The U.S. and Eurozone: A Widening Divide Into 2025

A Detailed Economic Outlook on the Spread Between The U.S. and The Eurozone

Hey guys,

I finished Q4 11.27% up, it was a great end to the year.

Time management has been tough. As mentioned before, some things in trading couldn’t wait and needed attention immediately which is why I skipped last week’s report.

Quality > Quantity

In other news, the Fed have ramped up their hawkishness in Wednesday’s FOMC meeting, let’s dive into that.

Macro watch

The Fed cut the benchmark rate by 25bp to 4.50% as expected. We already knew this was going to happen as it was priced in, so this wasn’t my major focus.

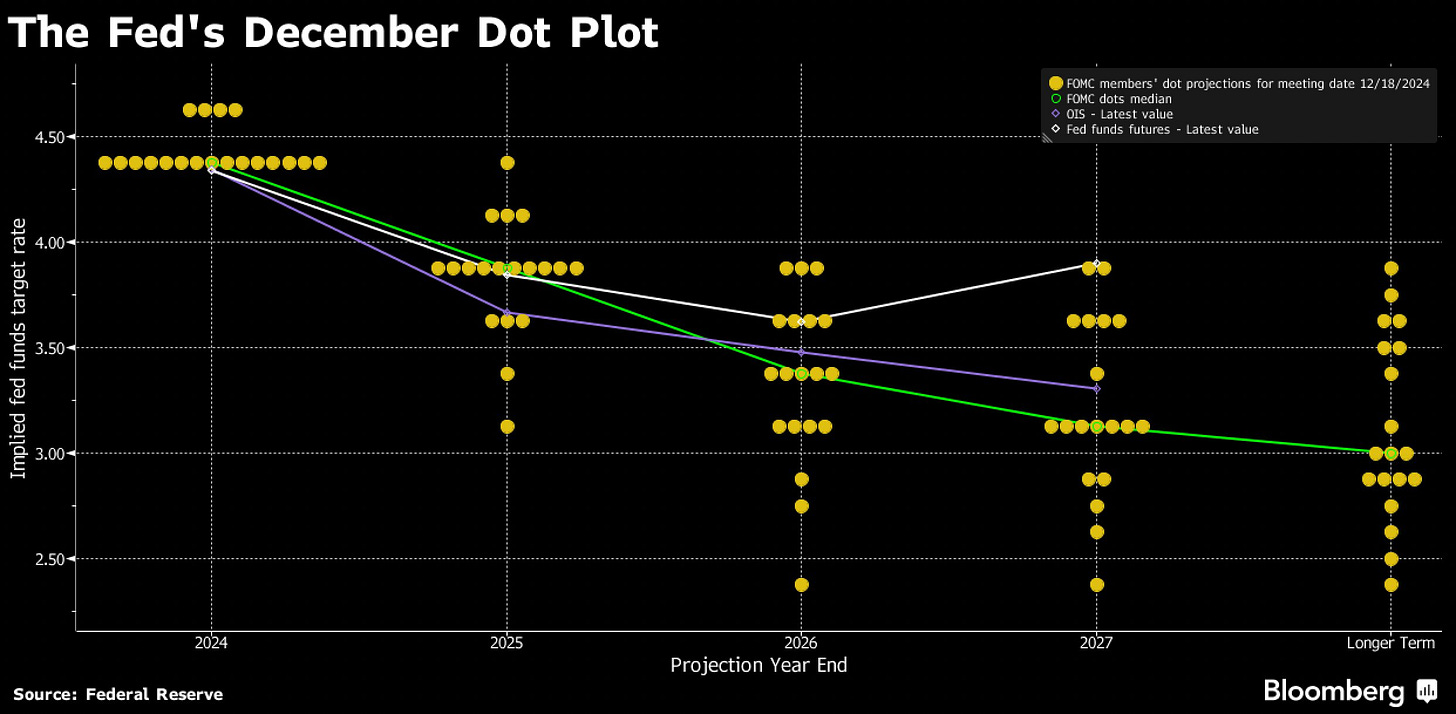

Cleveland's Hammack dissented in favour of no cut. This was a hawkish cut, but way more hawkish than anticipated. Hammack’s actions were the first dissent by a regional bank president since June 2022. Median forecast of Fed policymakers for the end of next year is now 3.9%. That compares to 3.4% back in September. This suggests just 50bp of cuts in 2025 compared to the 100bp expectation back in September.

Markets rallied, December really hasn’t been quiet. Bear steepening was initially seen in U.S. yields, but the short-end unwound some gains the following day while the long-end remains propped up.

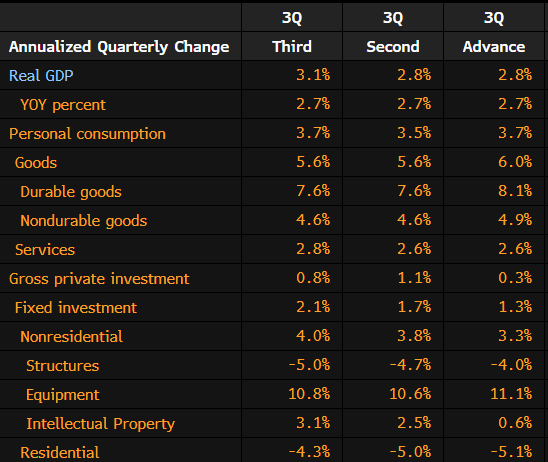

The Fed were definitely not the only drive of the 10Y staying elevated. Strong GDP data has led to further expectations of higher inflation for longer.

Trump is likely to keep GDP strong with his policies, a higher terminal rate is being priced in and the U.S. will need to get used to these high rates although they seem immune to them.

Market mover

The Euro is approaching parity with the Dollar. Following the Federal Reserve's unexpectedly hawkish rate cut, the Euro has fallen below $1.04. The interest rate differential between the Eurozone and the U.S. is anticipated to widen further, driven by the repricing of U.S. rates in the OIS market, strong GDP growth, inflationary pressures linked to Trump's policies, and a dissenting Fed member opposing the decision to cut rates.

The Euro faces more challenges than any other G10 currency at the moment, including political turmoil in France and Germany, sluggish economic growth, weak PMI figures, and a prolonged recovery ahead. Attention is particularly focused on Germany, the Eurozone's largest economic contributor.

U.S. Triumph VS The Eurozone

Firstly, the Trump regime’s in focus for me due to the reflationary effect:

Tariffs - Industrialisation can only happen effectively with a weaker dollar

Tax cuts - Excess consumer spending can refuel inflation

Aside from Trump, the Fed have already set the tone for 2025…

At the Fed’s meeting, by concentrating on inflation, Powell jawboned the breakeven inflation rates lower while nominal rates slightly rose from overly dovish expectations. Financial conditions tightened and systematic investors seem to have priced in an overly-hawkish Fed NOW because of self-reinforcing volatility targeting flows. With four consecutive prints of 0.3% MoM core CPI, considering 0.3% MoM was the average across 2023 (showing no signs of progression), the Fed has made the correct decision.

Credit conditions have tightened slightly, and HYG (the high-yield corporate bond ETF) has dipped below its 50-day moving average following the recent Fed meeting. This is definitely something I’m keeping my eye on to determine if the longer-term bullish trend has come to an end. However, the economy is in a significantly different position, with much of the debt extended to longer maturities. The reason I’m focused on the trend is because this ETF gives close insight into credit conditions, which shape the outcome for inflation and growth.

I favour credit conditions to remain on the tighter side, but definitely not anything significant. The higher for longer rates, which the U.S. seem partially immune too, don’t cause enough concern to credit conditions when they are counteracted by Trump’s regime (which in simple terms leads to more money into U.S. consumer’s pockets).

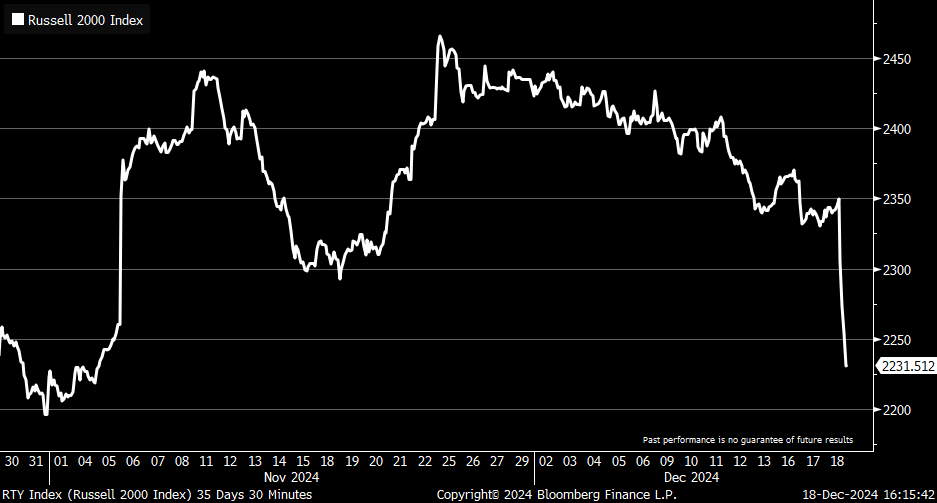

Volatility went crazy after the FOMC meeting, the front-month VIX reached 27, while the 3-month VIX dropped to 24, showing an inversion in the volatility structure. Historically, over the past decade, this has been one of the most reliable contrarian signals, marking an exceptional buying opportunity for equities. This is another theme truly widening the spread between the Eurozone and the U.S., equities are outperforming because conditions are ripe for them.

Now, the main spread that causes concern for the Euro.

Rate differentials. Before you read below, bear in mind that ECB staff see the level of the neutral rate between 1.75% and 2.5%.

The tilt is now from growth to inflation. The Fed are hawkish, but people are definitely over-seeing the fact that in the dot-lot there is a 0% probability of another rate hike, simply a hawkish cut. The Fed just clearly sees that being on hold is the cure for inflation. If you take a look at Figure 6 below, the Fed’s dot plot sees rates at c.4.00% for 2025. Growth may have been a bigger concern but Trump’s optimism and strong business PMI’s have saved that side for now.

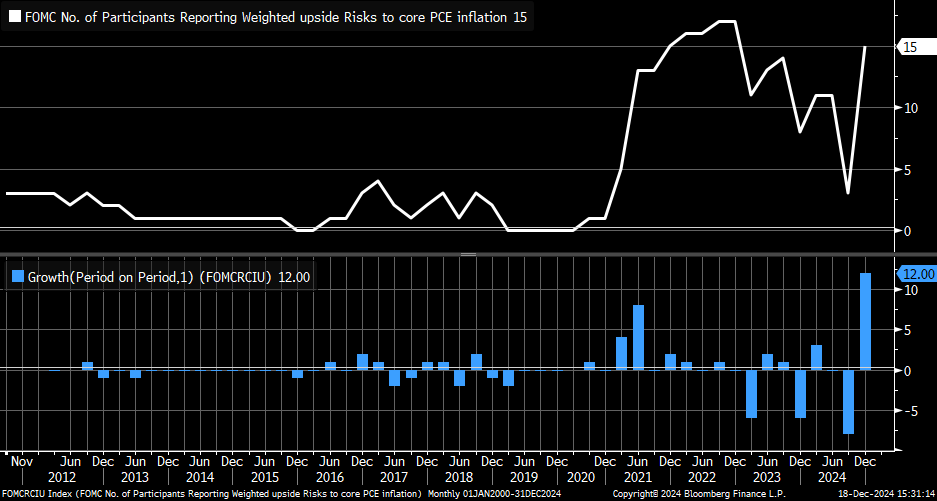

I don’t necessarily see inflation bouncing higher in a trend, I just see more of a bounce around these levels. However, 15 FOMC members see upside risks to core PCE inflation, this was part of their decision but it’s taken us by shock to see the Fed this hawkish at current rates. Tariffs will be inflationary, it’s pretty simple, that’s the clear reason alongside current stickiness to why FOMC members are seeing upside risk.

It’s going to be push and pull for the dollar. As I’ve mentioned before, Trump’s industrialisation can only happen with a weaker dollar. So although the dollar is going to gain traction from rate differentials, I think there’s larger tail-risk. Higher rates will eventually lead to weaker growth regardless of Trump’s policies which will drag the dollar and pressure on domestic companies (particularly small-caps) may be felt once tariffs are introduced. Positioning is at all-time highs, sentiment is at all-time highs and volatility is high. I’ll keep repeating: U.S. consumers need to understand that 3% is the new 2% when it comes to inflation. The Russell-20000 is already seeing it.

Cue the spread…

Growth expectations from the ECB for the Eurozone were released just a few days ago. Just 1.1% growth is seen in 2025, I think that could even be a little generous for the Eurozone considering two of their largest economies (Germany and France) are going to have political structural shifts in 2025 and Trump is not going to hold back on Euro trade with the U.S. when it comes to tariffs.

Considering Germany contribute c.30% towards growth inside the Euro area, and their growth is expected to be flat next year, I’m really not sure where the ECB has got these numbers from.

Volatility isn’t favoured in an economy if the upside risks are so high. There’s clearly a lack of confidence domestically and internationally for France. Their credit-rating watch was downgraded just over a week ago. This exacerbates the challenges of debt sustainability. In France, for instance, any effort by one political party to address the unprecedented budget deficits is undermined by the opposing side. Next time, the roles reverse. This cycle of what I term 'destructive politics' is both highly costly and inefficient.

To keep it simple, the Euro doesn’t have any upside risk to me which will devalue it VS the dollar, however, speaking about dollar individually, I think there is a fair balance between upside and downside risks.

I hope you all enjoy the holidays and happy new year to you all!

Well written, thank you! But wouldn't you think the PCE on Friday already puts the FOMC hawkish narrative at risk? I mean, couple of things to note...

The market is now pricing LESS than 2 cuts for next year, the FED said two, market overreaction? I think so.

Now the PCE gives market again some hopes that inflation is not necessarily going to head back higher? I think so.

And most of all... non conventional thought but...

The FED timing recently hasn’t been impeccable either, they cut 50bps in September right before three consecutive months of sticky inflation prints, wouldn’t be a surprise if they pivoted hawkish on Wednesday right before a resumption of the disinflationary trend?

Would love to know your thoughts.

Thank you.