US Macro Compass: Deep Analysis, Step by Step

America’s Dovish Gamble: A Deep Macro Dive

Hey MMH readers,

The big picture always matters more than the day-to-day noise.

Macro is about connecting the dots before the crowd sees the pattern.

This report is a long one, much needed.

Let’s begin.

Central bank tracker

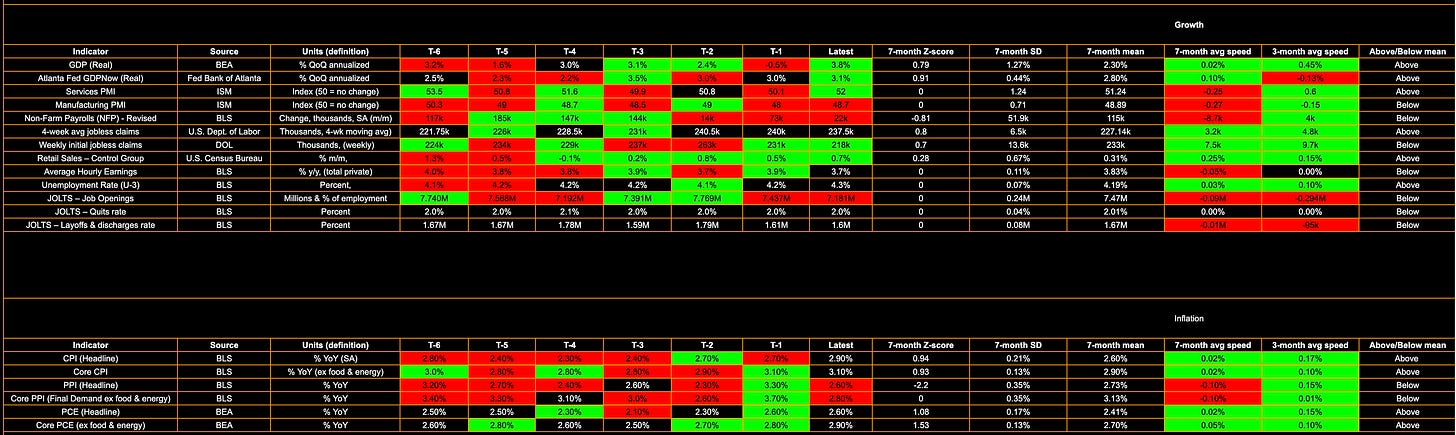

US data tracker

Deep analysis: Step by step

First things first, the speed and direction of policy still set the tone for everything else. The September cut didn’t just lower the rate to 4.25%, it reset the probability distribution the market uses to price the future. Roughly 43bp of additional easing is now pencilled in for year-end and the Fed’s dots still only whisper two more 25s in 2025, yet the curve carries something closer to 150bp by the end of 2026 with a brief flirt at a 3% terminal before hikes creep back in. That gap between what the Fed is trying to say and what the market insists on hearing is the oxygen for this tape. It’s why the front end wants to rally, why the curve wants to steepen, and why the equity complex keeps rewarding risk even as the inflation problem refuses to behave. I’m confident that Z6 needs to trade lower and price in less cuts as inflation materialises even stronger.

What made this meeting decisive wasn’t the 25bp itself, it was the posture. Powell called it risk management & Miran broke ranks and argued for 50bp, the statement leaned into labor softness while downgrading the persistence of tariff related inflation. You can call it an insurance cut if you like, but markets price distributions, not adjectives. And cutting into a backdrop where growth and inflation are both running positive speeds is not the same as cutting into a stall. It’s a conscious lowering of the “shock” threshold. A small disappointment in growth now reads as validation, not crisis, while a small upside surprise in inflation now matters more, not less. The Fed blinked into strength, and the market immediately began to explore the edges of that decision.

If you’re looking for a historical rhyme, 2003-04 remains the better analogue than 2019. Back then, reflation arrived with an easing bias, the dollar softened, gold ripped, small caps and cyclicals outperformed, and the curve steepened until credibility demanded a flattening into hikes. 2019 was a mid-cycle adjustment where equities rallied, credit never blinked, the curve tried to steepen and then re-flattened, but the dollar never delivered the kind of weakness we’re living through now, and the inflation hedge impulse was far smaller. Today’s constellation, weak USD, record gold, firming inflation expectations, tight credit, small-cap catch up, looks like 2003–04 with a thicker layer of inflation hedging poured over the top. If the USD weakening persists at the speed it has, foreign holders of US equities will be forced to sell as their returns neutralise around 0%.

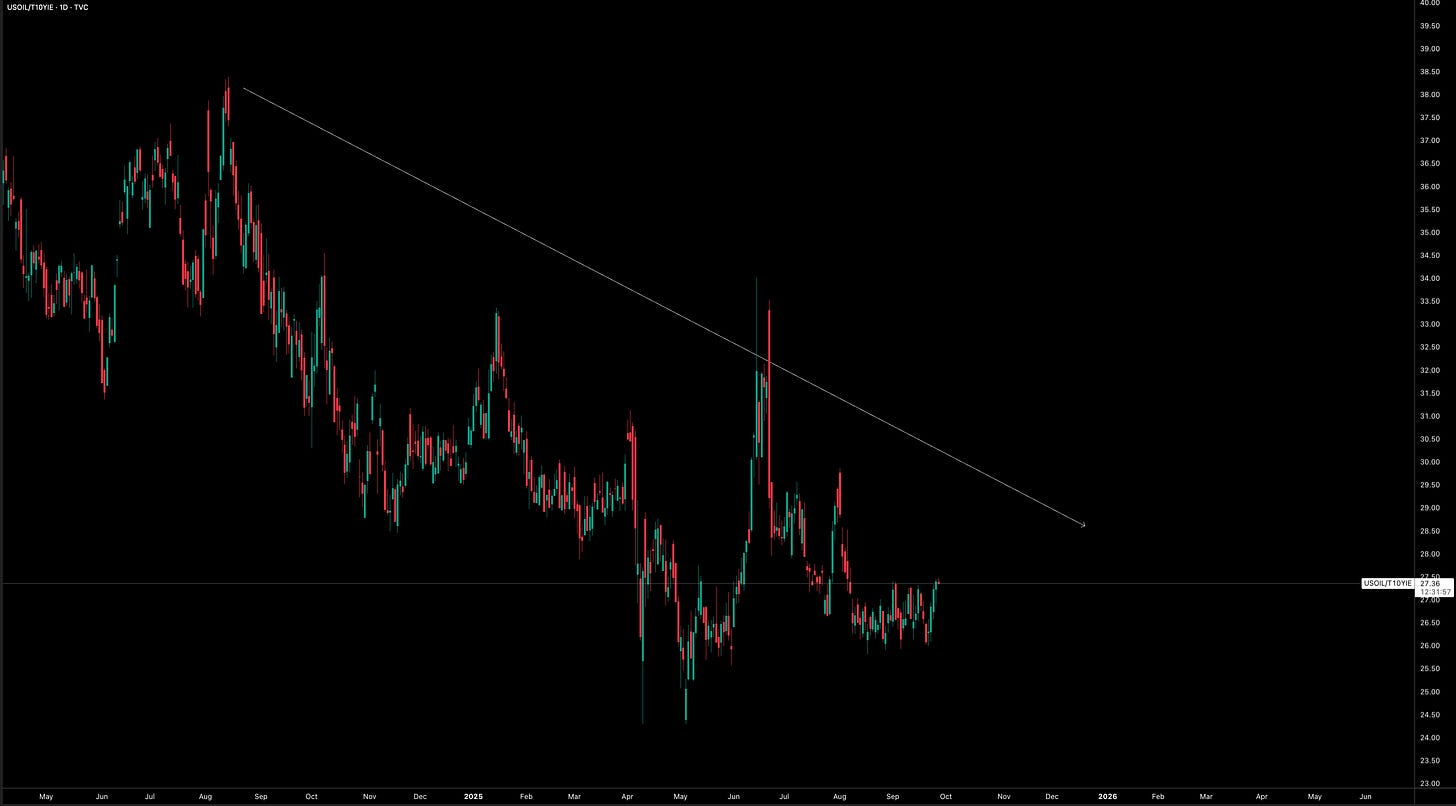

That inflation layer is the tell. 1Y inflation swaps near 3.3%, 2Y at 2.9% and 5Y at 2.7% isn’t a panic, it’s a stubborn refusal to glide back to 2%. Breakevens are beating oil, which is the market’s way of saying “this isn’t just barrels; it’s the regime.” TIPS have clawed back to 2022 levels, WIP has outpaced them most of the year, and the gold to TIPS ratio has surged since late August. Gold itself is at/near records and up north of 40% YTD, silver has been outperforming since the spring, and the trade is bigger than a commodity story, it’s a portfolio story. With policy easing and the dollar still 9-10% lower YTD, investors are buying insurance against the possibility that inflation sticks above target even as nominal growth stays decent. That’s the central contradiction the Fed has created: easing into reflation encourages precisely the hedges that make later inflation credibility more fragile. When energy isn’t the source of inflation, it becomes harder to control. Persistent outperformance of breakevens vs oil has been in play across 2025

And yet, if you’re looking for recession, you won’t find it in the places that matter. Growth momentum is positive on 3 and 6-month speeds, the surprise index is only mildly negative (-0.1), hardly a macro cardiac event. Funding spreads are essentially zero. IG and HY remain pinned near their 2024 tights which means nothing systemic is leaking through credit. If the recession door were ajar, you’d see it first in credit, then in funding, then in equities rotating defensively. Instead, you’re getting the opposite: cyclicals, small caps, and high beta factor leadership, with weighted indices outperforming since April and staying on top even post FOMC. Breadth in the S&P is decent, 56% above 50-DMA while implied correlations are low (15), and dips continue to be absorbed, helped by positioning: COT still shows net shorts in S&P futures (although I don’t pay too much attention here). This is not a contraction, it’s reflation with policy cushioning the downside.

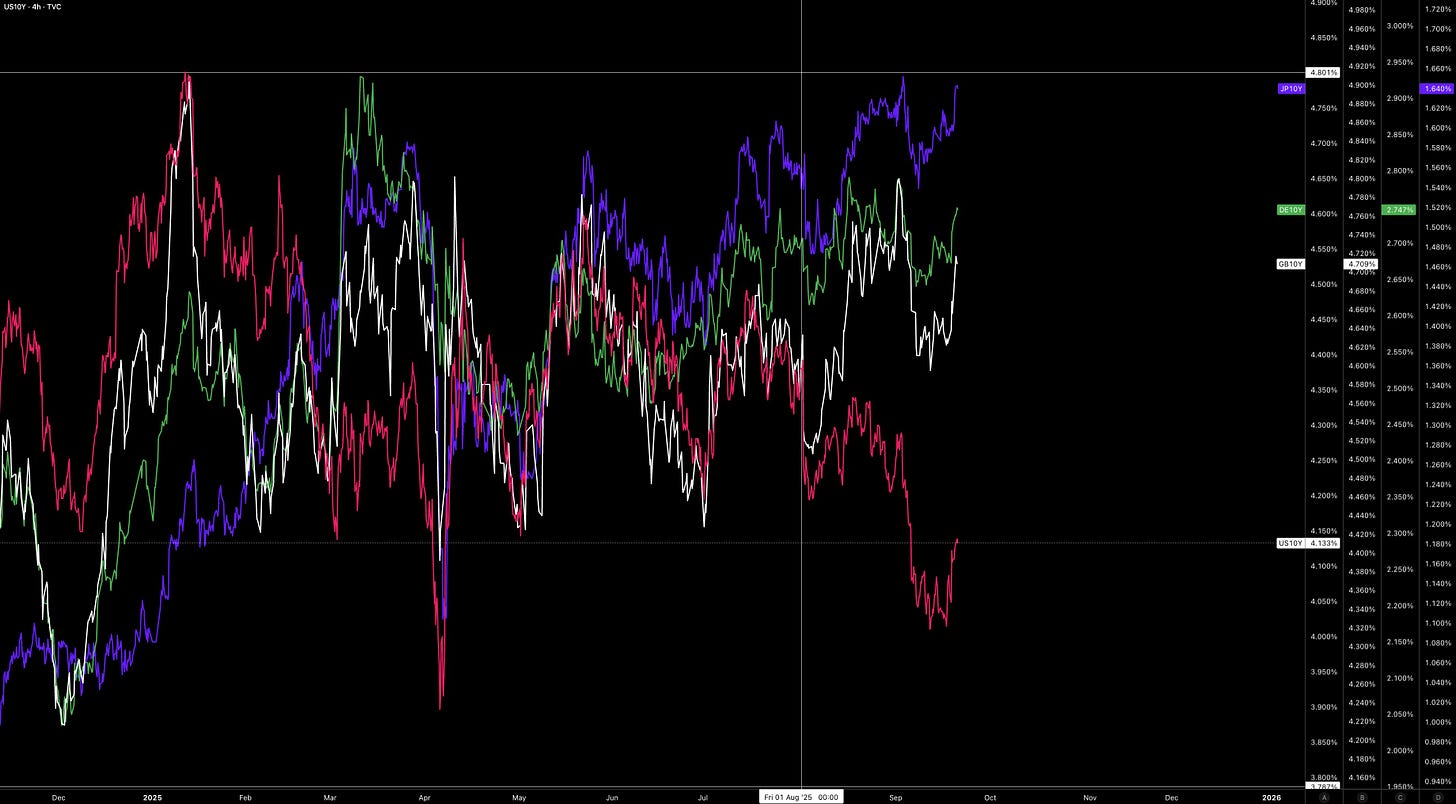

Volatility markets narrate the same story in a different language. VIX around 16, VVIX 96, the VVIX/VIX ratio grinding higher since April, VIX3M-VIX near 2.3, none of this screams stress. MOVE sits in the low/mid-70s, nearer to January 2022 than to 2023’s spikes, rates vol is contained relative to its own peaks. Implied > realized, front-end term richer than 3-month, investors are systematically “buy-the-dip via options” renting shallow protection with put spreads while leaving tails relatively expensive. That is exactly how late cycle calm looks when policy is easing and growth isn’t rolling, vol is suppressed, the surface front loads, and the real risk migrates forward in time toward a later repricing in real yields. When we do get that blow up higher in yields, this will cause major unwinding in equities as the long-end finally applies the pressure. I wouldn’t be surprised to see the 10Y back at 4.5%+ in 2026.

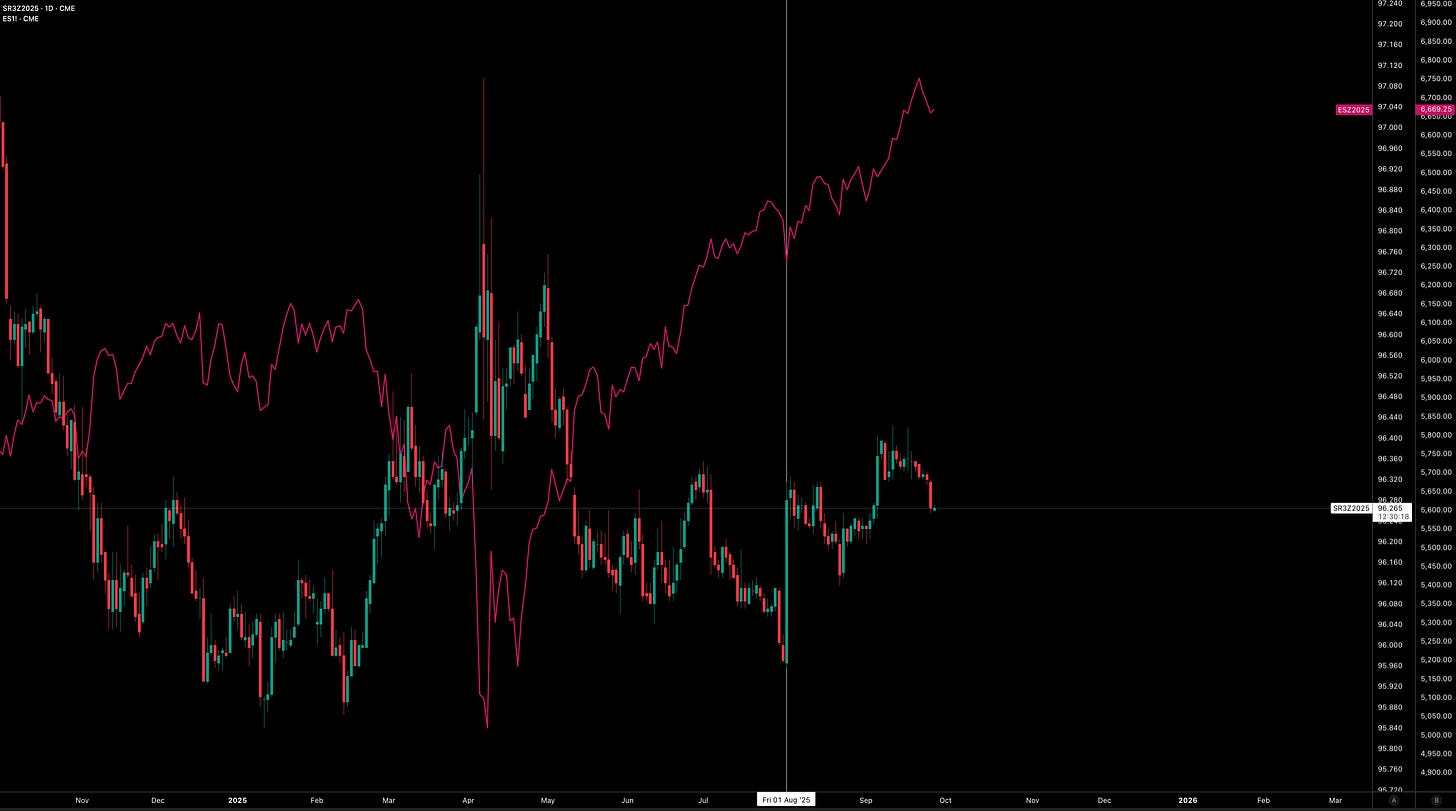

On that score, real yields deserve the spotlight. The 5Y real sits around 1.25% and the 10Y real around 1.75%. They have declined for the majority of the time the Fed has been on hold, and the September cut only helps that drift. As long as reals don’t lurch higher, equity duration is fine, in fact, the S&P has been displaying a bullish sensitivity to rates. The more the front-end prices cuts, the more ES tracks higher (as expected). You can see it in the positive correlation between ES and SR3Z2025, when the strip cheapens cuts, equities wobble, when the strip re-adds cuts, equities levitate. That’s what “easing into strength” feels like in price: the front-end leads, the belly chops, the long end waits for a credibility test.

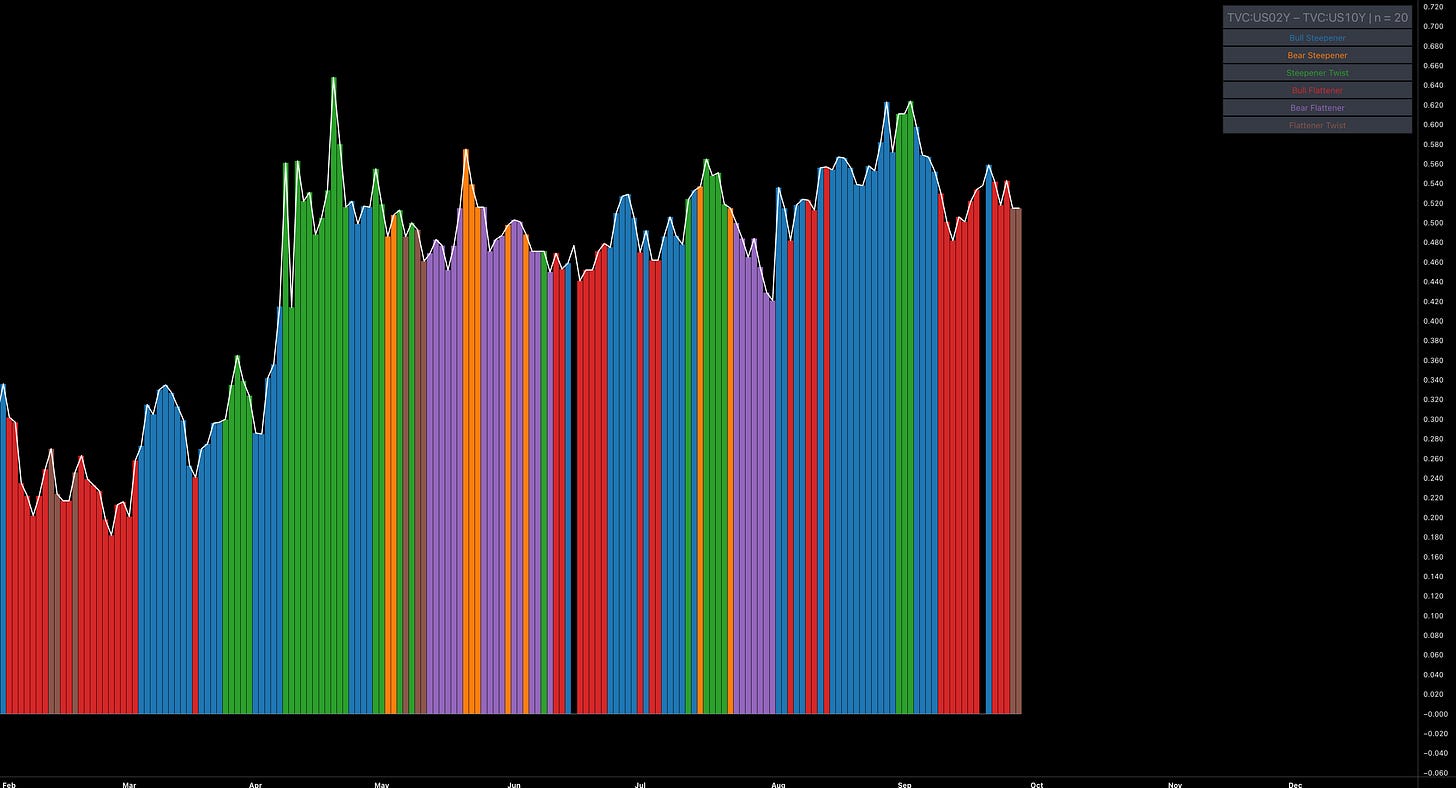

Curves are the messy intermediary translating that story. Since early August, 2s10s and 2s30s have toggled between bull-steepening and bull-flattening with brief steepener twists, 5s30s has been more consistent, bull-flattening since mid-September after a summer steepening burst. The 1s2s5s triangle steepened heavily from August as the front-end dynamics are doing the heavy lifting. None of this noise changes the structural preference, in a dovish-reflation regime, the clean expression remains a 2s10s steepener (as I gave out last week in the Substack chat). The front-end is dragged lower by policy and optics, the long end is tethered by issuance, sticky inflation expectations, and the growing, not shrinking, risk that 2026 cannot live at a 3% terminal if inflation sits north of 2.5–3%. The steepener breaks only if the Fed abruptly re-asserts inflation credibility (crushing cuts back toward 25bp into December), inflation speeds roll decisively, and 2s10s pushes through its FOMC low on a weekly close. That is not the tape we have. The RR given out was as followed below, the trade still remains ITM.

Equities have been honest about it. The Russell has been beating the Dow since April, tech continues to outrun SPX and SPHB remains on top of SPLV. Weighted indices have outperformed since April and again through the FOMC window. The S&P’s trailing PE near 30.8 and forward 24.6 are lofty, but regimes sustain multiples more than multiples sustain regimes. With growth +, inflation +, policy easing, high valuations are a feature, not a bug. If there were a brewing earnings collapse, you would see defensives bid over cyclicals; instead discretionary and industrials have been among the “massive performers” with financials in the mix, a sector pattern wholly inconsistent with imminent contraction. A brief note on leadership rotation: BTC outperformed gold from April to August, then gold took the baton, BTC has outperformed ES through September, but the Russell has outpaced BTC since early August. Micro-rotations that still sit inside the same macro envelope where liquidity is ample, inflation hedges are prized, and beta is rewarded.

The rates-equity connection has been unusually clean. Since April the 10Y hasn’t exerted much drag on equities but that changed slightly around the FOMC last week where a brief rise in the 10Y began to bite. Still, SPX/US10Y remains below the FOMC high, equities have not fully “given in” to duration. Globally, 10Y yields have been rising since August even as the US 10Y ranges, a reminder that policy divergence isn’t linear. The US eased first, Europe is cautious, Japan is normalising at a glacial pace. Bunds have outperformed Treasuries since June, the periphery is calm. French-German and Italian-German spreads sit at low, normal levels, no sovereign stress impulse to transmit back into risk. In Germany, the DE10Y has applied only a small drag to the DAX since June, in the UK, gilts haven’t weighed on the FTSE since April. That cross-market serenity is why the VIX/MOVE ratio is rangebound, neither leg of the rates-equity correlation is screaming “break.” Global yields rising while US yields drop (because Fed is artificially suppressing the cost of capital) will only last so long before they all blow higher.

Credit has been even more emphatic. HY and IG spreads are at/near 2024 lows, the level 52bp on tighter measures tells you more about carry than catastrophe. Duration risk has been greater than credit risk since January; growth risk has been lower than credit risk since April. HYG/US10Y remains below its FOMC high, HYG/RTY below the CPI high. Translations of the same refrain, equities are more sensitive to the path of rates than to the state of credit. When credit is this quiet and funding spreads are flat, equity dips find sponsors. Your first real macro canary remains simple: HY +25–40bp in a week, or IG +15–20bp. Until then, “no recession on the table” is the correct base case.

FX and EM round out the picture. The dollar is down 9.5% YTD, tactically firmer into event risk as the market occasionally questions the speed of cuts, but structurally weak while the Fed leans dovish into reflation. That combination is the sweet spot for EUR and commodity linked FX on dips, while JPY still needs a nudge lower in US reals (and a BoJ nod) to reassert itself meaningfully. EM equities outperformed the S&P from the start of the year but have ranged since April; the US500/EM ratio remains below its NFP high, again signalling a market unwilling to abandon cyclical beta even as the US keeps its growth premium. The EM basket has outpaced DXY since January, and developed markets have beaten frontier since April (URTH/FM above the FOMC low), a cross-section consistent with a world rotating around US policy, not collapsing because of it.

Commodities, as ever, are the prism for the inflation thesis. Breakevens outperform oil, the OIL/BEs ratio sits near 2021 lows which is evidence that inflation is being priced as a macro regime rather than an energy accident. Gold/TIPS has been ripping since late August, that’s the market choosing “inflation hedge” over “pure real rate hedge.” The kicker is that the moment 5 & 10Y reals stage a sustained, data-driven rise, that gold/TIPS outperformance will wobble. Until then, the glidepath stays supportive. In SOFR, Z5–Z6 has risen since late August while Z6–Z7 is little moved, two curves telling you the market is comfortable front-loading the easing but reluctant to underwrite a persistently low terminal deep into the out-years. That reluctance is the seed of 2026’s repricing risk.

And that is the heart of it, 2026 won’t tolerate a 3% terminal if inflation refuses to die on schedule. The market has pencilled a fairy-tale, cuts through 2025, terminal around 3%, less than a year parked there, then gentle hikes. But the swap curve is whispering a different ending: inflation above target for longer, a Fed that has to choose between growth optics and price-stability optics, and a long end that cannot permanently clear at today’s reals if the policy anchor keeps sliding. If inflation runs 2.7–3.0% into 2026, the term premium won’t stay asleep, you’ll get a credibility impulse that bears a family resemblance to 2013—not a carbon copy, but a rhyme: reals up, curves buckle, gold checks lower with duration, and equity leadership rotates toward quality with a valuation compression that doesn’t require an earnings collapse. That is not today’s trade but instead, it is today’s risk.

Between here and there, the tape remains what it says on the screen: dovish-reflation. The dollar is weak on trend; gold is strong; tech and cyclicals share the baton; small caps keep repairing the damage; weighted baskets are in charge; dispersion is healthy; implied correlation is low; vol is suppressed; funding is benign; credit is tight. Even the awkward corners agree: the S&P has outperformed oil for months (especially since April), Russell has outpaced Bitcoin since early August even as Bitcoin has beaten ES through September, and TIPS have been bid while WIP outperformed for most of the year. Those are not the tells of a market hiding from growth—they’re the tells of a market riding liquidity, hedging inflation, and daring the Fed to prove it still owns the long end.

The curves will likely keep flickering. Bull-steepening on data bumps, bull-flattening on supply and optics but the centre of gravity hasn’t moved. As more front-end cuts are priced, the S&P’s positive sensitivity to SR3Z2025 reasserts; when the strip pauses, equities breathe; when it adds, they run. The 2s10s steepener remains the cleanest macro expression because it sits exactly where the contradiction lives, policy easing at the front with inflation expectations and issuance at the back. The trade is “still on” not because it always wins, but because the regime that would kill it, a hawkish Fed reclaiming credibility while inflation speeds fade and long-end reals slide, hasn’t arrived. We are, instead, in a market that buys dips with options, funds gold with duration shorts on rallies, sells the dollar on rips, and keeps a wary eye on 2026. An update on the 2s10s steepening/flattening (incl a lookback period):

Call it what you like, insurance cuts, recalibration but the effect is the same which is that the Fed has lowered the bar for volatility later by suppressing it now. Recession is not the story but inflation credibility is. The next act isn’t a growth scare; it’s a terminal-rate argument. And unless the data break the other way, that argument will be settled not in dots or pressers, but in the slope of the curve and the level of reals. For now, the tape keeps rewarding the reflation consensus: G+, I+, P-easing. When the repricing comes, it will come through 2026. Until then, the market will do what it always does when policy leans dovish into strength, lean into it.

Have a great weekend!