Themes of the Week: G4 Outlook

Japan Wobbles, Rates Reprice, Commodities Rip

The street is shouting for a December melt-up just as most are already maxed on risk and short on patience. Into month-end and year-end, the trade may be less about the rally itself and more about getting paid before everyone else runs for the exit.

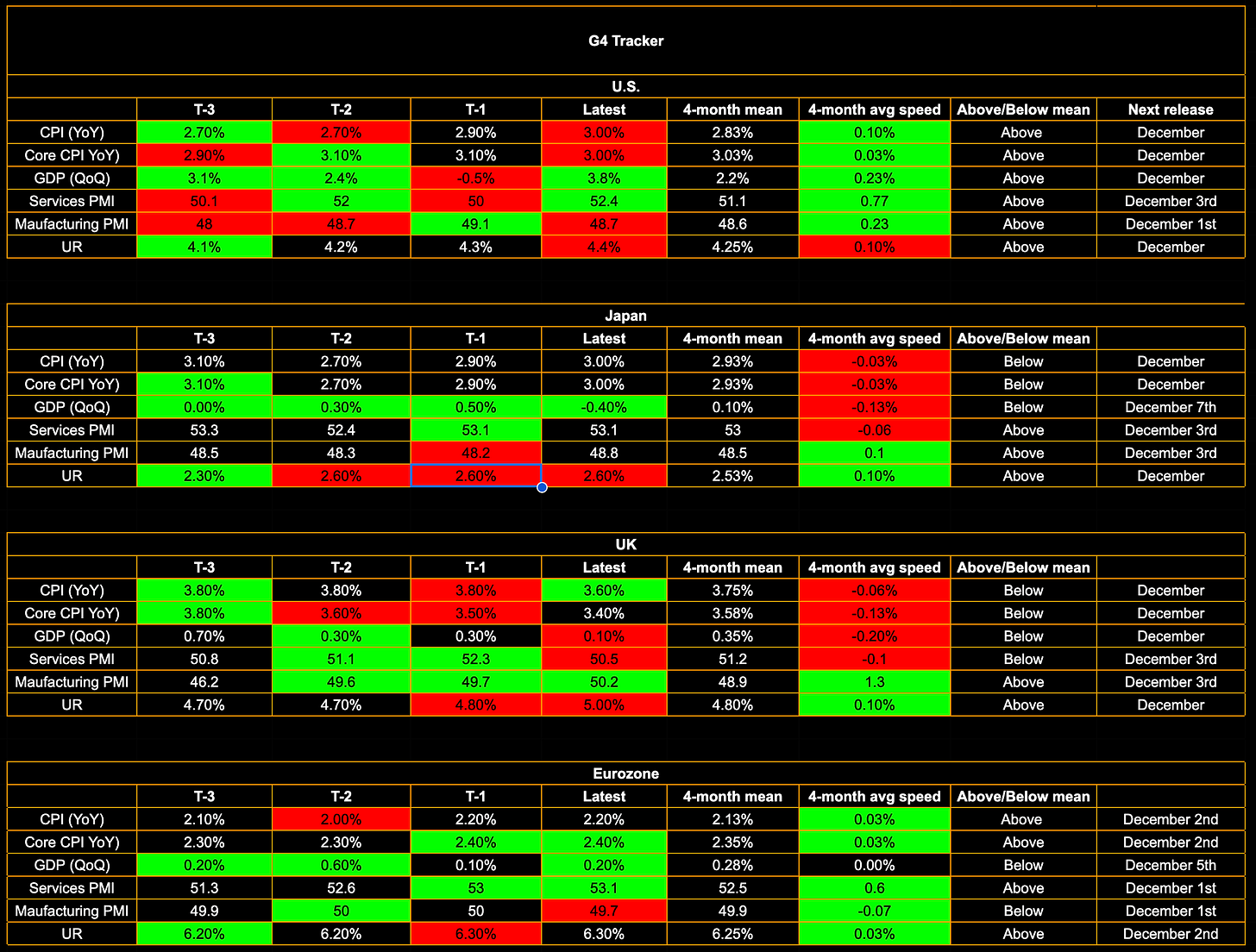

G4 Tracker

Going into the week, the December rally is on everyone’s mind. This week is not packed with data and honestly I like those weeks, quality data rather than quantity. There is nothing worse than trying to cover every single angle of the market while also developing models and keeping up with a firehose of releases.

Anyway, my focus is on Eurozone CPI and PPI, key inflation metrics that will give the market a bit more clarity on where the ECB terminal rate sits and how future ECB communication might evolve. Eurozone inflation has been under control since April, which is why we have seen rate differentials widen so much on crosses like EUR/GBP and EUR/USD. What has really grabbed my attention is that these rate differentials have not been the driver of a stronger euro (consider the fact it is the 2nd most liquid currency, while the dollar has been weakening too). EUR/GBP is up over 5% and EUR/USD is up more than 7%. A stronger currency has basically allowed the ECB to sit on their hands, while the BoE and the Fed have walked themselves into a horrible corner where inflation is sticky, especially services inflation, which is notoriously hard to drag down, while labor growth slows or, if you are in the UK, growth in general slows.

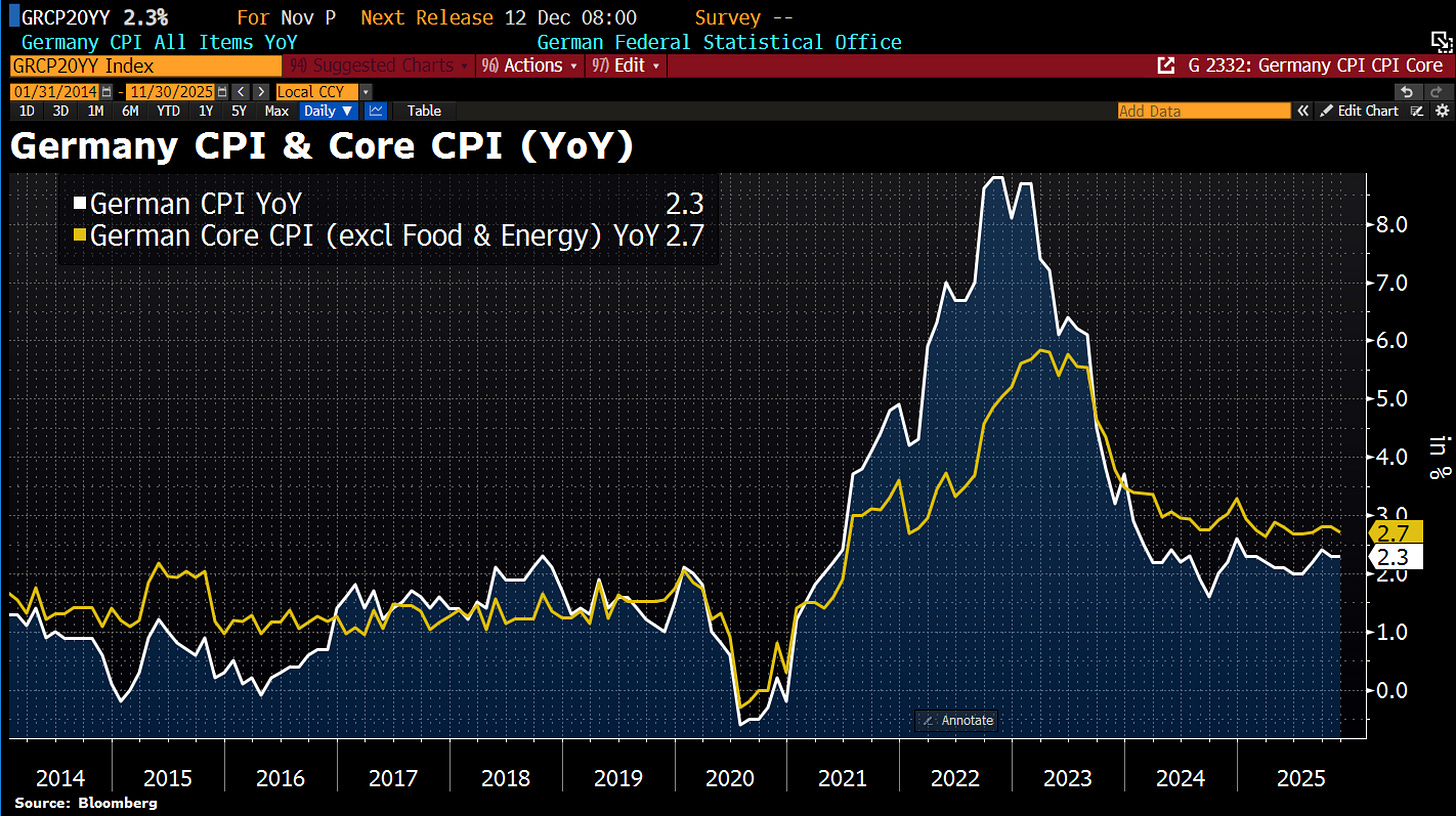

The tail risk to the ECB potentially turning more hawkish is the fact that one of their main members is struggling to get inflation under control. Germany’s inflation rate is still sitting stubbornly above 2%. In November, headline held at 2.3%, while core eased only slightly from 2.8% to 2.7% and services inflation is stuck at 3.5%. If this continues to tick up, I think we are likely at the terminal rate for the ECB, but if the range persists, then we’re likely 25bp away from the terminal rate. The headline Eurozone figure can be deceiving given how many members sit under the umbrella, so I prefer to focus on the main players. But let me be clear, I am not saying the ECB will re hike, even if Germany’s inflation hangs around these levels for a while.

So why would the ECB avoid re hiking? The simple answer is that it would imply they got it wrong. Once you begin a cutting cycle, the bar to hike again becomes extremely high. The only situation where the ECB would consider re hiking is if inflation was re accelerating across the whole euro area, not just Germany. That is the fragmentation risk the eurozone always lives with. I do not think this is a real cause for concern. Germany’s inflation will likely continue to drift lower, but it is a tail risk I watch. Fragmentation matters. The 2s10s curve gives us the best read on policy expectations at the front end and growth expectations at the long end. It is pricing higher future inflation and growth, but crucially, it is not pricing a hawkish ECB that comes back with more hikes. That is good, because it is unlikely anyway.

I am not going to dwell on the ECB inflation prints too much because, honestly, they probably will not change anything. There is not much coming out of the UK or Japan this week either, at least not anything that really matters, unless you count Keir Starmer possibly jumping in front of cameras to insist that neither he nor Rachel Reeves misled anyone on the economy. Why would they, right? For context, Bloomberg’s headline was, “REEVES: ‘OF COURSE I DIDN’T’ LIE ABOUT SCALE OF BUDGET HOLE.” So now we will likely get Starmer emphasising all the great work they have done and how they inherited a terrible economy and heroically cleaned it up. Reality is they probably did know and lied. Shocked? No.

Across the pond, we have entered the Fed blackout window so I am not paying attention to speeches. What I am focused on is the November ADP report Wednesday, jobless claims Thursday and PCE Friday. We have seen just how reactive the Fed has been to labor data, even in the face of strong inflation, although inflation swaps and general inflation pressures have ticked down recently.

Markets are pricing an 87.6% probability of a 25 bp cut in December. It will take a lot to meaningfully shift that, but this is exactly why I am paying attention. If the data comes in way off expectations, we could see pricing fall, maybe even down to something like 60%, which would be enough to move markets. I still think we get a cut regardless, because this week’s data is not strong enough to overturn the broader trend and Fed communication, but I am watching for changes in pricing. Any change creates a domino effect across markets and can spark real moves.

The issue is that a shift from 87.6% to 95% for a 25 bp cut would not spark a huge rally. Sure, you might get some upward drift but nothing major. But if expectations fall to 60 to 65%, that is basically a 50 or 50 “not sure” setup. I don’t think this is the base case, but it is the reason the data matters. In SOFR contracts there is about 14 bp of cuts priced. This could easily shift up after this week’s releases. Bonds may have already found their ceiling.

We know the Fed is always watching PCE. It has ticked up from the May low of 2.1% and the most recent reading for August was 2.7%. This data is backward looking because Friday’s release covers September, and inflation swaps have already signaled that pressures continue to move lower. But if PCE comes in even 10 bp above expectations, which sit at 2.8%, and if ADP surprises above 100k with jobless claims below 220k, that combination could nudge the Fed’s confidence.

As for Japan, there is not a tonne of data but there is plenty to watch. Japan’s 2 year yield just spiked above 1% for the first time since 2008 on rate hike fears. At this point, I think they will skip a hike in December given the pressure it is causing, the lack of growth and the fact they just rolled out a stimulus package that I talked about in last week’s outlook.

Trade updates

Copper has rallied since I flagged the idea in the chat. Any move higher in SOFR pricing toward a 25 bp cut will support it. Still around 200 bp of risk here.

Gold is running risk free and in heavy profit. Same story as copper. If the SOFR curve leans closer to a 25 bp cut, it supports the position.

Euro futures from last week are running at a loss. I will look to hedge as we approach stop levels. No surprise here given the sheer change in US rate expectations across the last trading week.

Have a good one!