The Oil Pendulum.

Analysing the rally in WTI crude, the cause and the future for oil.

Hey guys,

It’s a late one I know.

Thanks for your patience.

I’m confident you’ll take a lesson or two away from this report, even a trade idea.

What’s Going On With Crude?

For most of this year, I’ve held a bearish outlook on WTI Crude oil, most notably expressing my view through shorts earlier this year which played out. However, recently, oil has skyrocketed through the $70s - $80 per barrel mark, now trading shy of $90 per barrel. In times like this when I’m wrong, I go back to a key lesson I’ve learned and continue to learn.

“Strong opinions, weakly held” — Paul Saffo, Stanford

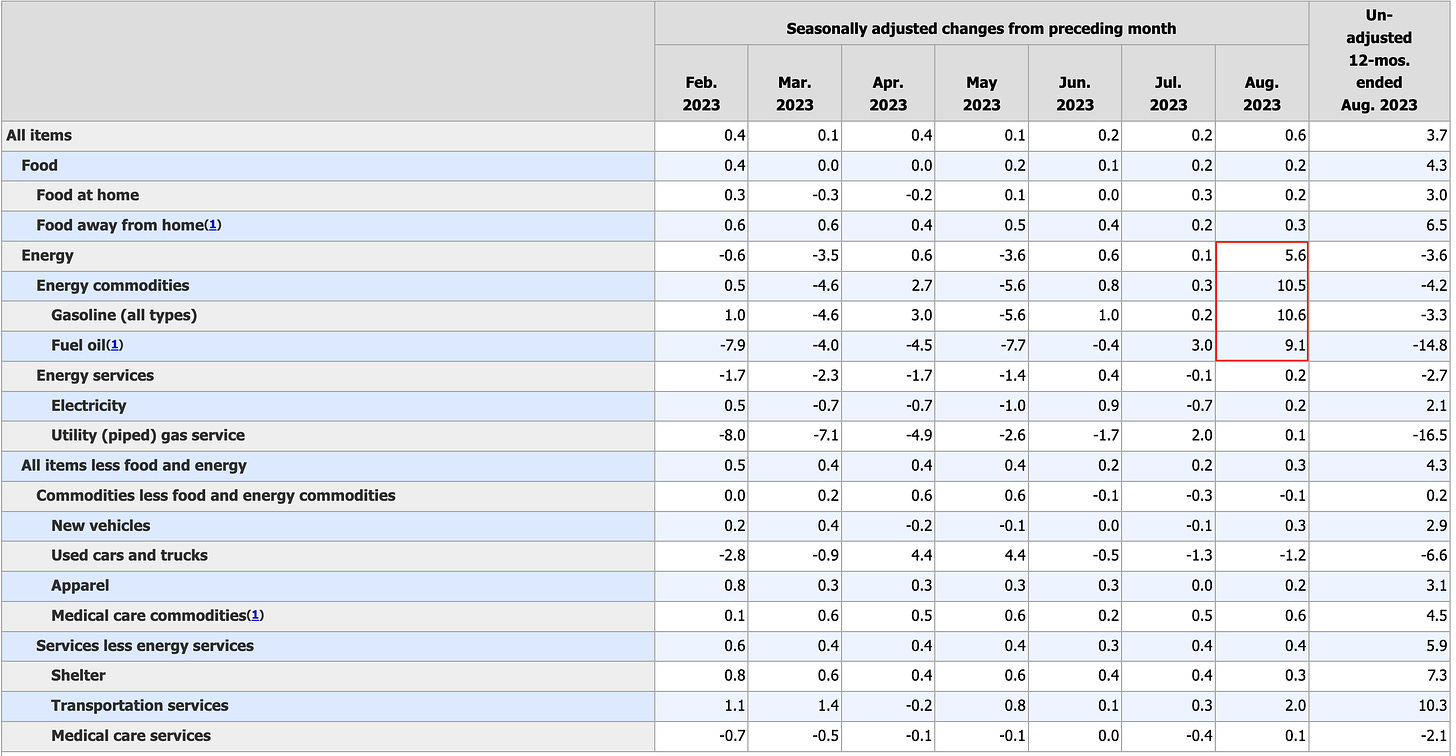

As I’ve explained in prior reports, oil is a base commodity that is heavily dependent on global growth and consumption to drive prices higher. Yesterday US CPI rose to 3.7% YoY with the MoM increase of 0.6% and as you would expect energy prices, stemming from higher oil prices contributed the most to the overall increase.

The energy component of the Consumer Price Index (CPI) increased by 5.6% in August. This was driven by higher prices for gasoline, fuels, and energy commodities. However, if you look at the monthly changes in each of these subsets, you can see that they were all negative for most of the year. This dragged the overall CPI reading lower.

There was a discussion in the Discord group about the relationship between oil and inflation. I didn't understand the basis of the points raised, so I'll clarify the link and connection here.

Within the composition of CPI, the shelter component contributes most to the overall reading, it accounts for roughly 33% of the overall CPI reading. Energy, although accounting for 7.5%, has a huge influence on the movements in headline CPI. Here’s a clear link between the two.

The direct relationship isn’t anything of a new discovery, but from this chart, we’re reminded of the direct macro lag between rising oil prices and inflation.

The answer to where this large increase in oil demand is coming from is no surprise. China. Reports of increased consumption and demand from the Chinese transportation sector resulted in China tapping into reserves during July to meet the domestic demand. Looking backwards this comes as no surprise, oil was trading in the mid $60s to $70 per barrel region for the majority of May, June and July and China boosted its oil stockpile to the highest level in 3 years!

According to a Reuters analyst, China's oil imports in June reached a three-year high of 2.1 million barrels per day (bpd), up 400,000 bpd from May 2023. This may seem counterintuitive, as China's economy is currently experiencing deflation. However, the answer lies in Russia.

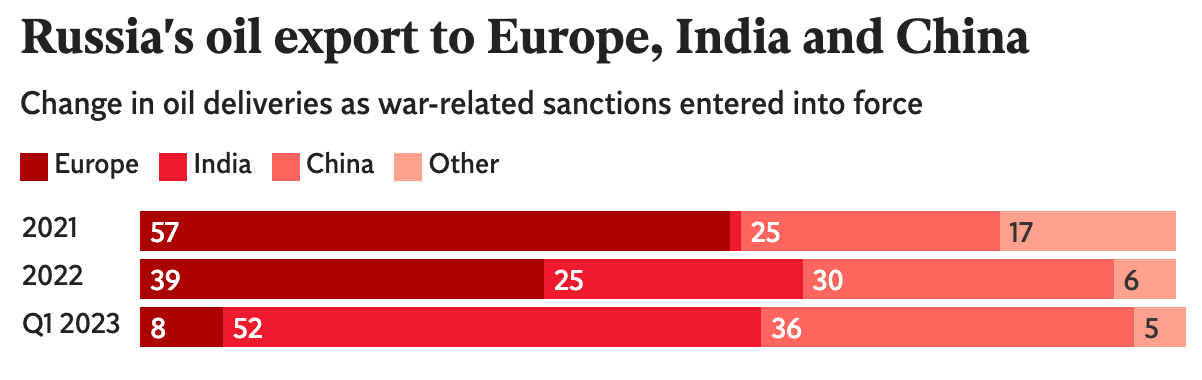

After the invasion of Ukraine, the G7 group of nations agreed to sanction and cap the price of Russian oil in an attempt to strangle Russia's ability to finance its war. However, this plan backfired spectacularly. Countries like China, India, and Turkey have stepped in to scoop up cheap Russian oil, effectively nullifying the sanctions.

The price cap for oil was set at $60 per barrel, causing Russian oil to trade at a huge discount vs the likes of Brent and WTI crude. The G7 group anticipated that Russian oil may turn the heads of world leaders but believed it “wouldn’t be a problem if the price cap was correctly implemented” according to the co-founder and lead analyst at Research on Energy. As you can see below, the price cap has been more of an imaginary ceiling for Russian oil which has traded above the cap since the policy was introduced.

In summary, when oil prices are in cheap territory, such as they were in early March, May, June, and July, large oil consumers will take advantage of these prices by overstocking on the commodity. This is a hedge against the possibility that oil prices could rise to $100 per barrel, as analysts at Bank of America have predicted.

What’s the alpha?

The question that should be on your mind. Are markets uncertain or certain about this oil rally?

Let’s answer that with the chart below.

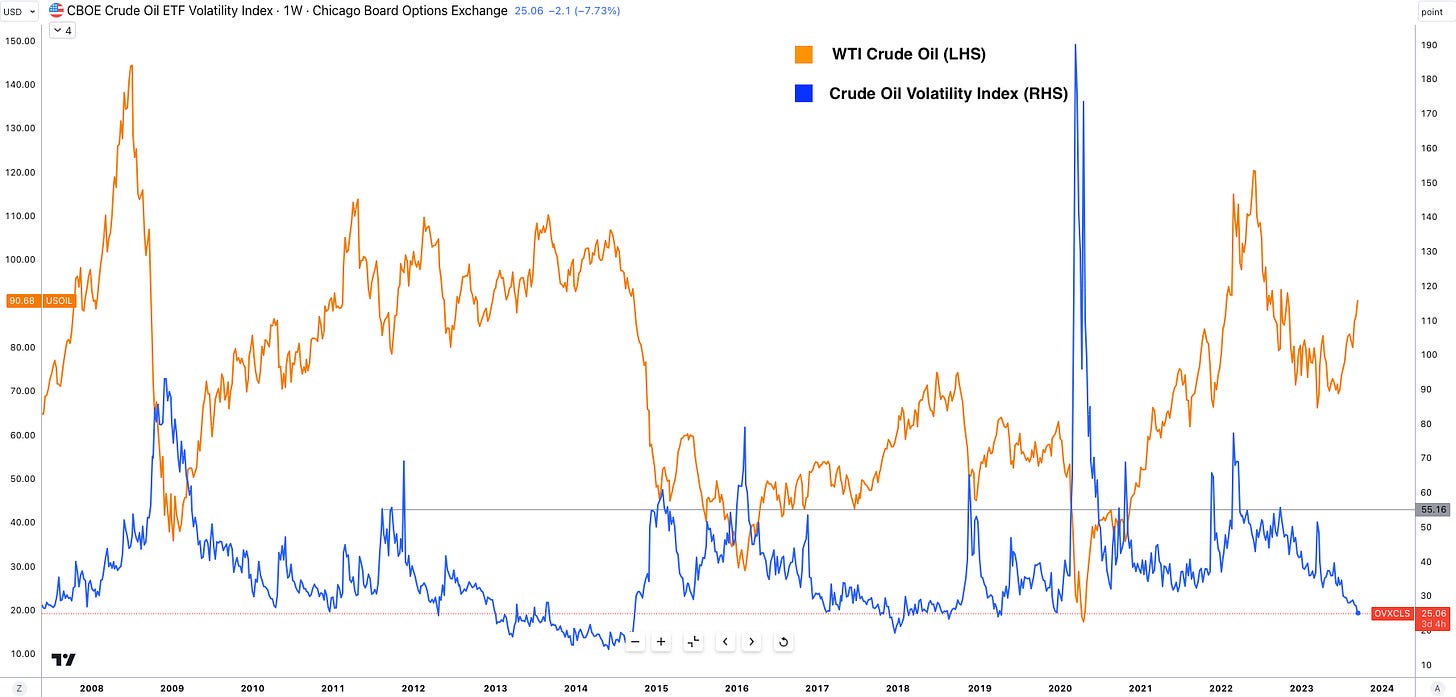

The chart illustrates the relationship between the WTI crude oil price (orange) and the crude oil volatility index (blue). As with the MOVE index, a sharp rise in the volatility index indicates high levels of uncertainty in the oil market, which can result in sharp swings in prices as investors lose confidence.

The crude volatility index is a great tool for participants in the oil market. When the VIX index is low, as it is showing right now, this indicates that investors are not expecting much volatility in the oil market. So we as traders, can interpret this as investors having some certainty that the current price of oil is a true representation of global supply-demand dynamics. But we’re paid to read between the lines, and trade tomorrow’s expected value of assets not today!

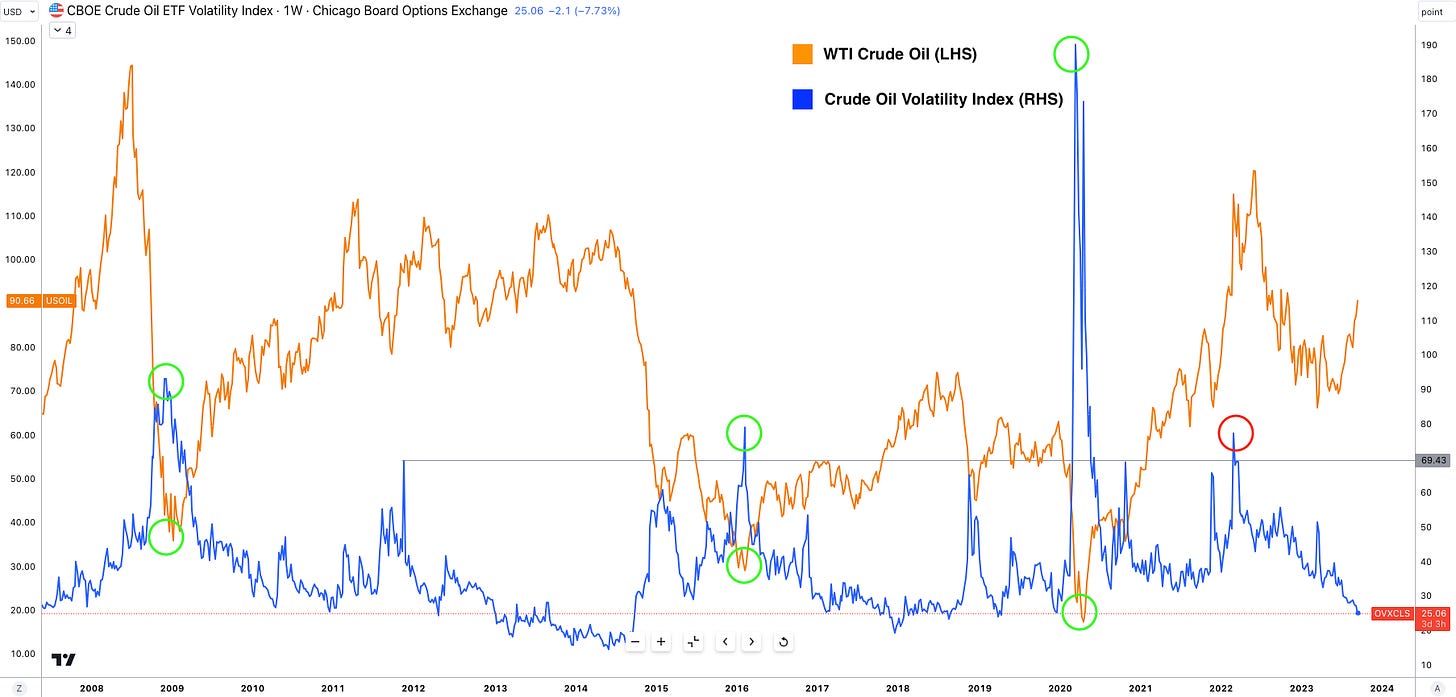

As always, I try to add my own perspective and view to my analysis. So here’s one reason why I’m betting on there being a turning point in WTI crude price.

The green circles on the chart represent the peaks in the VIX index. I have also highlighted the price of WTI crude oil during the same time period as the peak in the VIX index. Over the past 14 years, dating back to 2009, the price of oil has more than tripled each time the VIX index rose above 55, with one exception in 2022. Of course, there is a whole macro story behind each move, but the first step is to spot these inflection points in the market. The opposite is true when the crude VIX index was subdued below the 30.00 level, the price of crude tanks.

As we speak right now, the VIX reading for crude is 25.00 so you can say my bear calls on crude are going to start from now. Price may extend above $100, as supply remains tight, but once we reach the end of the Saudi and Russia cuts if oil prices haven’t already tanked I’ll definitely be looking to make this position live.

As global growth across developed countries begins to disappoint and China scales back large crude imports due to expensive oil prices my bias is further reconfirmed. As this idea evolves I will share my key confirmations as I nurture this position into reality.

But as learnt many times.

Strong opinions, weakly held.

I hope you enjoyed this report, if you gained insight or value, always let me know!