Trading Black Swan Events

Alpha focused thinking in times of distress.

Hey crew,

Happy New Year.

I hope you’re feeling just as aligned as I am.

This year has started on the front foot, geopolitical tensions, elections, macro & more.

This is a perfect and timely way to go into depth on how I’m navigating such moments within an elevated geopolitical macro climate this year.

Alpha Focused Thinking: Black Swan

Black Swan events, such as an earthquake, or geopolitical confrontation bring havoc to us. But it is more than that: it brings significant instability to financial markets. Institutional investors feared its unpredictability and potential to erode portfolio value rapidly. Such events, characterised by their extreme rarity, severe impact, and widespread insistence that they were obvious in hindsight, pose a unique challenge to all of us, traders, financial analysts and portfolio managers.

In the meantime, it presents opportunities. Such events are characterised by huge swings in asset prices, and investors sitting on the right side of the trade could stand to realise substantial profit. But how?

This report attempts to offer a conceptual framework for trading Black Swan Events by distinguishing the “inhuman” response during such events and behaviours of different actors, namely governments, households, and corporations.

In simple terms, a black swan event would have two layers of impacts on the financial system:

The Inhuman, Physical Channel: This emphasises the direct physical impact of Black Swan events on infrastructure, resources and the environment, which then translates into economic and behavioural consequences.

Black Swan events often bring about direct and destructive physical impacts on our environment. This can take various forms, each with specific financial implications. For instance, consider a tsunami that devastates a key industrial facility, such as a chocolate factory. In such a scenario, it would be logical to anticipate a negative impact on the factory’s production capabilities and, consequently, its financial prospects. Similarly, a geopolitical standoff leading to the blockage of a crucial shipping canal would likely drive up transportation costs. Direct trade opportunities on global commodities like oil arise in such environments.The Response Channel: Beyond the immediate physical destruction, Black Swan events often elicit responses from various stakeholders, each driven by distinct objectives. In the aftermath of a tsunami, business owners, aiming for consistent profit margins, might reconsider their operational locations to avoid coastal areas. With that the supply-demand dynamics for commercial real estate changes. Post a terrorist incident, governments, striving to maintain public safety, could implement stringent security measures at transportation hubs. These effects, while less direct, can be just as significant in shaping market dynamics and investment opportunities.

Using the 9/11 attacks as an illustrative example, we can clearly observe the manifestation of both the Inhuman, Physical Channel and the Secondary, Response Channel.

The Inhuman, Physical Channel: The immediate and tangible impact of this tragic event was starkly visible in the destruction of the Twin Towers. This led to an immediate need for reconstruction, not only of the World Trade Centre but also of the surrounding damaged infrastructure. This surge in demand inevitably pushed up the prices of local building materials and construction services, as the supply chain strained to meet the sudden increase in demand. The physical devastation thus had direct economic implications, affecting sectors directly involved in the rebuilding efforts.

The Secondary, Response Channel: The broader impact of the 9/11 attacks was felt across various sectors and behaviours. Households, prioritising safety in the wake of the attacks, significantly reduced their travel activities, leading to a pronounced decline in the entertainment, travel, and leisure industries. This shift in consumer behaviour had a ripple effect, impacting airlines, hotels, and related tourism services. These factors all contributed to a sharp economic downturn following the attacks.

Another example of a black swan event was Covid-19. This unprecedented global health crisis, which began in late 2019 and escalated in 2020, has had profound and multifaceted impacts.

The Inhuman, Physical Channel: The most immediate and painful impact of Covid-19 was the devastating death toll across the globe. This loss of life had profound human and social implications. Economically, it also affected various industries, particularly those reliant on human resources and physical presence. The workforce in many sectors was directly impacted by illness and loss, leading to reduced productivity and challenges in operations.

The Response Channel: In response to the pandemic, governments worldwide imposed lockdowns and travel restrictions, profoundly altering economic activities. These measures, while necessary to control the spread of the virus, had wide-reaching economic impacts. Businesses, especially small and medium-sized enterprises, faced significant challenges, many closing permanently due to loss of revenue. The lockdowns led to a shift in consumer behaviour, with a rapid increase in online shopping and digital services.

Just like many of my previous reports, the response channel represents the ‘second order effect’ which spirals far and wide with such events. This is where we as analysts and traders must seek to find underlying opportunities.

2024 Sea of Japan Earthquake

The idea for this report came to my mind after Japan suffered its first earthquake of 2024 just 3 days ago, and instantly I thought to myself, “Depending on the severity, what reaction will we see in financial markets, gold, oil, stocks etc? and do I have any exposure to Japan right now?”. I discussed this in-depth with a member of the MMH analyst team and it became clear that this was a topic which would provide invaluable lessons to you all.

Some may look at this mental mode of thinking as lacking emotion, which in some cases may be true, but when tasked with protecting one’s portfolio from losses and producing ‘alpha’ we must separate emotions from all investing/trading activities.

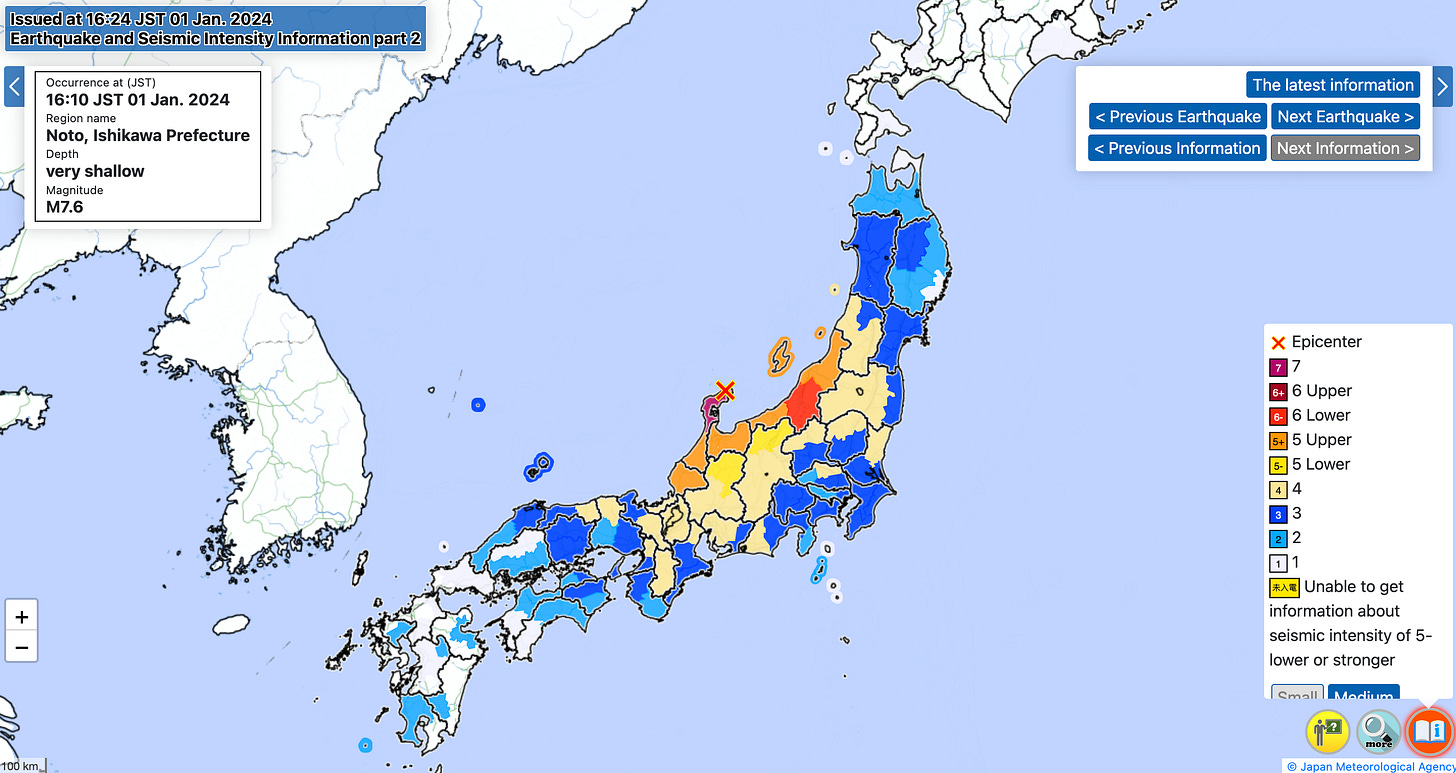

On Monday 1st January 2024, Japan reported the first 7.6 magnitude earthquake since May 30th 2015, when the Ogasawara earthquake struck offshore Japan. As we know, Japan is no newcomer to earthquakes, but that doesn’t mean there are no second-order effects which pose threats to financial markets. Here are a few stats of the 2024 Sea of Japan Earthquake:

A magnitude 7.6 earthquake struck Ishikawa

The earthquake generated ocean waves about 1 meter high along Japan’s west coast and on the coast of neighbouring South Korea triggering tsunami warnings

Tsunami has already made contact in Wajima city in Ishikawa

The death toll stands at roughly 88

33,000 households without power and c.100,000 people were evacuated to evacuation centres.

Using the framework above, here’s “The Inhuman, Physical Channel”:

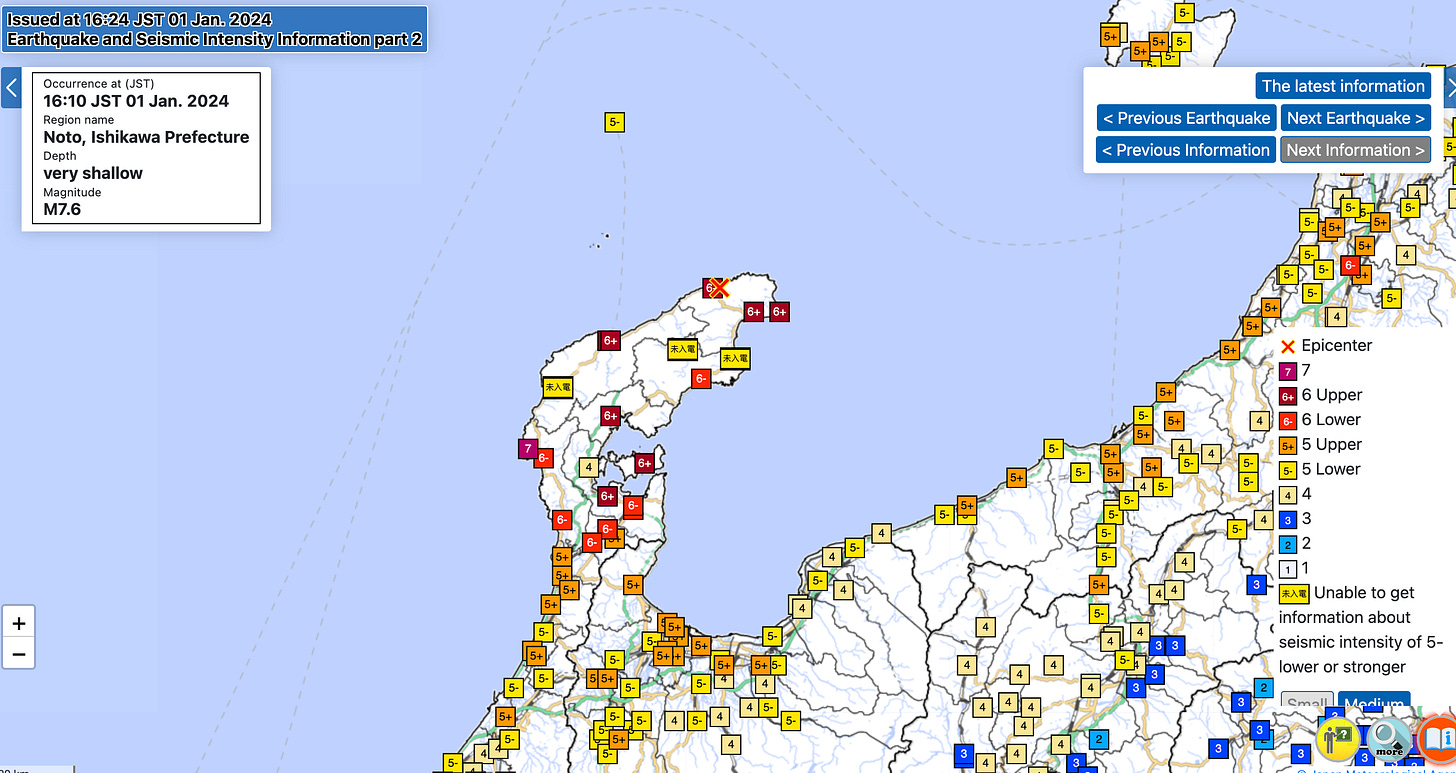

Outside the loss of life, the infrastructure damage remains the largest impact the country of Japan will have to face. Business production will drag as a result of damage to buildings, power outages and disruption to transportation networks potentially resulting in production delays and short-term supply chain disruptions. The below figure provides colour on the intensity of the earthquake.

Figure 1 shows the seismic intensity map of the earthquake. The scale to the right-hand side represents the intensity of the earthquake, with higher intensities represented by the warmer colours. Fortunately, the lower intensity of the earthquake compared to similar historical events appears to have mitigated the potential for widespread panic in asset markets, which I had considered as a possible scenario. It is in the widespread panic that we see huge moves across global yields, namely treasuries due to Japan being the largest foreign holder of US debt and a flock to safety.

At 16:10 JST, the earthquake's intensity peaked at the epicentre, exceeding 6 on the JMA scale. This level indicates a high risk of destructive shaking and significant infrastructure damage, ranging from moderate to severe.

Post the peak of the earthquake nearby the intensity and magnitude dropped significantly marking the end of the 2024 Japan earthquake.

Investment Implication: Black Swan

In the immediate moments, it was unclear as to how intense the earthquake was, which prompted me to draw up several precautionary trade ideas. Here are a few I instantly created:

Long plays:

Gold

Japanese construction stocks

Short plays:

Sell out of Yen longs

Oil shorts

Japanese residential/commercial real estate providers

My consensus

Long Japanese Construction

The construction play is still viable and in the research process before executing the trade. Considering the recent significant movements in the Japanese construction sector analysing whether the trade still has any legs is most important, as being late to a trade is just as bad as being wrong.

Gold Longs

My gold idea has been removed. The severity of the quake won’t be enough to warrant widespread panic and a rush to safe-haven assets which nullifies the need for the short-term idea.

Oil shorts → Oil longs

Across the river, the ongoing tensions across the Middle East and the escalation of conflict in the Red Sea amplify the price volatility of oil forcing prices higher. As a result, my view has shifted from looking short to neutral/bullish with more digging to do on the geopolitical winds behind the commodity. The Red Sea provides direct access to oil-rich countries in the Middle East, including Saudi Arabia, the UAE, Iran and Iraq.

The geopolitical tensions at play have kickstarted oil to a year which we can only expect further increases volatility. Over a dozen countries including the US and UK have issued statements and warnings to Iran to end their support of the Houthis, the Shia Islamist political and militant organisation, who have attacked vessels on the Red Sea along the Suez Canel, a major transportation chokepoint for global energy flow. The result of the continued escalation is higher oil prices which in itself presents an opportunity provided one can account for the geopolitical risks within the trade.

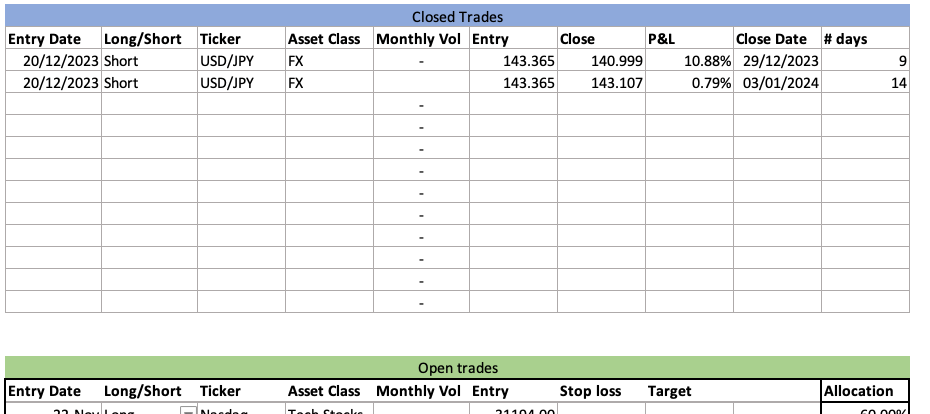

Yen Longs made futile

As a result of the Japanese earthquake, I closed the second position within my trade idea on a strengthening Yen and a BOJ set to pivot. The earthquake adds additional difficulty for the BOJ to move away from an ultra-easy monetary policy. The Japanese government will have to raise finances, by issuing bonds and rediverting budget to support the rebuilding of Ishikawa and neighbouring areas damaged by the quake. The damage to the economy will put a dent in the productivity of businesses and therefore put downward pressure on the ability of the Japanese economy to maintain robust inflation above 2% which will convince the BOJ to step out of its negative policy framework.

As a result, my dollar yen shorts reversed with the price returning to my entry forcing me to close out the position in expectation of a weaker Yen as the earthquake puts a halt in the BOJ’s potential hawkish pivot.

As I embark on future macro positions and plays I aim to share with you both my thinking behind such positions and my framework for turning trade ideas into high-conviction plays.

As always, I aim to keep this principle whenever deciding on an investment or trade, and that is:

“Strong opinions, weakly held”

Thanks for getting to the end.

This deep dive into black swan events is an important one, especially in the environment we’re entering with geopolitical tensions at multi-decade highs.

I’d love to hear your thoughts!

Hey, if the case was BoJ will have to maintain ultra low interest rates. How comes you weren’t thinking of buying UJ?

Im always locked in on your reports! Beastmode. A beast you are. In your own world!