Two Negative Quarters, Recession Finally Here?

Whoever controls the volume of money in any country is absolute master of all industry and commerce — James A Garfield

Is it official, that the U.S is in a recession…or is there more to the story?

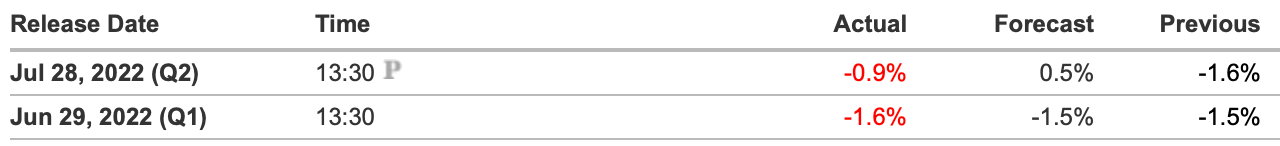

According to widely accepted knowledge, a recession is defined as two consecutive quarters of negative declines in GDP, which we have seen in the U.S after Thursday’s reading. That was until Jay Powell decided to change the definition across the web; problem solved right? No. In Q1 the U.S economy's GDP figure declined at an annual rate of 1.6%, and over the last three months declined by another 0.9%.

However, that is not an official definition of a recession, let me explain what is;

A non-profit organisation called the National Bureau of Economic Research defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months”.

Ok, so now that we know what an actual recession (officially) is, let’s look at what Jerome Powell had to say in response to comments about the U.S sliding straight into one.

I do not think the U.S is currently in a recession and the reason is there are too many areas of the economy that are performing too well — Jerome Powell

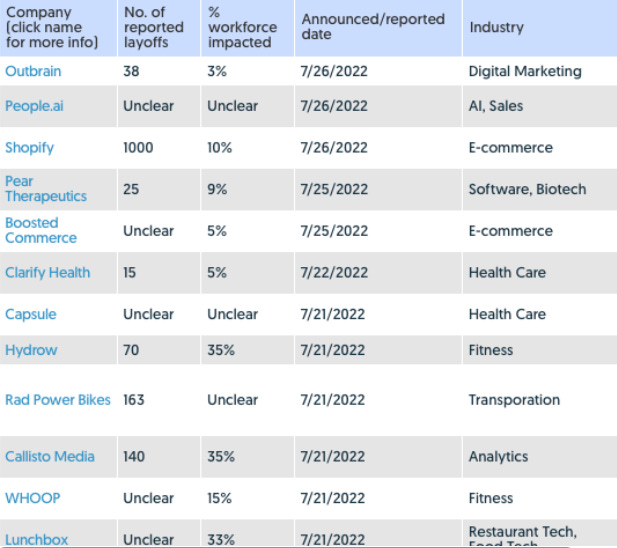

Typical Powell, to boast about the state of the labour market which we both know is a lagging economic indicator and as we have been seeing across the news prominent corporations like Robinhood, Netflix and Shopify are just a few of the many Technology firms being forced to fire/cut employee numbers due to economic conditions tightening up.

So the question to ask is when will we begin to see job layoffs impacting the wider Non-farm Payroll data figure we’re seeing?

Now that we’ve opened up the floor let’s take a look at the Fed hike and the message perceived by the markets.

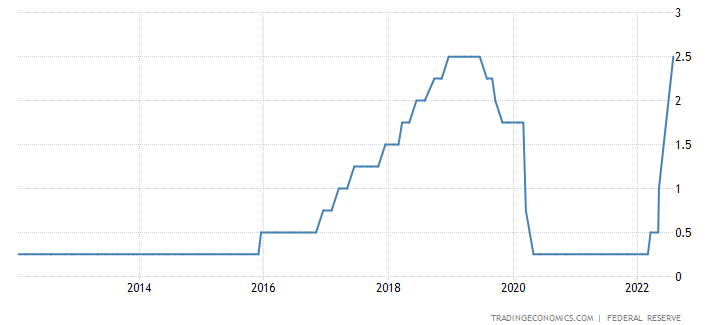

We saw the Fed hike rates by 75bps which was pretty much priced in by markets, what wasn’t priced in was the dovish comments made by Powell which sent risk assets rallying. So if your equities or crypto holdings are up, thank Jay Powell :)

After reading the transcript of Jay Powell’s conference this week here’s what stood out to me:

Powell acknowledged the fact that the unemployment rate is currently sitting near a “50-year low”, which although that sounds good from the outside looking in, we have to understand that his goal and overall purpose is to deliver his speech with the utmost confidence in the labour market further backing the actions the Fed take; however, the markets picked up on the dovish comments made by Powell which I’ll highlight later in this piece.

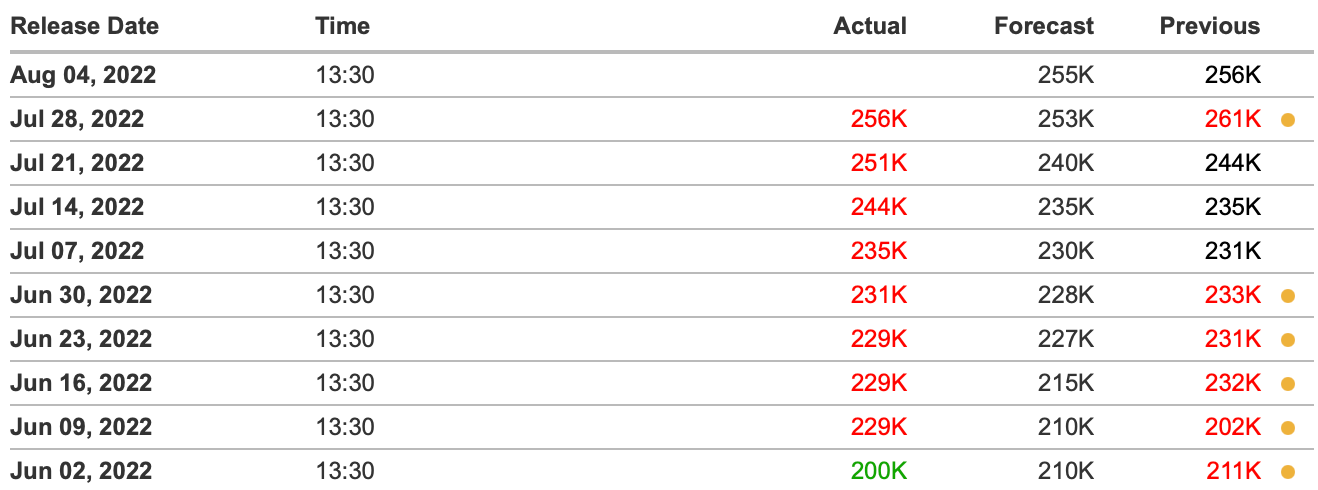

Starting with the labour market I’m seeing a consistent increase in the initial jobless claims, showing more people filling for unemployment on a weekly basis which could be a sign of cracks appearing within the perfect labour market Powell keeps rambling on about.

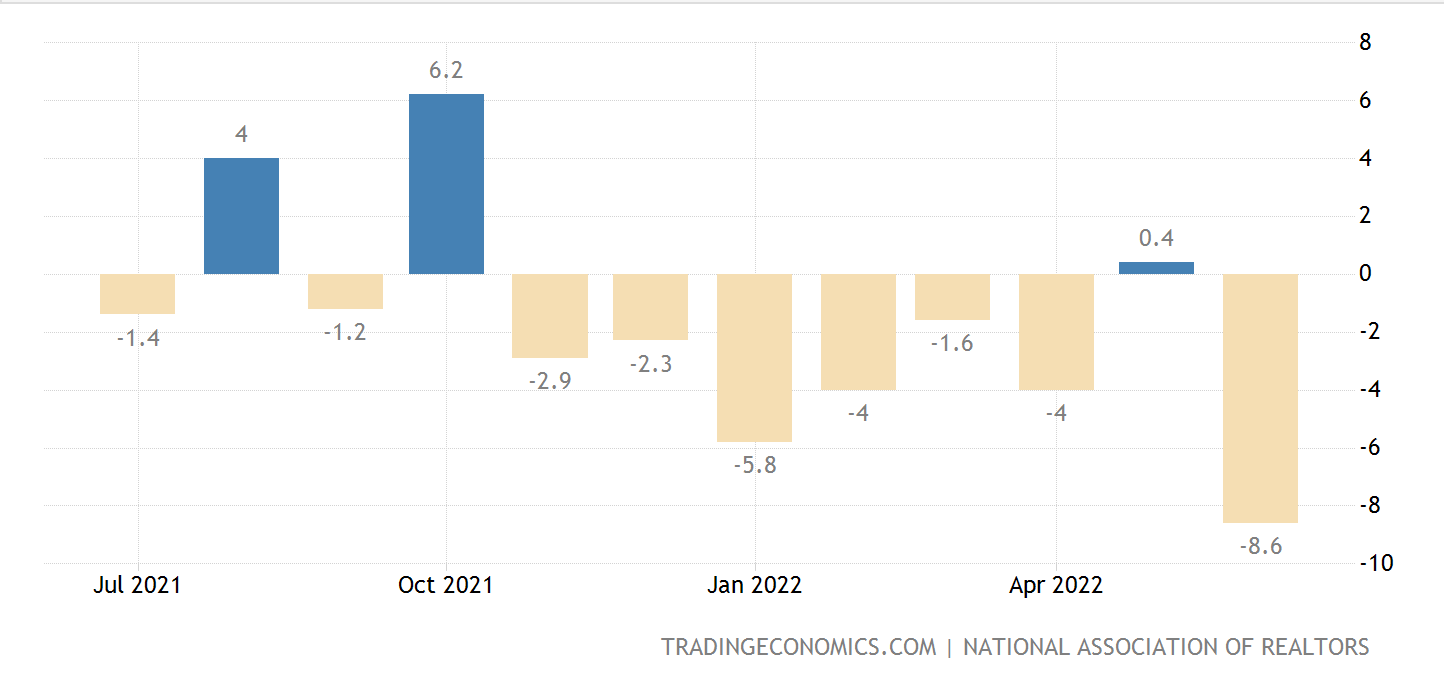

Not only is the outlook looking weak in employment, but a look into pending home sales provides a leading insight into how consumers are pricing up the market for purchasing new homes. If both the housing price and mortgage rates are looking attractive then you can expect a higher number of pending home sales across the U.S and the exact opposite for unpleasant conditions.

The latest reading came in at -8.6%, the worst reading we have seen since early March ‘21.

It’s clear to say we are already experiencing demand destruction across the U.S with pending home sales declining rapidly as well as new home sales. This shouldn’t come as a surprise considering where 30y Treasuries are at, taking a mortgage out in this environment would be crushing to your pockets.

I said I would cover it so here it is, bare with me…

Post the Fed Interest rate hike you would expect equities to shift lower and borrowing costs in yields to steepen right?

That wasn’t the case and the reason why is statements such as these from Jay Powell:

it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.

So, I guess I'd start by saying we've been saying we would move expeditiously to get to the range of neutral. And I think we've done that now. We're at 2.25 to 2.5 and that's right in the range of what we think is neutral

Both statements have indirectly told market participants that we will no longer be looking to hike aggressively above the neutral rate into the restrictive territory; so you can start buying up risk assets since the bad days are over.

So in this hiking cycle, Powell has given equities, crypto and other higher-risk assets room to rally with such comments; if there’s one thing we know about inflation is that it’s like a helium balloon, easy and quick to go up but painfully slow to go down. Moving forward I’ll be watching closely how leading/lagging indicators line up giving me a clue on how conditions are shaping up and what that means for the Fed meeting in September.

As always, thanks for reading this! Share with your macro heads in your group— much appreciated.