The U.S. in Focus: Small-Cap Stocks and High-Yield Bonds

Exploring Correlations and Outcomes in the U.S. Market

Hey guys,

Research > Test > Research > Repeat.

Global macro is a never-ending game of learning.

You really don’t know what you don’t know, that’s the hardest part.

The U.S. is all we care for right now, so I’m going to dissect.

Give this one a read until the end, trust me.

Macro watch

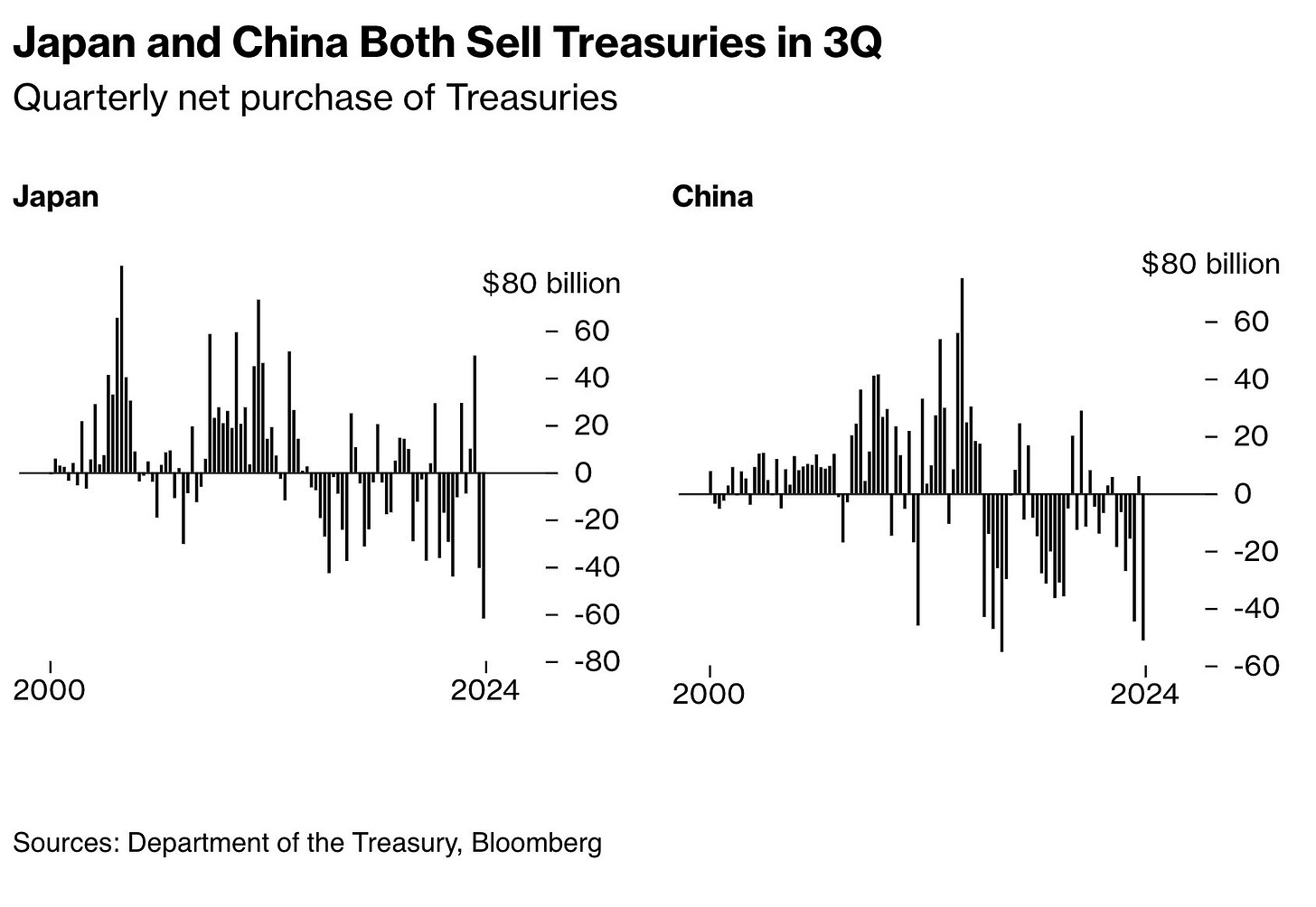

Japan and China dumped their U.S. Treasuries before Trump’s victory. Japanese investors sold a record c.$61.9bn of the securities in Q3, while funds in China offloaded c.$51.3bn during the same period, the 2nd biggest sum on record.

Japan's sales were likely linked to managing its foreign exchange reserves and addressing domestic financial needs, such as funding fiscal stimulus or balancing its international accounts. On the other hand, China had been selling U.S. Treasuries to stabilise its currency, which was under pressure due to capital outflows. To prevent excessive depreciation of the yuan, the Chinese central bank intervened in foreign exchange markets by selling U.S. Treasuries and using the proceeds to support its currency, a sterilised FX intervention.

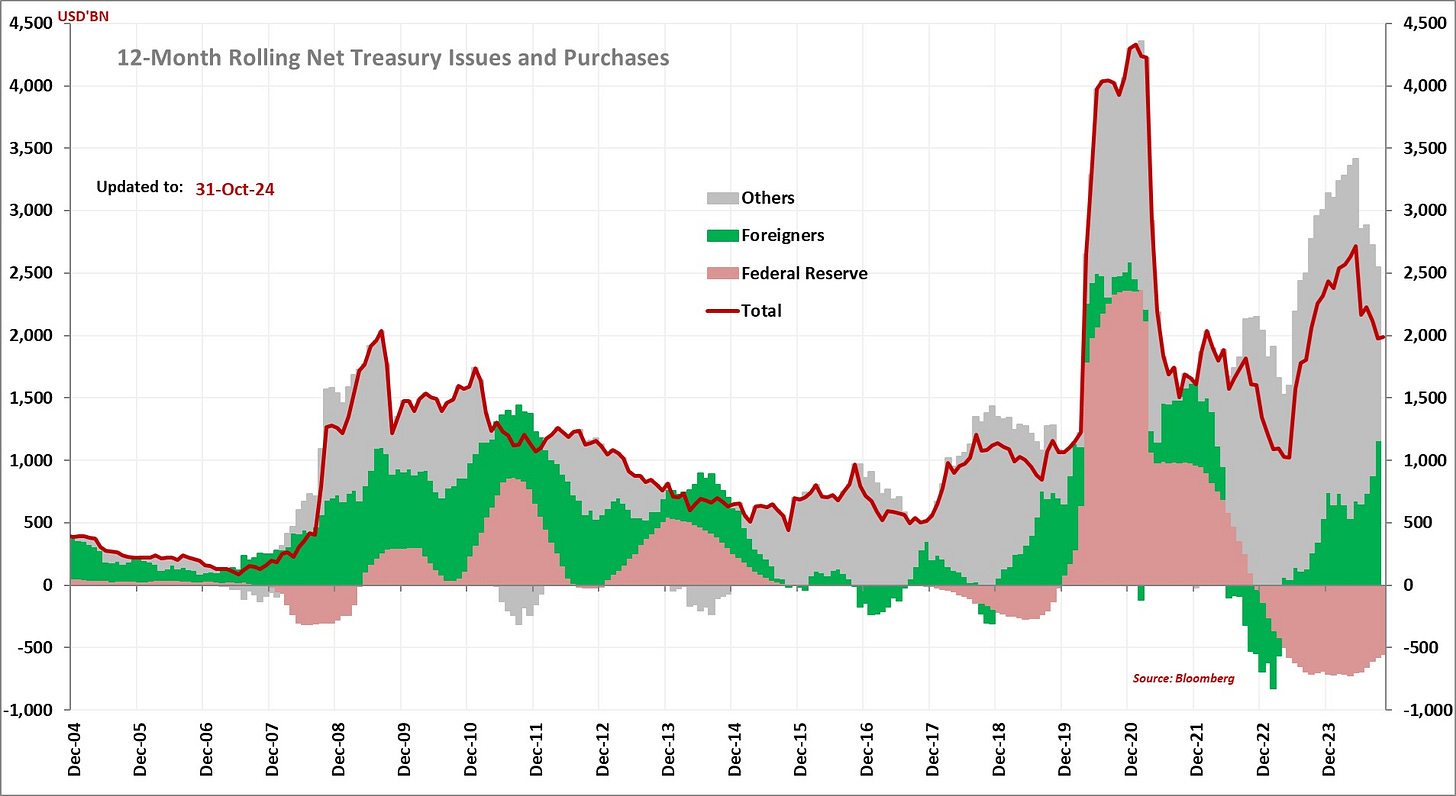

Despite this, foreigners as a whole are net buyers of U.S. Treasuries, attracted by higher rates vs. their home countries.

Foreign purchases and sales of U.S. Treasuries are always on my radar, shifts in sales and purchases can lead to shifts in sentiment.

Market mover

The Euro is c.-4.7% against the U.S. dollar since Trump’s presidential election win. This really hasn’t been the only driver of a weak Euro though, Germany’s economic data is really falling off a cliff.

We already know that Germany abandoned any potential for growth recently, but now the question is how deep will they fall into a recession?

Instability politically, weak PMI’s and no hope for a pickup in economic activity. The German private sector slid deeper into contraction on the services side which deals another blow to an economy grappling with a government collapse alongside flat-lining growth.

Parity for EUR:USD in the near future?

The U.S. in Focus

Market imbalances have evidently defied macroeconomic factors over the last couple of weeks.

We’ve seen small caps (Russell 2000), U.S. Treasuries and the dollar all soaring higher, but the last two on the list aren’t good for small-caps.. right?

Well, the movement we’ve seen could prove that thesis wrong.

Euphoric moves throughout all risk assets have pumped markets higher across the board as the volatility indexes (MOVE & VIX) unwound and the dust settled from the election. We always say it, markets dislike uncertainty, so when volatility comes there is typically great moves afterwards, which we have seen in U.S. markets. There’s likely going to be a continuation of the lower volatility as we head into December too, seasonality is also part of the unwind and buybacks are common in this period too, so nothing dramatic for markets. The Fed meeting in December isn’t enough to prop up the MOVE or VIX to heights we were recently at.

With the Fed meeting on the 18th of December being the next real tail-risk to markets, rate differentials may keep the dollar higher. Just over a week ago, Powell made this statement:

“We are moving policy over time to a more neutral setting but the path for getting there is not preset. The economy isn’t sending signals that we need to be in a hurry to lower rates.”

His forward guidance hasn’t provided clarity on whether they’ll skip a cut in December or not, OIS markets have priced in c.12bp for the December meeting, bear in mind that the Fed have a CPI print to work with on the 11th December so we’ll have more clarity then. I think they hold in December and cut 25bp in January. The risks to cut pose a higher threat than to hold, remembering that the last CPI print was also 20bp higher and core inflation has been bouncing around 3.3% for the whole of Q3 and beginning of Q4. We should also begin to see the unwind in QT from the Fed, there’s heavy pressure on the long-end and the debt service is very high.

Driven by a few other factors too, I think the Treasury market also has the same opinion as me with rate expectations. Higher for longer will continue to drag oil which is trading at c.$71/b on expectations that higher rates will drag growth. I think too many people are getting lost in Trump’s election, yes he is pro-growth but it’s really not an overnight fix, in the meantime growth expectations will be pulled lower by higher for longer from the Fed. However, I am also bearing in mind that lower oil prices are also being driven by the fact that Trump plans to boost U.S. oil production, meaning markets are front running this expectation.

There are a few scenarios in the U.S. that could unveil. Based on what I was saying above, higher for longer is the first scenario (skipping a cut in December too). We could see short-end yields stay high, long-end yields drop (bull flattening in USTs) and the dollar weakens off of worsening economic expectations, less U.S. resilience, risk assets could then face issues despite dollar weakness. But now the second scenario, where the Fed cut again sooner, may mean more inflation and the dollar falls. I think for any scenario the dollar is overextended right now.

Let me just re-emphasise, I do really believe that Trump will have a net-long impact on the dollar, but we’re going to play the cards we’ve currently been dealt. Everyone is focused on Trump’s tax cuts, because less revenue means a higher deficit and a higher deficit means higher yields, in theory. But there’s little focus on his lower government expenditure. Lower government spending is simply going to lead to lower issuance of debt, bringing yields lower, it just comes down to which is more powerful out of the two, tax cuts or lower government spending. Trump wants to industrialise the U.S., but he can’t do that with such a strong dollar because costs for domestic producers becomes so high. D.O.G.E are cutting wasteful spending, so let’s just do a rough calculation. Let’s say they cut $300bn in spending, there will be no need to refill any of those gaps that have been cut back because they were simply wasteful, so that’ll be at least close to $300bn in debt issuance saved, lower yields!

Also, just take a look at the high-yield credit spreads below, there’s simply no premium seen in Government bonds right now, even at 4.4%!

A surge in yields has a tightening affect worse than Fed funds, mortgage rates are already rising again at a fast pace. The chances of a recession are low, but truly not off the table just yet. If the Fed cut in December, then these yields could rise further on inflation expectations meaning small-caps could outperform large-caps because the small-caps benefit when credit availability improves in a growing economy, even if the service on the debt is higher. While a higher dollar on higher yields is more detrimental to large-caps as multinational earnings become more competitive globally, with small-caps relying on domestic revenue.

I’d love to hear feedback from you guys that made it until the end!

Love this