Trade Outlooks: Thematic Macro Plays

Exploring future opportunities in the macro landscape

Hey crew,

Recently, I’ve noticed this newsletter has begun attracting a number of finance professionals, particularly within the banking sector, names from top banks and firms so I appreciate you all sharing and subscribing.

As we transition into 2024 I want to highlight my viewpoints on potential macro plays that I anticipate emerging as good risk/reward positions.

Lastly, as it’s Thanksgiving in the States today, and black Friday very soon globally I have a little treat for you all, tune in to tomorrow’s report.

For now, enjoy the report.

Fixed Income Overview

Throughout 2023, the key themes in global macro have been navigating rising inflation to disinflation, rising Treasury yields across the long end, tightening of monetary policy, and large fiscal spending from the US government, which has helped keep US economic growth robust.

To understand where we are going, we must understand where we have been, and most importantly, why. Interest rates have been the foundation of every single macro move throughout the year. Year-to-date yields across the front end of the curve, the 2s, have rallied by slightly less than 50bps, which may not seem like a lot, but when expanding our perspective and horizon, we see that throughout 2022 yields on the US 2y rallied by more than 370bps.

This sharp rally is a result of the Fed hike of 2022 which started in March. Comparing the move across short-dated bonds to long-end bonds you can see that the longer-maturity bonds showed a similar yet significantly smaller reaction to the US2y.

Yields on the benchmark 10y rallied 200bps through 2022, and a further 83bps in 2023, more than its 2y counterpart. The reason for the latter move in 2023 is key for understanding what we’re seeing in bonds right now.

That reason is simple, investors are viewing long-end bonds with two key questions.

“What term premia am I being paid to hold this bond?”

“What is the implied interest rate over this horizon?”

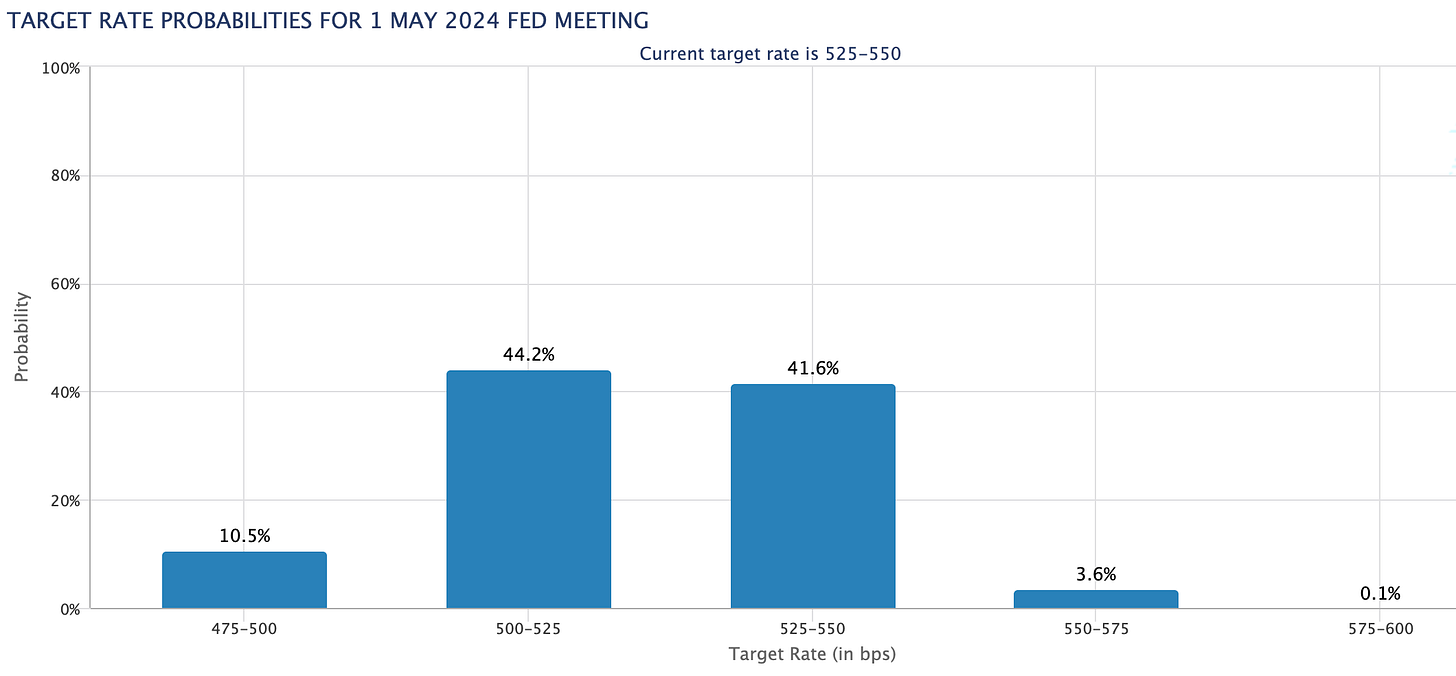

Term premia for those unfamiliar with the term is the additional yield an investor demands for holding long-term bonds. Implied rates are the market’s expected interest rate based on interest rate options. So in layman's terms, implied interest rates are a way to estimate what investors believe the future interest rate will be. To make this easier to understand, think of the CME Fedwatch tool, something you all are familiar with which shows the probability of a Fed hike, pause or cut. That is an example of an implied interest rate tool, it calculated the probability of interest rate movements based on a number of futures contracts.

This increase in the term premium on the 10-year bond is an immediate reaction to higher yields on short-term bonds, as demonstrated above. Duration risk is a genuine factor which investors demand compensation for. Without adequate compensation, investors may as well continuously roll over T bills, such as the 1-month, 6-month, and 12-month bills, all of which are yielding +5.25%.

So, those two key questions represent the rally we’ve seen in long-term bonds, additional reasons would be the expansionary and inflationary fiscal policy of the US government which raises the creditworthiness of US debt before credit rating agencies and thus investors.

The Proxy Trade: 2s10s Reversal

The shift in the treasury curve can be explained through this chart right here, the 2s10s curve. This is the spread between both bond instruments. When the 2s10s curve flattens or inverts this is called a bear flattener. Something I explained here.

A bear flattener occurs when short-term interest rates rise faster than long-term interest rates. For example, the 2-year Treasury yield may rise faster than the 10-year Treasury yield. Bear flatteners typically occur when the Federal Reserve is raising interest rates to combat inflation. This is because investors expect higher rates to lead to lower long-term economic growth and inflation expectations.

Looking forward, the 2s10s has been inverted due to the large front-end Fed hike; with the Fed tightening cycle over, I expect the 2s10s curve to return to positive ground as a result of the short-end of the treasury curve falling faster than long-term rates in anticipation of a Fed funds cut which, based on implied rate expectations will come by May of 2024.

As opposed to expressing this trade idea through fixed income, via trading the 2s or 10s, my conviction leads towards a weaker US dollar presenting a short opportunity on the UUP 0.00%↑ (US Dollar ETF) since one can’t physically trade the DXY over the counter.

The timing of this position is crucial. Entering the market too early or too late is just as bad as missing the trade, so I’ll look to execute this position by the new year.

My reasoning for looking short on the dollar is this, the Fed has reached the end of their hiking cycle, and of recent YoY CPI came in at 3.2% whilst the core was slightly higher at 4.0. From Fed statements, we know that the remaining tightening of monetary policy will be transmitted through higher real rates which currently sit at 2.3% when adjusting for CPI YoY and by May 2024, the Fed is expected to begin its cutting cycle which is expected to take off at least 75-100bps from the Fed rate. The short end of the yield is highly sensitive to changes in the funds rate, so a removal of 100bps or less will inevitably result in yields on the 2y declining.

My short on the UUP 0.00%↑ is a proxy of my viewpoint that yields on the 2y will decline, resulting in weaker flows to the Dollar as holding the dollar and T-bills become less attractive due to lower yields.

Policy Normalisation, Yen Longs

Japanese markets have always been an interesting market for me to research into, their disregard for conventional monetary policy tools makes them a central bank to closely watch.

The weakening of the Japanese Yen is of no surprise to all of you reading. Widening yield differential vs G10 currencies + a super accommodative BOJ monetary policy outlook resulted in a rally through 2022 which resulted in two separate interventions by the MOF.

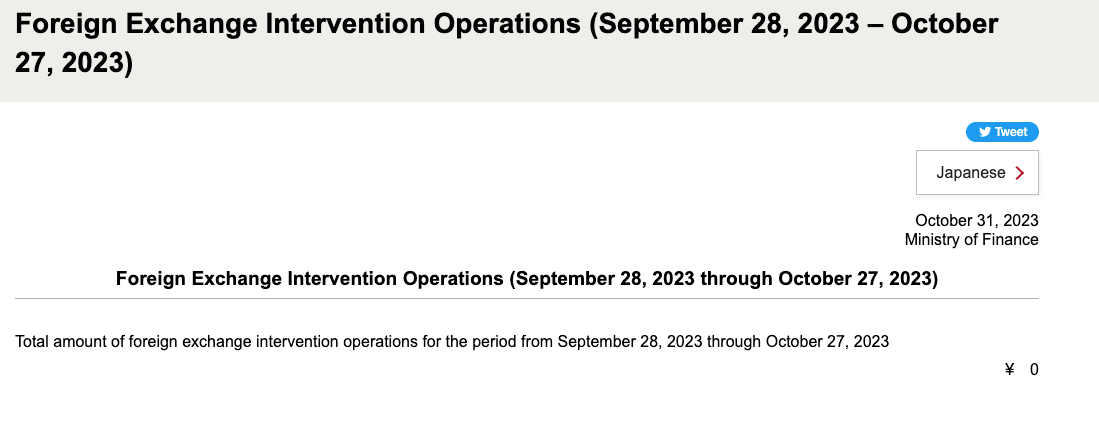

Since early October, there have been a number of speculations on whether the MOF intervened, driven by the sharp move on the 3rd of October, but after diving into the MOF’s currency books there’s no evidence of a currency intervention from Japan.

With all that said, the Yen remains in an increasingly weak position. This creates problems for the Japanese economy, businesses importing goods, materials, and metals are faced with higher import costs which cuts down their margins. Eventually, that additional cost is passed onto consumers.

On the commodity side, Japan’s economy is dependent on imports for 94% of its primary energy supply, with over 80% of that coming from the Middle East alone.

The pressure of a weak Yen is a problem for BOJ Governor Ueda, but as he has reinforced, the way out of ultra-loose monetary policy is when inflation sustainably reaches 2% over the long run.

Betting on a BOJ interest rate pivot is a game with no end, which quite frankly, isn’t wise. However, analyzing the recent actions of the BOJ and the yen's movements suggests a further adjustment or potential removal of yield curve control (YCC). I believe this process is already in motion. During the July meeting, the BOJ decided to raise the 10-year Japanese government bond (JGB) yield ceiling to 1.00% from 0.5%. While the market's initial reaction perceived this move as relatively soft and dovish, a closer examination of Japan's economic climate suggests that gradually diminishing the relevance of YCC by allowing the 10-year JGB to trade freely is a step towards abolishing this initiative altogether.

The anticipated tightening of Japanese monetary policy amidst a Fed easing creates the perfect opportunity for Yen's strength. The MOF will remain and act as a last line of defence, hence why I can’t see the Yen trading above the 152.000 region for a sustained period before Yen sellers begin to buy out of their positions.

The structure of this position presents a good downside potential which I will keep you all up to date as and when I execute.

I’ve still got a few more ideas, one being my pending oil play, which I’d love to share with you all, but for the sake of not making this report too much of an extensive read, I’ll save those positions for another deep report.

As always, I appreciate your readership!