c.$39.

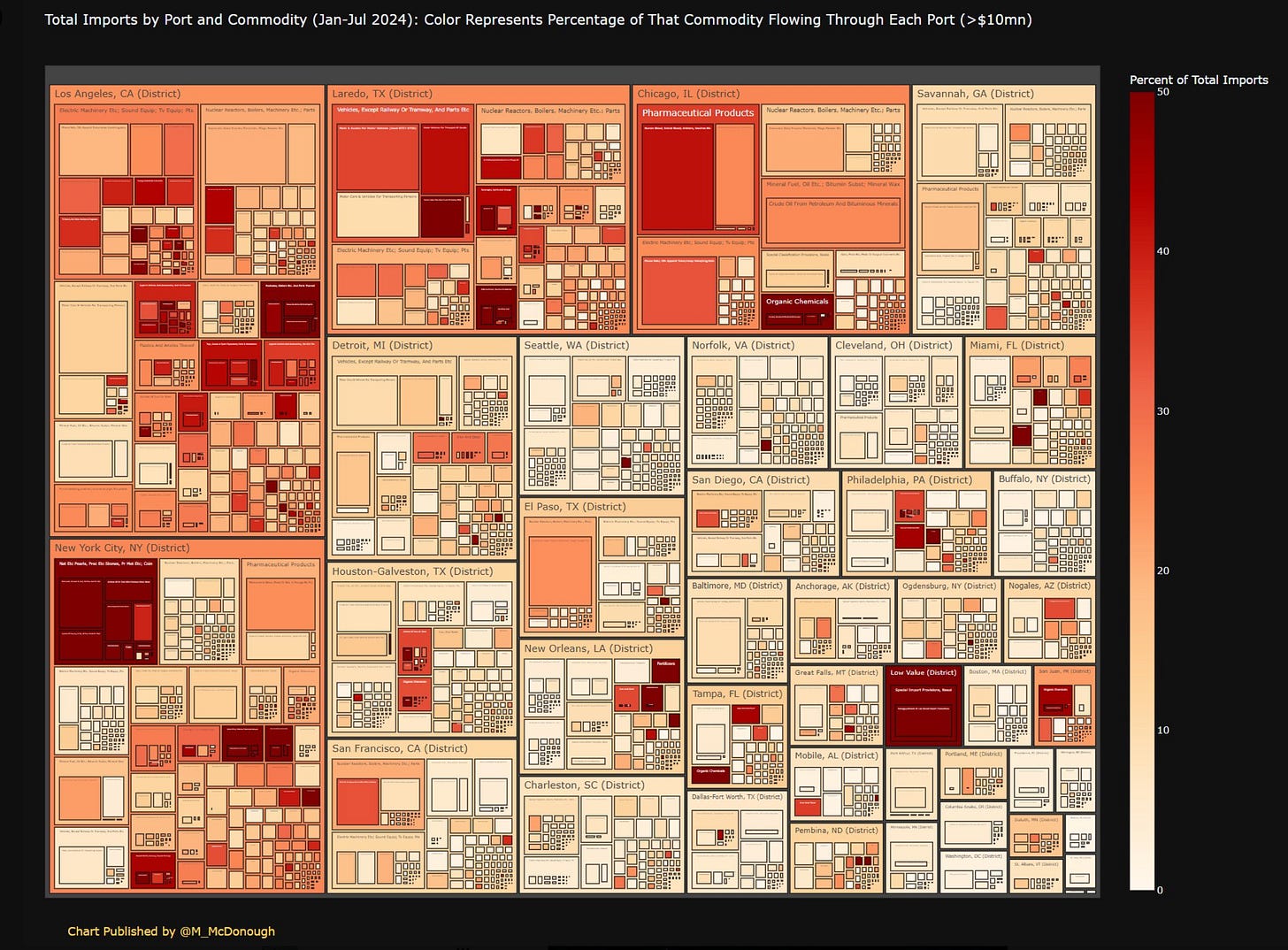

Below is a chart representing the commodities imported from every US port.

The tailwind of these strikes are supply chain disruptions, which will in effect cause some risk to inflation, even if it’s temporary. Although these strikes can come to an end (for now), if the deal isn’t made official, the strikes could begin again and cause further risk to supply chain disruptions. Now, these supply chain disruptions won’t be anything like the COVID-19 example, however, there will be enough disruption to cause temporary changes to importing and exporting prices if the strikes do continue, which is not what the Fed want.

Also, with such an extreme wage hike (c.62%), it makes me question which other sector inside the US may feel as though they need a wage increase. The real question is, how contagious are wage strikes? In the UK for example, the wage strikes began in the NHS but led all the way into TFL and school teachers, there was (and still partially is) large contagion in the strikes.

Market Mover

EUR/USD has seen a c.1.67% loss this week as dollar dominance has prevailed. Although a 50bp cut from the Fed is largely embedded for either November or December, bets are pushing the likeness of the larger cut back to December, which has provided the dollar with temporary strength.

Also, sentiment shifted away from the Japanese Yen as the BoJ board member Asahi Noguchi said there is a “need for monetary policy to remain loose”, supported by the new Prime Minister Shigeru Ishiba who believes the BoJ are “not ready for another rate hike” and wants to focus more on inflation. A weaker sentiment in the Yen has provided some inflows, potentially temporary, to the US dollar which is part of the reason for the move down this week.

To add to the Euro’s weakness, Germany’s new growth forecast has been revised down to 0.1% from 0.3% as economists expect stagnation. The lack of confidence across the country in Germany is apparent, with accounts savings at their all-time high, even though the purchasing power of the Euro has declined significantly in the last decade. The ECB’s hawk Schnabel also stated this week that “the ECB can’t ignore headwinds to growth”, emphasising the need for a rate cut.

The European Union have also voted to impose tariffs on Chinese EV’s of up to 45%, very similar to the Trump tariff proposal but not as extreme. These tariffs are set to begin next month and last for 5 years, the effect will cost carmakers billions of extra dollars to bring cars into the bloc.

UK’s economic structural differences VS G4 currencies

Global trade differences

There are large global trade differences between the G4 currencies, in regards to their trade relations, importing countries and exporting countries. Since Brexit was officially imposed on January 31st 2020, the UK has faced large trade barriers with its largest trading partner (the European Union), which accounts for c.42-45% of the Uk’s total trade (imports and exports).

As the UK is a net-importer, they are susceptible to external shocks like supply chain disruptions, tariffs and geopolitical conflict. Now, when we compare the trade differences with a country like the US, there are large differences. Although US are similar to the UK in regards to being a net-importer, they are less trade-dependant as their domestic market does support growth. When it comes to global energy shocks, the US is less vulnerable as they have a fairly self-sufficient energy production market.

Japan is also a net-importer, running a deficit of c.$4.3bn. However, Japan is highly integrated with Asian markets, especially China and Southeast Asia. They are heavily reliant on imports of energy (c.88% coming from abroad), so are largely affected when there is volatility in the energy markets. c.95% of their raw materials imports come from abroad and that causes even more risk than their energy exposure.

The UK’s service-oriented economy is really the large contrast against the other G4 currencies. c.80% of the UK’s GDP came from the services sector in 2023, particularly financial services as London is a well established financial hub. In comparison, the Eurozone and Japan rely on industrial and manufacturing exports, which allows us to focus on different parts of the economy when analysing potential trades. This also helps us understand why the UK has struggled to bring down services inflation, which still remains sticky and a slight area of concern for the BoE.

Brexit has significantly reshaped the UK's trade relationships. The country no longer has the same seamless access to the EU (its largest trading partner before Brexit), leading to new customs barriers and tariffs, particularly in goods trade. The shift has forced the UK to renegotiate trade deals independently, while other G4 members are part of larger trade blocs (like the EU or various multilateral agreements).

There are also sectors that the UK fall behind on in comparison to the likes of the US, Japan and Europe. Innovation sectors such as tech in the US and industrial technology in Germany and Japan have been pivotal for growth, while the UK, though strong in fintech, hasn’t kept pace with those countries in high-tech manufacturing and digital innovation.

UK’s tech investment - c.$35 billion (3.5% of GDP)

US’ tech investment - c.$300 billion (1.1% of GDP)

European Union’s tech investment - c.$120 billion (0.7% of GDP)

Japan’s tech investment - c.$45 billion (0.7% of GDP)

Another large part of the UK’s economic structure is their housing market. The UK's housing market plays a more pronounced role in its economy compared to the other G4 countries. High house prices, especially in London, have contributed to inequality and regional imbalances. This is less of a factor in the US, Germany, and Japan, where housing policies and market dynamics are different. The large divide in the housing market creates a fiscal issues inside the UK, beginning from the cost of living crisis and ending with an increased wealth divide. This feature of the housing market, as a differ from the other G4 currencies, means that investments inside the UK can be tail-winded by their housing market and fiscal issues can arise, leading to different patterns in government expenditure, a problem that Europe, Japan and the US are less likely to face.

In terms of growth, although the UK isn’t diversified into newer sectors like tech, in comparison to other G4 counterparts, they do have a very flexible regulatory framework. The UK tends to emphasize market-driven policies and has seen efforts to review and relax EU regulations since Brexit, the regulations i’m referring to just means there are less restrictions on firing and hiring which brings a more elastic labor market. However, this doesnt mean the UK is a weakly regulated economy, it’s home to one of the largest regulatory bodies, the Financial Conduct Authority (FCA). This in turn allows the UK to have strong anti-money laundering and financial crime laws that are among the strictest globally, while allowing for looser regulations in areas that spark growth like the labor market (the UK are known for having one of the most flexible labor markets).

So we’ve gathered that the main structural differences are that the UK is heavily reliant on services, has a divided housing market, doesn’t allocate much capital to tech and has regulations in favour of economic growth.

But why is this important when it comes to capital allocation?

Let me break down how we can now analyse the UK for investments:

Heavily reliant on services - Given the dominant role of services, we can focus on key service-related indicators such as consumer spending, business services, financial activity, and retail sales. For example, tracking the performance of financial services, tourism, education, healthcare, and IT services provides a clearer picture of where growth is occurring or stagnating.

Divided housing market - Monitoring house prices can have direct impact on areas like consumer spending, if these prices are trending with momentum, there could be reason to believe the government may have to intervene to reduce the wealth gap and introduce affordable homes, eating into the UK’s fiscal budget.

Low tech investment - Shows the potential challenges in areas like productivity growth, global competitiveness, and innovation.

Flexible regulations - The regulatory landscape allows us to predict investment flows into various sectors, particularly in industries such as tech, finance, and renewable energy, where the UK has established supportive regulatory frameworks for economic growth.

Trade update

I’m sorry, it’s just tough to keep this one out again…

Hang Seng Index is up c.36.8% since we sent the entry point, the large move was driven by the Chinese stimulus (spoken about in last week’s report).

See you again next Sunday for another report!

As always a very detailed & insightful report, thank you Alfie.