Trade Outlooks: Factoring Geopolitics in Macro

A inside view on using history to assess the potential for geopolitical crisis.

Hey guys,

This note is slightly later than anticipated, thanks for your patience.

Based on the macro and geopolitical events that have transpired since H2 commenced I think it’s time for a report covering my biases, views and trade ideas mid-execution.

This is pt.1 of a two-report series.

Update on my short outlook for Crude Oil

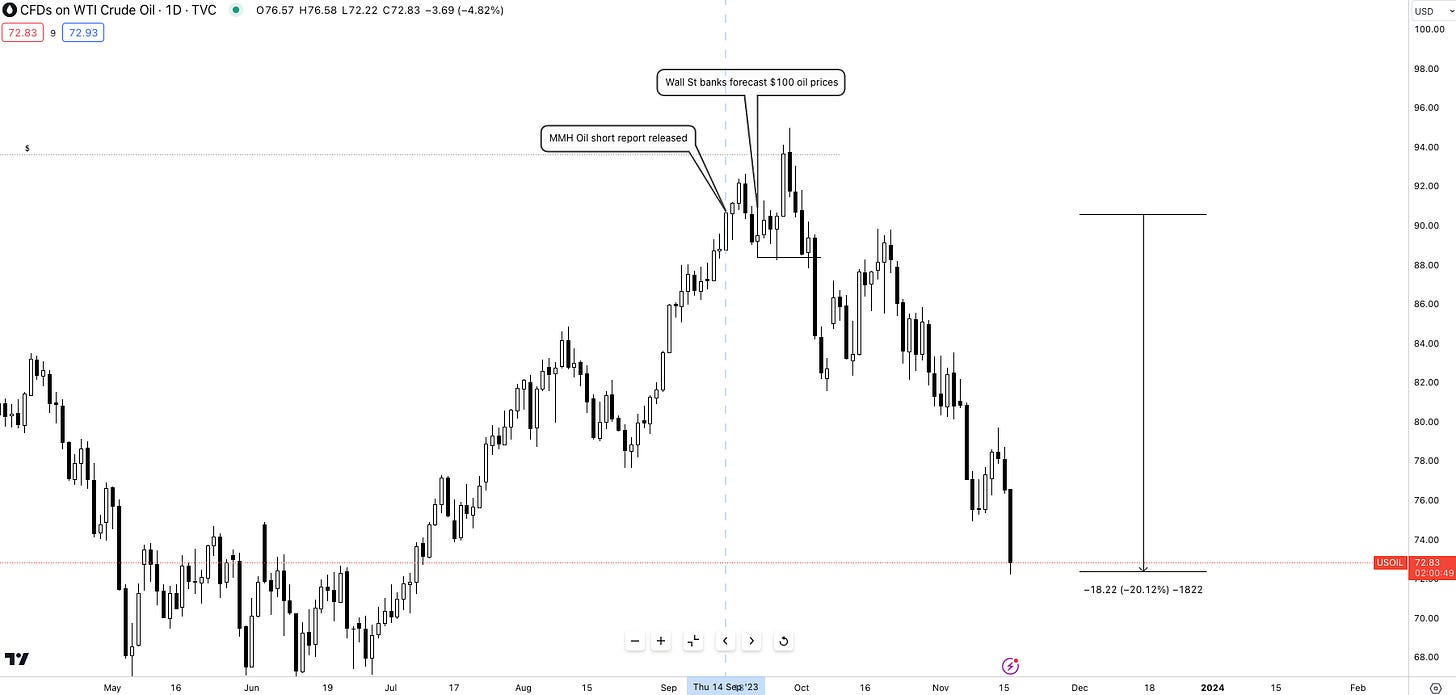

As many of you will know, I’ve been very vocal about my bearish viewpoint on USOIL, dating back to mid-August when I felt there was a disconnect between prices and demand levels, but most notably when I published a report analysing its price level waiting for confirmation.

That was Sept 14th, here’s the report in case you missed it.

The Oil Pendulum.

Hey guys, It’s a late one I know. Thanks for your patience. I’m confident you’ll take a lesson or two away from this report, even a trade idea.

The analyses in this report are very much valid and at play right now so my viewpoints shared here are neither outdated nor irrelevant to market conditions.

Let’s look back at this move and explore reasons why it may have played out well as well answer the main question, "Does this trade have any legs in it?” meaning, is there still a viable risk/reward position available in this position?

Timely, to say the least.

As annotated above, I released my report on the 14th of September, amidst a flurry of analysts at tier 1 banks calling for oil to top $100 per barrel. To further tilt the scale, this rally seen from June 2023 until late September was the largest rally observed on the global commodity since December 2022 when oil rallied from $62.50 p/b to $130 p/b.

I share these screenshots so as not to say I know markets any better than the head of commodities at GS but to emphasise the importance of independent thinking.

This is something I’ve learned to implement from studying economic giants like Ray Dalio, something he discussed many times. The power of creating your own thoughts and ideas, and most notably, not being afraid to bet against the crowd. Expressing this in financial markets, especially macro is even more challenging; battling your own thoughts of whether your analysis is thorough enough, and then having to sit on the opposite end of every ‘top analyst’ can make you question your viewpoint. However, in moments like this staying true to your investment/position framework is vital.

Post my publication on the 14th of September, Wall St and Main Street began calling for $100+ oil prices around the 21st of September as the commodity neared the $91 p/b handle. From my report, the commodity rallied another 4.85% before prices declined 20%. Once oil broke the $88 p/b mark my bias was confirmed and I was ready for entry, waiting for a deeper retracement back to the $86-88 handle. However, the one thing I failed to anticipate was the geopolitical factor, Israel-Hamas, which ultimately caused me to abandon the position due to lack of certainty amidst a war in the Middle East which presented a scenario where the additional volatility in oil would have made this trade increasingly riskier.

Looking back, do I regret holding back from this position? No.

On the dawn of the Hamas attack, Oct 7th (Saturday), reports came out with little sense of the potential tail risks, but as the situation evolved and the stakes both humanitarian and geopolitically rose, the risk of sovereign states across the Middle East escalating tensions became a risk I simply wasn’t prepared to take. In times of geopolitical crises, the risks posed to the financial market are elevated. When trying to understand oil’s reaction to geopolitical and financial crises, history is the best teacher. Just in the last three decades, we’ve experienced several different geopolitical and financial crises, and that gives us data points to look at in relation to how asset markets, particularly oil performed to give us an accurate picture of its price volatility.

Some of those geopolitical and financial crises include the Gulf War of 1990-91, the Asian financial crisis of 1997-99, the Dot-com bubble of 1995-2000, the US terrorist attack of September 11th 2001, the GFC of 2008, Covid-19 of 2020-21, the ongoing Ukraine-Russia conflict and of recent the Israel-Hamas war.

As you can see, keeping count of the geopolitical and financial crises that have happened over the course of 30 years is challenging, and that list doesn’t cover all events of that nature which have occurred.

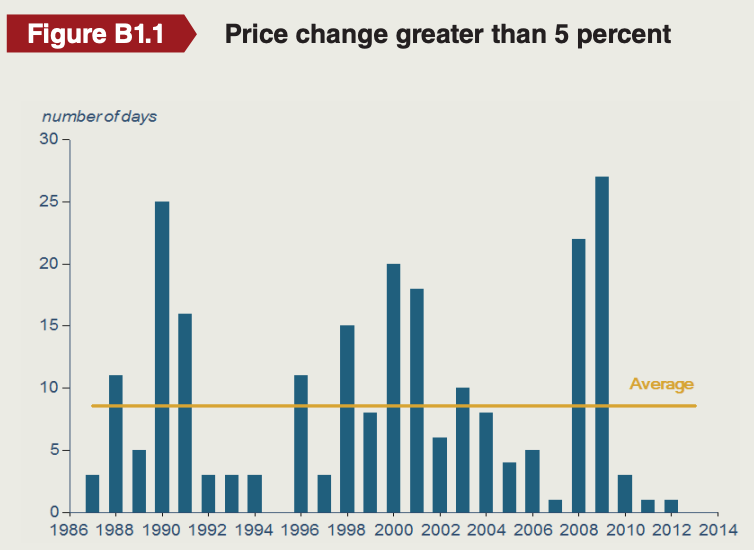

Below we can see the chart showing the number of days where the price change of oil was greater than 5% in a single day dating back to 1986, just before the Gulf War in Iraq.

During the Gulf War from 1990-91, oil prices changed greater than 5% on 25 days in 1990 and another 16 days of + 5% daily price movements in 1991. Now if we observe how the spot price reacted to the Gulf War the volatility is expressed through the commodity’s price action.

A clear observation regarding the relationship between crises and oil prices is that any form of conflict, even if it doesn't directly disrupt supply chains threatens the stability and reliability of oil prices. This vulnerability stems from the potential for trade and transit routes, along which oil cargoes travel, to be disrupted or rerouted due to ongoing conflicts. If you’re wondering why, consider the different factors that contribute to the production and pricing of oil. One key component of getting oil to consumers is transportation. Container freight rates have a significant impact on both the cost and price volatility of crude oil.

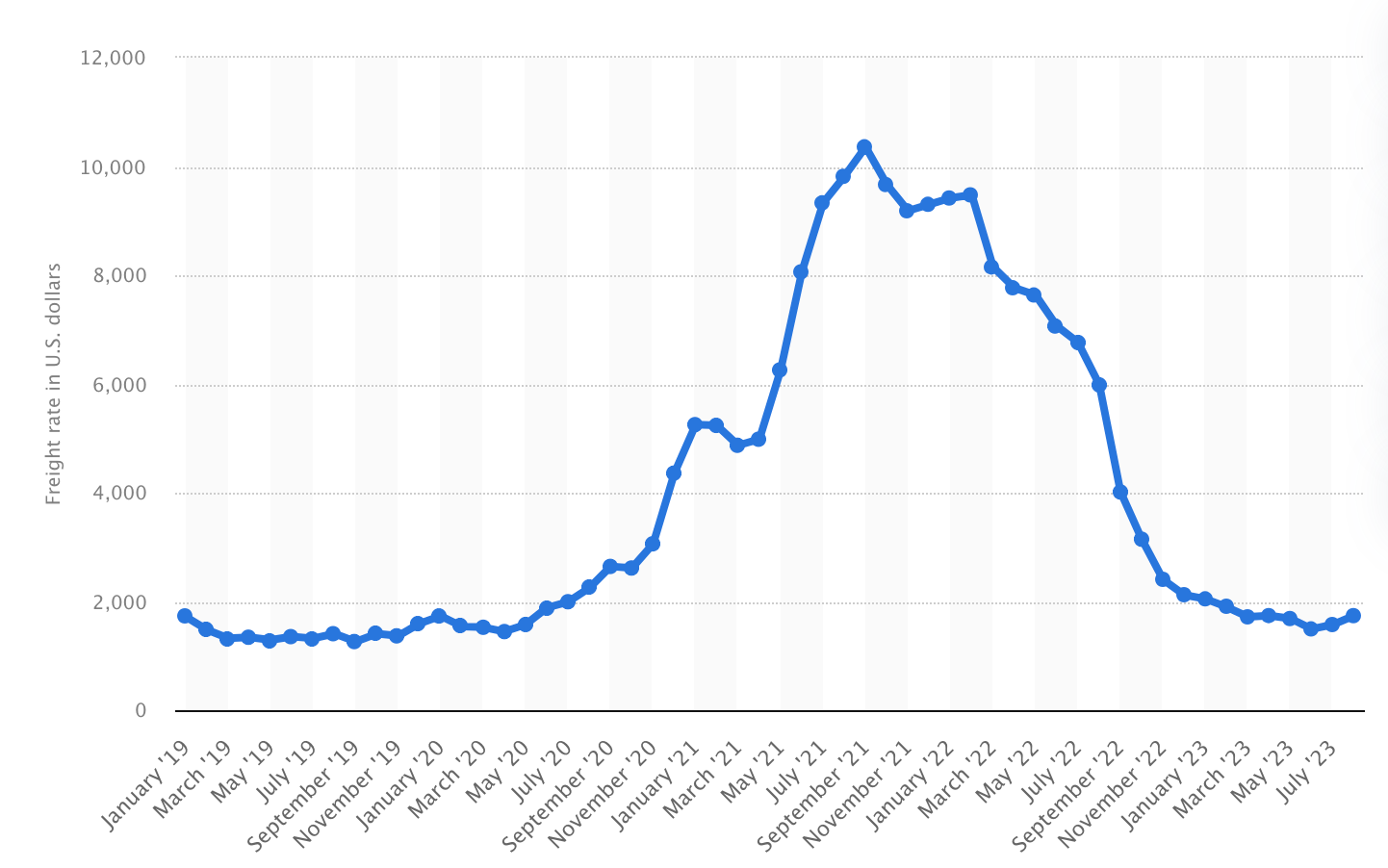

Post Covid-19 was a great example of the relationship between oil prices and freight rates globally, as freight rates quadrupled practically over 12 months the cost of oil subsequently began its steep rally from the lows of negative $38 p/b to $100+ p/b.

This report was the first of the series reviewing my thought process of navigating the geopolitical risks with my trade ideas and how understanding previous cycles of geopolitical tensions can help one assess current risks appropriately. In my next report, I’ll be diving into my current trade ideas, and execution points, including oil’s future potential return, opportunities across FX and more.

If you would like to see more idea creation and trade thought process then be sure to let me know, it’s something which I feel we can all benefit from.

Until then, I appreciate your readership and support.