The Regime Trade

Breaking Down The Asset Allocation Quadrant & What That Means For My Positioning

Hey MMH crew,

As markets are at a standstill, I’m getting my head around what macro reports and lessons to schedule for you guys.

In this piece, I’m going to uncover what positions I’m actively exploring or holding and how you can depict the macro climate, what asset would perform best and my reasoning.

All in simple laymen's terms. I’ll be sharing a free report later today exploring the ‘Debt Ceiling’ implications on markets so be on the look out.

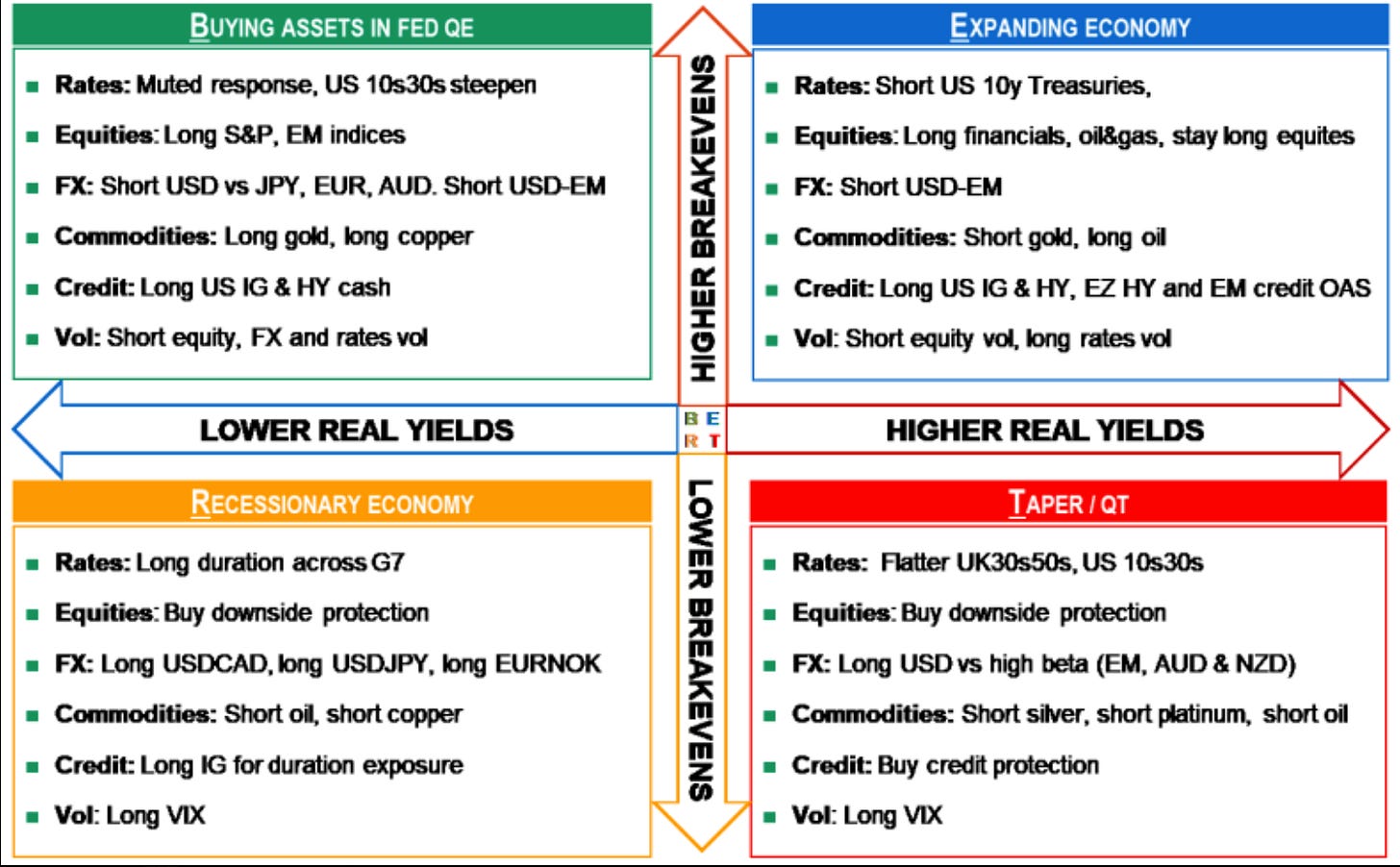

Asset Allocation Quadrant

Ok, so we’re going to be analysing how we could position ourselves to be in the money this time around so let’s start with what we know; non-other than our current macro cycle we’re in.

Now. Before I delve deeper, I know what you’re probably thinking, what’s ‘lower breakevens/higher breakevens and real yields’ — so let me explain.

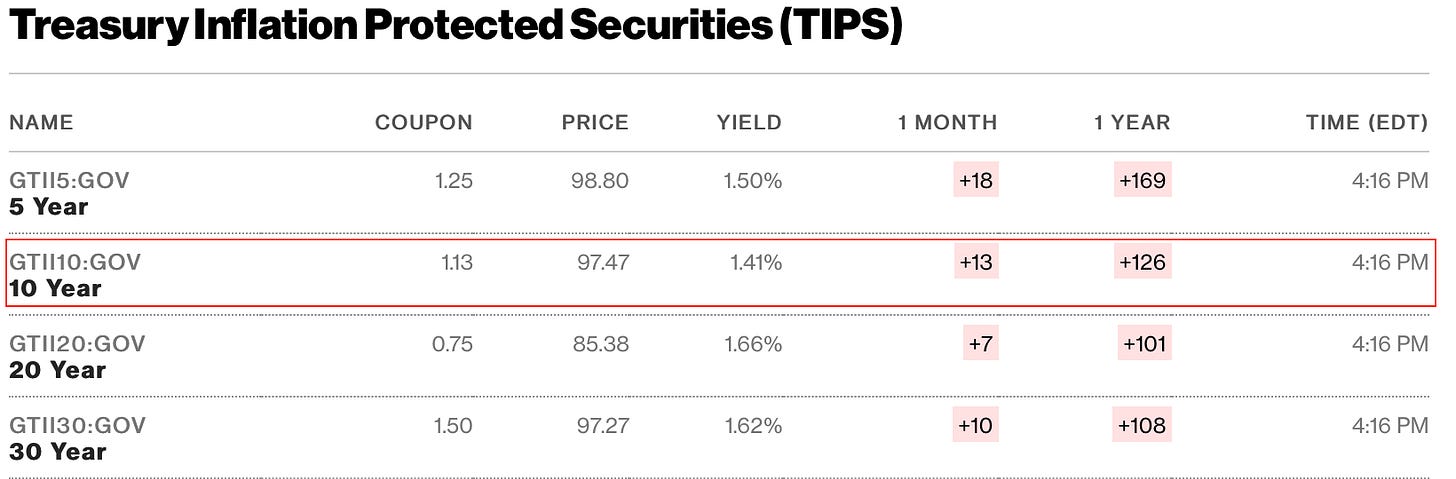

The 10-year breakeven rate is simply the expected future inflation rate over the next 10 years. It’s measured by taking the yield on a nominal government bond and the yield on an inflation-protected bond of the same maturity and finding the spread between the two.

e.g

As of writing, the US10y bond yields 3.57%

The yield on a 10y inflation-protected bond is 1.41%

Meaning?

The current US 10y be (10-year breakeven rate) is 3.57 - 1.41 = 2.16%

So that figure means that investors expect inflation to be 2.16% over the next 10 years.

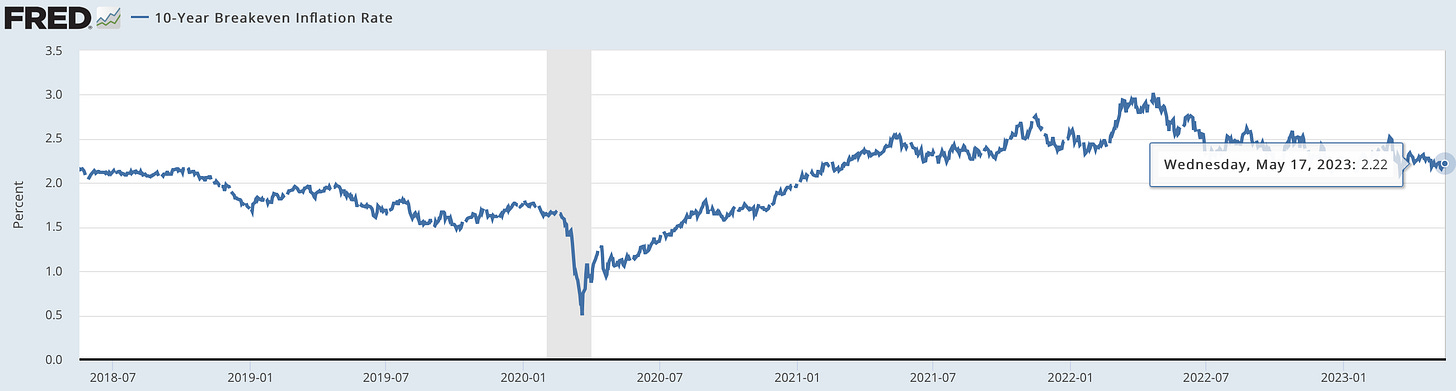

Confirmed by the chart below, off by a fraction of a per cent due to price discrepancies. I hope this small example helped you understand the 10y be.

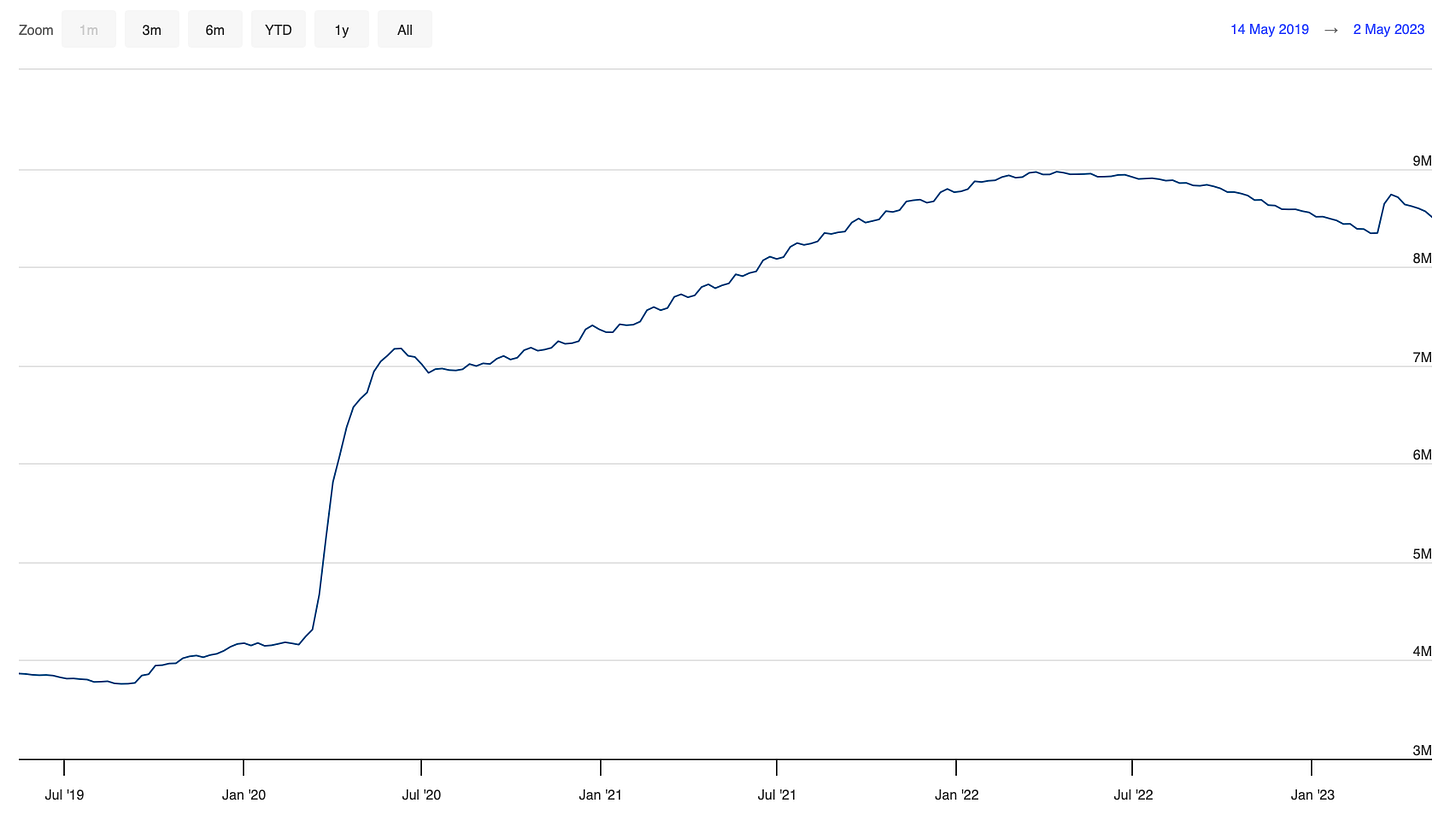

So, looking back at the quadrant, we can go through a process of elimination. We’re clearly not in a period of rising, or higher breakevens, as you can see by the above chart breakeven rates are declining in trend. So automatically, the top two quadrants are eliminated. The Fed is not providing any assistance or QE to markets, nor are we experiencing any form of economic growth and expansion in the current macro climate.

Ok. It must be between the bottom two quadrants, taper/QE or recessionary economy, right?

Yes, well, sort of…

Slow growth, persistent inflation → recessionary environment over the next 6-12 months

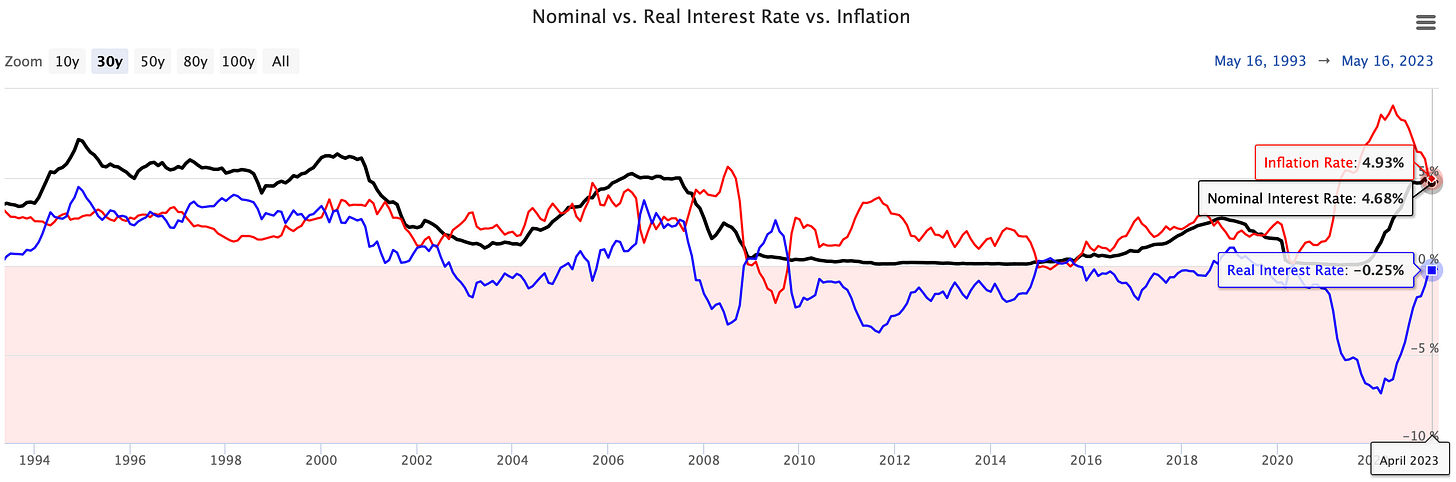

In my opinion, we’re currently somewhere in the middle of transitioning to a recessionary economy. Real yields are moving lower, as you can see from the chart below:

By the way, real yields are simply the actual interest rate when accounting for inflation. It is calculated by taking the nominal interest rate in the economy and subtracting the current inflation rate from the figure, leaving you with the actual, real interest rate.

Now, it’s important to remember that the Fed is still continuing with quantitative tightening! So that may have you thinking we’re in the red ‘taper/QE’ quadrant, which is explanatory.

You might be thinking, but Joe… didn’t the Fed step in to backstop the failing banking sector with the BTFP (Bank Term Funding Program) as well as provide over $300b to support struggling banks?

Yes.

They did, but the Fed can both tighten (QT) as well as support the banking sector simultaneously without deviating from its current policy plan to restrict the money supply in the economy and remove bonds from the Fed’s balance sheet.

Nevertheless, just because we haven’t heard the words “we are in a recession” from Jay Powell, it doesn’t mean we can’t begin to position ourselves appropriately as if we’re in the fourth quadrant when looking for macro trades and potential ideas.

My Short-Term Macro Plays

Over the past few weeks, I have shared with you all my growing bias and conviction for two positions:

Dollar ETF Shorts (high conviction)

Crude Oil Shorts (high conviction)

Of recent, I’ve actually found myself exploring and executing on two positions, one of which, came about as a rough idea due to the debt ceiling panic and the other trade being crude oil shorts.

For regulatory reasons, I have to say this is not investment advice, but rather me sharing my independent decisions and viewpoints.

So as it stands, I’m short on crude, which will be a short-medium term hold < 3 months, but I guess we’ll see how long it takes to see whether I’m right or wrong.

As the position develops I will share insights and the chart to show my position etc.

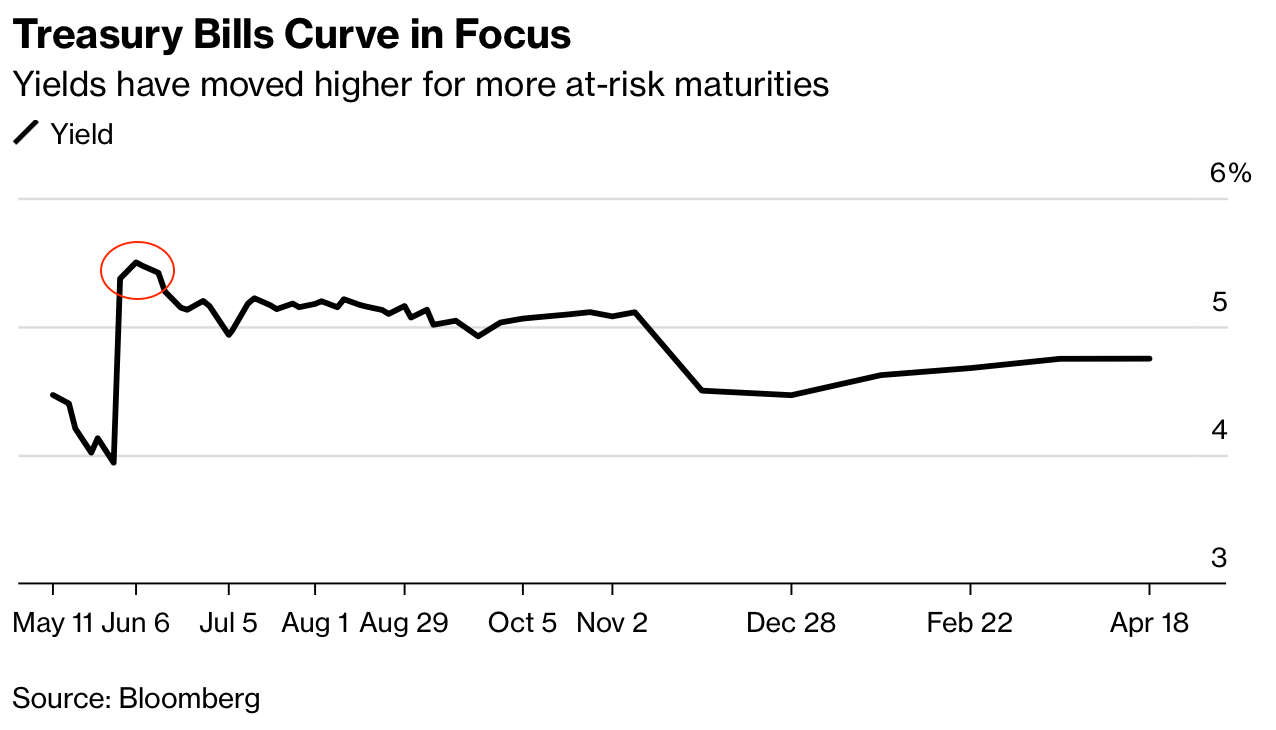

The second position I executed was to short the front end of the treasury curve, based on the premise that as we draw near to the debt ceiling investors will demand a higher interest rate premium for short-dated bonds therefore the price of such instruments would trade south. If you’re scratching your head trying to piece two together, let me touch upon this quickly:

After doing some digging I found out that “Investors have historically demanded higher yields on securities” that are set to be repaid shortly after the US is seen as running out of borrowing capacity. From there it’s a simple way of viewing how bonds work, if investors expect higher yields for such short-term securities the only way that can happen is through prices on those bonds trading lower.

A new concept I’m exploring with this position but that’s the journey to mastery guys, no perfection without new experimentation, and that’s the journey we’re on here.

The short end of the T-bill curve has repriced for the higher yield investors are expecting.

Now, back to the dollar, I think it’s evident from price action alone that a relief/rally was needed to fuel the next leg downwards which I’m holding high conviction due to a number of macro and economic factors such as:

We’re currently experiencing slowing global growth

The Fed is no longer tightening so this is potentially the end of the hiking cycle

Cracks are starting to appear within the U.S economy potentially triggering further market strain (CRE loans, banks, credit crunch)

We’re sitting in the middle of the dollar smile

Corporate earnings are set to struggle in upcoming quarters

For me it’s simple, up until the Fed openly ring the recession fire alarms I see minimal to no reasons to be net long the dollar on a macro higher time frame position >6 months - 12 months etc.

That’s a brief educational and informative wrap up of how I’m approaching the current macro cycle and conditions we’re seeing.

Next week will be a deeper report to uncover a few things so be on the lookout!

As always, appreciate you guys— till next time