The U.S. in Focus: An Economy Gripped by Uncertainty

Delving into the market sentiment and forecasting potential consequences

Hey guys,

Prepare a pen and paper for this report, it’s a long one because there is so much to unpack in the current market environment.

Markets are tanking, fear is in the air.

The HODL cult is slowly fading in equities and crypto, now the recession guys are creeping out of the woods, what an interesting time to trade the markets.

In moments of volatility and noise, I like to take a step back and focus on real data rather than consensus.

If you’re on Twitter, you can definitely get caught up in the consensus groups where people are stressing a bias simply because they have a holding of that equity/crypto, but their bias stems more fromm hope rather than real data.

Anyway, let’s unpack it all!

Trade recommendation update

Both reports in December 2024 - USD shorts for H12025 recommendation (DXY is down c.4.3% YTD)

10th January report - USD/JPY shorts recommendation (USD/JPY is down c.6.5% since that report)

2nd February report - S&P500 short recommendation (S&P500 down c.7.5% since that report)

Safe to say that the calls from the beginning of the year have been pretty good…

Macro watch

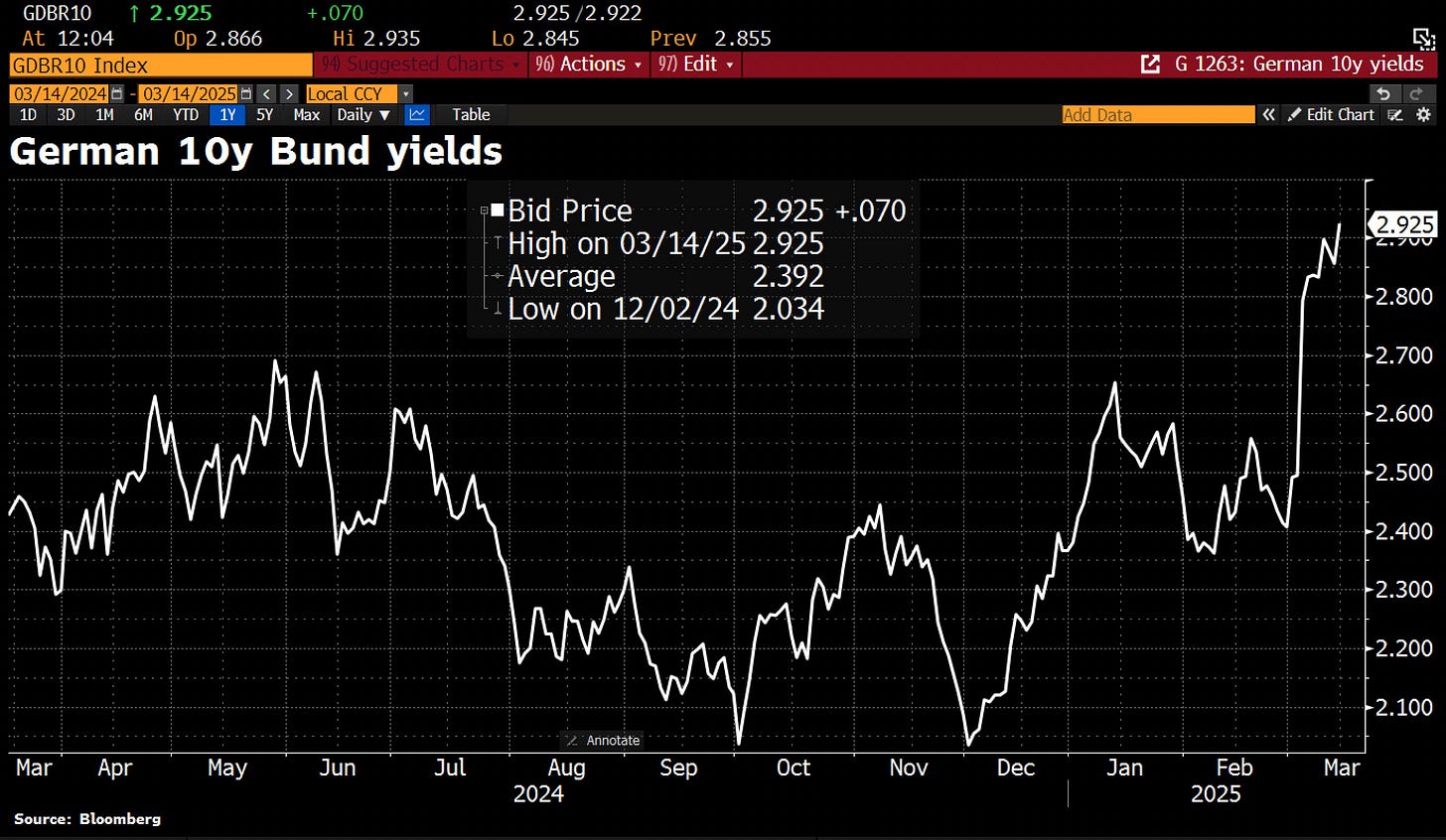

There was a small bump in the road when it came to Germany’s Merz and his plan to borrow c.€900bn for defence and infrastructure. The bump was from the Green Party (who will likely not be part of the next government coalition) when they announced that they’d oppose the defence spending plan and requested greater environmental guarantees. However, they soon backtracked and said they’d be open to negation, which re-sparked German Bund yields.

There’s been a c.45bp jump in 10Y German Bund yield since the announcement of this plan from Friedrich Merz. However, just today Chancellor Friedrich Merz reached a deal with the Greens on the country's c.€1,000bn debt plan. I know many see this debt plan as positive because of potential growth, but the downside may be large. This plan is a large bet on defence and infrastructure, in a time of growth and inflation fears. It’s not common in these periods of time for government spending (debt) to be increased, it’s pretty safe to say the working class in Germany may get wrecked in a case where this plan doesn’t lead to growth relative to the amount spent.

However, A positive from the Eurozone is that Trump’s special envoy Steve Witkoff is reportedly in “serious discussions” with Russia about ending the war in Ukraine, but this could lead to a lower amount of defence spending actually needed…. (negative for Germany). Eventually, these spending plans that could affect Germany’s growth on a large scale may weigh on the Euro. However, focusing on the current times, A sell-off in the Euro may not be an impulsive one but as markets focus more on their reciprocal tariff threats from the U.S. in April, we’re likely to get a level of recovery, alongside some safe haven demand for the dollar off the back of global uncertainty. 1.10 on the EUR/USD seems a bit far-fetched for the next week or two and will likely stay range bound.

Market mover

Markets don’t like uncertainty.

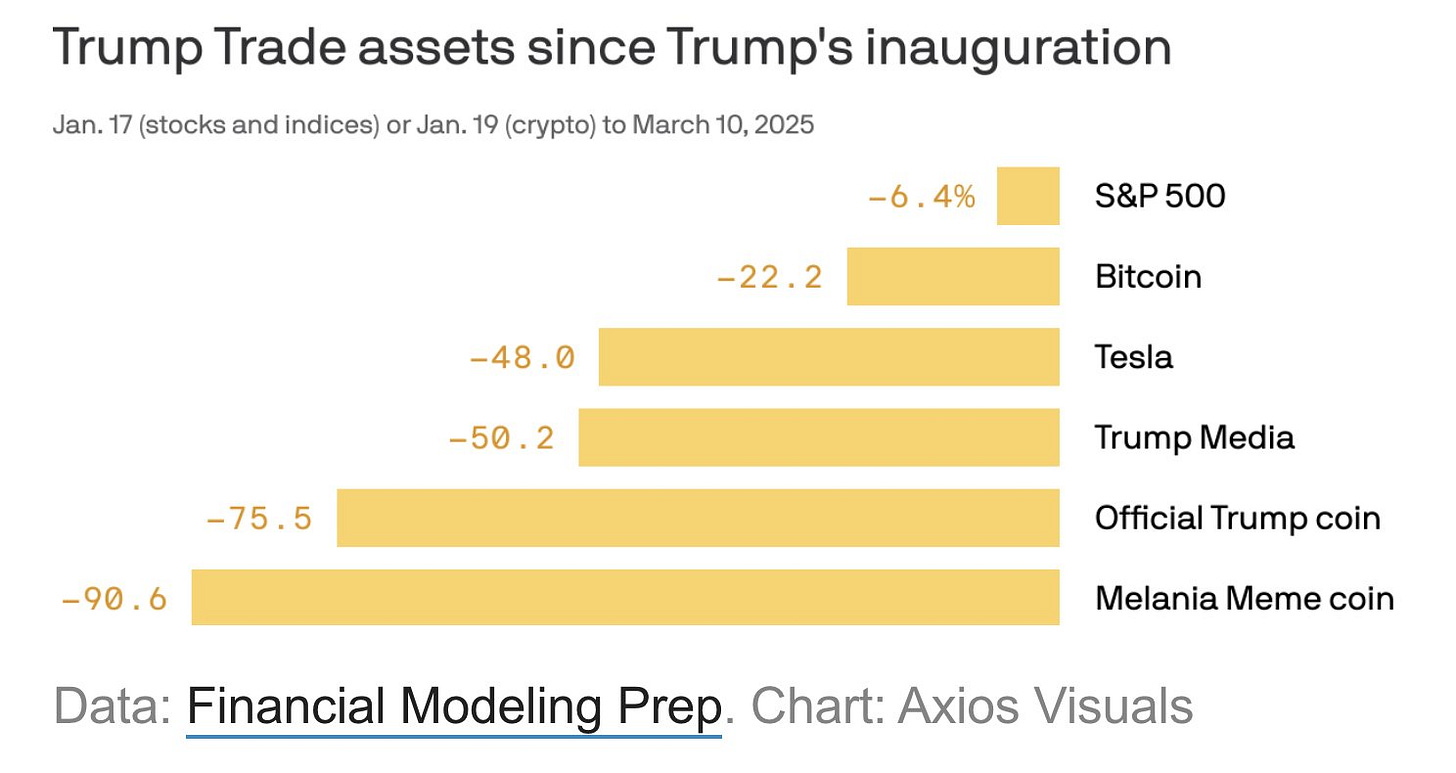

Only one of the Mag 7 stocks remains in positive territory this year, while the others have suffered significant losses. Tesla has declined 45% year-to-date. Concerns over tariffs and what they will do to U.S. equity has caused this large sell off. In times of uncertainty the biggest players want to be flat in positioning, the risk-off mood has really taken over.

To add to the large Mag7 sell-off, anyone who has bet against the "Trump trade" since the inauguration has seen impressive profits. There’s absolutely no surprise here to me, the only way for those crazy rallies to continue is for Trump to over-deliver on his fiscal plans, but he hasn’t even delivered let alone over-delivered! It’s all part of a bigger plan in my opinion, Trump knows what he is doing. Not only does he get what he wants by threats (because they know he will do it), but he is also weakening the dollar and equities beside that so that if tariffs do come into place, they’ll be less harmful to U.S. growth because of the weaker dollar & lower equities.

It’s not just the market sentiment that is affecting large equities, it’s their individual problems (seen in Tesla and Apple). Apple sell-offs continued as they announced that the new Siri update wouldn’t be released until 2026, which led investors to believe there is less incentive to upgrade to the new Iphone in September 2025. Apple is down c.15.7% YTD and c.10.9% this week alone.

The U.S. in focus

When Trump was asked about a potential recession on Monday his response gave an indirect answer. He said, “there will be a period of transition”. A recession is priced at just below 30% based on the Fed’s recession probability model, but keep in mind that previous recession calls were inaccurate but tariffs can make a quick change to growth. We’ve seen the back and forth in discussions on reciprocal tariffs and they’re getting quite extreme. The EU have planned to impose a 50% tariff on U.S. whiskey imports and Trump said he’d impose a 200% tariff on the EU’s alcoholic products if they did implement it. Investor sentiment is at extreme lows, the lowest level since March 2009 (from AAII sentiment survey).

It’s getting to a point where these tariff implementations (on all goods imported) are so frequently pushed back that the confidence in them being imposed is becoming lower, but the threat still remains. If we get another pushback on tariffs on April 2nd, I can quite confidently say they’re not going to be imposed or at least not at that level (25% on all imports). Tariffs are such a powerful negotiating tool and Trump knows how much leverage he has over Canada and Mexico, especially with Canada’s own fiscal dynamics causing problems for them, so these tariffs will definitely not be welcomed.

Remember, for these tariffs to work effectively and give the U.S. a higher chance of avoiding a recession, the USD and equities must be lower. That’s simply so that the USD will be cheaper for imports and will still receive a good level of foreign demand, while equities need to be lower so that inflation doesn’t jump up and cause the Fed to keep rates so high which will drag growth into recession. The U.S. also have international challenge, China is setting up further stimulus (lower reserve requirements, cutting interest rates and potentially new finance measures) so capital is flowing towards there which is hurting U.S. equities further (positive for recession survival chances but not for equities individually). According to Goldman Sachs, last Friday’s and this Monday’s degrossing by hedge funds marked the largest sell off in over 2 years, real uncertainty is very evident right now.

A recession really seems overpriced to me, the “growth scare” is all theoretical and until there is further data and evidence of a true growth scare, then a recession is not in my base case. There’s been plenty of time over the last 18 months where recession calls have been inaccurate, data and sentiment can turn real fast off the back of one catalyst.

Anyone trying to hurt the U.S. is only going to hurt themselves worse, trust me. Canada and the EU are the biggest speakers of retaliatory tariffs yet their growth will be at risk, they will listen to whatever Trump wants them to do (in my opinion). The EU retaliatory tariffs would be on $26bn of U.S. goods, I think the EU comes out worse on that (as they definitely will if they go through with the 50% tariff on U.S. whiskey because Trump will retaliate 4X larger, 200% tariffs on alcohol).

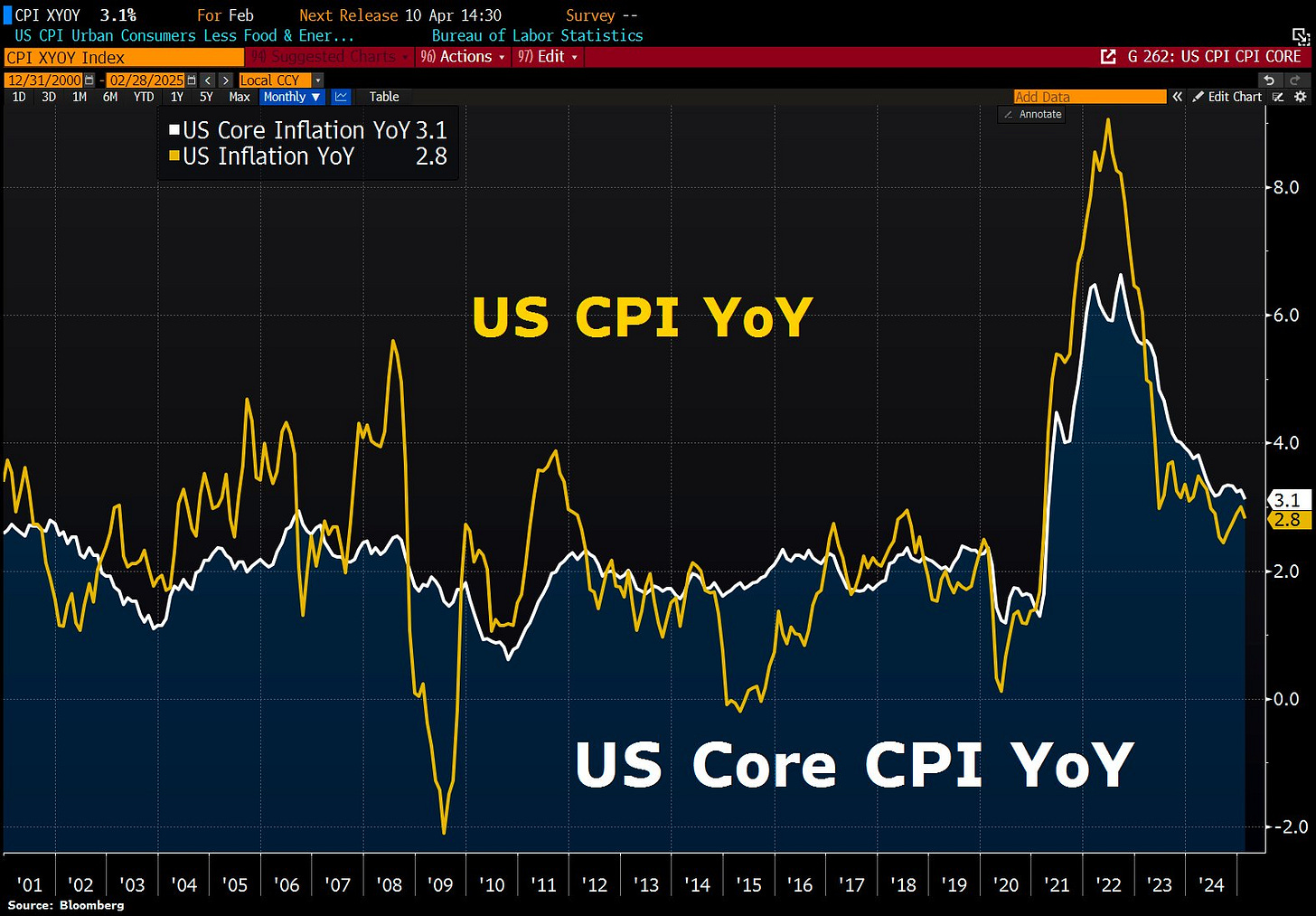

On the inflation side of the U.S., there has been some progress seen in this week’s print, with CPI (YoY) slowing to 2.8% which was below expectations. I think any potential front-running of tariffs would’ve already been seen in CPI prints and I don’t think tariff front-running purchases has upside risk to the coming inflation prints.

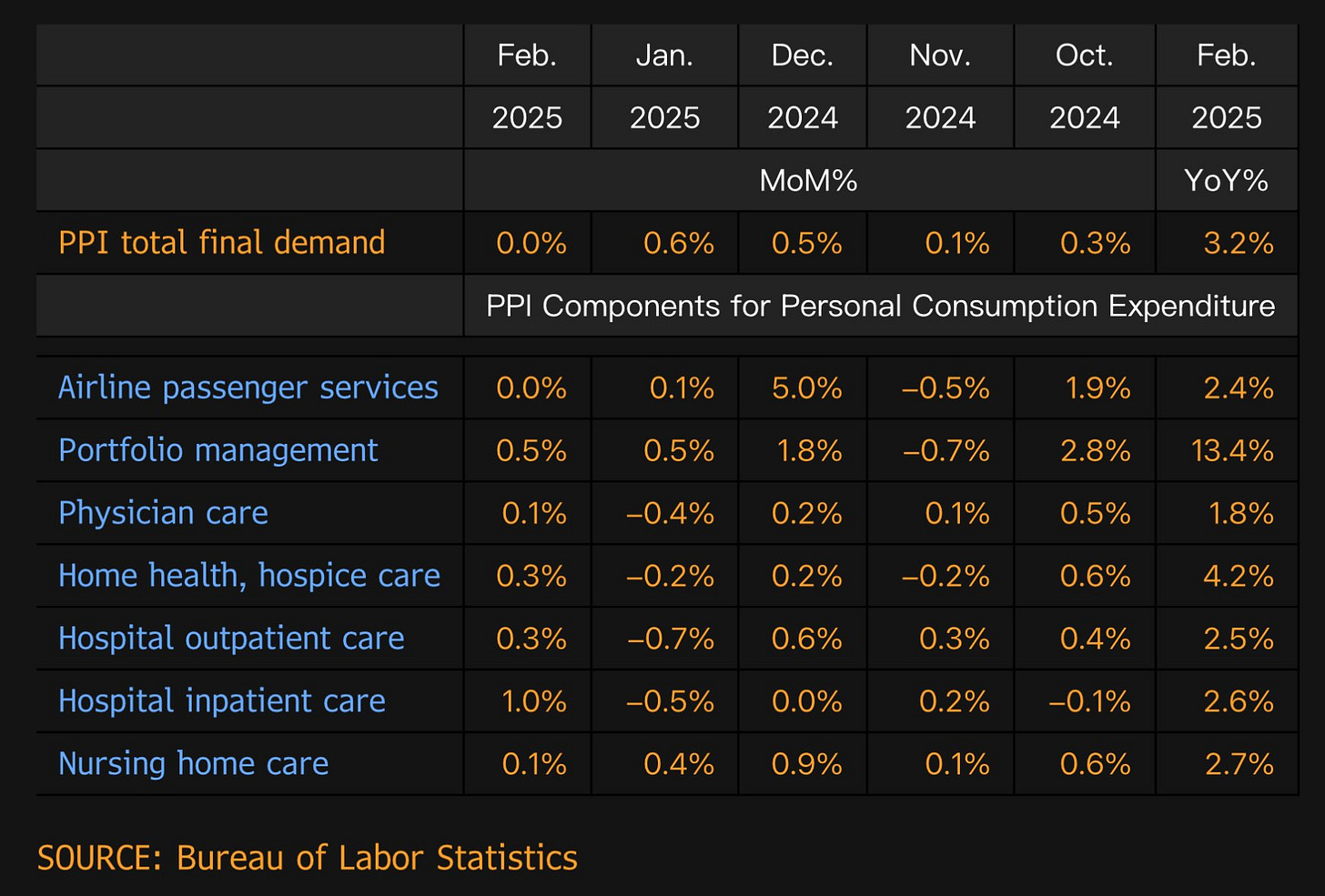

The only potential upside we may see, which wont affect the Fed’s pathway in my opinion, is to PCE. I say this because of the uptick in PPI, the components that ticked up in this reading map over to PCE which we know is the Fed’s preferred gauge.

The importance of the two inflation readings this week was that we know they aren’t causing higher risk to the market and that the market will continue to be driven by sentiment (recession risk) and tariffs rather than rates. Like I always say, rates will have effect on markets but the main drivers of markets will change from time to time depending on the significance of events.

For me personally, I’m risk-off for now and there is not any positioning I’d class as prime to execute, sometimes sitting on your hands can pay more than being in a volatile market. We’re not here to make money every single day but instead to focus on our longer term gains.

Gold has evidently shown the risk-off environment, racing to new ATH’s against the USD.

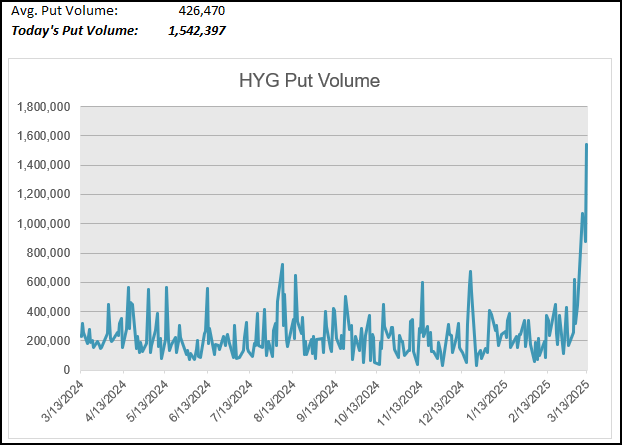

In addition to Gold seeing large safe haven flows, the HYG (the index that tracks high yield corporate bonds) put volume has gone parabolic which is just a second-round effect of investors wanting to be flat in this volatile time to reassess, the good side to this is that there are now some major equities at large discounts.

Have a great weekend!