The Market Brief: What's Ahead

A Look Back and a Look Ahead: Market Insights

Hey guys,

Another report from Emmanuel here - I am currently testing something that will be released (if ok) next week.

I am just waiting on some feedback from some people.

I’ll be hopefully releasing a market outlook weekly via a Substack video rather than a typed report.

If you guys can let me know in the comments whether that would be something you’d like to see that’d be great.

An update on the structure of MMH:

Me - Global Macro

Emmanuel - FX

Let’s get into another one of Emmanuel’s great reports!

There hasn’t been a scarcity of market drivers this week from both geopolitical event risk and macro outputs.

What started as a relief party following a less-than-expected inflation print in the US threw markets off, sending them into risk-off territory due to developments in the Middle East, marking a temporary top in equities and a flight to safety elsewhere, with FX continuing to paint a complex array of scenarios.

This report outlines our assessment of recent developments in currency markets, central bank communications, and the divergence in pricing among market participants versus relevant themes, as well as our positioning expectations for the coming weeks.

Without further adieu, let’s dive in.

Dollar Duality—Fleeing Uncertainty and Covering Risk Exposures

This week’s trio (CPI, PPI & Claims) delivered a dose of downturn in the dollar, at least exhibiting a more traditional market response correlating with UST being bought as both STIR and duration yield sank, flattening further across the 2s10s curve.

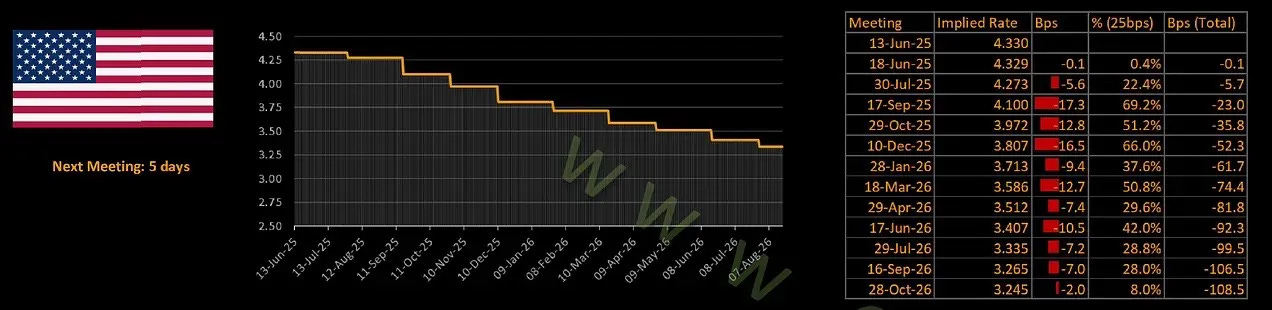

Overnight rate added c.8bps, pricing fully two (2) cuts by year-end.

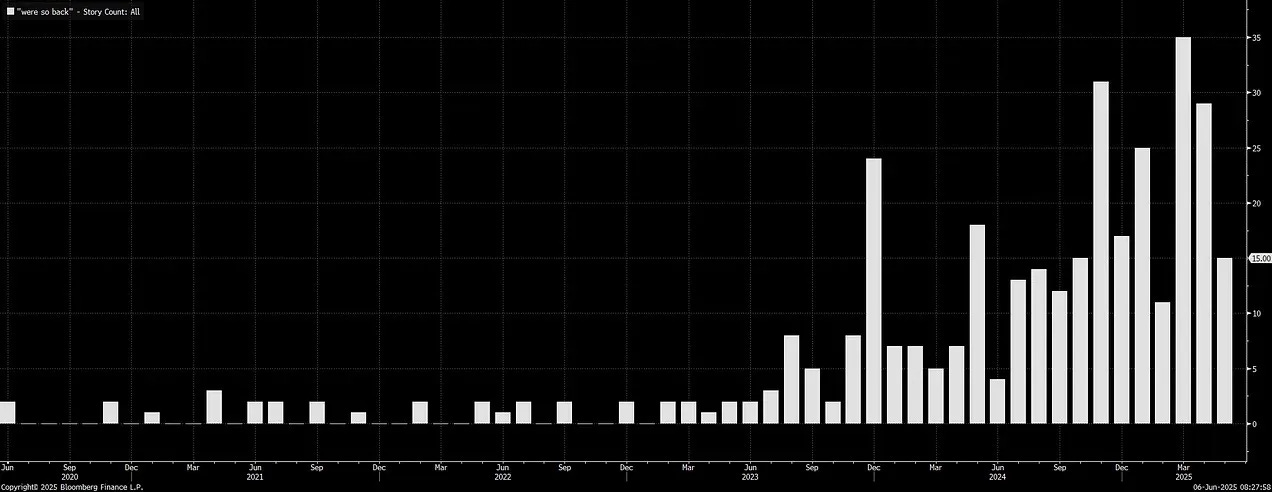

Uncertainty premium refuses to clear, with tails seeming to spawn almost every other week as markets perform a macro seesaw, periodically sounding the alarm bells from “it’s so over“ to “we’re so back“. I guess you can tie that to the limited capacity of modelling the TACO (Trump Always Chickens Out) series of possible outcomes.

Throw in the half-baked, less optimistic US/China trade ‘deal’ and the domestic macro downturn that kept equities edging higher, only to have its balloon popped by the rising reality of the Israel-Iran nuclear conflict. The White House claimed not to be involved; however, 48 hours before the Israeli strike, it withdrew its staffers from the US embassy. I suppose, in hindsight, that was a crucial tell that things were set to escalate.

We think for equities, dips will be bought. We’ve seen retail aggressive risk-taking since the start of the year and frankly expect that to continue with support, as institutional funds slowly warm up, yet views remain constructive. It’s a story of equities being done with catering to fearmongering, and until hard data mirrors concerns—higher she goes.

Okay, down to more serious business, FX…

For us FX traders, it goes far beyond ‘dip buying’. The currency market appears more nuanced than that. The dollar, which remains a focal point of extracting signal, is important to understand in short-term proliferation against broader & longer-term cyclical shifts.

The million-dollar question: ‘how low can the dollar go?’. Listening in on a Morgan Stanley call this week, and when discussion of the dollar came up, in-house strategists held what they deemed a ‘contrarian view’, citing potential further double-digit decline for the greenback.

No dollar bull left in sight. Let’s talk about…

Duality flows: The clearest way to extrapolate and develop a bias is to examine the dollar through the lens of safe haven flows and commodity bloc, highlighting pro-growth sentiment.

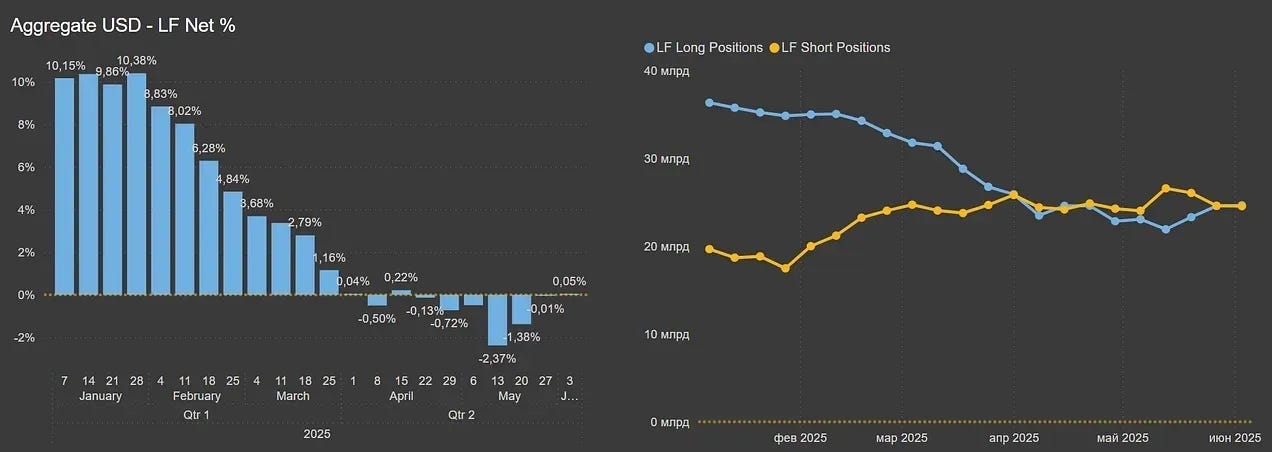

For the first time since the infamous liberation day, dollar positioning among leveraged funds has turned positive. However, for clarity’s sake, it would be impossible based on the totality of this book alone to deduce the net exposure, as it fails to account for hedges. Nevertheless, let's examine more closely. The first thing I would like to point out is that this appears to be more nuanced than the classic risk-off/on narrative.

On one hand, safe haven currencies like the JPY have continued to receive more inflows in the same environment as a marginal pickup in dollar demand. If you have yet to read our USD/JPY piece, we recommend you do so as it offers more insight into our longer-term cyclical thinking of the path ahead for the

BoJ. However, short to medium term follows a more tactical risk assessment path. For one, Ueda seems to play both sides of the coin well, preaching an accommodative stance yet acknowledging inflation targets remain above the bank’s mandate. For now, we expect this lukewarm stance from the central bank governor to take a back seat in driving the Yen.

Without expectation of a hike in sight during next week’s monetary policy meeting (as largely expected), instead we see the view of the yen’s safe haven status combined with US higher rates (lower yields) beneficial to the yen. These combined factors of lower US yields and priority of risk aversion make it not the most optimal funding currency across G10 in our opinion.

Okay, I digressed for a bit. Back to the subject matter.

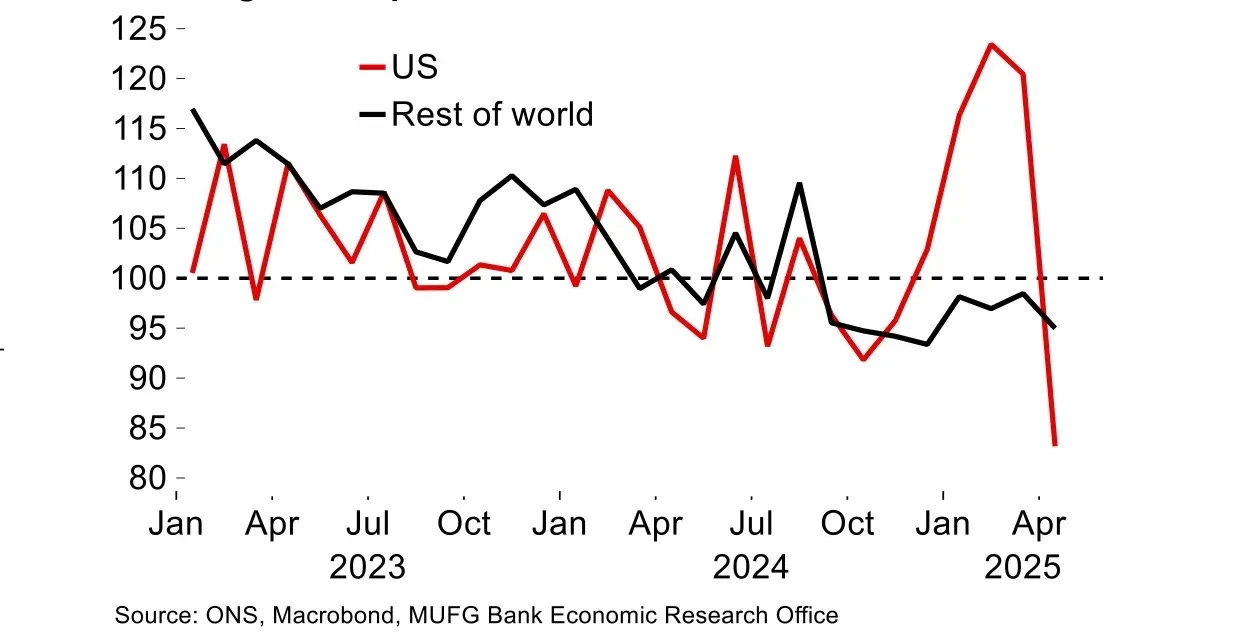

The chart above reflects clear signs of de-risking, particularly when viewed through the lens of pro-growth currencies like the Antipodeans (AUD, NZD). This suggests repatriation flows back into core currencies, though USD flows are marginal and not forceful enough to trigger a significant squeeze.

This is even more concerning when we factor in the developments in the Middle East. Historically, flight-to-safety flows into the U.S. dollar are a given in periods of escalation. Yet what’s puzzling is the market’s muted pricing of geopolitical risk. One explanation could be the now-familiar pattern of headline-driven spikes that tend to fizzle out quickly, causing traders to discount the longevity or severity of such events.

Meanwhile, gold has held its gains, especially in relative terms compared to the dollar, which has pulled back slightly trading on the war headlines, even as yields repriced higher toward session close. This dynamic suggests a selective bid for safety, with gold benefiting more directly than the dollar, at least in the short term. The cyclical drivers still supporting the “sell America“ narrative seem to overpower the “end of the world“ risk.

We have yet to fully observe the pass-through effects of recent tariffs, which, in our view, complicate forward guidance and reinforce a growing stagflationary theme likely to emerge in the next Summary of Economic Projections (growth down, inflation up). We expect Powell to acknowledge the increasing risks to both aspects of the dual mandate and the heightened uncertainty. While tariffs are inflationary in theory, it is difficult to overlook the strong disinflationary trend that has persisted since the beginning of the year. This suggests a return of the so-called “transitory” effect, albeit in a new form.

We may be approaching a genuine inflection point, especially when factoring in geopolitical tensions and the broadening scope of global conflict.

On the surface, the labour market appears resilient, but deeper indicators show softness:

• The bulk of job additions is concentrated in hospitality & health care, while federal employment declines and the professional sector posts negative figures.

• Hiring appetite & quits level remain historically low, signalling employers are unsure of the future and a lack of worker confidence to find new jobs, evident in claims data coming in hot.

We believe that real income will come under pressure, especially as the tariff shock ripples through the system. A weakened labour market is unlikely to absorb these shocks well, and the pass-through to wages could reinforce a negative feedback loop.

Prices of some items are rising slightly due to tariffs, while prices of others are decreasing due to softness in demand, cheap oil, and cooling services. The narrative could shift significantly if the duration of this crisis keeps oil prices near $100. A persistent oil price shock at that level would likely lead to demand destruction, not just in the U.S.

If this scenario unfolds, the inflationary pass-through would be global in scope. As growth slows, we can expect to move toward the crest of the dollar smile, where the USD appreciates as global capital flows into U.S. assets amid a synchronised slowdown in global financial and capital markets.

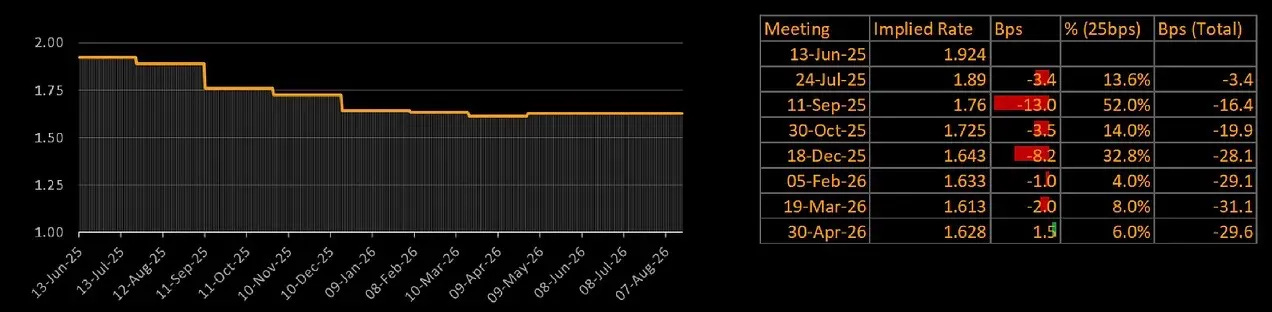

ECB: Have they won… and Done?

After a total of 200bps in cuts, leaving the deposit rate at 2.0% with inflation anchored at target (1.9%), the ECB can now truly wear its data dependency crown. It’s been a 180-degree ride for the Euro bloc from a consensus view of a parity party in sight at the start of the year on the back of Trump’s tariffs to becoming a main beneficiary of ‘de-dollarisation’ (yes, you can add gold to that list as well), trading in the 1.15–1.16 range.

This is ultimately a confluence of factors supporting an alternative reserve narrative for the euro, underpinned by monetary policy flexibility, a renewed fiscal push from Germany, and the April tariff announcement—all of which have led markets to question the durability of the

U.S. dollar’s reserve status. Germany’s decision to suspend its constitutional debt brake adds momentum to this theme. Additionally, provisions like s899 of the new U.S. tax bill effectively impose a levy on U.S. sourced income held by foreign investors, which could further accelerate capital rotation out of the U.S. and into European markets.

From a positioning standpoint, the euro also benefited from a reversal off extreme net short levels entering the year. While many valuation models suggest the euro is overvalued relative to the domestic backdrop in the eurozone, the current drivers for EUR/USD strength remain intact. The key arguments for continued euro appreciation centre around global asset allocation shifts away from the U.S., the beginning of European fiscal stimulus, and the fading narrative of U.S. economic exceptionalism. These trends are likely to intensify once the Fed resumes its rate-cutting cycle.

That said, risks remain, particularly from a potential growth slowdown linked to tariff developments. However, we are more optimistic than most and view the risk will continue to unwind more gradually than headlines suggest. Our view is also supported by recent comments from Boris Vujčić, Governor of the Croatian National Bank and member of the ECB Governing Council.

In a recent interview, he indicated openness to extending the current pause beyond the July 9 deadline, stating that the ECB could “take the time” to avoid reigniting inflation. This view appears to align with recent comments from former President Trump, who signalled potential cooperation on the tariff front in the interest of a more structured policy approach, maintaining optionality to extend the pause date if need be.

While some remain fixated on a pessimistic outlook and the likelihood of a further rate cut, we see upside risks to long-term growth. This supports a bullish position on the 2s10s steepener, which offers an appealing way to capitalise on the reflation theme as momentum is turning, driven by stronger growth, rising inflation pressures and increased debt issuance to fund fiscal commitments

BoE: Between a Rock and a Hard Place

This one is proving particularly complex to navigate. UK economic data has seen a string of misses, with April GDP contracting by 0.3% m/m—the weakest performance since 2023. The pullback reflects the unwinding of Q1 trade distortions, adding to this was the non-event from Chancellor Reeves in the spending review, which has led analysts to increasingly price in the likelihood of tax hikes this autumn as the UK faces fiscal constrain.

Like the Fed, the Bank of England is being drawn into a stagflation narrative. However, compared to the eurozone, the UK faces fewer economic and political risks, and that could help lift sentiment over the coming quarters. The OBR’s annual growth forecast of 1.9%, however, we are not that optimistic.

The latest payroll figures, showing a 109k decline, have added to concerns. While some scepticism remains around ONS data quality, the pattern of downward revisions continues to build a more cautious picture. As these figures are reflective of a new fiscal year for the UK economy, it could push the BoE further toward a dovish stance.

That said, we’re maintaining a conservative view. We interpret the decline in hiring more as a response to the recent hike in National Insurance Contributions rather than a drop in consumer demand. This suggests wage growth, though gradually easing, is likely to remain sticky. At 5%, it still implies meaningful cost pass-through effects ahead.

Energy prices could also pose upside risks to inflation, especially amid ongoing geopolitical tensions. In addition, regulated water bill increases from April could feed into broader cost pressures. These factors may delay the BoE’s ability to pivot fully toward growth support, keeping inflation management a priority.

The gilt curve continues to flatten, this time reflecting both domestic slowdown and softer inflation out of the U.S. While we lack a clear conviction on the precise rate path, we do think the BoE's growing policy constraints justify a dovish tilt. Against that backdrop, GBP may increasingly function as a funding.

Well written market brief Emmanuel, looking forward to the video

Video is great 😃👍