The Oil Update: Balancing Demand, Supply & China

China's Economic Struggles Cast Shadow on Crude Prices, Investment Neutrality in Short Term, Bearish Long Term

Hey crew,

It’s been another fruitful week.

Each step forward reinforces the next, and the next, and the next. It’s a spiral wheel of increasing self-belief.

I encourage you to seek opportunities that force you to grow into a better version of yourself.

A mentor of mine I’ve never met said this:

“When faced with new information, don’t revert to old instincts. Change”

Anyways, today we’ll be covering a key look at what’s shaping the global macro landscape. It’s been a while since a deep dive into the world of commodities so here we go. As always, grab a pen, and paper and take notes.

Oil Markets Developments

Crude Oil House View: Neutral/Bearish

World Growth

Global growth is a key attribute to the performance of Crude oil prices. Although there are many factors which can affect the price of crude such as geopolitical tensions, the market boils down to the fundamental trend of global growth which drives supply-demand dynamics.

For many of us, including investors, global growth in 2023 outperformed our forecasts and expectations. For one, was quite pessimistic about the dollar's performance against the G10 basket. However, the Biden administration's stimulus package, including measures like the IRA (Inflation Reduction Act), triggered a surge in US growth pulling the rest of the world further.

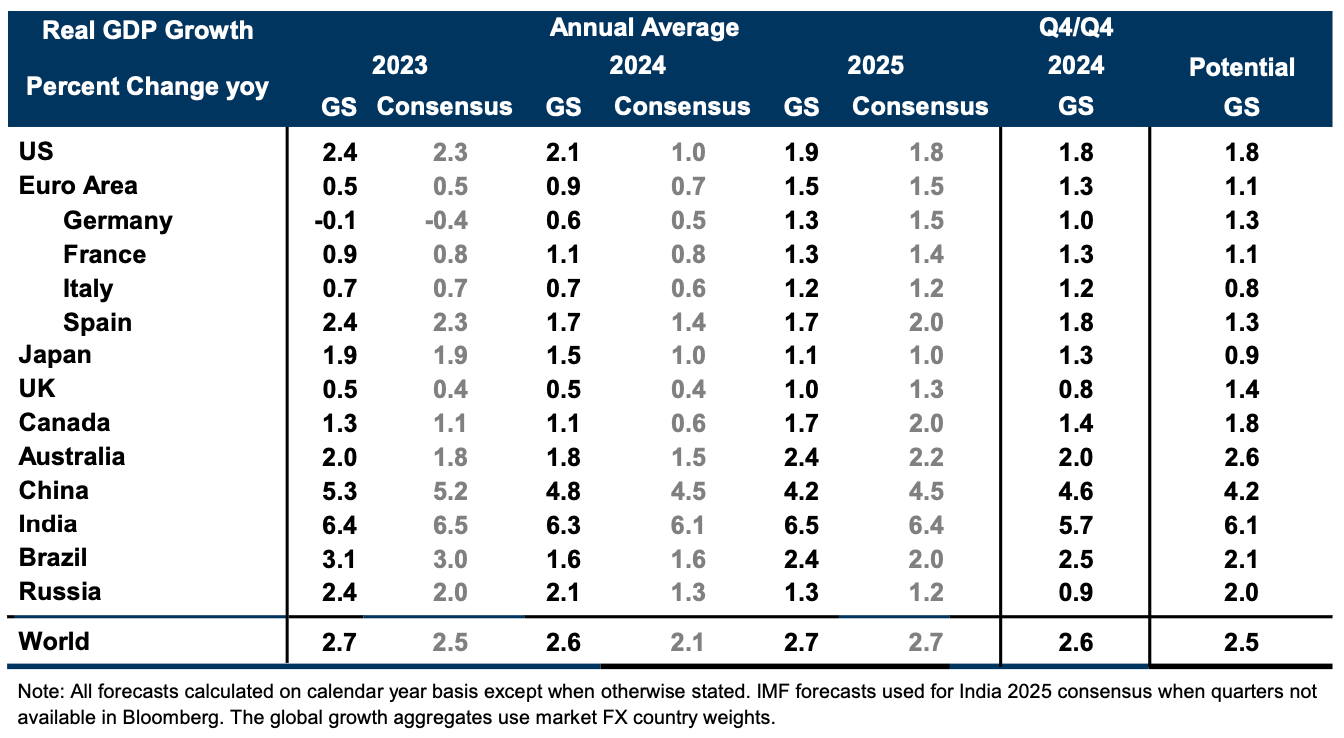

Looking forward, global growth is expected to grow by 2.7% according to GS, which is aligned with several Wall Street banks’ estimates.

The U.S is expected to continue with its economic strength growing by 1.9% in 2024.

World Oil Demand

As we know, the largest consumer of crude products is Mainland China, which unfortunately has been experiencing structural and economic weakness across the economy over the last 5-6 years mainly, stemming from the introduction of tighter capital controls in 2016 and the trade war between US-China encouraged international companies to de-risk away from China. The restrictions now limit individuals to exporting only $50,000 annually, further dampening economic activity.

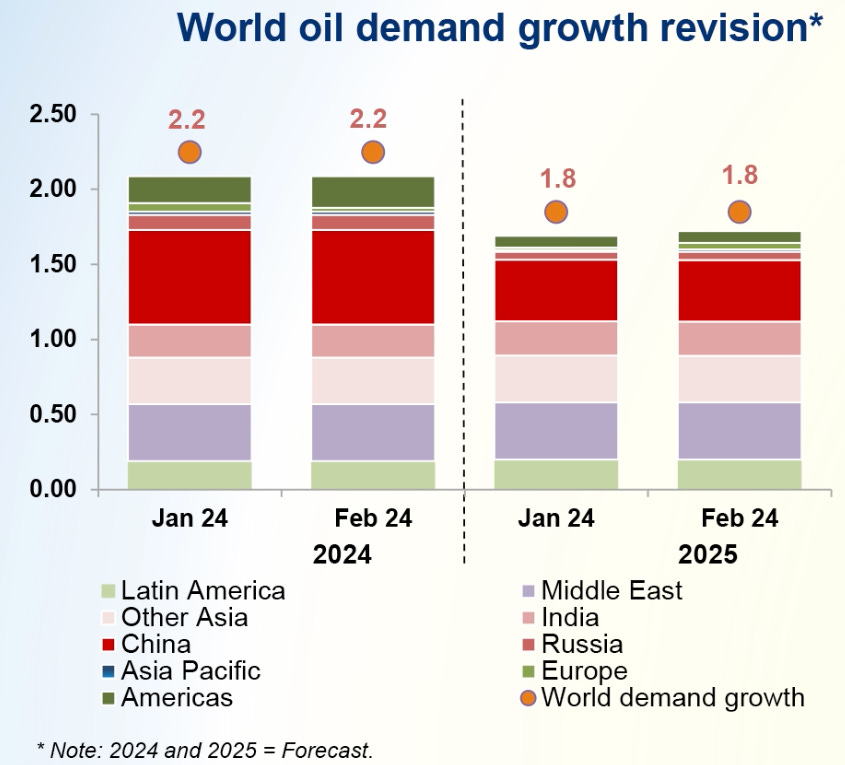

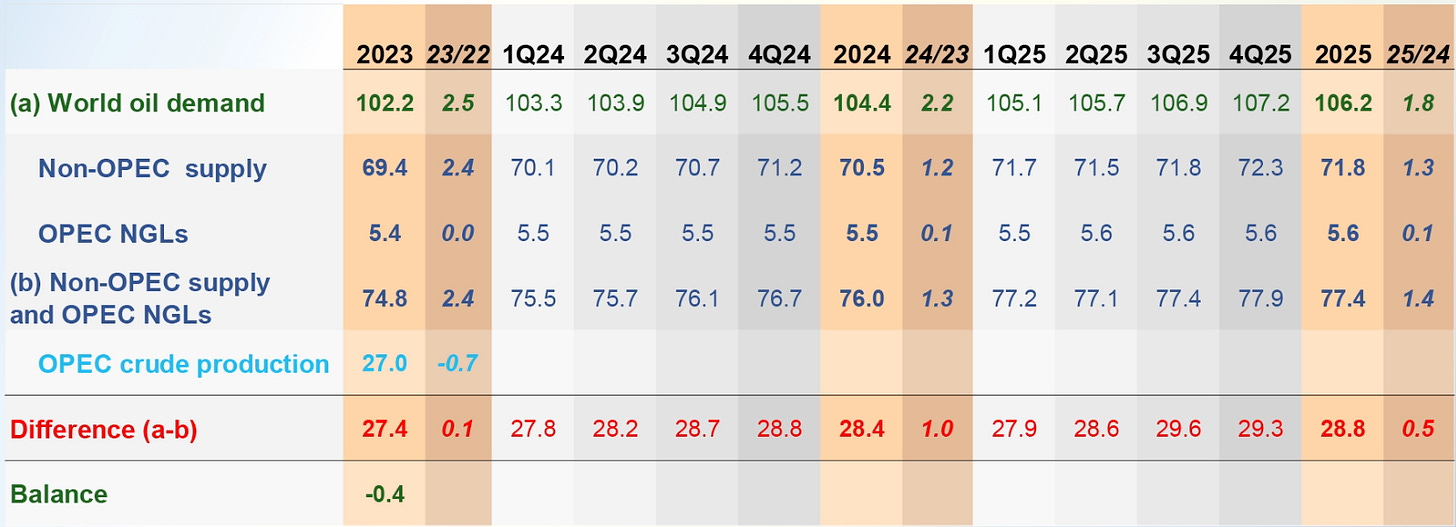

Figure 2 depicts OPEC's recent revision for global oil demand in 2024 and 2025, predicting a flat trajectory. This raises a crucial question: is the current oil market in equilibrium at its prevailing price? While I'll address this later, let's delve deeper into China's economic outlook, represented here by the "large red stack." Structural issues weigh heavily on both domestic and foreign investors. The Chinese economy's diminishing dominance in global low-cost trade, with the rise of competitors like Vietnam, adds to concerns. Furthermore, the "balance sheet recession" – where consumers prioritise debt repayment – and the property sector's struggles (accounting for nearly 20% of GDP and facing widespread developer defaults) further dampen the economic outlook.

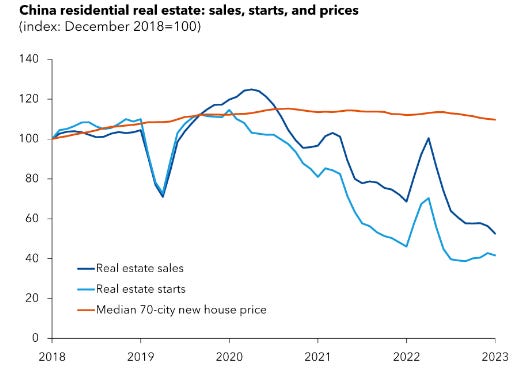

Housing starts in China have plummeted to just 40 on the index, representing a staggering 60% decline since December 2018. While real estate sales haven't fared as poorly, they still show a significant 50% drop. This weakness stems from a confluence of factors:

Demand-side headwinds: Demographic slowdown, rising household debt, and overall economic uncertainty have dampened buyer sentiment.

Supply-side constraints: Years of overbuilding in many cities, coupled with high developer debt and stricter government regulations, have squeezed the life out of the property sector.

The combined effect is lower GDP growth, which translates to reduced demand for crude oil as the industrial sector cuts back on large, commodity-intensive projects.

World Oil Supply-Demand Dynamics

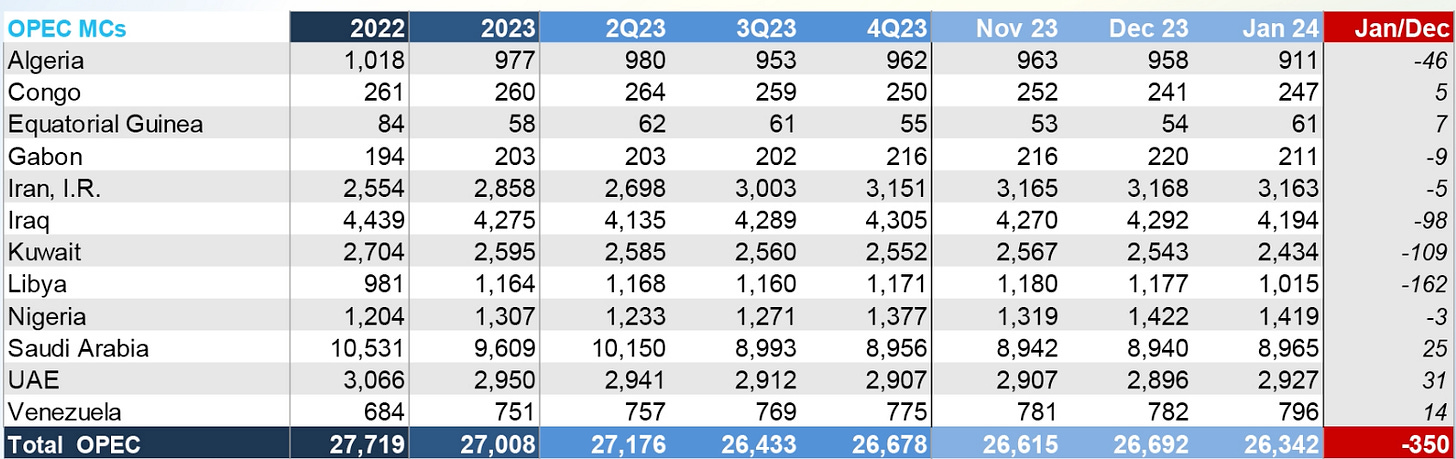

OPEC crude oil production decreased by 350,000 bp/d MoM from December 2023 to January 2024. As seen in Figure 4, production decreased the most in Libya, Kuwait and Iraq. The unrest in Libya forced the Sharara oilfield to temporarily suspend crude output.

OPEC's total production declined by 700,000 barrels per day (bp/d) from 2022 to 2023. This decrease was primarily driven by voluntary cuts from Saudi Arabia, which slashed their output from 10.5 million bp/d to 9.6 million bp/d, representing a significant 900,000 bp/d reduction. The largest drop occurred in the third quarter of 2023. As of January 2024, OPEC's total production stands at 26.34 million bp/d.

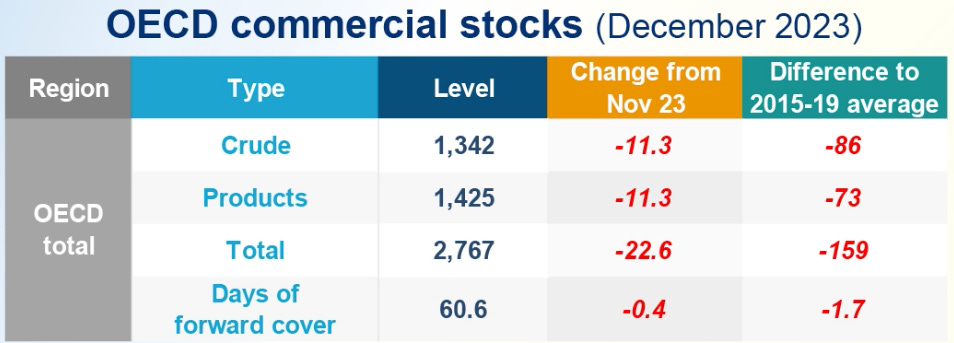

For December 2023, total OECD (Organisation for Economic Co-operation and Development) commercial oil stocks were down 22.6 million barrels month-on-month vs November ‘23. At 2.7m total OECD stocks were 159 million barrels below the 2015-2019 average. To break this down, OECD commercial stocks refer to crude oil and refined petroleum products which are kept for various purposes such as:

Meeting fluctuations in demand: Inventories act as a buffer against sudden changes in oil demand, ensuring smooth supply during temporary spikes.

Maintaining operations reserves: Companies need a certain level of inventory to maintain consistent operations within refineries and other facilities.

Strategic security: OECD countries aim to hold reserves equivalent to around 90 days of net oil imports or 61 days of average daily inland consumption to mitigate potential supply disruptions.

So, they serve the purpose of balancing oil markets and mitigating risks/shocks. Days of forward cover show that the commercial stock level is still above the minimum requirement.

Demand for OPEC crude for 2024 is expected to reach 28.4 million bp/d, an increase of 1m bp/d vs 2023 estimates. As it stands Brent crude oil is trading at $82pb with a $4 spread from its WTI crude partner that’s trading at $78.00.

Investment Conclusion: Short Crude

My overall outlook on crude is neutral in the short term (interim) but bearish in the long term (3-12 months). Despite recent geopolitical tensions and war, oil prices have remained surprisingly stable. This stability reflects traders' focus on the deeper driver of demand: China's economic growth. However, the current price range of $78-$82 hinges solely on the 1 million barrel production cut by Saudi Arabia. This output limitation supports prices, but raises concerns. Even if China's demand recovers later in 2024, it's likely Saudi Arabia will simply increase production again, given their position as China's largest oil supplier which will suppress crude prices even further as neighbouring OPEC countries look to increase their crude output.

It’s vital to wait for all factors to align before entering any macro plays on commodities, especially due to their volatility. Furthermore, rising global stockpiles (reserves) and slowing economic growth suggest a trend toward lower oil prices throughout 2024. Nevertheless, I remain committed to keeping you informed with the latest data and insights as developments unfold to ensure our research remains informative and actionable MMH crew.

As for now, that’s it.

Thanks for getting to the end of the report crew, this was a deep dive which I’m sure you gained a thing or two from.

As always, let me know your thoughts as always, they’re valued.