UK Mortgages: A Ticking Time Bomb

Unveiling the shocking data we've seen from the UK and what this means for UK home owners & the economy

Hey guys,

Forgive me, I know it’s been a while.

Last Thursday I had the best birthday yet.

Nothing but surreal views, competitive tennis and Mediterranean food.

Not much I could ask for right?

Anyways, upon return, we’ve received some concerning CPI data out of the UK adding to pressures that we could likely see a mortgage crisis evolve.

So let’s go beneath the hood and understand where the issue lies and the possible outcomes for the UK.

As always lend me your attention:

Surprise Hikes Aren’t Going To Cut It BoE

On Wednesday the 21st, the worst possible scenario became the only scenario, a recession. UK CPI YoY (May) held at 8.7% vs the 8.4% forecast. Terminal rates before the meeting were expected to peak between 5.00% to 5.25% according to most bank reports and forecasts; now rates are expected to rise to as much as 5.75% according to GS, JPM and Deutsche.

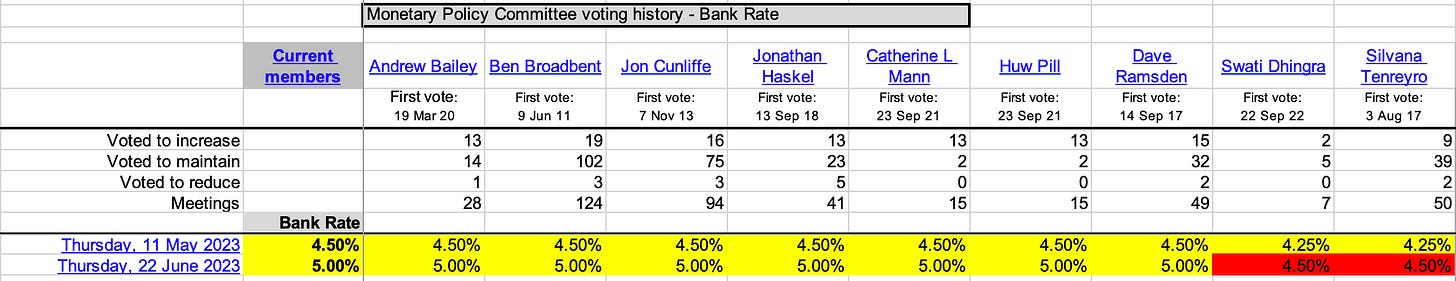

The BoE was expected to advance rates to 4.75%, but after the hot CPI print I was convinced that 50bps would be the appropriate reaction, and it seems the MPC too were also convinced. Below you can see my Excel sheet showing which members within the BOE voted for rate increases or pauses.

Silvana Tenreyro, an external member of the MPC is a well-known dove alongside Swati Dhingra, Tenreyro’s term comes to an end this July 4th, so this was her final MPC meeting after being re-appointed for a second three-year term in 2020.

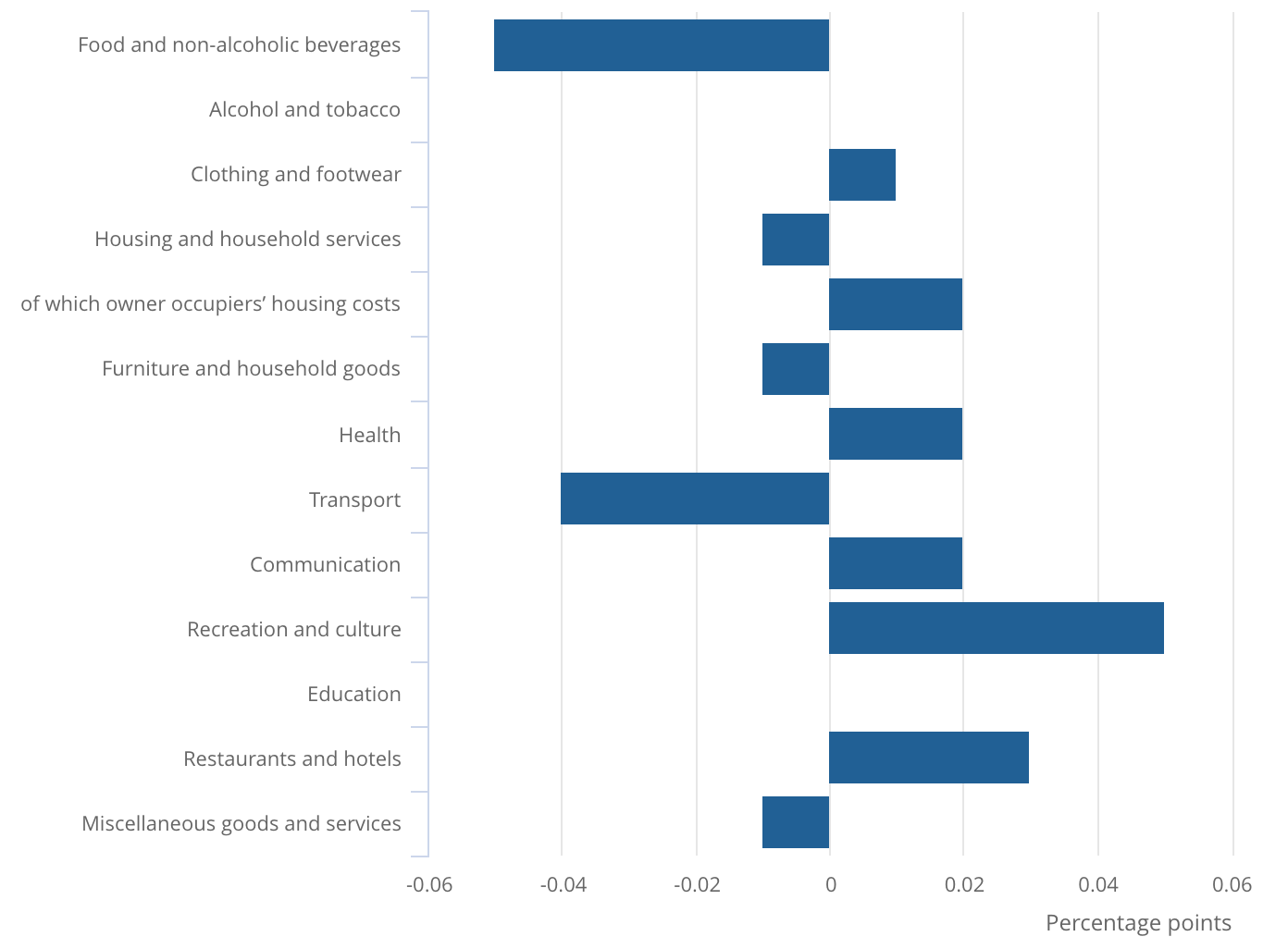

The truth always lies in the details. Take a look at the composition of inflation for May’s reading.

What we can gather from the above is the cyclicality of consumer spending behaviour as we enter the summer season. We’re seeing a shift from buying food and non-alcoholic beverages to spending on takeaways and restaurants as seen by the increase in restaurants and hotels. Warmer weather and longer days due to the sunlight is encouraging consumers to spend their days out in the city, or local town, deterring consumers from slowing the rate of purchases of recreational goods. To support that, recreation and culture had the most significant monthly contribution to the inflation rate.

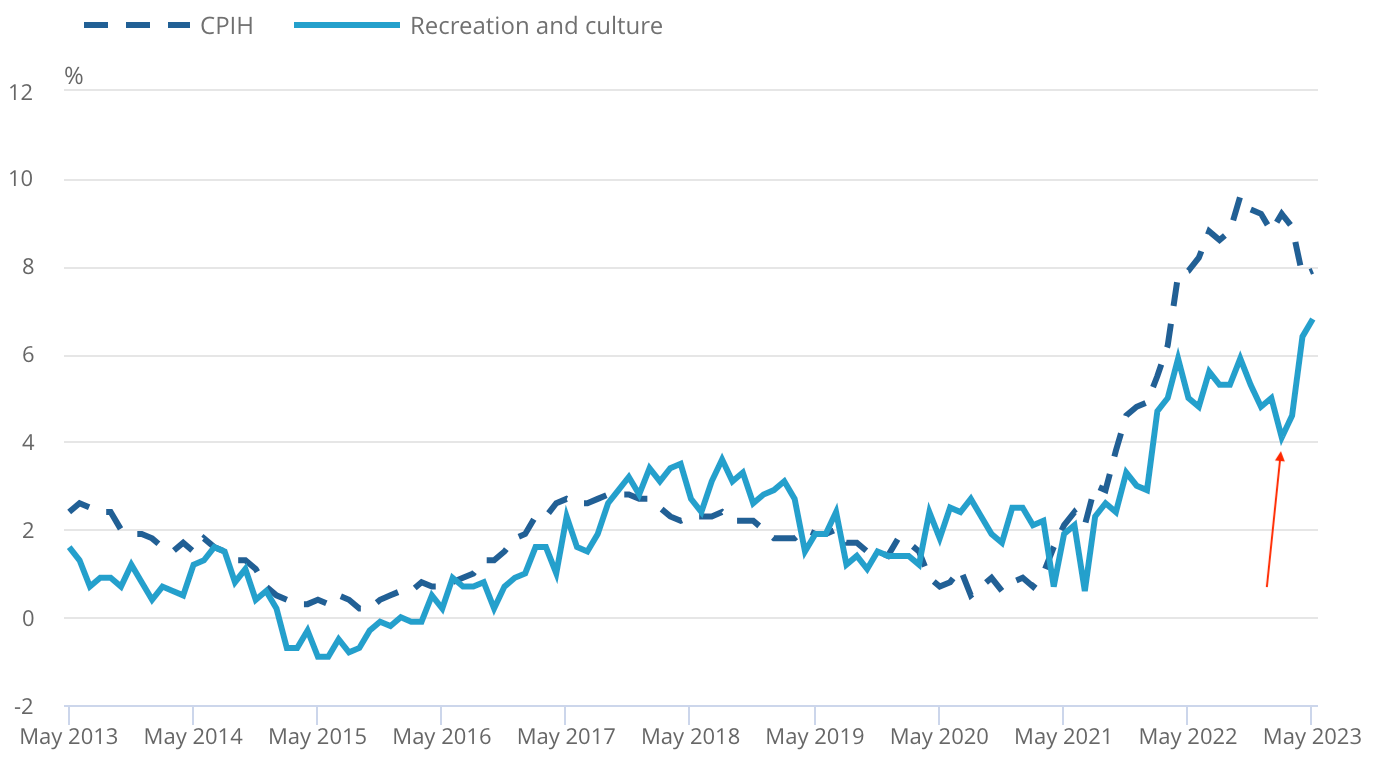

February 2023 marked the trough in annual inflation for recreation and culture in 12 months, but from March to April we saw a huge rebound in consumer spending in this particular component.

It’s safe to say that UK consumers are not letting a cost of living crisis ruin their summer, my concern however rises when we take a look at the BOE’s policy and the ripple effects set to trickly through the property market as a result of higher interest rates.

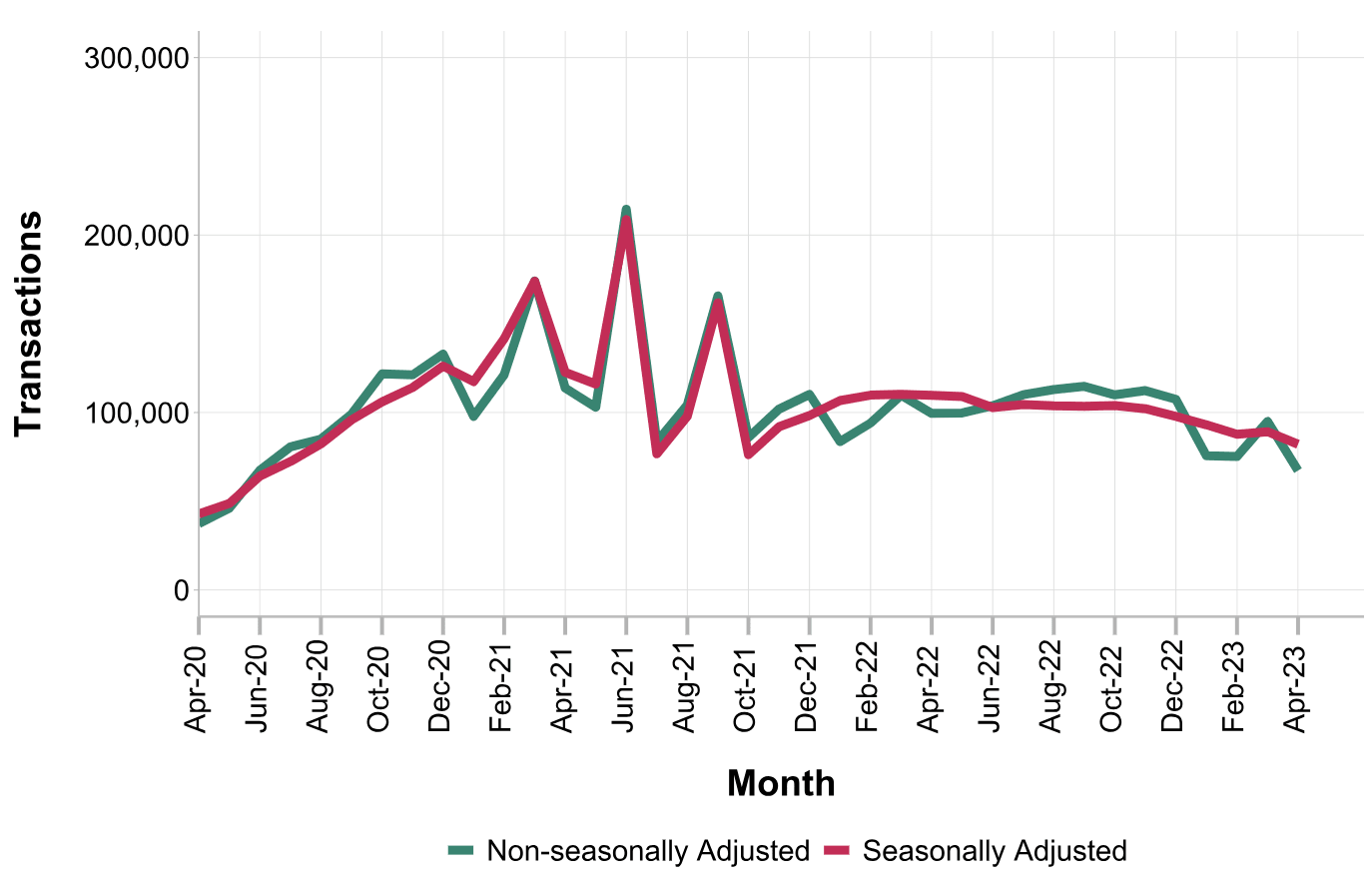

Let’s first take a look at home sales on a seasonally adjusted basis.

For those who aren’t familiar with the seasonal trends in home sales, here’s a brief explanation.

Just like any other market, there are cyclicalities, and within home sales, the trend is that more homes tend to be sold in the spring and summer compared to the autumn and winter. Looking at the line chart it’s evident the UK housing market has been on a consistent declexceptn of March, predicated by the rising cost of properties and the increasing mortgage rates.

The reason higher rates pose such a risk to UK mortgage owners is for the following reason; the average rate of a fixed term mortgage in the UK is typically 2-5 years as supposed to a 30-year mortgage in the U.S. Meaning, homeowners have greater exposure to interest rates volatility due to the shorter fixed rate period. For a long time, the interest rate sensitivity of the UK economy weighed on the BOE, preventing them from following the Fed’s aggressive tightening outlaid in 2022.

So now imagine. Between 1.4 - 1.8 million homeowners on fixed-rate mortgages are due to refinance in 2023 with mortgage rates now exceeding 6%. What do you think that does to both homeowners and the economy?

It’s simple, homeowners fall behind on payments eventually defaulting on their mortgages leading to a contraction in spending and consumption within the economy which ends in the only probable way, a recession. We’re still yet to see signs of a contraction in spending as retail sales for the UK beat expectations for May, contracting YoY but up 0.1% in May.

A few hours earlier, we heard from the Chancellor of the Exchequer, Jeremy Hunt who confirmed there will be a 12-month grace period before repossessions if mortgage owners miss mortgage payments. Earlier today there were also rumours that banks would allow lenders to switch to an interest-only mortgage for six months, or extend their mortgage term to reduce monthly payments which have now been confirmed.

The second half of that agreement is straightforward to understand, pretty much rolling their debt over a longer duration, just like any sovereign would do; the first half however may be fairly new so here’s my explanation.

There are two main types of mortgage payments:

principal and interest (P&l)

Interset-only-payments

The way the first of the two works is simple, with P&l you pay back the portions of the amount you borrowed and the interest on the property, this is the most common type of mortgage payment. Interest-only payments are just as straightforward, you pay back the interest on the mortgage and settle the principal at the maturity of the loan or when you plan to sell, or take out a new mortgage.

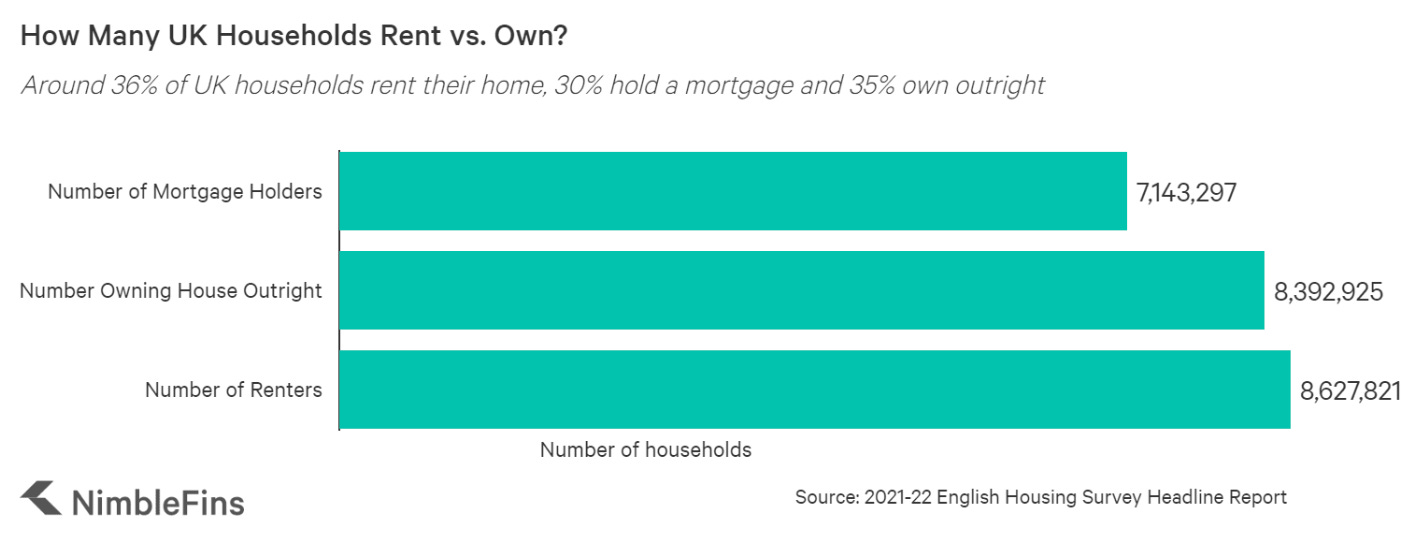

So with this new infrastructure to support UK homes, there’s a backstop to what would have been a bloodbath. All resolved? Not exactly. This only supports roughly 30% of households.

The other 70% is compromised of outright homeowners (c.35%) and renters accounting for c.36%. Will private renters be as lenient as banks and other lenders, this a question which we can only answer as we see the true effects of the sharp interest rates within the UK.

As is expected, my outlook on the UK remains extremely weak, I wouldn’t be surprised to see the pound retreat below the 1.2600 level over the medium term as we’ve seen cable reach a new 52-week high.

As always, I appreciate you for getting to the end of this macro report.

I’ve got some work in motion for you all which I’ll share shortly.

I’d love to hear your thoughts on the UK and this report in the comments!

1. UK consumer spending has not gone down despite the high cost-of-living.

2. When the variable rates kick in for mortgages, the interest payment obligation would immensely affect consumption, and this in turn would lead a contraction in the money supply in the markets.

3. This decrease in demand would pull down the prices and therefore effect the top line.

4. The overall affect being lesser GDP or even worse, a full fledge recession.

Is this it ? @joe