The Quiet Before The Storm.

What are central banks doing, but most importantly where are markets headed?

Hey guys,

Feels great to share my first research note on Substack, I’ve been going on about this for some time now, but we’re here!

Major announcement: We’ll be launching the Four Foundations Of Macro FX on March 31st; this is not for the newbie macro head or trader, you will at least need 1-2 years of experience to maximise your value gain from this, you’ll love it. More about it later.

But for now, markets…

We’re currently in an interesting space within global macro, the China reopening trade, commodities, Fed terminal rates and a lingering inflation cloud.

So let’s dive into it.

As always, lend me your attention from here.

Time To Long/Short?

That’s the question on everyone’s mind.

We’ll get into my conclusion and the current position I’ve taken later, first let’s look at where financial markets are.

The U.S10yr breached 4.00% now yielding 4.08%

The last time 10yr bonds were at 4.00% was in November 2022.

Why is this notable?

Simple, as we know, treasuries set the cost and level of borrowing within the U.S economy, everything is benchmarked off the 10yr treasury. Mortgage rates, car loans, commercial loans & personal credit etc. Housing is the most interest rate-sensitive sector in any economy, making it a great indicator of how interest rates are affecting an economy. When looking at the data for building permits (approval for new construction projects), the most recent building permits for January showed 1.339 million residential constructions approved, the same amount as June 2020 during the Covid-19 period. YoY building permits are down -27.3%; higher interest rates = higher mortgage rates = lower housing demand which results in this—withdrawal of buyers looking to purchase homes.

The reason the housing market in the U.S is able to withstand the pressure from higher interests is because of the tenure of the mortgage rates provided. Approximately 57% of all mortgage applications in the U.S are for 30-year fixed rates, meaning that citizens who secure these 30-year rates aren’t affected by the interest rate hiking cycle. Whereas, the most popular and frequent mortgages in Europe, the UK and Canada range from 2-year fixed to 5-year fixed with some pushing 7 in a rare case.

So, a 2-year fixed homeowner is bound to feel the pressure and effect of sudden rate hikes, unlike the U.S homeowner.

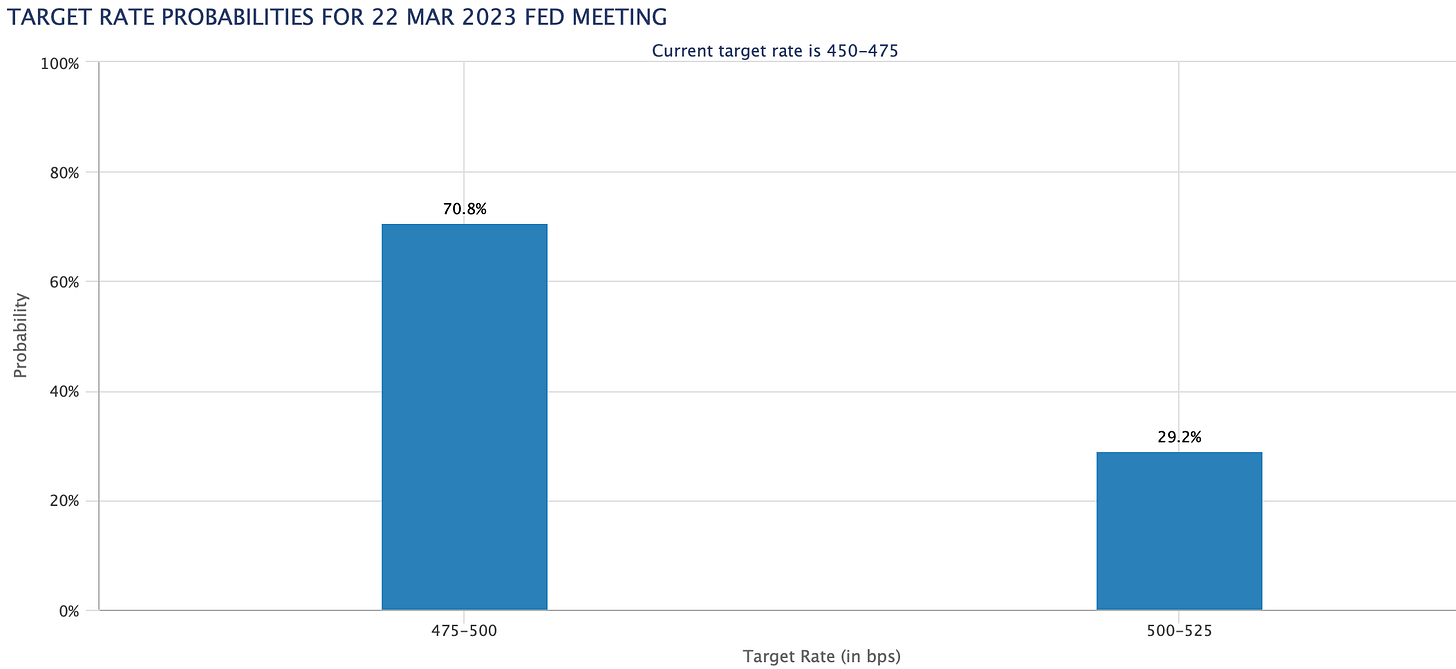

Leading on, financial conditions in the U.S are still loosening but I think we’re going to see conditions materially tighten in the upcoming weeks/months as the Fed draws near to the terminal rate of 5.50-75% as expected by markets. In the upcoming meeting, the market is already pricing in a 70% chance the Fed hike the federal funds rate by 25bps to 5.00%.

If you ask me, I wouldn’t be surprised to see a 50bps hike after the hot PCE reading we saw in February and two Fed members, President Loretta Mester and James Bullard seeing a “compelling economic case” to raise rates by “another 50bps” at the March meeting.

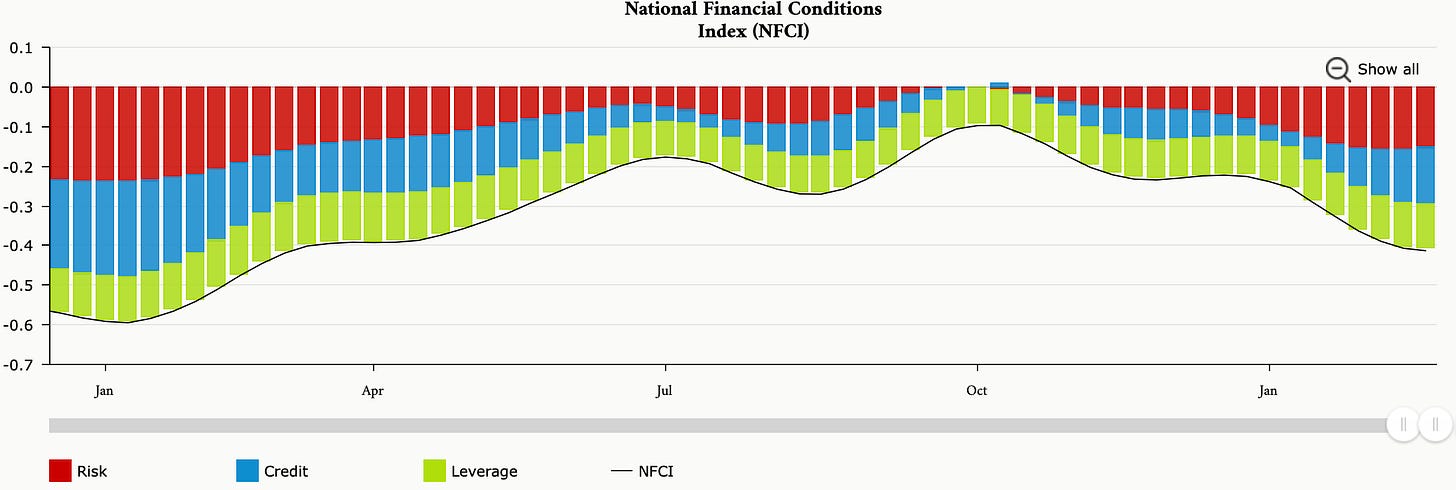

Here’s how financial conditions are looking in the U.S

When the index is above 0, this means financial conditions are tightening, when the index is below zero, negative, this means financial conditions are loosening. As spotted in our last article, financial conditions have been loosening since October, and as a result, on February 24th we saw a surprise to the upside in the PCE inflation reading. What a surprise.

If financial conditions are loosening, one has to think about the secondary effect this has, more credit has a direct link to inflation, greater leverage, pushes asset prices to extreme valuations and a greater appetite for risk can be seen in recent mini-rally in risk assets.

Now, many of you do not actually know the difference between PCE & the CPI reading, although they both record inflation, there’s a huge difference, which is why the Fed focuses on the PCE reading during all their press conferences:

PCE (personal consumption expenditure) measures the change in prices of goods and services that consumers actually purchase, while the CPI is calculated on a fixed basket of goods that may now truly represent the constantly changing consumer behaviour.

PCE measures consumer spending on a wider range of goods and services than the CPI. PCE includes durable goods, (cars, furniture, appliances) anything with a longer life span than 3 years, whereas CPI is more focused on housing-related expenditure which accounts for 33% of the total reading.

All in all, PCE provides a better in-depth view of how U.S citizens’ shopping habits and spending habits change during a given time period.

At the start of this note, I noted how we’re in a very interesting space, and we are. After the China-led rally, from commodities to crypto to equities and even the emerging market EMBI etf. Now, it seems the market has plateaued and is configuring where next to move as we re-price the Fed terminal rates and the ECB terminal rate, currently forecasted to peak at 4%.

My near to short-term trade I’ve taken is commodity longs, particularly USOIL, you could say I’m still long the China-reopen. Feb 14th the OPEC came out and said:

"Key to oil demand growth in 2023 will be the return of China from its mandated mobility restrictions and the effect this will have on the country, the region and the world," — OPEC

A statement I’m totally behind, OPEC expects the world demand in 2023 to rise by 2.2 million barrels per day, 2.2%. We’re yet to see the full force of the Chinese economy back in full motion swinging, and once we start to see that happen, greater activity, higher GDP revisions and production I think we can see oil make a return to the $92-$94 region as highlighted. I now have to say, this isn’t investment advice, but rather my personal viewpoint and market positions.

This is a simple yet clear play on global growth, both oil and copper are directly linked to global growth, and those commodities are the building blocks of expansion.

When looking at the wider market, I’m leaning towards re-entering markets, even though forecasts are pointing south, with equities it’s better to have time in the market than try to time the market, commodities are a different play.

Guys, that’s it for today—thanks for your patience during this transition. Back next week with a bang.

As always stay tuned for the Macro Guide launch at the end of this month, you’ll get first looks with a 20% discount for early birds in the first 48 hours!

Thank you Joe very inciteful article excited for you to be on this new platform can't wait for what's to come