US-China: Signed, Sealed… Uncertain?

The Aftermath of The Temporary US-China Deal: Sealed Deals, Open Questions

Hey MMH readers,

I thought that the end of April/start of May would be the beginning of some certainty, it’s fair to say that assumption was very wrong.

It’s easy to get caught up on the “ifs, buts and maybes” - Instead, focus on the data we really have.

I’ve seen a lot of people fearful that they won’t catch the top/bottom in markets during this crash but that’s not the aim of the game.

Staying in the game, finding the edge and producing alpha is the goal.

Anyway, let’s unpack markets this week!

Macro watch

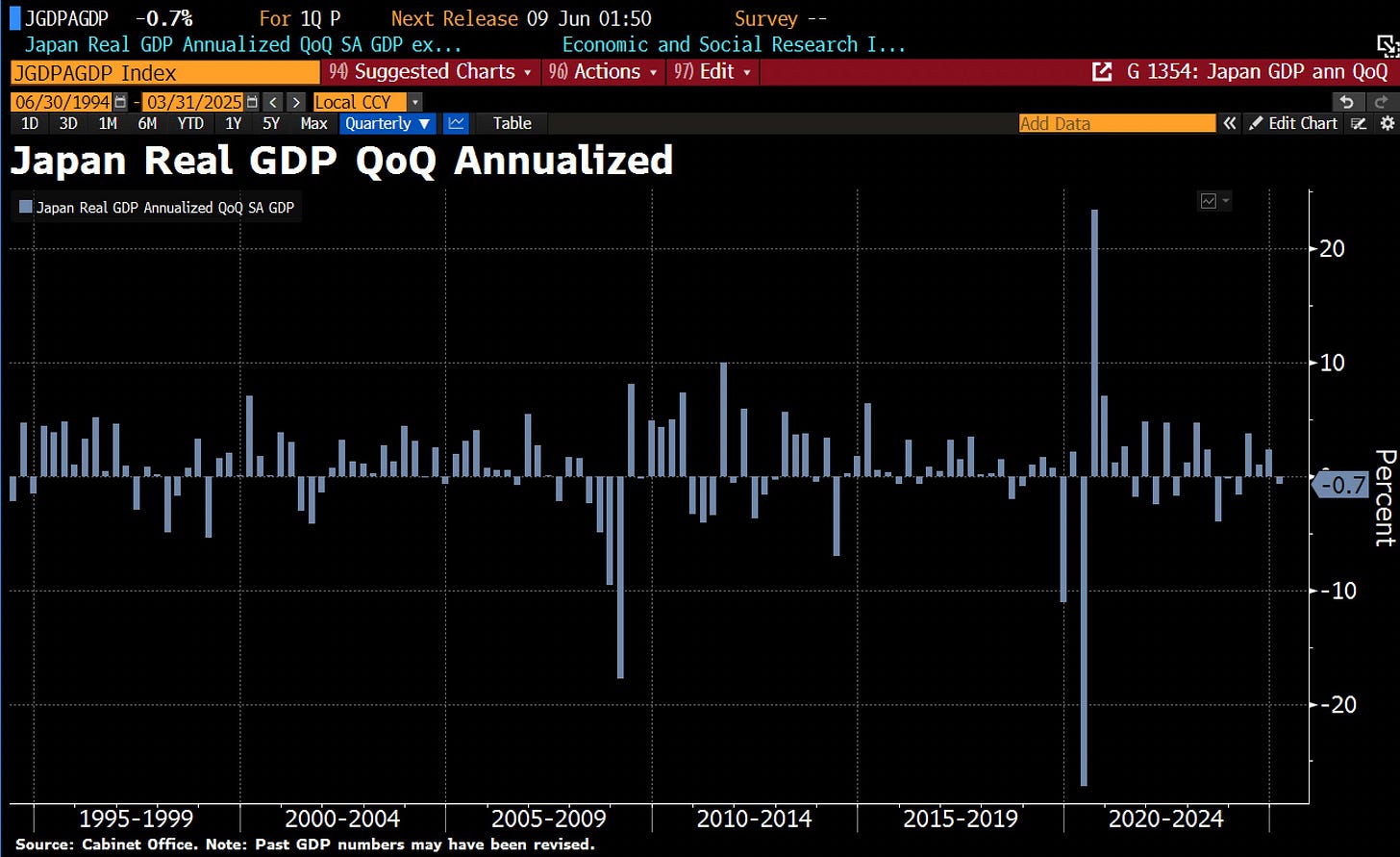

Japan’s economy contracted for the first time in a year, underscoring its underlying fragility, even before the full impact of Trump’s tariffs is felt. Inflation-adjusted GDP fell by an annualised 0.7% in the first quarter, a sharper decline than forecasts, with expectations set at just a 0.3% drop.

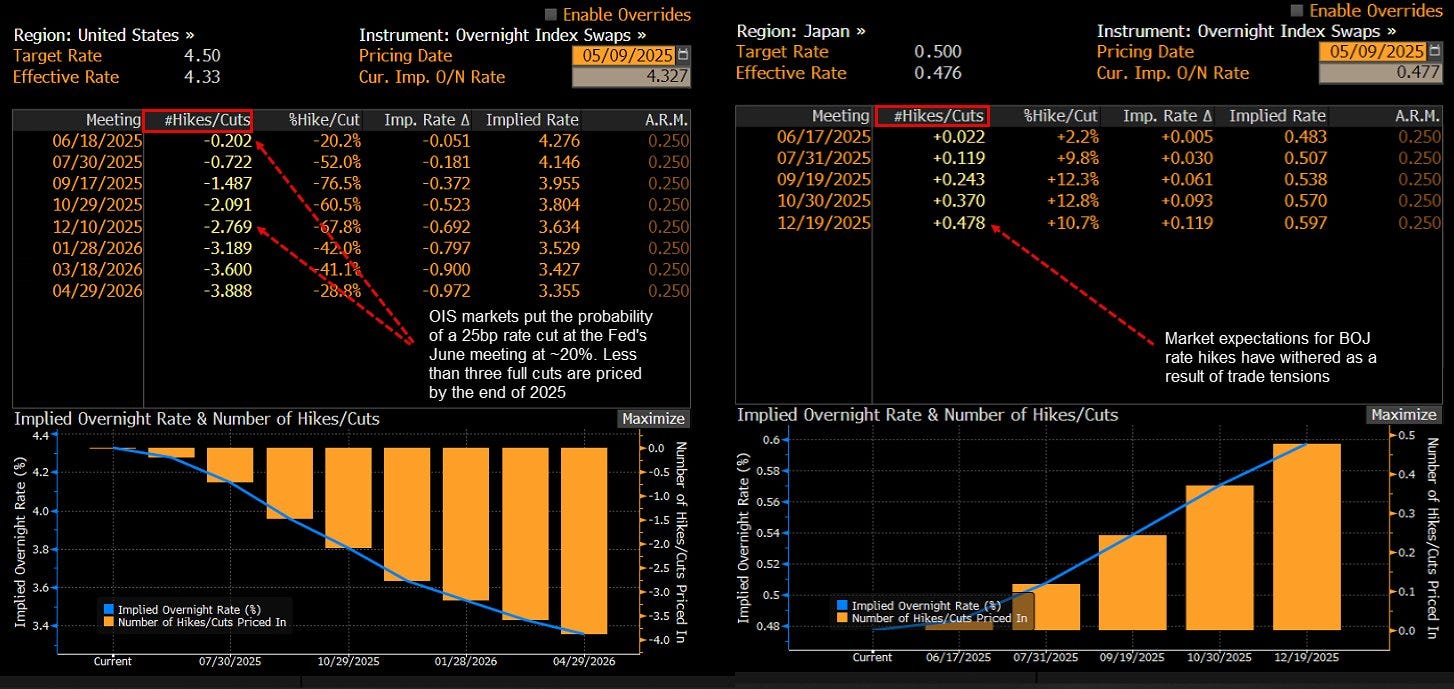

The economy that drew so many investors’ attention because of the interest rate path has now shown a crack. We’ve seen a major pullback in the OIS curve for Japan, just c.16bp of hikes is now priced in vs 40bp just one month ago. This takes us from an environment where the BoJ could’ve hiked in July vs RoW who were expected to cut in that period, to a place where the BoJ are expected to maintain rates until at least September while the RoW has had some rate cuts priced out.

The key thing here is that this is the data we are dealing with (negative), while the full effect of tariffs hasn’t been felt. Although the BoJ Governor reaffirmed his hawkish stance by stating, “We will keep rising rates if the economy and prices improve as projected”, we know that the chances of the economy improving is showing downside risks in the medium-term. Known as one of the more dovish members of the BoJ, Toyoaki Nakamura gave a more realistic approach saying that, “Japan’s economy is facing mounted downward pressure”, which urges against any nearer term hikes.

Also to bear in mind, Japan hasn’t struck a deal with the US just yet, on the basis that this deal isn’t positive for Japan, we could see further weakness in Japan. We also know that currency valuations aren’t being considered in deals, as Bessent has assured us. I see the JPY having weakness vs risk-on currencies in the near term (1-3 weeks) as a catalyst for newfound Yen strength awaits.

You can see the change in rate pricing between the US and Japan below:

Market mover

I was positioned long on risk-on assets over the weekend in anticipation of some positive trade talks between the US and China in Geneva, which played well. The reason behind that idea was because of the role Scott Bessent has played in recent weeks. He has calmed markets, he knows what markets need and is more realistic than Trump (who is aggressive in negotiations). Prior to the meeting, he had made it obvious via a speech that the deal was going to be nice for China and we all know that the 145% tariffs on China were just unsustainable.

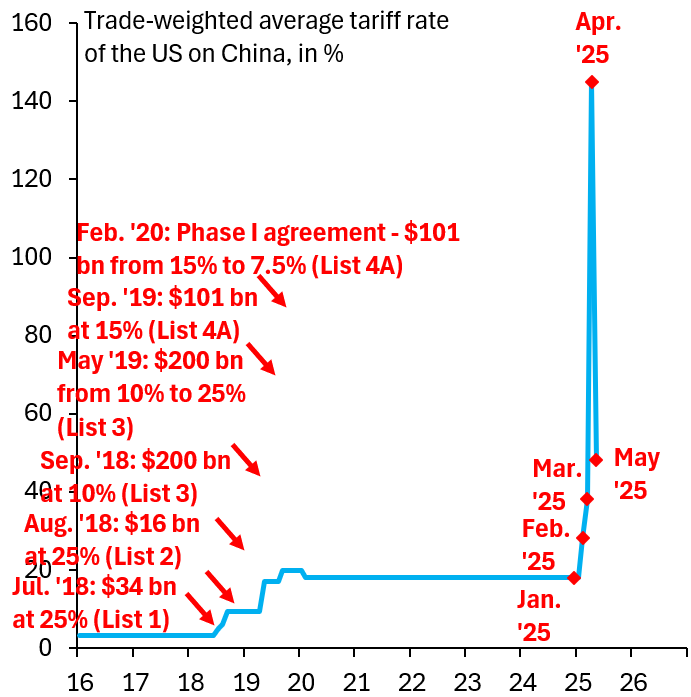

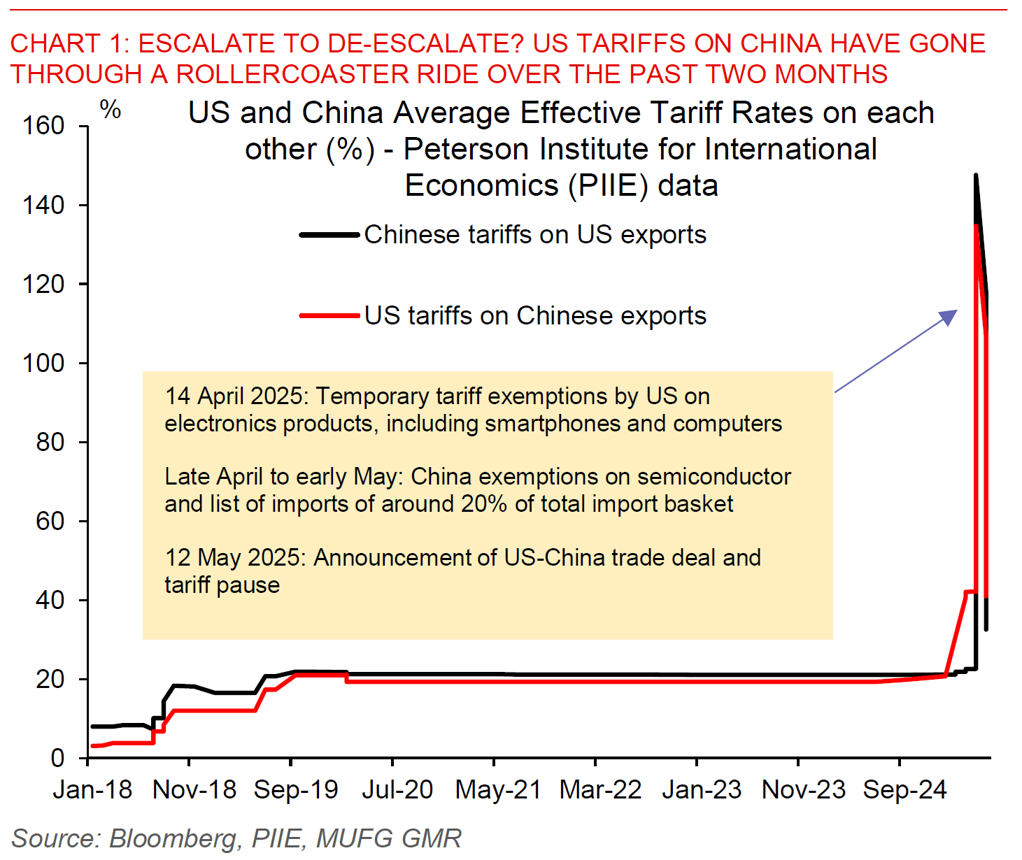

The trade talks between them led to a 90-day reduction in tariffs while a longer-term deal is made. The tariffs dropped significantly:

China’s tariffs on the US: From 125% to 10%

US’ tariffs on China: From 145% to 30%

There was confusion about the current state of US tariffs on China. The key detail is that the two recent 10% hikes (one targeting fentanyl-related goods and the other a broad-based increase) are added on top of the existing 2018 tariffs. After accounting for various exclusions, the effective tariff rate is now approaching 50%. Very high.

It did give a brief rally in risk-on assets, with many gapping higher at the open on Sunday night. The S&P500 actually turned positive for the year!

Who would have thought this just one month ago?

However, people have got a little ahead of themselves and are forgetting that these tariffs are still in extreme territory given the history of tariffs. Many of the moves (outside of equities) retraced their gains, there will need to be some more concrete longer-term plans set out for the market to gain full optimism back into the US. For macro moves, we need a catalyst to set them off and many thought this would be it. However, that has only proved true for certain markets, while the dollar index still struggles to gain any traction.

I think there is some short-term upside risk on the dollar based on minor optimism and hope, I don’t think we are positioned for more dollar shorts just yet. However, my longer-term short USD bias given back in January for H1 still remains.

Uncertainty looms

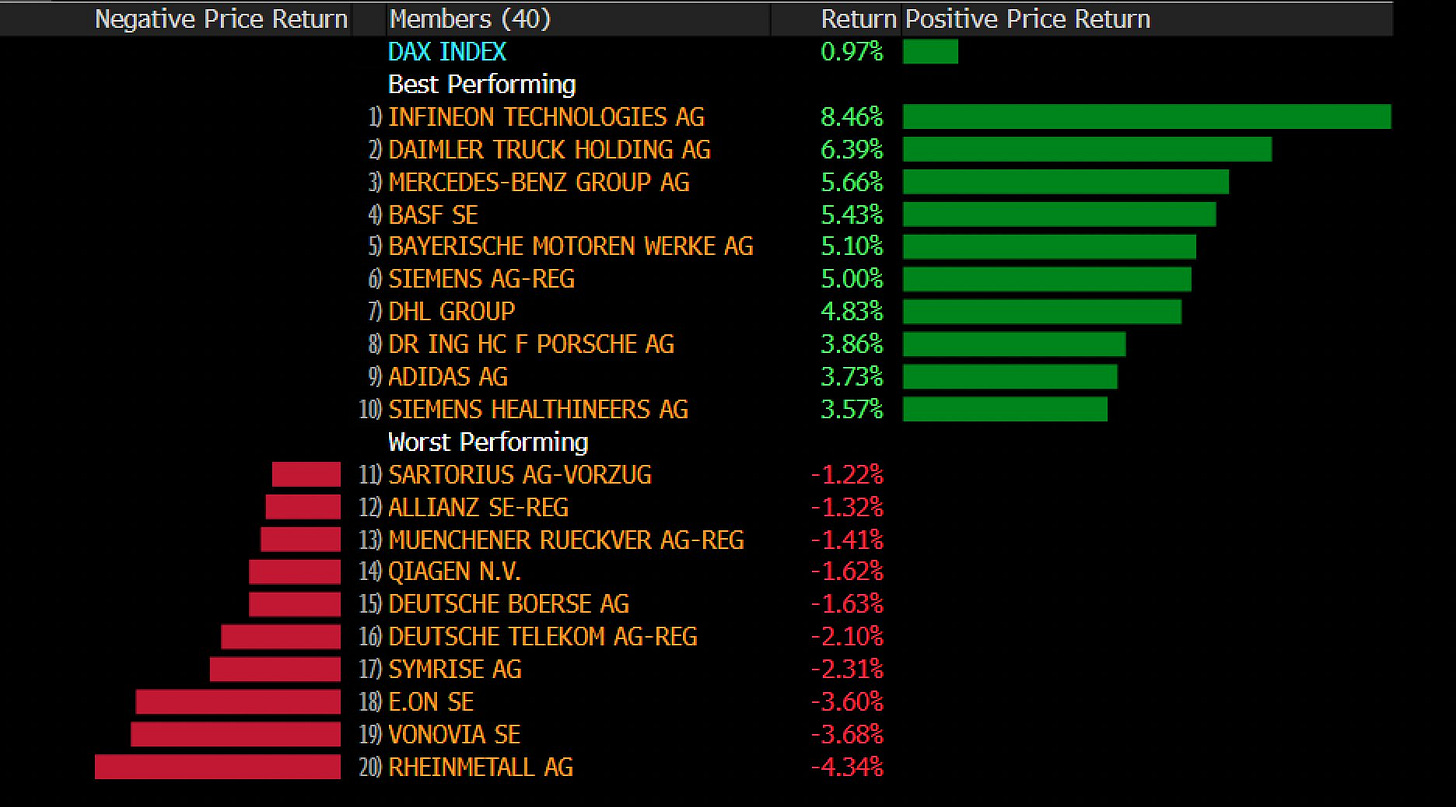

Coming as no surprise, the 90-day truce in the US-China trade dispute is boosted German stocks with strong China exposure.

Bear in mind that the majority of losses in these equities were down to the 125/145% tariffs, so even though the reduced tariffs are still very high, some repricing is needed. It’s also optimism from the fact that Trump is open to negotiations with China considering how aggressive he has been, things have toned down a bit. However, pain may be felt a little more as the tariffs that were implemented and the ones that are active are still damaging.

The uncertainty looms due to the fact that the tensions escalated so fast between US-China last time, which is why I explained that we’d need to see some more concrete parts of the deal that can give a longer-term idea on tariffs otherwise the risk of re-escalation remains (as it does now). Here is a chart representation of just how fast things escalated within the last 5 weeks:

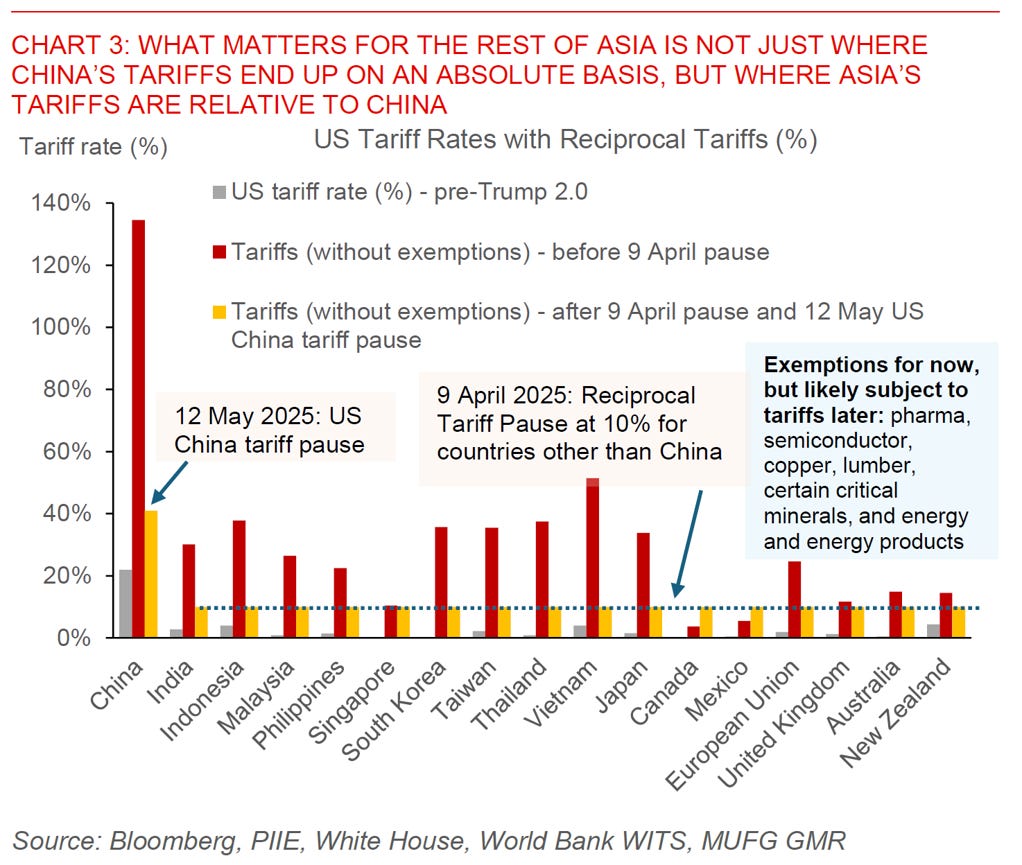

Asia is exposed but is being protected partially by the “sell America” theme and also the pause on tariffs. Although there is exemptions, there is high-risk that industries like semiconductor, pharma, copper, lumber and some others have their tariffs placed back on at a higher rate (but not as high as the initial tariffs).

There has already been some front-loading from Asian countries (excluding China) of exports to the US, yet no inflationary effects have been that dominant as of yet (and likely won’t be, in my opinion). You can see front-loading below:

Away from tariffs, there has been some major shifts in OIS pricing, as partially explained above. We went from a point just 4-5 weeks ago where there was shouts for 125bp worth of cuts this year from the Fed, to a point here where just c.65bp is priced in. We’ve not seen this major shift in rate expectations have much effect on the Dollar, mainly because rates aren’t driving the movement there at the minute, it’s more about perceived stability.

The yield curve is flattening quickly and there’s good reason for it. The widely favoured 2s10s steepener trade, which was based on the so-called "Trump premium," suffers from poor carry and roll dynamics. To merely break even over a three-month horizon, the curve would need to steepen by 12 to 13 basis points. You can clearly see just how much rates have changed in the 2Y, which is not surprising given the Fed’s stance.

The fall in the Euro vs Dollar underscores that it takes very little for US exceptionalism to come back. As I’ve reiterated many times in recent months, this lack of confidence surrounding the US can be reversed by one man. So although many people are saying this is a structural shift away from the US to Europe, I disagree. Although the Euro has retraced some gains, this was the chart at the open on Monday which shows how one decision can bring back some certainty in the dollar.

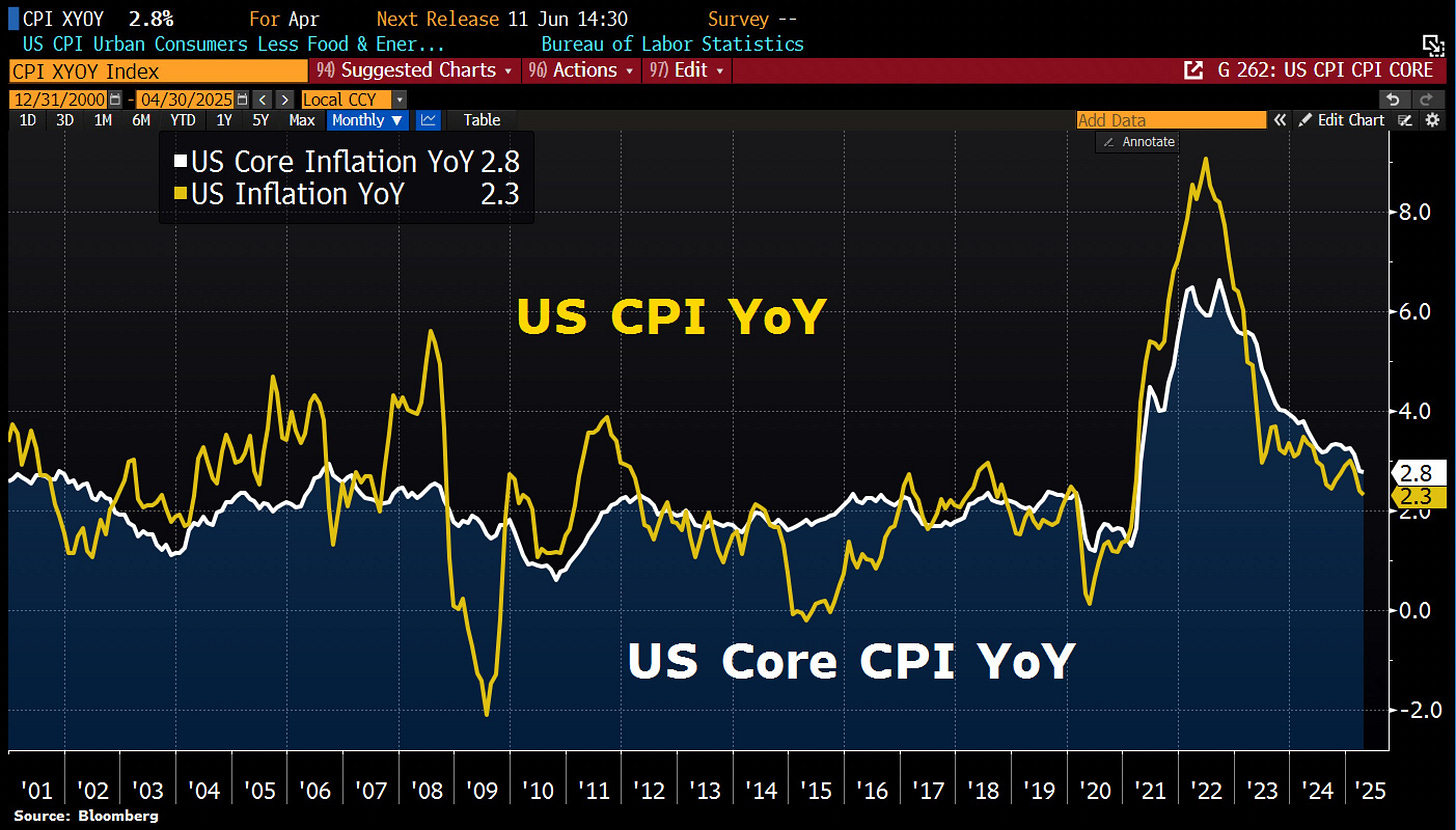

Now, back in February there was major discussion above how inflationary tariffs would be, yet we are still to see major shocks to inflation. US CPI this week is evidence of that, coming in 10bp cooler than expected at 2.3%, which gives the Fed this confidence in pushing rate cuts back to “be more certain” that inflation is under control. The reason for the lack of inflationary pressures comes from the mitigation effect in currency values, energy down and some other smaller factors. This was an opinion I held back in January and it went well with USD shorts.

I hope you guys haven’t skipped past the ideas shared in this report! I am positioned in them and although I’ve not made the asset tickers explicitly clear, you get the idea of my bias.

See you all next week!