The Yuan Trade & The Bull Dollar

Here's why my conviction is a weaker Yuan

Hey guys,

It’s been one of the most hectic weeks of the year yet.

The guide is out in a week.

I’ve got a church conference in a few days, so I won’t be as active later this week.

Nevertheless, the work must be done.

No excuses.

I’m short of time so I’ll hold back the usual life lesson. So let’s get into this detailed report on why further weakness, longs, on the Yuan is a high conviction trade based on a macro comparison of both the U.S and China.

As always, lend me your attention:

The PBoC vs the Fed

The Yuan has been a central focus point over the past few weeks.

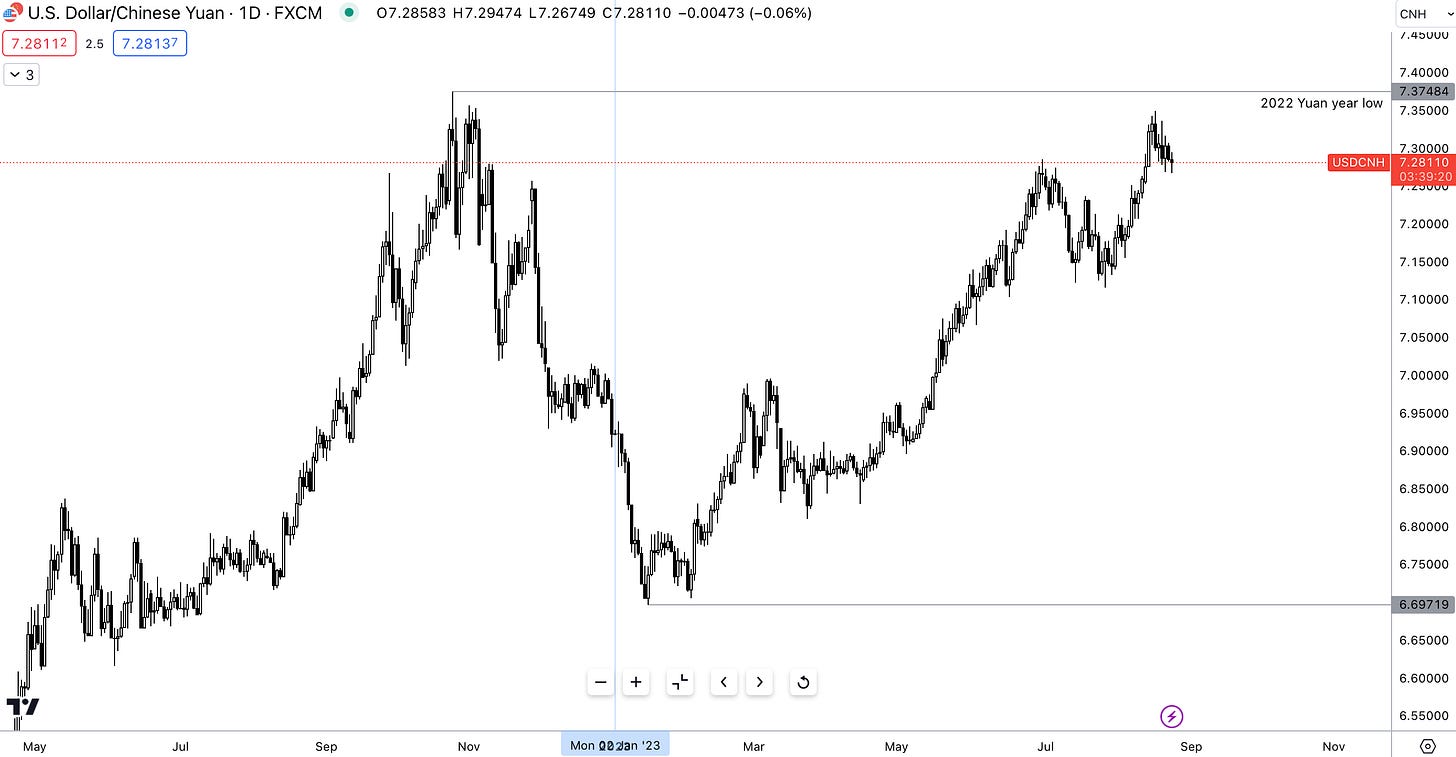

Mainly because we have seen a +6.47% move in CNY 0.00%↑ this year, taking the Yuan to 16-year low territory of 7.2800, all whilst watching the collapsing property market in China.

Before I get into the different economic data points, I want to walk you through how I’m building this macro position from a framework perspective. I’ll start by comparing the two central banks and their respective policy:

Doves will be doves

This seems to be a common theme among central banks within the Asia region, maintaining their dovish accommodative policy regardless of the global hiking cycle.

The PBoC dropped the LPR (loan prime rate) another 10bps on Monday to a low of 3.45%.

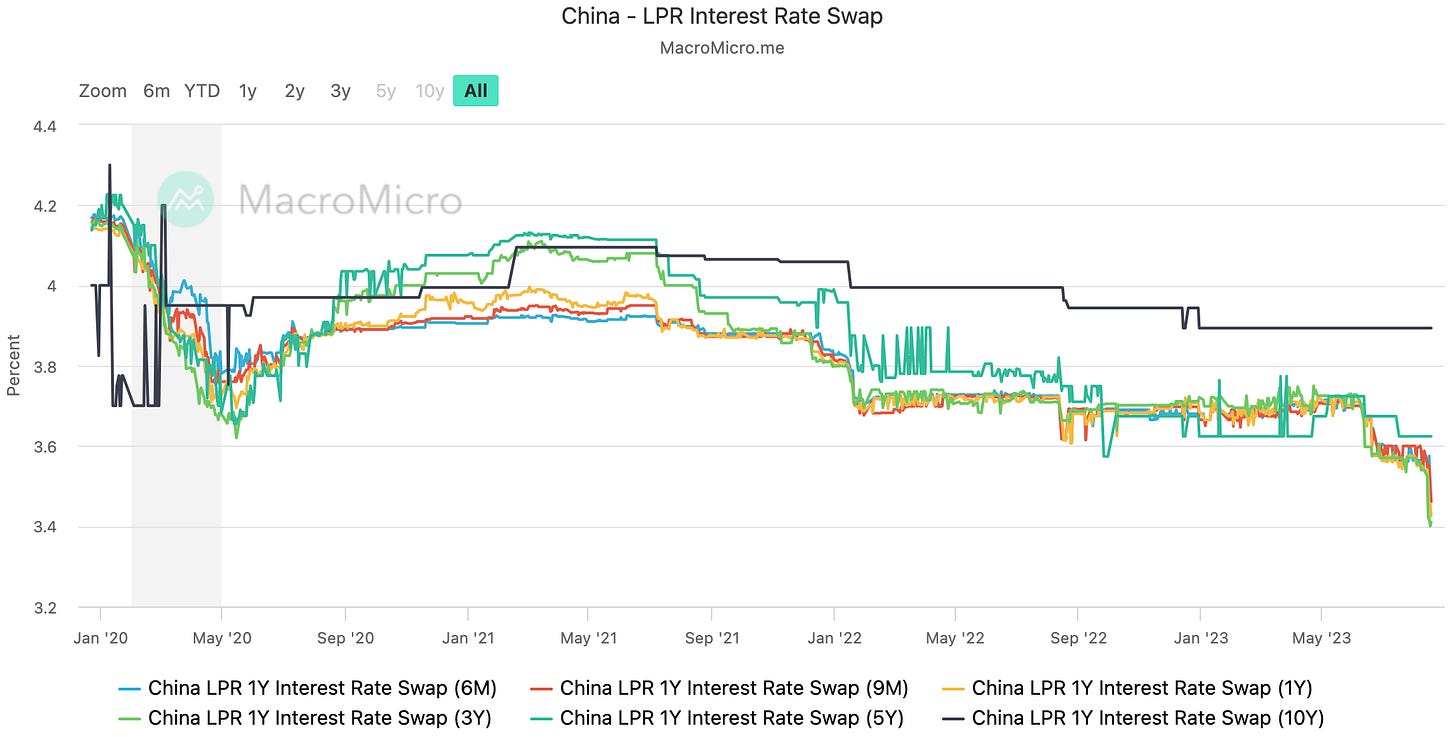

When looking at interest rates, rate swaps in China paint the same picture of lower rates in the future for China meaning investors’ and market makers’ overall consensus remains bearish for rates in China.

This is the interest rate swap for China, the maturities for these instruments range from 6M (6 months) to 10 years as seen. “But what is an interest rate swap you may ask?”

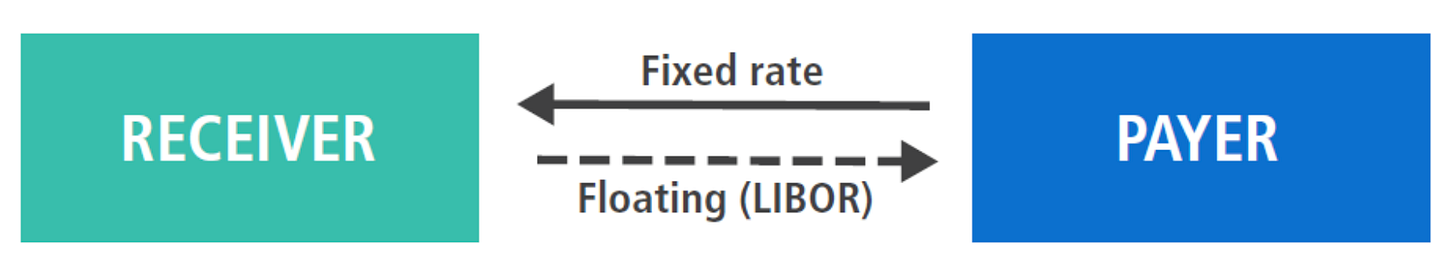

Here’s the best explanation that I could find.

PIMCO defines this to be “an agreement between two parties to exchange one line of interest payment for another, over a set period.” PIMCO is one of the world’s largest fixed-income asset managers so I’d take their word for it, but let me dive a bit deeper and explain it in laymen’s English.

In an interest rate swap agreement, there are two parties, for this example we’ll use company A and an investment bank (who are the market makers for these agreements). This swap agreement is a way for company A to hedge against interest rate volatility. If company A knows that it will be borrowing money for a long period, say 4-5 years, to fund its company, the risk presented is that the cost of borrowing increases making capital difficult to acquire.

As we’ve seen over the past year, interest rates can move 300-400bps over a single year, that’s a risk many companies simply cannot afford. To protect itself against such occurrences, company A can use an interest rate swap to lock in a fixed interest rate for the 4-5-year term it requires.

Here’s the visual on how that works.

So, company A benefits from securing a fixed rate, and will profit if the floating rate SOFR (since LIBOR is no longer in use) is higher than the fixed rate being paid.

Enough about derivative contracts and interest rate swaps, the point is, when looking at the cost of these swap agreements in China the overall direction of where rates are headed is towards lower rates predicated on weak Chinese conditions.

The Fed, U.S Consumers & Chinese Data

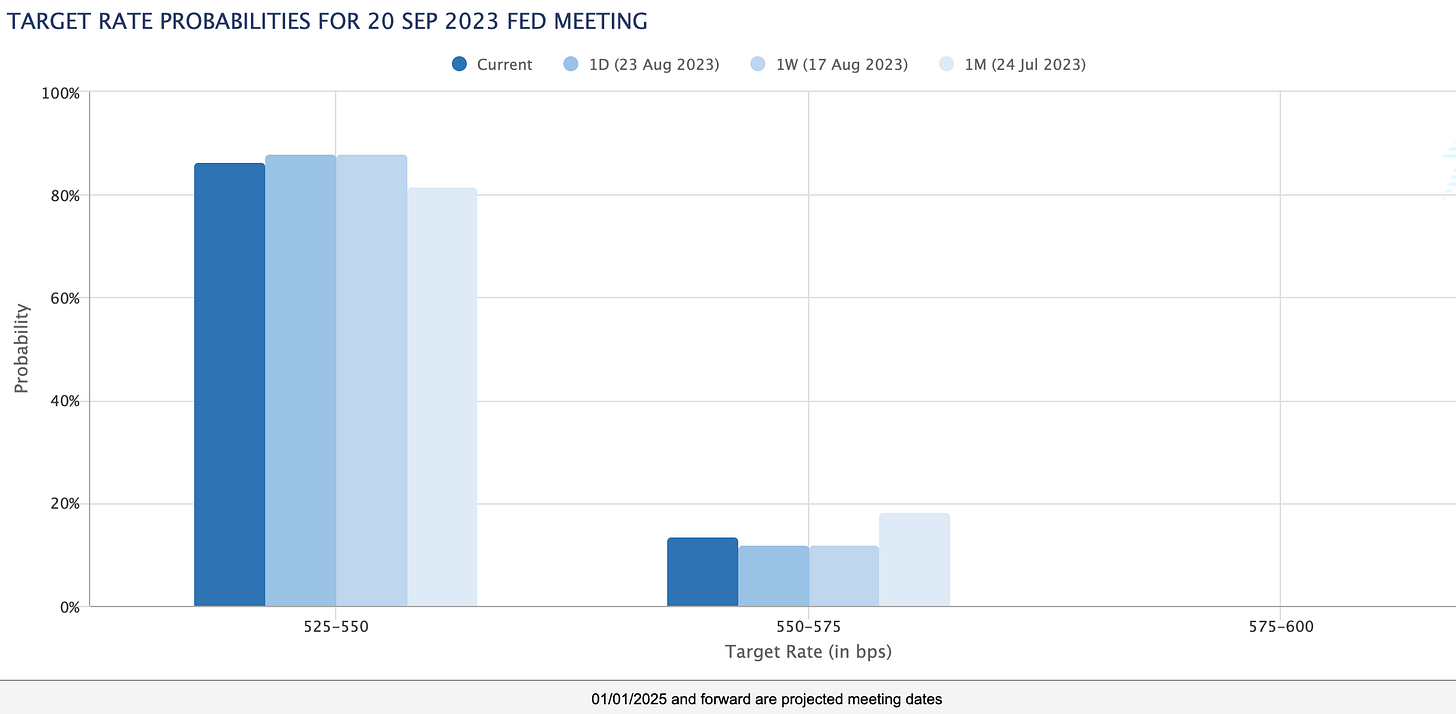

Whilst the Chinese may be holding strong to their easing stance, the Fed has been firm in keeping the tone for where rates are headed.

The target rate is expected to be unchanged at the upcoming meeting and that’s due to one reason.

The U.S consumer.

I think one thing we can all agree on here is how surprised we are at the resilience of the U.S economy, and that’s predicated on the strength of the consumer.

Although existing home sales fell 2.2% in July, new home sales jumped 4.4%.

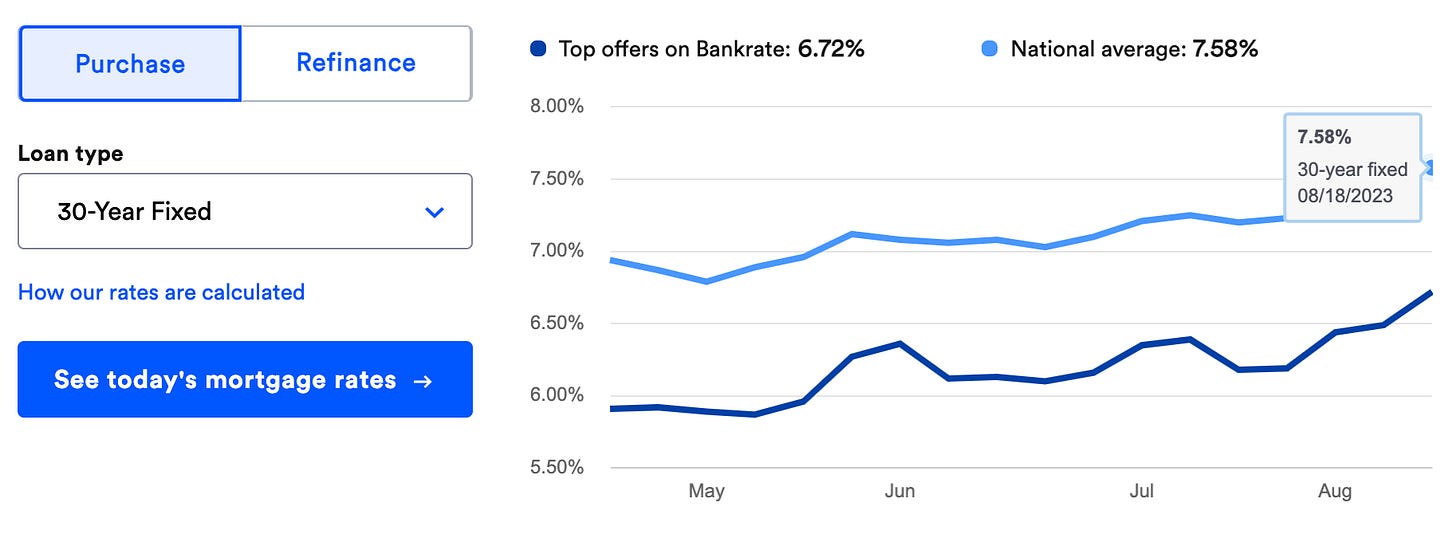

This just shows the strong demand for new homes within the U.S, and as we know the unemployment rate is still at multidecade lows of 3.5%. Wage growth in America remains strong last clocking in at 5.97% in June, so on all fronts the U.S consumer isn’t backing down from tighter financial conditions with mortgage rates still on the rise closing in on 8%!

Take note, the reason I show you mortgage rates is because when analysing how tight monetary policy is for the private sector you need to observe mortgage rates for households to see the true tightness of policy.

Chinese woes

Resilience and strength are two things that cannot be said about the Chinese economy.

As discussed in last week’s report we have a property bubble unravelling before us in the shape of Country Garden and a large number of Chinese property developers which account towards c.40% of home sales but there’s more. Days ago the Chinese government suspended its release of youth unemployment data (16-24 year olds) following six consecutive increases in the unemployment rate. The last rate recorded in June was 21.3%!

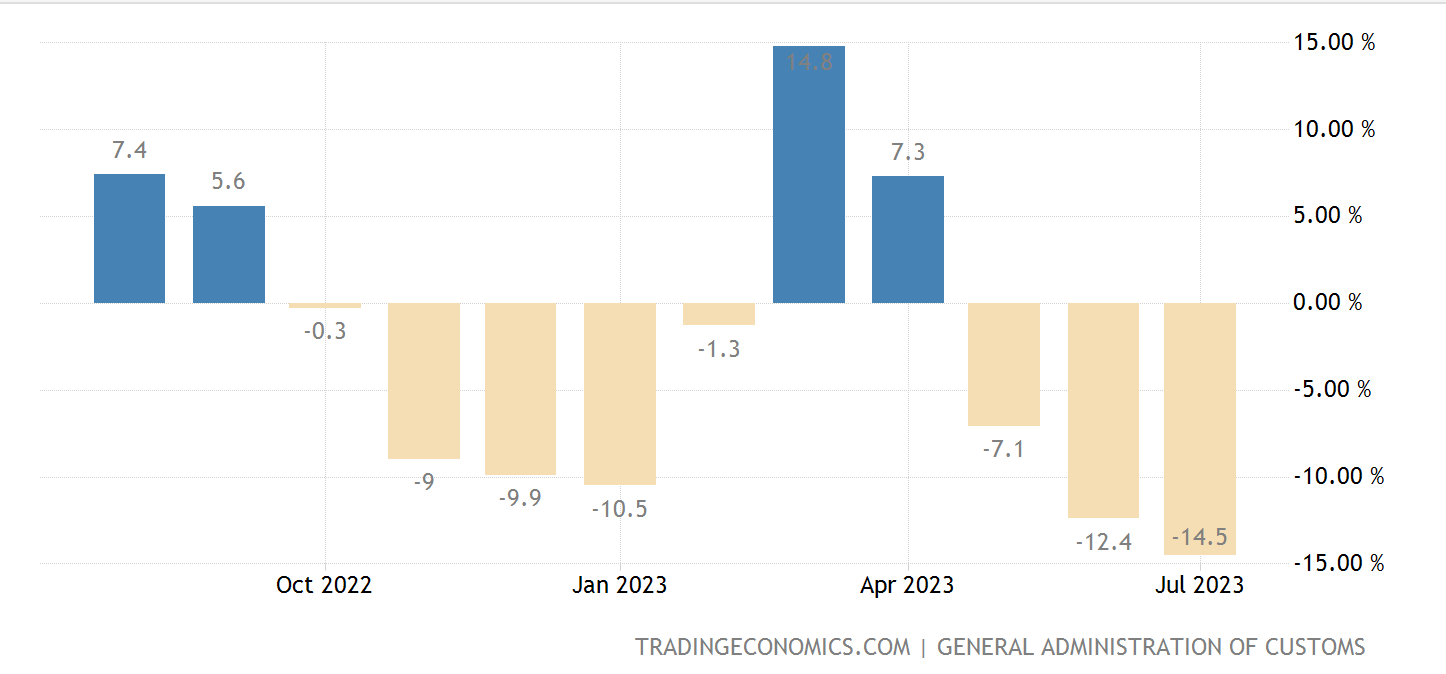

This simply drags down the working demographic in China able to produce goods contributing to the activity in the country. Add to the mix deflation and extremely weak export data from China showing a 14.5% decline in July during a period where you would expect exports to be booming due to the emphasis on the re-opening!

Whichever way you look at it. This is a sour fruit only getting worse by the hour.

The long view on USD/CNH both offshore and onshore stems from the points mentioned above, but there’s one key point that I referenced ever so slightly last week.

Yields.

In the U.S we’re seeing the long end of the yield curve, 10s, 20s, 30s all steepening and rising which means there’s only one direction the dollar is headed, and that’s higher prices.

Higher U.S yields strengthen the dollar as the U.S becomes an attractive destination for capital resulting in greater demand for U.S assets in the form of debt, money market funds and mutual funds. The increase in yields, the continued resilience of the American consumer and the hawkish Fed all levy up to my view that the Yuan could trade above 7.4000 and potentially higher.

What would make this macro position invalid?

There are a few things, but the one that you’re probably thinking about is the PBoC. What if the PBoC intervenes in the FX rate like they’ve been doing, asking state banks to sell dollars in the offshore market to prop up the Yuan? This is the one and main risk I see, but from observing the recent actions from the PBoC and also taking into account the stack of evidence showing the Chinese economy is in no strong position to warrant a stronger currency I believe that any interventions from the PBoC would be nothing more than a temporary fixture to keeping the Yuan below 2022 lows. The eventual flow of capital to the dollar and weakening in China would push through and show itself through the exchange rate regardless of what the PBoC try to do.

This next reason is of smaller significance but still prominent enough to be on my radar, and that is a weakening in the U.S consumer. From September-October student loans are set to resume, meaning that roughly 45 million consumers will make monthly payments of $200 removing c.$9bn from spending. That’s $100bn annually, so that will play a part in how consumers behave throughout Q4 towards Q1’24.

These two risks are the most significant and prominent; the PBoC always present great friction due to their ability to intervene, but in this particular scenario with both U.S markets and yields looking to move higher it’s a bet and conviction I’d happily take.

That’s it for me today guys, I’ll be sending another brief email later tonight to get your feedback on something.

As for now, I hope this was an informative and educational piece. If so, it’s always great to share your thoughts.