The Last Dance

Macro, hedge fund performances, & a rather important update

Hey crew,

It’s time.

For the past 2 years, I’ve been working on MMH, building expertise to provide the best value I can while trying to figure out my own journey and path ahead.

In doing so I’ve been blessed by my Lord and Saviour to have grown a great community in you all and some great names across the largest money managers in the space.

This year I set out to push myself to the limits, to stretch myself beyond my wildest beliefs and achieve what was the impossible.

I relentlessly refined the vision and solved for the puzzle, acting accordingly.

And to the glory of God, last week I signed a contract to join a multi-billion pound L/S Equity Hedge Fund.

It was far from easy. Required everything. But I wouldn’t have been able to get here without all 2,431, now, 2,439 of you, so thank you, guys.

As you can imagine, that means my reports will be less frequent here. But I have to give you guys something more. Call it my ‘last dance’.

So, this Saturday at 10 am UK time I will be doing a webinar for all subscribers, going through the current macro landscape, what you can look forward to from Market Macro Hub and a long-awaited Q&A to give you best practice for the path ahead.

One thing that resonated with me when speaking with a mentor of mine who spent 20+ years at the highest level in capital markets both in London & Wall St is this:

“It’s going to cost everything…but if your dreams don’t scare you, they aren’t big enough”

— ND

Macro Snapshot

Is it time yet?

Yesterday’s CPI data was the most widely anticipated inflation print in a while.

Data showed that the trajectory of inflation in the US is swinging towards the downside with all three key readings coming in lower vs the prints.

MoM CPI came in at -0.1%, yes, negative, whilst core inflation ticked lower to 3.3% and the headline inflation print ticked lower to 3.0%.

We’ll talk more on this later.

Thought of the Week

The battle for more with less continues.

First half % returns for HFs.

Some great, others not so good when comparing against the strategy benchmarks.

To no surprise we see two strategies dominating the leaderboards, your pod shops and your equity L/S, and (presumably) your long-only equity shops.

The concentration of high returns across H1 was centred on equity markets—given the great run since Q4 last year in US markets it’s clear to see the trade of all these funds being long tech, long Ai, long GLP-1’s and long semi's/data centre stocks. I’m sure there were more, but these are themes which would have been top priority at those desks.

H2 will most likely present much of the same, over the last 88 years, since 1928, during election years the S&P averaged 11.5% p.a. Of course, unless you simply have broad exposure, carry a large drag of beta in your portfolio which your funds wouldn’t do, your returns would look different as you drill down to specific sectors.

Chart of the Week

Here’s what a hawkish to dovish central bank pivot looks like in currency markets.

The RBNZ unleashed the doves during their Wednesday meeting. The central bank noted how restrictive monetary policy had “significantly reduced consumer price inflation”, a shift in tonality from previous statements on the effect of rates on inflation.

The committee is confident that “inflation will return to within its 1-3 percent target range over the second half of 2024”. Further dovish rhetoric from the well-known hawk central bank.

Off the back of the meeting, yields in New Zealand gov bond market were down 25bps. The Kiwi slipped against a basket of EM/DM currencies. As we’d expect the MXN peso was amongst the top gainers against the Aussie as the peso recovers from losses instilled from volatile elections.

On the note of currencies, it’s been a while since I’ve mentioned the Yen, so please allow me to.

The silent intervention. Synonymous of the BOJ, aka widow makers. Once again the MOF/BOJ traded around the US CPI print. Hot print = don’t fight the data, soft print = sell the Dollar and buy up Yen.

The Yen post US CPI, up just under 2%. Unfortunately, the carry differential still persists so this is only buying the BOJ time, most likely time to move policy rates higher.

Macro Recap & Discretionary Macro Plays

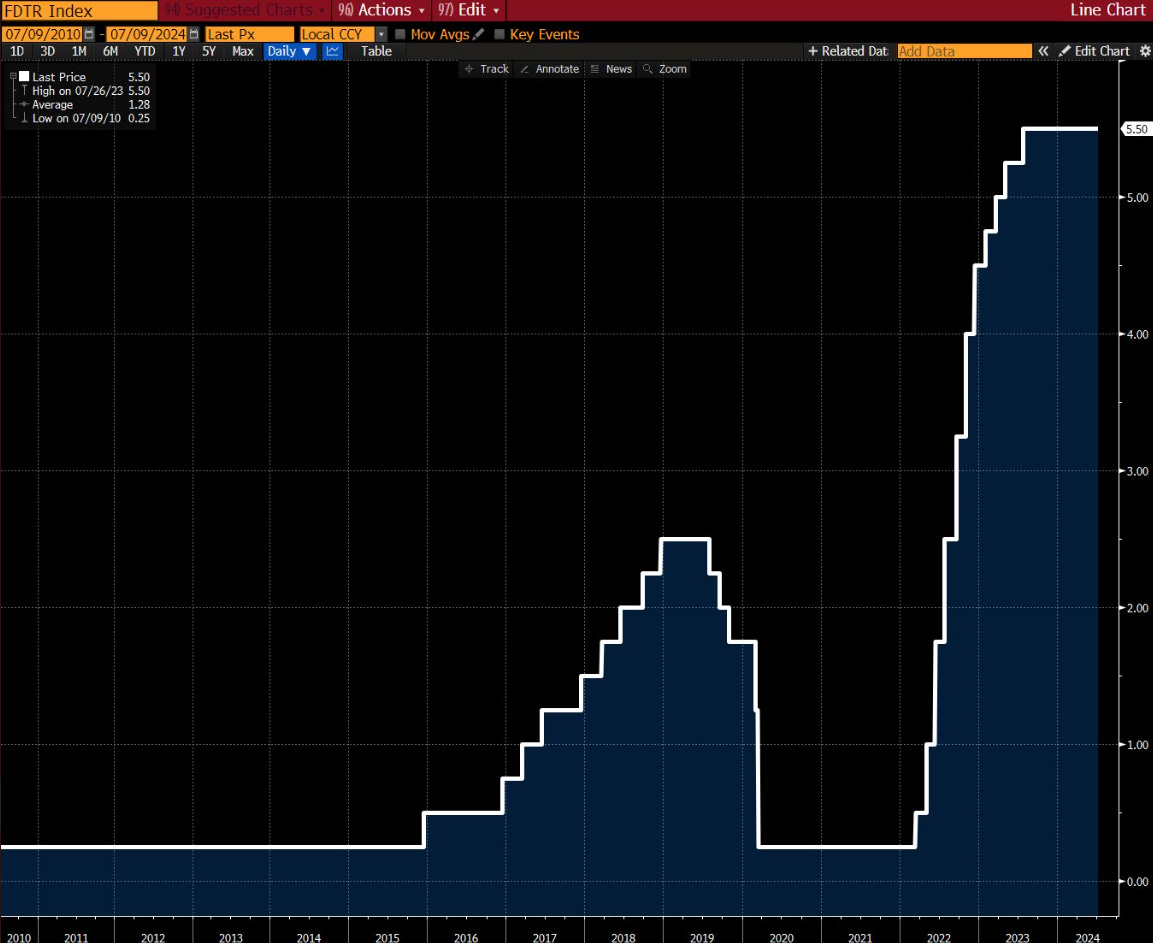

The most important topic in macro markets has been the trajectory of rates over the past 12 months, but more so the past 7 as we awaited the first Fed pivot since 2019.

In such environments when every inflation print, jobless claim and non-farm print has the power to swing markets into a rally or sell-off one simple trade appears to profit from such macro condition. In order to get the trade down you have to conclude which camp you stand in:

Inflationary risks are rising: we’re going higher

Disinflationary pressures rising

Binary, in its simplest form. From here it’s increasingly easier to identify positions that align with your view of the US economy.

Since late ‘23 I recognised both the upside-tail risks of inflation resurfacing but was strongly in the camp of disinflationary pressures continuing as the more volatile components of the reading came under control. This of course led me to call certain positions such as longs across the 2s and 10s, namely the bull steepener early in April when yields on the 2s were still around 5.05% and the 10s floating at 4.600%.

That report is here:

Since then it’s safe to say this position has performed rather decent—caveat, yes, the positioning matters heavily, how many contracts you’re long on the 2s & 10s, what sort of move you expect to see on the curve, DV01 etc, etc— but for the simplicity of this report, this position is up 50bps since publishing. Disclaimer, I am not in this trade.

Regardless, this is the beauty of macro, you get to strip away all the noise and focus on the few intricacies that may dictate the flow of markets. For the disinversion play on the 2s10s curve, there’s a few things which impact the short end and the long end.

The short end of the yield curve is primarily influenced by short-term interest rate expectations. As such, the 2-year U.S. Treasury yield serves as a key barometer for market sentiment towards Federal Reserve policy.

In contrast, the long end of the yield curve is shaped by a broader set of factors. Beyond short-term interest rate expectations, investors also consider long-term inflation expectations, economic growth prospects, and risk premiums when pricing longer-term bonds. This term premium compensates investors for the increased uncertainty associated with holding bonds over a longer time horizon.

So, if we’re in the camp of inflation continuing its disinflationary trend we know this translates into the following:

Dovish Fed. Lower short-term Fed funds rate

Lower growth expectations (Fed won’t pivot on strong economy)

A short dollar

Bullish rates on US treasury yields

So one very, very simple trade would be to play this out on the 2s10s curve, or even play this out as two individual but linked trades. The choice is yours.

This is base 1 of trading this macro outcome. There’s several.

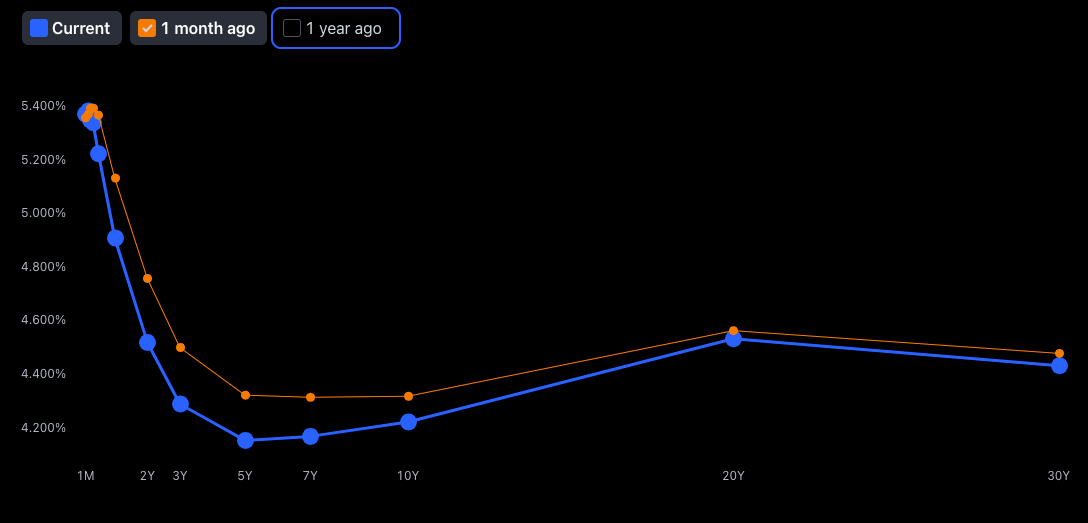

Post CPI print on Wednesday this is what we saw across the yield curve.

Bullish rates.

(As a rule of thumb, higher yields = bearish rates, and lower yields = bullish rates)

This is the UST curve from a month ago and the current. Here you can really begin to understand the trade more, the bull steepener, where front-end rates catch a bid resulting in short-term rates falling faster than long-end rates.

The belly of the curve (2y - 7y) has experienced the greatest bid, with the 2y steepening the most over the past month. The heart of the trade would have produced a larger % of the return.

US02Y 1 Month Ago = 4.756%

US02Y Today = 4.512%

US02Y 1 Month Ago - US02Y Today = 4.756 - 4.512 = 24.6bps So as we can see the yield on the 2s rallied 24.6bps over the past month, the largest ∆ across the belly of the curve.

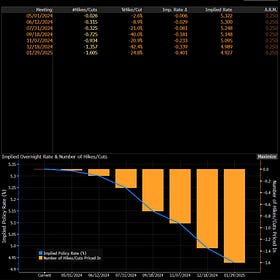

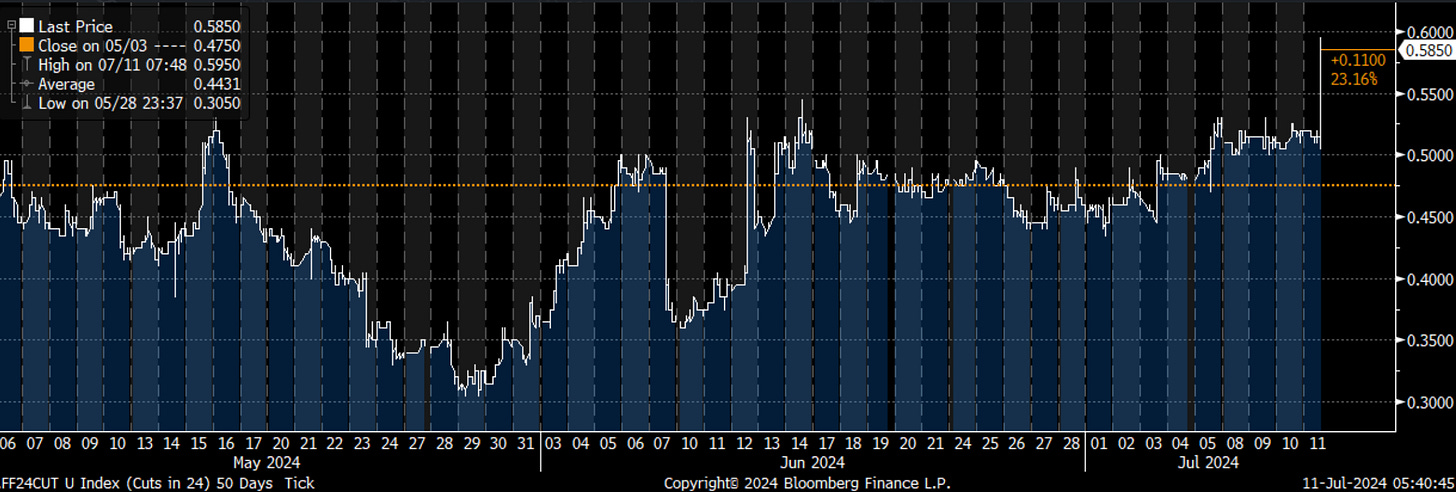

The chart you see below is the implied probability of a Fed cut in 2024 based on the futures pricing of traders.

The Y-axis shows the implied probability percentage for Fed cuts.

After the Wednesday print, traders increased the implied size of a Fed cut by 11bps to 58bps for the year.

So, as the implied probability for further rate cuts increases, the FX play is a soft dollar. So now it’s about constructing a basket of ideas which revolve around this theme of disinflation, lower yields, a weaker dollar and a dovish Fed. Once again, this is base 1, there’s proxy trades and other ways to combine and express this theme in markets.

I’ll be covering some of this on our webinar this Saturday, it won’t be recorded so aim to be there.

Where does MMH go from here?

As Jordan Belfort said, “I’m not leaving”— what we’ve built here is something powerful, special and impactful. I’ve received dozens of messages from both working professionals in the field at top institutions and graduating econ students as well as individual traders who have expressed their love for the simplicity of the ideas, educational value and clear signal behind these reports.

That’s what it’s always been about for me.

Providing clear, actionable macro insights that make you say “I didn’t think about this in this way before” and “Aha I see”.

The job is far from finished, if anything, it’s just started, I aim to bring you guys along (as best I can) and build the team of upcoming analysts at MMH to provide even better insights.

I’ll leave you with this:

“When you make a choice and say, come hell or high water, I am going to be this, then you should not be surprised when you are that. It should not be something that is intoxicating or out of character because you have seen this moment for so long that ... when that moment comes, of course it is here because it has been here the whole time, because it has been [in your mind] the whole time."

— Kobe Bean Bryant

Congratulation Joe. Is this thanks to the work you've been putting out here in MMH and that has been seen by your recruiters ?

Catching up on Macro - Gotta be one of my favorite reports out there and congrats Joe, well deserved!