Unmasking The Inflation Beast

Decrypting the CPI figure and what this means for markets, Fed funds rate and investors.

"Once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI" — Stanley Druckenmiller

Hey guys,

Feels good to be back actively sharing macro insights.

Easter was intense.

I mean back-to-back restaurants, all in the same night…wild

Enough about my that, CPI came out on Wednesday, and the FX, Equity & Bond markets seem overly confused so let me give you the information you need.

As always, lend me your attention:

What Does 5.0% CPI Mean?

The question on everyone’s mind at the minute.

Will the Fed cut, will the hike now, or will they pause? We will answer this in this report.

Traders have one or all of these possibilities going through their heads as we speak. So let’s play the cards we were dealt.

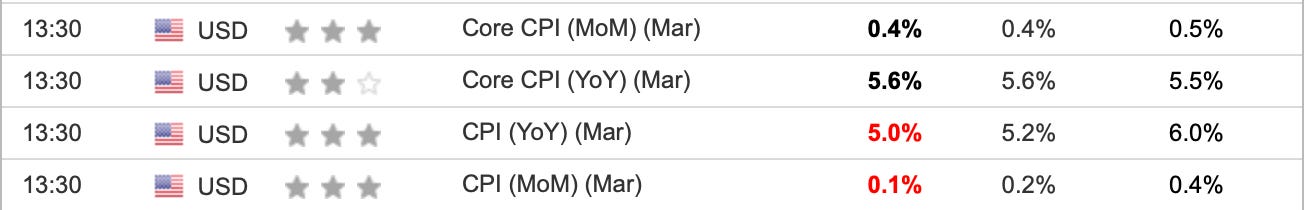

On Wednesday we were hit with a flurry of inflation figures from the BLS (Bureau of Labour and Statistics).

Let’s start with the good. CPI YoY for March dropped a whole 1.00%, I’ll dive into each individual component but this already shows that the Fed’s harsh tightening cycle is starting to have some positive effect on the topline inflation figure, however, in the same breath we also had an increase of 0.1% in core CPI.

Now if you’re a trader and you’re not sure what the main difference is between core CPI and CPI this is the simplest way to remember that:

Core CPI = The inflation reading without the volatility of food and energy prices

CPI = The inflation reading for everything under the sun.

Remember, the Fed focuses on PCE more than CPI when it comes to making monetary policy decisions, simply because it provides a deeper insight into the actual inflation reading compared to CPI. How? CPI measures the inflation on a fixed basket, whilst PCE measures consumer spending on a wider range of goods and services than CPI making it more sensitive to actual changes within the economy. The PCE index changes every quarter dependent on consumer spending patterns, i.e if the price of cereal goes up 5% on one particular brand like Kellogs consumers may adjust their spending habits by either purchasing a cheaper brand, buying less cereal or cutting spending on other areas, PCE would pick this data up whilst CPI would only measure the endpoint which is the change in prices.

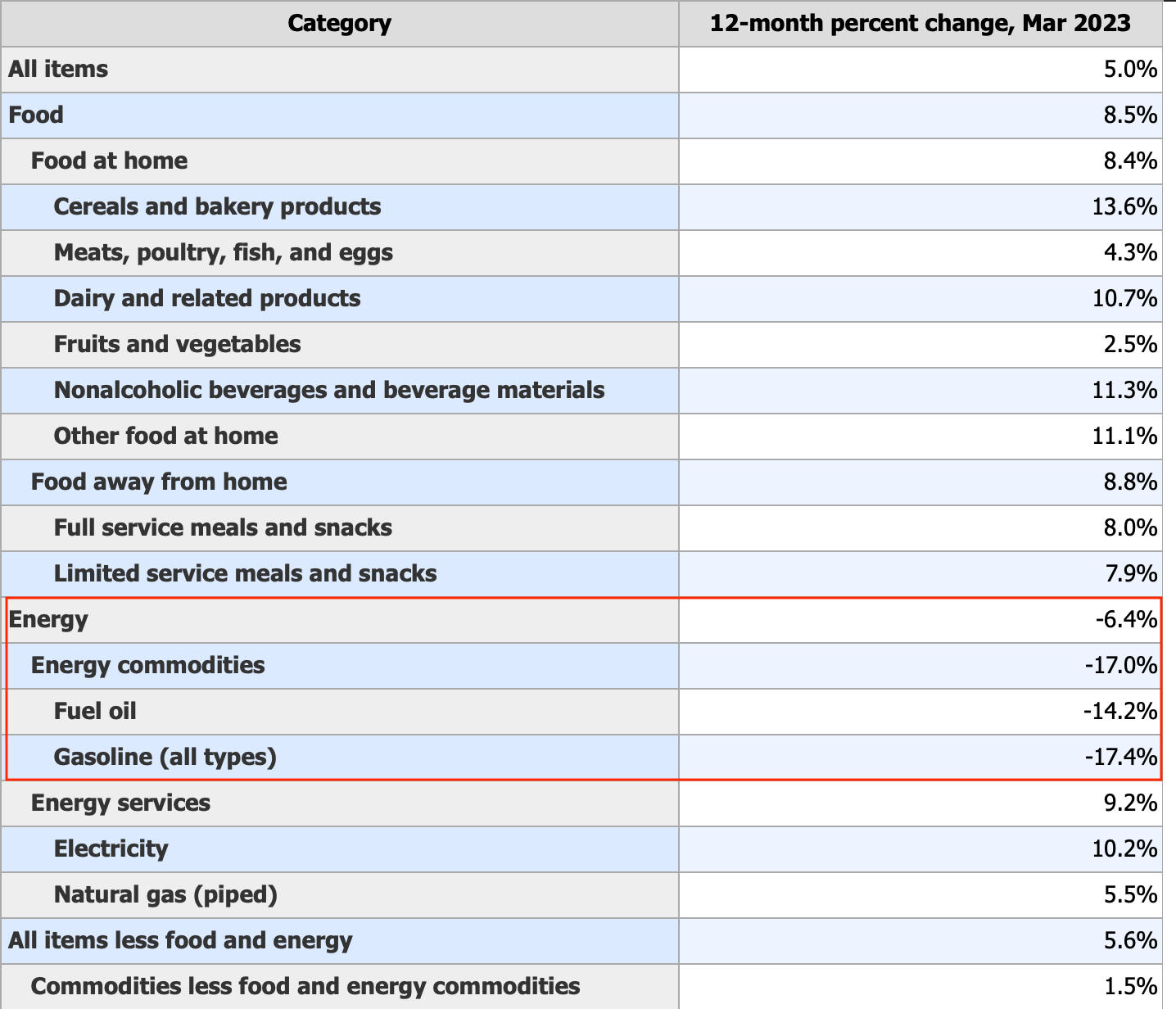

Now, back to the CPI print. When breaking the inflation report down component by component it’s interesting to see what is happening.

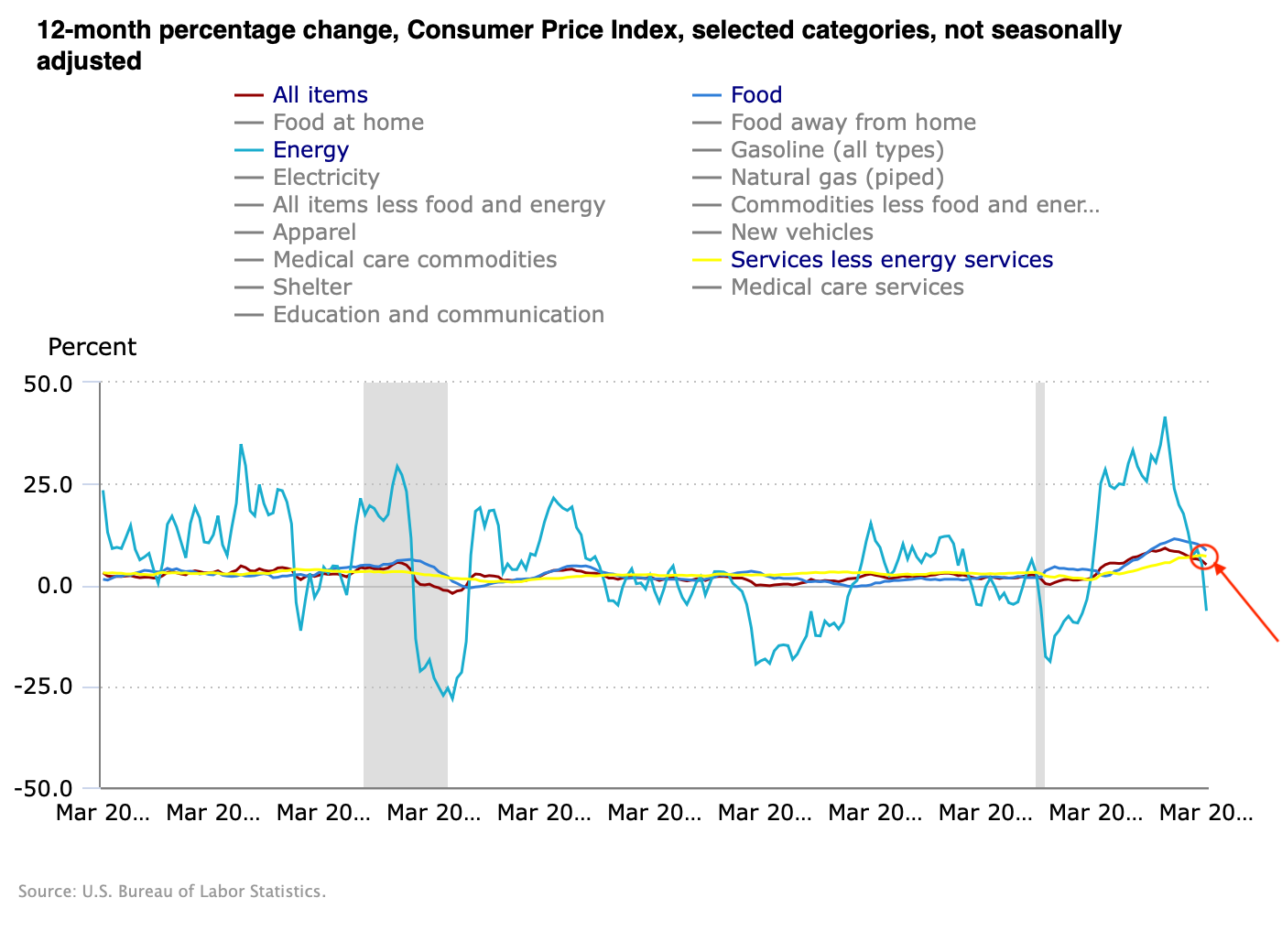

The energy component was the main reason there was a significant drop in inflation last month, to date, this has been the largest single drop in inflation since Covid began. Over the past year we’ve seen energy take a back foot post the ‘energy crisis’ we saw during the invasion of Ukraine, but let’s focus on why we’ve seen such a drastic drawback in the energy figure.

March was a month of high alert within capital markets, the banking blowup left imprints across the whole financial landscape after SVB and First Republic Bank to name a few collapsed this signalled to markets especially commodities that we may be heading for a deeper banking sector collapse, not only that but the banking crisis caused an immediate withdrawal of credit from the financial system which added additional downside pressure to commodities.

The reason is, credit is to the financial system what oxygen is to the human body, too much and you pass out, too little oxygen and you’re dead. So, when banks withdrew credit from the financial system, growth outlooks suddenly become dull, and thinking backwards, if we know that higher growth is a consequence of higher inflation, which spurs commodity prices to skyrocket then the opposite would have the exact same result we’ve seen in figure 2.

The chart above signals the issue at hand within the U.S and my reason for blaming the rise in core inflation on the labour market. As it stands unemployment in the U.S is 3.4%, tight, vs the SEP projections which have unemployment sitting at 4.5% for the end of 2023, but that’s just the face issue. The underlying issue as we know is the level of stickiness within wage inflation.

Unlike goods, and energy which relies heavily on the laws of supply and demand wage inflation is difficult to directly affect as things such as the reluctancy to renegotiate wages, the rigidness of the labour market, the hunt for talent sparking higher competitive wages and of course, inflation expectations all are the reasons as to why services inflation remain elevated with little signs of slowing.

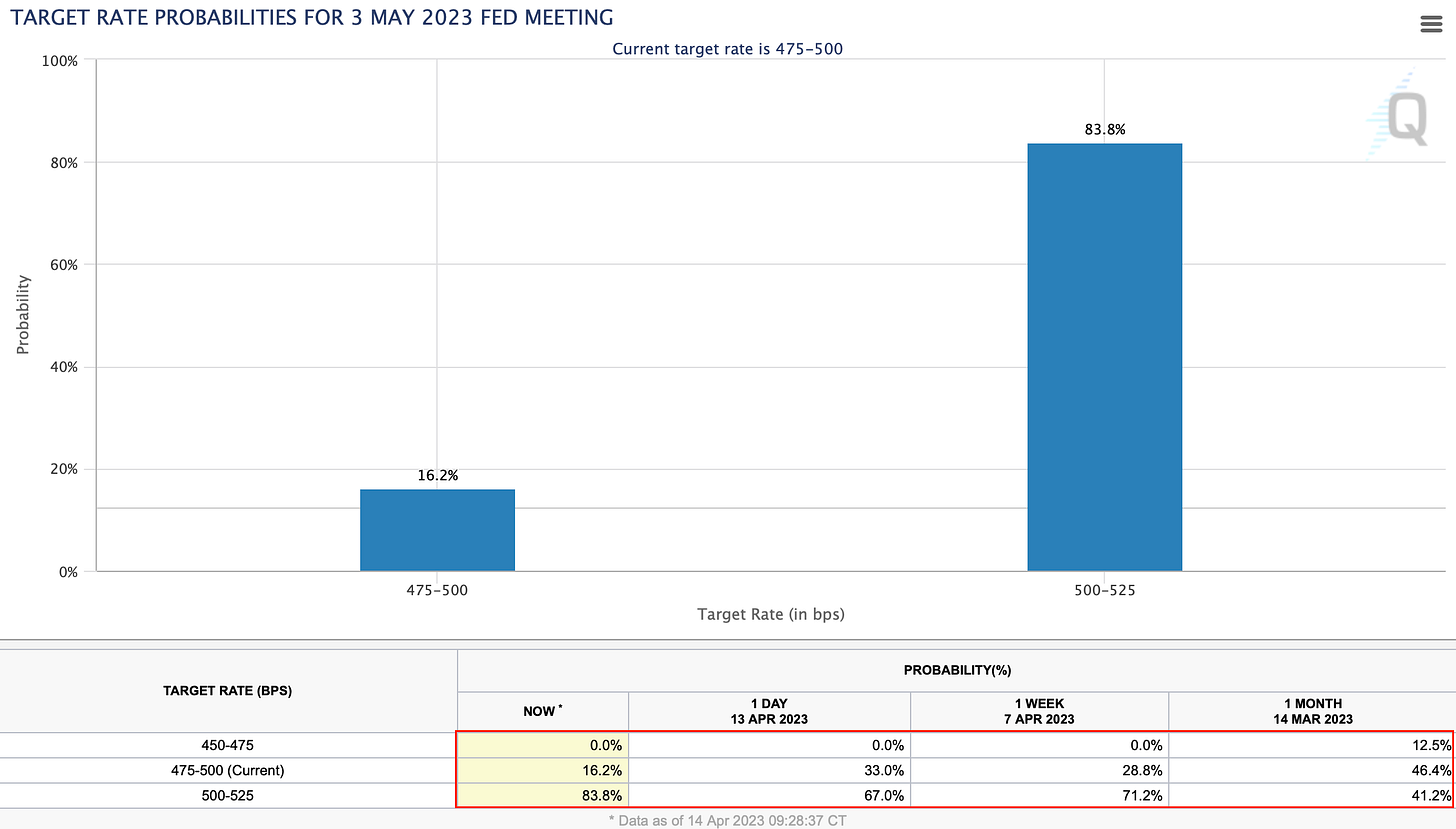

Let’s see what the market is pricing in for the Fed funds rate.

Rate of change. Probably the most important thing when analysing the macro environment, developments and changes in financial conditions. The series of events this past quarter were historical, and you can see how that has played into target rates probabilities for the Fed. March 10th, SVB collapses and triggers a number of other bank failures within the U.S that same week. Now look at the figure, 1 Month 14th March, expectations of a Fed pivot, aka the Fed cutting rates were 12.5%, with the majority of expectations shifting towards a Fed pause. You can see over a period of 4 weeks markets have done a 180, ruling out the slightest chance of a Fed cut at the upcoming May meeting and now fully backing a 25bps hike.

I think the Fed is making a big mistake here to continue hiking. Although we have just come out of a banking crisis, the aftermath and risks still remain elevated, J.P Morgan released a doc that I shared last week showing $500B in deposits have fled from smaller non-SIBs (Systematically Important Banks, i.e banks with >250B assets) to SIBs and government money market funds since the SVB crisis. Insane. Now, for the Fed to think the storm is past and continue pushing the lever higher whilst there are warning signals flashing red across the U.S. economy, shows a lack of sensitivity to markets and an unwillingness to be patient, see how conditions materialise in the wake of this crisis before deciding the path forward.

In my honest view, it would be better for the Fed to pause at the upcoming meeting, evaluate financial conditions then make a larger 50bps hike rather than consistent incremental 25bps hikes which doesn’t give the Fed enough time to actively be in sync with economic developments. But on the other hand, one may say that a Fed pause would send markets through the roof along with any other high beta asset, and to that, I say you’re completely right. Financial markets tell the story that everything is fine when in reality it’s not blue skies out here.

Am I a pestimistic bear? No. A realist? Yes, would I rather short or long markets like the SPX & Nasdaq from here, I would always go net long since ‘time in’ the markets beats ‘timing’ the markets when dealing with stocks. I was speaking with a friend of mine who’s an analyst and he mentioned that short-term T-Bills still offer great yields north of 4% which leads perfectly to my views below.

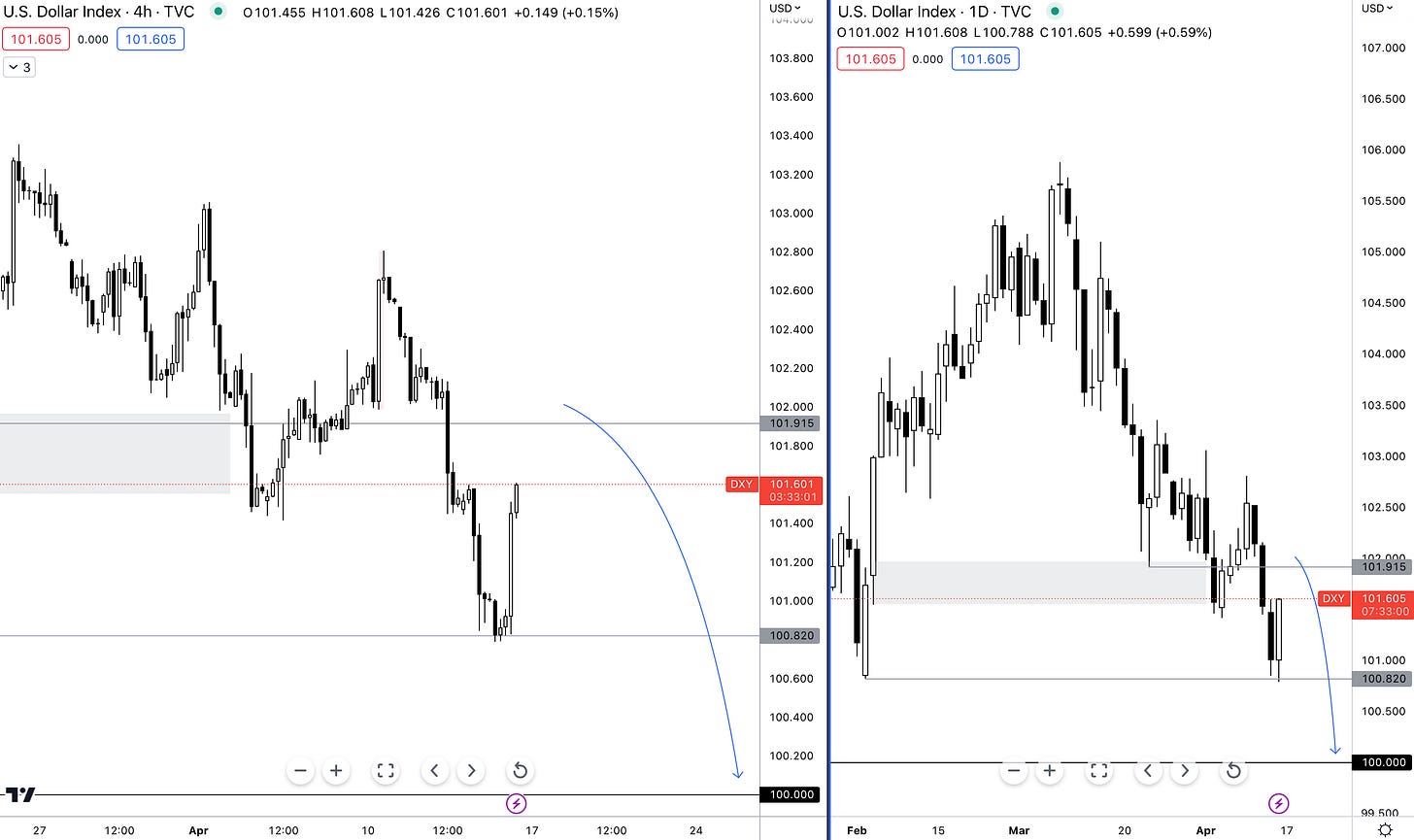

The Dollar & The 2-Year

My focus on the dollar directs me on the FX market and the direction we’re headed.

As you can see from the RHS chart, the DXY has reacted to a level we previously bottomed at in February earlier this year. Now that explains the sudden turnaround in the dollar seen today, apart from weaker retail sales figures which came out at -0.8% vs -0.3% forecasts.

Looking at the dollar further weakness seems eminent as we look forward, I don’t any reason for dollar strength in the immediate time frame so a break of the 100.800 level is a probable move for the dollar.

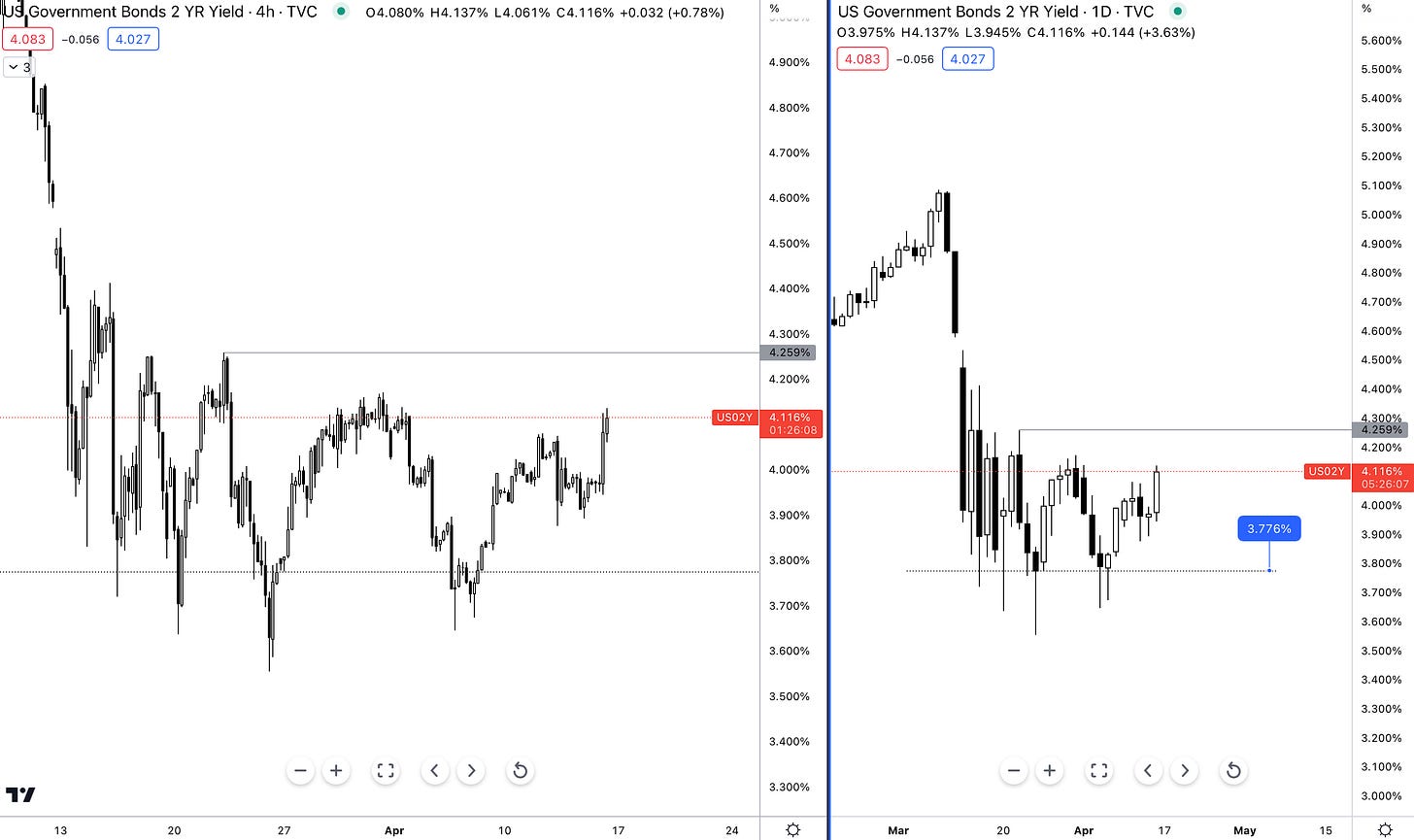

The 2-year bond.

As a rule of thumb, the shorter the maturity of the bond the more rate sensitive it is, so the 2-year provides a great insight into how investors believe rates will look like in the next 2 years; it’s also worth noting the correlation between bonds and the dollar something I’ve mentioned several times.

The 2-year has struggled to hold below the 3.778% region with expectations of more hiking from the Fed pushing yields higher as well; all in all the 4.300% appears to be the next target for the 2-year note.

As for now, that’s the end of today’s CPI review, I hope you were able to gain some clarity here!

I’m always open to hearing your thoughts and feedback so drop a comment!

One heck of a quarter.

Managed to finish and launch the macro guide which I’ve received some great feedback from, highly appreciated MMH community.

I’ve had a few requests for discount codes so here’s one to use, only for this weekend

Here’s 20% off the macro guide: MMHPro

Until next week, enjoy!

Excellent summary. Valuable information. Well put together. We'll see what materializes during Q2!

Very well summarised 👍🏾