The Macro Outlook

Uncovering opportunity, risk and inflation outlooks

Hey guys,

Inflation, rate expectations, geopolitics, BOJ pivot…

It’s all happening at once.

In this report we’ll uncover:

An update on our macro trades

Geopolitical risk premium in Brent prices

US macro update

Without further adieu, enjoy:

Trade Updates

JGBs shorts

Outlook: Bearish

Our JGB short, discussed last week, profited from the recent yield rise due to its short duration (<30 days). While we see further downside potential, exiting a crowded trade was optimal. Mark Dowding, CIO at RBC BlueBay Asset Management said “this is the largest macro-risk position we are currently running” when discussing BlueBay’s short positioning on JGBs. Great to see others on the street sharing the same view, however, we always aim to uncover strong trade ideas before they become known knowns.

With the Shunto wage negotiations expected to result in an average wage increase of c.4.1% compared with last year’s 3.6%, the BOJ are moments away from exiting negative rates. Comments from the policy board members reaffirm this view of a BOJ pivot; also on-the-ground economist, Takahide Kiuchi of Nomura Research put the probability of a BOJ hike next week at 70% compared to the market’s expectation of 50%. Noting that the spring wage report will ultimately be the catalyst that could trigger the BOJ to move ahead of expectations. Nippon Steel, Japan’s largest steel maker, has agreed to an 11.8% increase in base salary, whilst companies like Honda announced a 5.6% annual rise.

Brent Crude Shorts

Outlook: Neutral/Bullish

My Brent crude short position, announced last week, initially captured the market's downward trend, reaching lows of $80.85 per barrel. However, the geopolitical landscape shifted with renewed attacks on Russian refineries by Ukraine. I exited most of my shorts at $81.25, profiting from the small $1.65 per barrel decline before the market reversed sharply.

The reversal can be attributed to Ukraine's ongoing drone attacks on Russian refineries, raising concerns about supply disruptions and escalating tensions. For the second consecutive day, Kyiv attacked the Ryazan oil refinery, one of the largest refineries in Russia on Wednesday. This has reintroduced a geopolitical risk premium into Brent crude prices. While quantifying this premium is challenging, its impact on future prices remains crucial.

Currently, Russian refinery underutilization adds to supply concerns. Factors include routine maintenance and Russia's OPEC production cuts, resulting in less crude being processed.

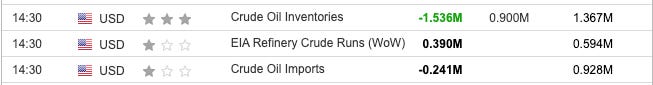

Further bullish sentiment came from unexpected US crude inventory drawdowns, extending the oil price rally.

Russia’s construction of refineries, a relic of the Cold War, makes refineries resilient against traditional air bombing. This limits the potential damage that Kyiv can impose as drone attacks won’t be able to destroy a whole refinery. They can, however, create a fire and if a drone strike manages to hit a gas fractionation unit/pipe, they may even be able to cause a bigger explosion.

Strategic war tactics aimed at disrupting Russia’s source of its war chest.

The Macro Update:

Headline CPI Exceeds Expectations, Rate Cuts Remain on Horizon

The U.S. Bureau of Labor Statistics released the February 2024 CPI report, revealing a higher-than-expected inflation reading. The all-items CPI rose by 0.4% MoM and 3.2% YoY, exceeding the consensus forecast of 3.1%. Similarly, the core CPI (excluding food and energy) came in higher than anticipated, rising by 0.4% MoM and 3.8% YoY.

Despite this upward surprise, we believe the market's muted response reflects continued expectations that CPI would print relatively hot for February.

Most notably, shelter and gasoline contributed over 60% of the monthly increase in the index; airline fares (3.6%) and motor-vehicle insurance (0.9%) also weighed heavy on the month-over-month inflation report.

Across the UST curve yields on 2 and 10 years have both rallied c.20bps since the release earlier on Tuesday, largely bolstered by Thursday’s initial jobless claims which printed 9k lower vs the consensus (218k).

U.S economic resilience seems to be the constant macro theme continuing on from H2 of 2023 and now 2024, although there are signs of economic strain in rate-sensitive sectors such as the commercial real estate market involving a number of banks holding onto distressed debt securities attacked to commercial real estate in the U.S.

Across equities, the reaction seemed rather muted, if you’re wondering why, inflation swaps data can answer this.

In an inflation swap, one party pays a fixed rate on a notional principal amount, while the other party pays a floating rate linked to an inflation index, such as the Consumer Price Index (CPI). The fixed-rate, therefore, could be viewed as the market’s expectation of inflation.

According to the Bloomberg-implied US YoY CPI Fixing Swaps data, the market has already priced in an uptick in inflation in February (and even more in March!), so naturally the market is less alarmed when the Fed hasn’t still achieved its target.

Additionally, the Intercontinental Exchange (ICE) provides valuable insights into U.S. Dollar inflation expectations through data on five different tenors.

Inflation 1Y: This metric reflects the market's implied expectation for realized inflation over the next year, starting from the most recently published Consumer Price Index (CPI) data.

Current Calendar Year and Next Calendar Year: These metrics represent the market's implied expectation for realized inflation over a 12-month period, starting from the previous December's CPI and the next December's CPI, respectively.

Finally, we have Forward Inflation 1x5 and 5x5, which put in Laymen's terms, tells us what the market thinks the long term inflation will be in 1 year and 5 years from now.

As illustrated, the CPI uptick has no effects at all on forward inflation (Grey and Green Line) and the market-implied inflation for the next calendar year (Pink Line), and only a slight impact on current year market-implied inflation (Light Blue Line), and relatively weak impact on expected inflation for the next 12 months (Dark Blue Line).

It's important to consider two things regarding the current year's inflation expectation (light blue line). First, this data point incorporates past data, meaning the recent increase partially reflects the February CPI increase that already happened.

Second, the market seems to be anticipating a decline in inflation. Even with a strong recent CPI reading, the market expects the inflationary momentum to slow down soon.

We share this view and believe inflation will eventually be controlled for several reasons, which we'll discuss further.

Downward Revision: A slew of economic data has been revised downwards. 4Q23 GDP growth rate is down to 3.2%; nonfarm payroll for the first 2 months of 2024 has been reduced by 167,000. The US economy is not as strong as initially thought.

Weakening Leading Indicators: Forward indicators, such as ISM services PMI, show a dip in economic activities to 52.6.

Fed Stance: Federal Reserve Chair Jerome Powell, during his appearance on the Senate committee, has suggested that the US "is not far from" the 2% inflation target.

To Conclude:

This week's economic whirlwind – data surprises, geopolitical tensions, and central bank pronouncements – revealed a complex market picture.

Our JGB short was successful, but we exited as the trade got crowded. Brent crude's initial short captured the downtrend, but a geopolitical reversal highlighted the need for adaptability.

The higher-than-expected CPI surprised the market, but the muted response suggests a temporary blip. Inflation swaps and forward data point to a longer-term inflation decline.

Downward revisions to economic data and softening leading indicators paint a picture of a less robust U.S. economy. Chair Powell's comments hint at the Fed nearing its inflation target, potentially paving the way for future rate cuts.

Despite the flux, opportunities remain. We'll monitor key data and sentiment to identify new trades. The potential BOJ pivot and the evolving Fed stance, particularly regarding rate cuts, are key areas of focus.

Next week, we'll dive into G4 central bank stances and outlooks, focusing on their impact on FI and FX markets.

While the current landscape presents challenges, thorough analysis allows us to navigate complexity and identify profitable trades.

Credits:

Jingxuan Niu Joe Olashugba

Top tier

Great work Joe!