Trading The Future: Q2 Forecasts

A global macro analysis of Q1 conditions and where markets are headed

Hey guys,

I want to get straight into it.

This is a longer piece than usual so take your time going through this, it’s worth the extra 5 minutes of reading to get a full analysis of Q1.

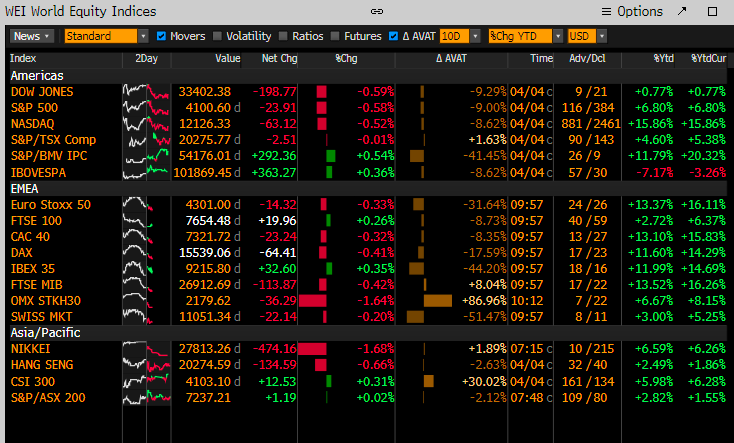

Q1 was a quarter filled with so much volatility, noise, and disruption, but in the midst of that markets still managed to pull off some impressive gains YTD.

As you can see below, equities globally have not struggled to get the race off to a good start with the Nasdaq being the top-performing global index.

In this piece we’ll review:

The trade of Q1 ‘23

The current macro regime and what that means for FX in particular

What I think Q2 may hold

Q1 Review

Starting off the year the narrative at play was the Chinese re-open trade, which if you ask me, was the driver of the outsized returns seen in equities and crypto.

To recap, the PBOC, People’s Bank of China made a statement around the week before the 23rd of December 2022 announcing the reopening of their economy which had a spiral effect on all asset classes.

Here’s a synopsis and three reasons behind that:

Commodities: China being one of the world’s largest oil consumers puts inflationary pressure not only on oil prices but also on the commodities market as China is the largest consumer of copper.

Eager to read the rest of this report & access the private weekly breakdowns?

Consider subscribing here, it won’t cost you as much as your weekly takeaway

I’ll be back tomorrow with a free breakdown, for MMH pro subscribers, get your pen and paper, let’s continue

The chart above is the oil chart, now you can see that we’ve been ranging between the $70 -$80 per barrel mark since November ‘22. Now, post the China reopening announcement, oil rebounded from the December lows to peak just above the $80 handle on expectations the reopening would add additional demand to the commodity.

Equities and crypto:

The risk-on sentiment fueled by the Chinese reopening and bets that the Fed would come to a quick end of their hiking cycle played beautifully into high beta assets, (high-risk assets) pushing the NASDAQ into a bull market (RHS).

Here’s a piece of analysis I shared back in February ‘23 showing the impact of the China re-open and equities.

Now to show you some charts as of today (April 6th 2023), not as pretty as the terminal but TradingView does the job haha!

This is what crypto currently looks like, low 70% gains for Bitcoin and 56% YTD on ETH.

It’s worth bearing in mind this is also a knock-on effect of conditions materially softening, meaning financial conditions were weaker, from the start/mid-October following the Gilt market crash.

Lastly, to tie up the review of how the Chinese reopen affected markets, the actions taken by PBOC also provided markets with additional confirmation that China’s re-entry into global trade and activity would drive global synchronised growth.

It’s estimated that the PBOC liquidity injections in December and January totalled $450 billion, for perspective, that is around 3x of the total injections in the past two years including the Covid-19 period.

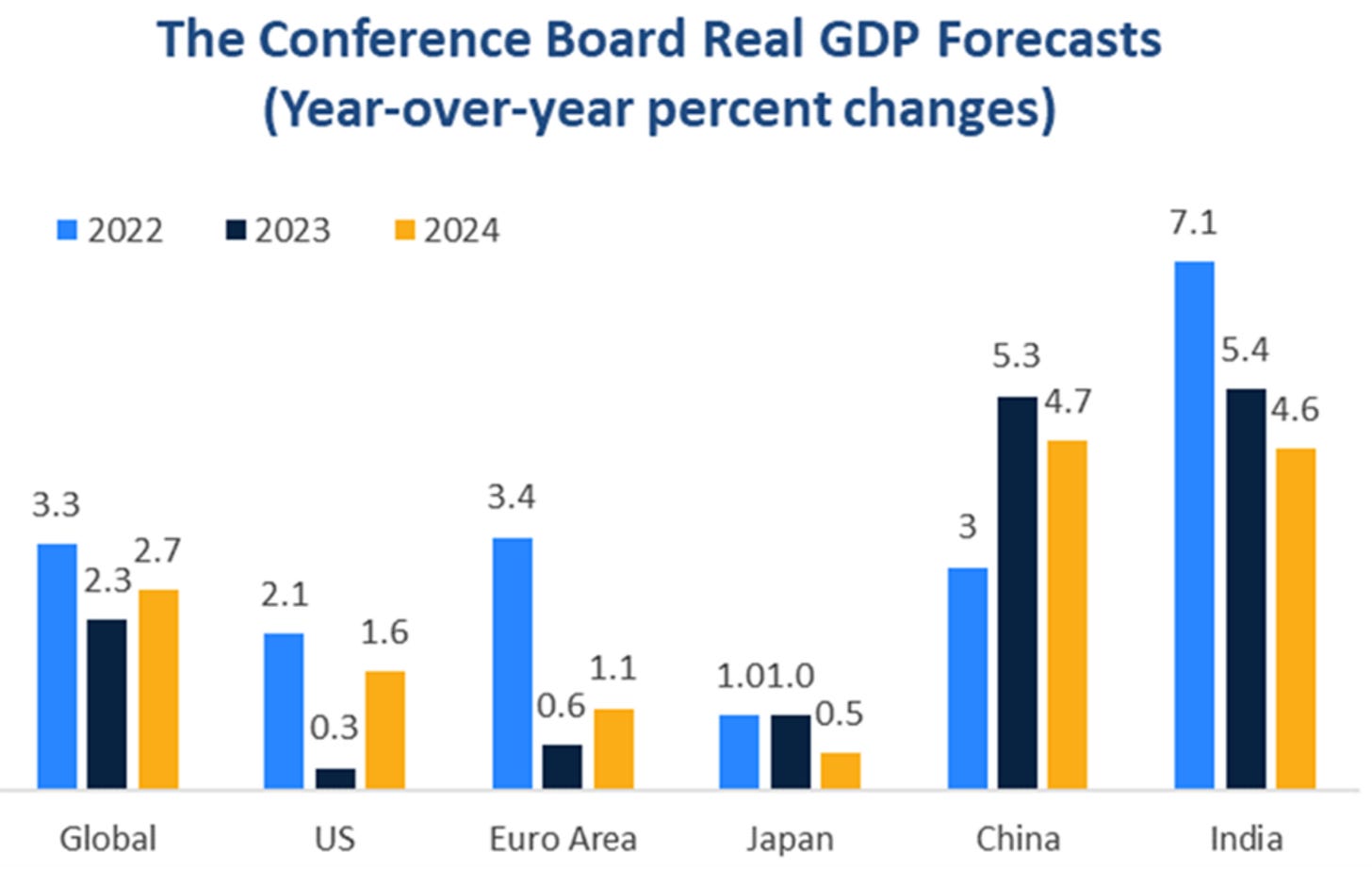

According to the IMF, China and India alone will account for half of the global growth this year, with the U.S, and the Euro-area combined accounting for less than 10%.

Here’s something interesting I picked up when reading the IMF report:

For every percentage point higher growth in China, “there is a spillover effect to the rest of the world that is about 0.3 percentage points”, which is quite significant when trying to understand how important China are in the realm of global growth.

Now that was just the China reopen, we also experienced the first large bank failure since that of the GFC.

Something I have covered actively over the past few weeks, the main contributors as we know were:

Unhedged treasury portfolio

Lack of stress tests on interest rate risks

What I want to highlight without repeating myself is this:

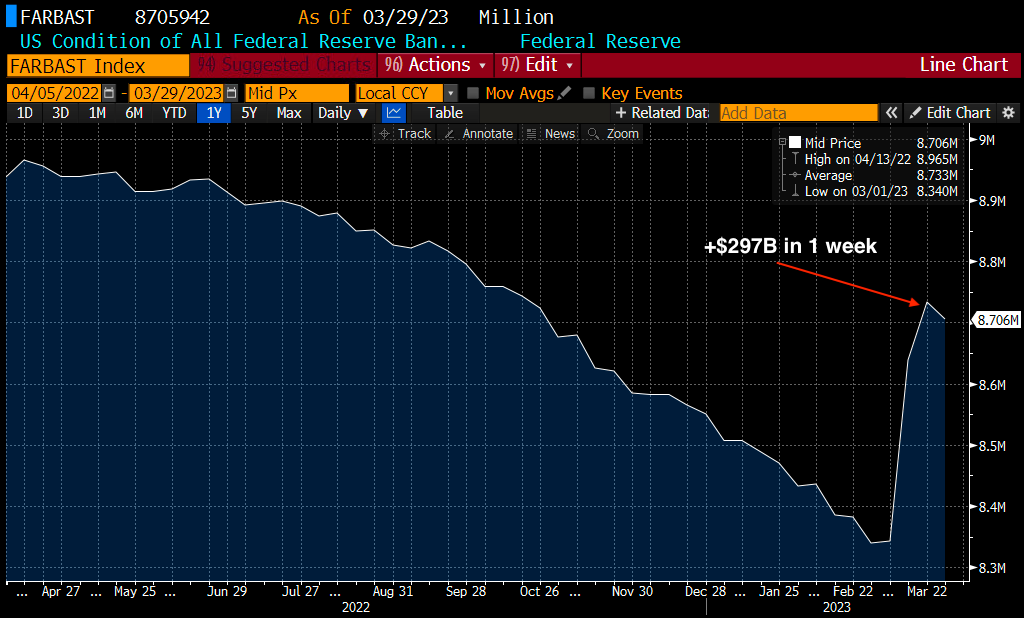

The Fed has been forced to battle a two-headed snake, one which they’ve adequately dealt with being the banking crisis, but that came at a cost as you can see from the Fed balance sheet.

In my opinion, this intervention will have no inflationary pressures, why?

Because this backstop was intended for banks to avoid further stressed outflows and to be able to withstand withdrawal requests. The reason this won’t be inflationary is simple, banks aren’t opening up new lines of credit. It’s as simple as that, new credit lines = real economy money = inflation. What we’re seeing is banks go into survival mode and reduce their exposure to loans of all sorts which should allow the U.S to continue seeing its topline inflation figure decline.

Q2 Expectations and Forecasts

As always, I want to start with the dollar index. And to do that we have to start with yields, the 2-year yield closely tracks the Fed rate expectations and like the 10-year yield, moves with the dollar.

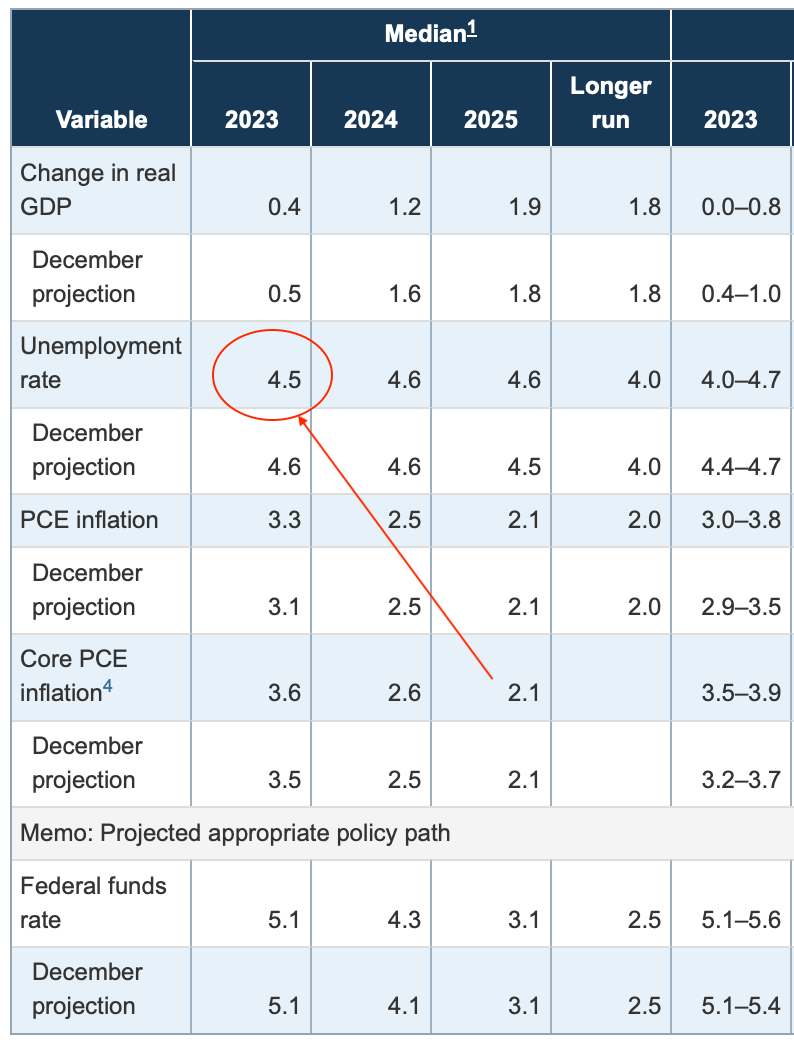

As it stands, expectations for Fed funds rates have significantly declined since the SVB crisis— the 2-year yields 3.744% vs 5.100% just a month ago. When looking forward, I don’t expect the Fed to hike any further than 25bps-50bps in the upcoming meetings leading to the upcoming June FOMC meeting.

What does that mean?

Dollar yields should hold steady, or continue to decline in my view if the Fed pause at the upcoming FOMC meeting, which is being priced in and that translates into a weaker dollar in return. If yields decline, in line with expectations of a Fed pivot or pause, and investors continue with their risk-on sentiment then government bonds and the dollar being safe havens shouldn’t see much flow over the next quarter.

For FX you know what that means, any dollar cross XXX-USD should see a rebound from a previously strong dollar, similar to the price action we’ve seen across the EUR.

2nd alternative!

No matter how good of a macro analyst I think I am there’s no such thing as a sure outcome. So let’s look at the second scenario that could happen over this quarter.

Now, the other side of the coin that could play would be a surge in the dollar in the event investor’s appetite for risk deteriorates based on a number of factors such as continued strength in the unemployment numbers and a higher-than-expected CPI reading for the U.S on the 12th April, it’s worth noting that CPI is always released in or around the 12-13th of each month usually the day that lands on Wednesday for the U.S. The reason this could cause a shift in risk appetite is simple, another strong labour market reading tomorrow signals to the Fed that the job market is resilient to the Fed’s hiking and that another round of hikes would be required to see the looseness Jay Powell wants to see in the labour market.

As a reminder, the SEP projections showed FOMC members expect unemployment to rise to 4.5%, as shown below.

A recession would cause a massive flee for safety meaning a surge in the dollar but that’s not expected to happen until Q4’23 / Q1’25, so looking forward to dollar shorts on the long-term macro picture seems a high probability given all things said, but as mentioned if any of the above scenarios happen the dollar short theme will be invalidated, in the event I will update you in real-time, the beauty of MMH Pro.

The regime we’re in has changed from higher for longer to tentative and reliant on economic data to decide future decisions.

To end this piece let’s circle back to commodities, particularly gold.

Gold traditionally has performed well in inflationary environments, but the attractiveness of the yellow metal to act as an inflation hedge has been declining which raises the question of what does gold really react to?

Could it be M2 creation (money creation) something I’ll cover later.

YTD Gold has returned a solid 10% thus far, and once again here’s another correlation to keep in mind.

Gold and bond yields particularly 10-year yields have n negative correlation as you can see from the chart below.

Thanks for reading until the end guys, I know this was a very long piece there was simply too much to cover but we’ll narrow down from next week and keep it sharp, simple and lean!

See you in the discord for our Sunday drop!