Trading Interest Rate Differentials: A Primer

Unraveling the Dynamics of Trading Interest Rate Differentials

Hey guys,

Firstly, make sure you read until the end as there is an update on my portfolio/track record that may be of interest to some of you.

I’ve been truly out of the game for a few days, a nasty flu has got the better of me!

But we're back to it, I had quite a bit to catch up on but the work needs to get done regardless.

A topic that many struggle with is the process of creating a bias/trade based on macroeconomic data and news.

Unlike quantitive trading, there is not one specific model that can be used trading global macro. It is not as simple as - “when XYZ happens, buy/sell”.

A lot of discretion is involved, because unlike technical trading, the global macro conditions are always unique to historical conditions (to an extent).

Macro watch

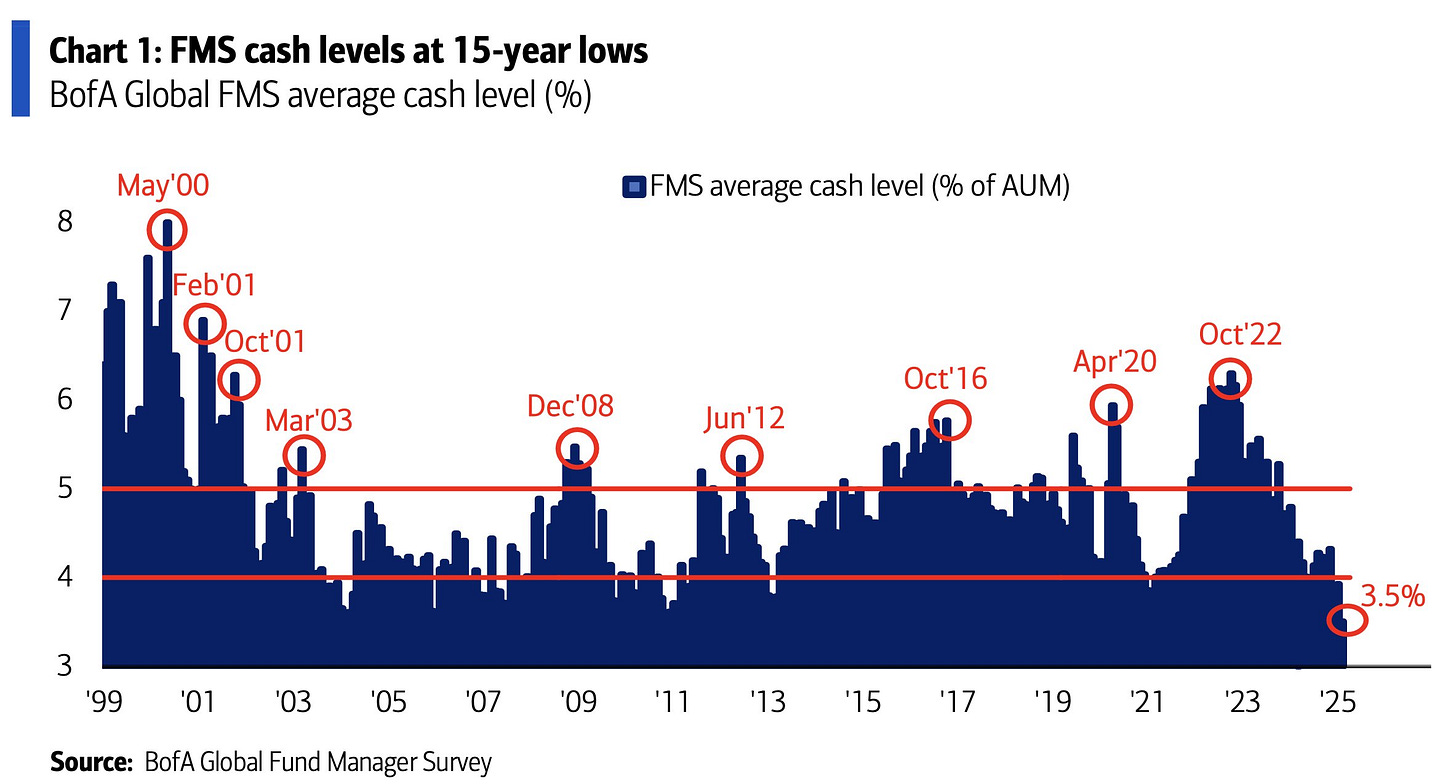

In Figure 1, the FMS (fund manager survey) cash levels have dropped to 3.5% which is the lowest level since 2010 Investors are extremely bullish and are heavily invested in stocks while betting against everything else.

Cash levels drop when fund managers expect markets to rise, so they allocate more capital to equities, credit, or other assets rather than holding cash. We can see this across UK, European and US equity indexes which have all made record highs since the beginning of 2025.

There is something called TINA (There Is No Alternative), that idea seems to be in play. The bullish sentiment is caused by a shift in monetary policy, which we have seen globally. For me, I think these cash levels have likely bottomed, although I don’t see any type of major reversal because conditions are mixed, let me explain:

Equities are a hedge for inflation

Central banks have began a reversal in monetary policy (looser conditions)

Real yields may decline which reduces the appeal to sit on cash

Now the one downside to this idea (which may cause a reversal in FMS cash levels, is the severeness of tariffs. Yes, they will cause inflation pressures, but the detriment is growth which could negatively affect consumer spending and eventually company earnings (dripping into indexes). So for now, I think cash levels will cruise around these percentages.

Market mover

There’s been some level of a tech sector surge…

This rally has been driven by several factors, including significant investments in AI by major tech companies like Alibaba, which announced plans to aggressively invest in AI and cloud infrastructure over the next three years.

The rally we’ve seen from DeepSeek’s AI breakthrough seems to have prompted more focus on Chinese tech companies. Also, President Xi Jinping’s recent meeting with Jack Ma and other tech executives has helped bullish sentiment in that sector, it suggests there’s more of a supportive regulatory environment for the Chinese tech sector’s development. As global funds pile into the market, there’s been a $1.3 trillion gain in Chinese stocks over the last month.

Now, the outlook on whether this trend continues or not is a little misty. This rally is sentiment driven and we may need something a little more concrete to prompt the move to make some real longer-term moves rather than a consolidating range. The ongoing developments with US-China trade relations can cause large downside to the Chinese tech rally, while the effectiveness of the Chinese government to support private enterprise and capital markets is also something that needs to be a little more set in stone.

Trading interest rate differentials

There’s many different methods of trading global macroeconomics, from equities to bonds to FX. Each market is driven by different data and news. For example, FX is driven by interest rate differentials (IRDs), equities are driven by earnings and growth and bonds are driven by inflation, rates and growth. Of course, all of these markets are affected by growth, inflation, interest rates, policies etc., but I’m referring to the main drivers.

For the sake of this week’s topic, interest rate differentials, the market in focus is FX.

Firstly, interest rate differentials is just a complex term for the difference between the interest rates of two countries.

So, why do these differences in interest rates move FX markets? Answer - Because of hot money flows.

Hot money is money that goes around the world to seek the highest possible short-term interest rate. The reason this drives the currency with a higher interest rate is because of the demand for the currency, check out the example below:

The U.S. sets an interest rate of 5% (let’s pretend this is the highest rate in comparison to the other G4 currencies right now).

Hot money comes into that country to capitalise on the higher interest rate.

The demand for the domestic currency (USD) surges as you need to transact in their currency to capitalise on the interest rate.

Now, this will put together the pieces to the puzzle for some of you. When central bankers (like Jay Powell) come out and make comments of a hawkish tone, the reason the USD often rallies off the back of them comments is because of the anticipation of higher interest rates (and we now know what higher interest rates mean for the currency).

Is it as simple as just buying the currency of the country which is hiking interest rates? Not really.

The real rate (inflation-adjusted interest rate) plays a major factor, if the U.S. offered an interest rate of 5% but their inflation was 20%, your real return is -15% so that’s where things aren’t so direct. If you’re wondering why the USD pumped even when inflation was higher than interest rates, that’s because of the TINA (there is no alternative) effect. They were offering the highest interest rate with the most perceived stability in comparison to other countries, therefore they received hot money and the currency rallied. Basically, people didn’t feel their money was safe anywhere else at that time…

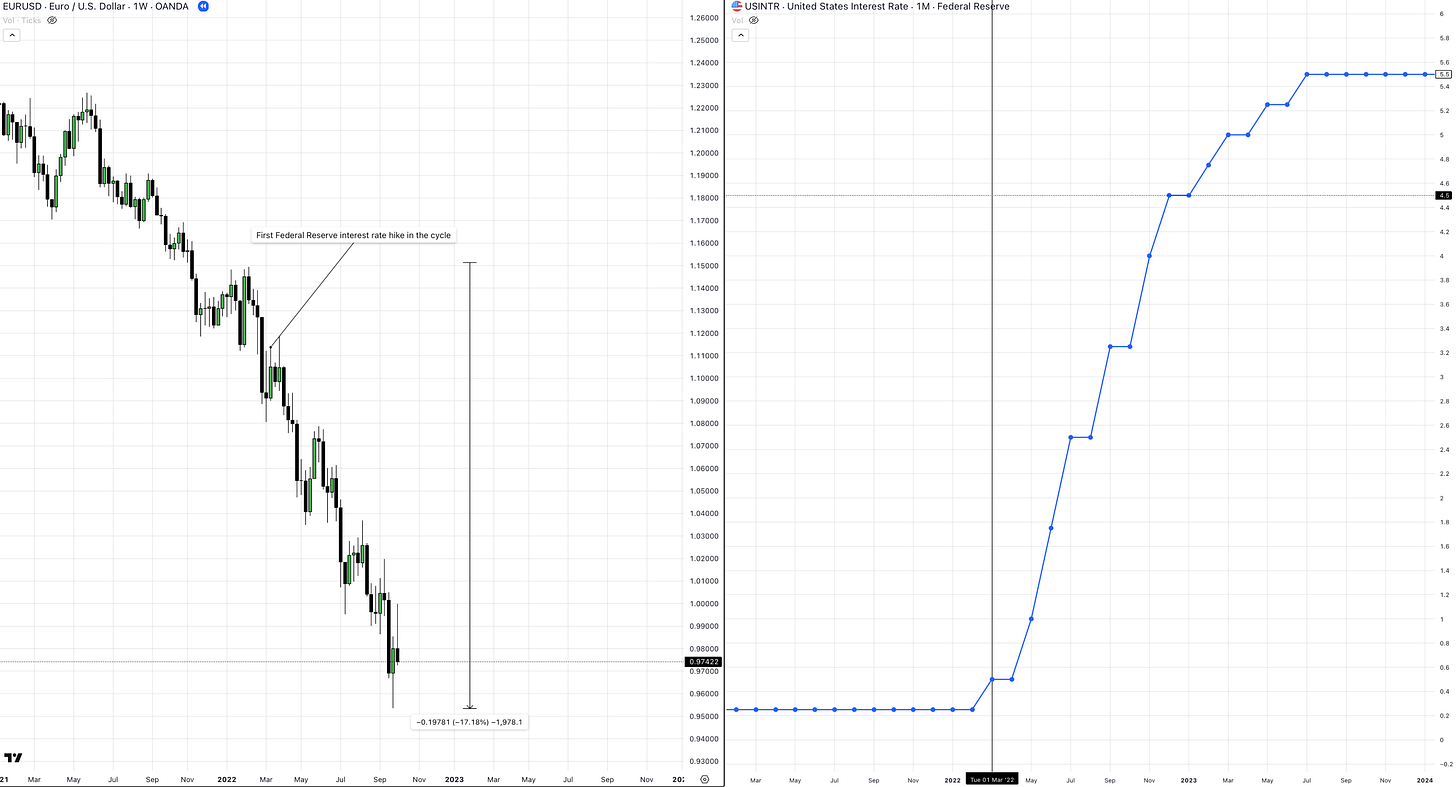

In Figure 3 below, you can see the correlation between U.S. interest rates and the EUR/USD currency pair:

So, you can see from this example that when you couple up the currency of a lower interest rate country against the currency of a higher interest rate country, you can really trade that direction for a while. In this example, the Federal Reserve were hiking rates faster than the ECB, which caused the interest rate spreads (interest rate differentials) to widen. Forward guidance is a monetary policy tool used to give an insight on what the central bank are looking to do in the upcoming meetings, this can also drive currencies due to perceived future interest rate differentials.

Here is an example of forward guidance driving a currency due to perceived future interest rate differentials:

So now you ask - “What do I need to keep a look out for because we can’t just trade once the interest rate has been hiked?”. Correct.

The answer - Anything that has an impact on interest rate decisions, which are:

Inflation readings

Forward guidance from central bankers

Growth (weaker perceived growth will limit the amount a country can hike)

A carry trade is the optimal way to trade interest rate differentials, but not the only way. A carry trade is when you borrow money in a low interest rate country, to then invest in a high interest rate country (buying USD/JPY for example from 2022 onwards).

However, we can still trade interest rate differentials when a carry trade isn’t implemented. Look at this example below:

I’ve kept every example and explanation as simple as possible, it can get a whole lot deeper, but for now this is more than sufficient to capitalise on in markets if you do your own research on top. If you miss the absolute top/bottom of these trends, that is perfectly fine, we are not here to catch tops and bottoms, we’re here to make money. The greatest thing with these IRD trends is that they typically drive currency pairs for plenty of months/years meaning that you can trade that singular direction with the macroeconomic bias on your side, adding to your edge. As for entries, that is each to their own and requires your own technical edge and not something we will discuss here.

Portfolio update

I have predominantly been trading FX in the recent months (with some index positions here and there), c.95% of my gains have come from trading interest rate differentials.

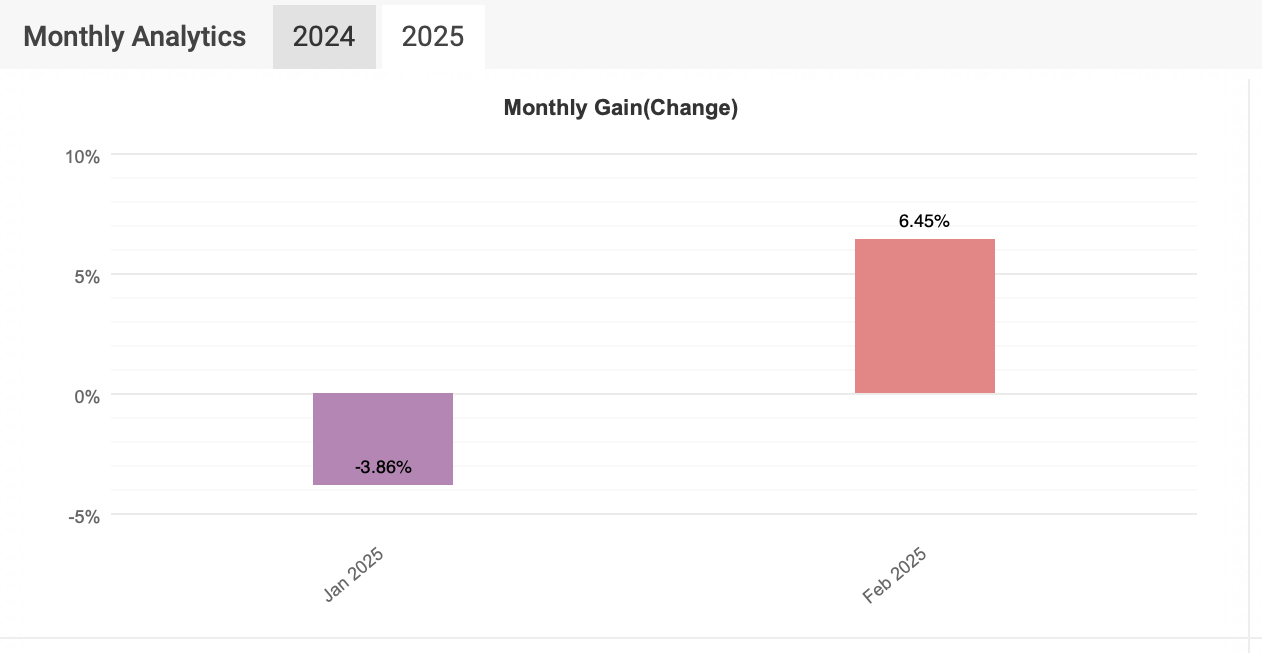

+13.88% since September 2024 and +2.59% in just 2025 so far. The take away from this, as I said in my last report, is that you don’t need every point of every move, but once you have a solid bias (rate differentials here), you can milk one direction.

Of course, you may get caught a few times when the rate differential expectations first begin to spread (as you can see in the loss streak in Figure 6) as the spread of rates may jump around at the start.

Until next week!

This is insightful. Message was clear from the get go. Well done. Looking forward to your next update