The Hidden Engine: How Collateral Fuels Financial Markets

Unraveling the secrets of re-used assets, safe bets, and market crashes

Financial Collaterals: What is it, what does it do, and how does it impact the financial system?

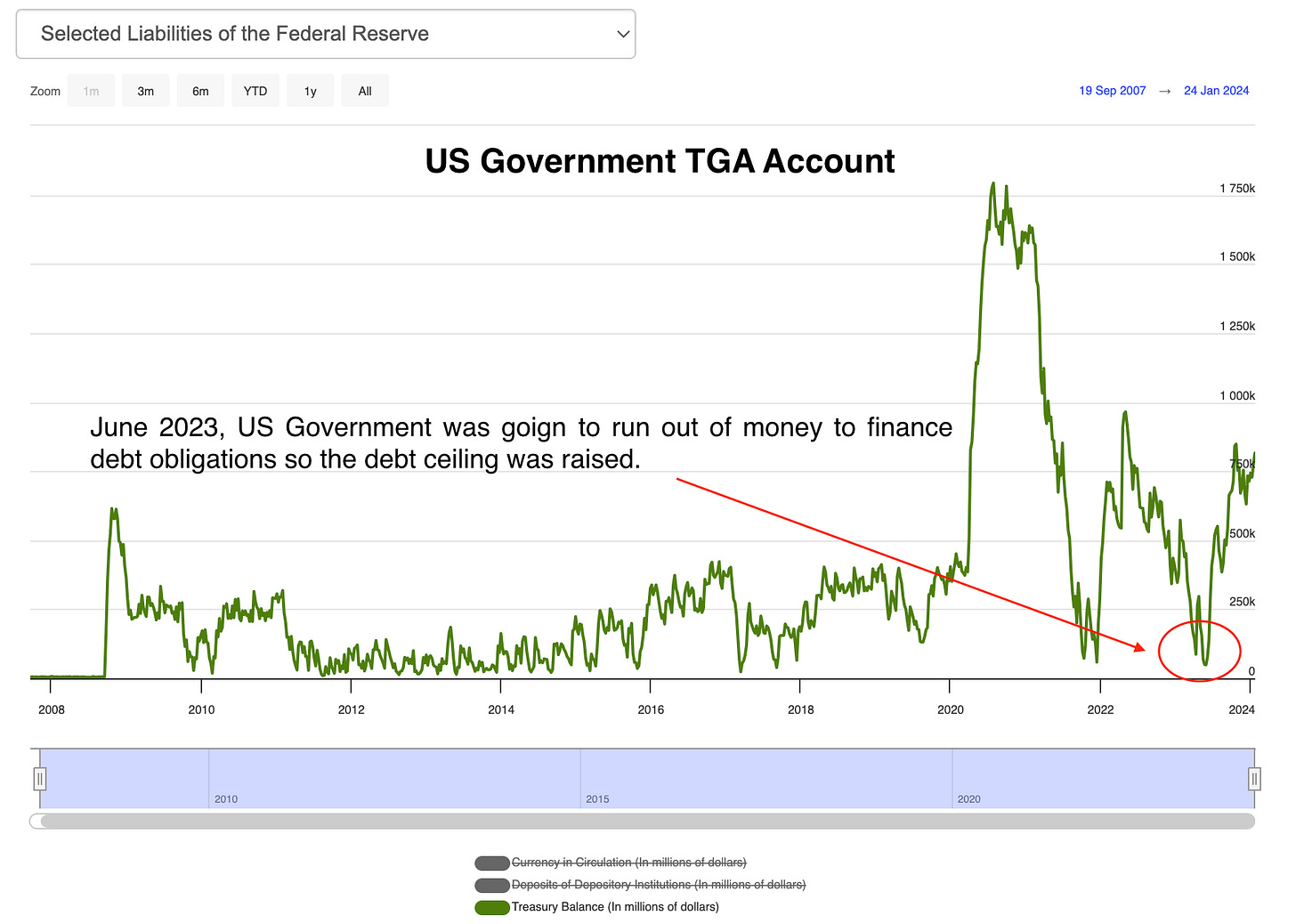

At the January 29th Quarterly Refunding Announcements, the US Treasury reduced its estimate for federal borrowing for the current quarter to $760 billion in net borrowing for January through March while intending to keep the Treasury General Balance (TGA) at $750 billion. Think of the TGA account as the checking and savings account for the Government.

If you recall, the US government was in a predicament just over 8 months ago, in June 2023. The government had reached its debt limit and would default on its debt obligations as it had run the TGA balance to the lowest levels seen since 2018. This caused a short-term market route which resulted in the price across front-end bonds, particularly 1m-1year T-bills, as investors holding securities set to mature around the X date (default date) demanded higher yields for the increased volatility and risk. I was short the front end of the curve leading up to the X date.

As a rule of thumb, every time the government has to replenish the TGA account they do so through issuing T-bills rather than long-duration bonds (10y, 20y etc).

The government do this for three main reasons: Liquidity, Interest Rate Risk and Market Efficiency.

Liquidity: T-bills have maturities ranging from one day to one year, making them highly liquid assets. The TGA needs instant access to cash to handle daily government expenses and unforeseen events. Longer-duration bonds, while offering higher returns, are less liquid and can be difficult to sell quickly when needed.

Interest Rate Risk: Interest rates fluctuate, and holding long-duration bonds exposes the government to interest rate risk. If interest rates rise, the value of existing bonds falls. Since the TGA needs predictable cash flow, minimizing interest rate risk is crucial. T-bills have minimal exposure to this risk due to their short maturities.

Market Efficiency: The T-bill market is large and efficient, with frequent auctions and high trading volume. This allows the government to easily buy and sell T-bills without significantly impacting their price. Longer-duration bond markets, while still large, may be less efficient, making it more expensive and complex for the government to buy and sell large quantities.

So, what was the market’s reaction?

Yields on the 10y dropped as investors were optimistic over the announcement that the government will be borrowing $55bn less than previously expected. Investors have become increasingly cautious over the overall supply of federal debt, with the main purchaser of government debt, the Federal Reserve, out of the equation conducting quantitative tightening, demand for the federal debt has been in question, but a lower issuance puts some relief in investors’ minds.

Lower-than-expected government borrowing puts downward pressure on bond yields as investors remove expectations of the Treasury Department issuing bonds with increased nominal coupons or floating rates, which would have triggered a sell-off in bond prices.

“Based on current projected borrowing needs, Treasury does not anticipate needing to make any further increases in nominal coupon or floating-rate note auction sizes, beyond those being announced today, for at least the next several quarters,”

U.S Department of The Treasury

In addition to that, there are always inevitable impacts on collateral markets, a segment that’s been overlooked in the past. This article will explain the nuts and bolts of this market.

1. What are collaterals?

As a homeowner, you might think opening a Brazilian restaurant is a good idea, probably because you anticipate a change in people’s flavour, but you don’t have all the cash you need to start a business. What do you do? You cash out your home. That is, you borrow against your home equity. Your home, in this case, serves as collateral. Collaterals, like your homes, have a huge influence on the economy. It creates money out of thin air, just because you own a home. However, It is also found to be a major driver behind financial bubbles. GCF, Tulips Bubble, Great Depression, you name it.

2. Financial Collaterals

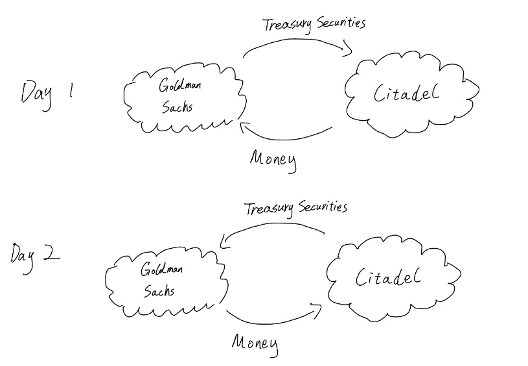

Similarly, in the financial system, you have financial assets. Bonds and equities alike could be used as collateral. Repurchase Agreement, for example, is a common financial transaction where securities are sold and simultaneously agreed to be repurchased at a later date. This transaction effectively functions as a short-term loan, with the securities serving as collateral.

What’s quite different for financial collateral, thanks to the cunning financiers, is that financial collateral can be “re-used”. That is, if you received collateral from Citadel, you could re-lend the securities to somebody else. This ongoing “chain” of collaterals could last as long as the system can take it. To bring it down to layman’s terms, collateral reuse means using the same asset, like security, as collateral for multiple loans or transactions. Imagine you own a car. You could use it as collateral for one loan, or you could borrow against it multiple times (reusing) as long as the total borrowed amount doesn't exceed the car's value.

For your reference, one measure of collateral reuse, “collateral multiplier” is 3 times for non-Treasury securities and 7 times for Treasuries. Simply meaning that Treasury securities have a higher collateral multiplier than non-treasury securities. The main reason why Treasuries have a higher collateral multiplier than non-treasury collateral is because of their safety and liquidity profile. Lenders, like Goldman Sachs, JP Morgan, and Citibank, feel comfortable accepting treasuries as collateral because of their liquidity profile.

This nature of financial collateral means that it is prone to sudden swings and volatility. Chains of collaterals could build up quickly just because the sentiment is optimistic, and it could fall apart just as quickly with a turn in sentiment.

3. Financial Collaterals and the Real Economy

The financial market and real economy have an interestingly interactive and reflexive relationship. Financial markets could create a perfect “condition” for economic growth, and economic growth could foster loose financial conditions (credit, leverage, risk) as positive sentiment sinks in. Financial markets are reflexive in their ability to create self-fulfilled prophecies.

Taking Agency MBS as an example, I could buy AMBS (agency mortgage-backed securities) when the housing market is on the rise due to all sorts of reasons. In turn, I could purchase even more AMBS by collateralising my existing AMBS. The price of AMBS will soar as a result of overwhelming demand, I benefit from having excess return by owning AMBS, banks are happy to lend me more money in turn for AMBS collaterals, and property developers are also happy – they could build more houses and count their revenues. Everyone seems happy until everyone is not. In a turn of events, the AMBS market could take a hit and the catastrophic deleveraging process commences... The main takeaway is that collaterals play a central role in the financial and economic boom and bust.

4. Safe Collaterals and “Unsafe Collaterals”

In the realm of collaterals, there are different types of collaterals. The differentiator is their ability to maintain its value during “crisis time”. Safe collaterals are, in general, government bonds that central authorities have the power to repay (the most powerful debtor in the country). There is also Agency MBS, which, despite being repaid by household, is ultimately backstopped by the US government. In times of crisis, market participants have ample confidence in this type of security because of the powerful guarantee. On the other hand, unsafe collaterals could see a rapid drop in values during crisis time. People are less confident (a lot less) in corporate credits and equities during crisis time.

The difference is exhibited through “haircut rates”. Haircut rates serve as a critical measure in the world of financial collaterals, effectively quantifying the perceived risk and stability of various collateral types during periods of uncertainty. Essentially, a “haircut” is a discount applied to the value of an asset when it's used as collateral. The size of the haircut reflects the lender’s assessment of the risk of a decline in the asset's value and their need to ensure they can recover the loan amount in case of a default. Therefore, the variance in haircut rates between different types of collaterals highlights the market’s trust in their value stability during crisis times. “Safe collaterals”, therefore, have lower haircut rates even during a crisis while haircut rates of “unsafe collaterals” would spike during crisis time.

5. Collaterals for Trading and Investing

For investors and traders, understanding the nuances of collateral utilization and its impact on market dynamics is crucial. The variability in haircut rates, especially during fluctuating economic conditions, can offer early signals of market shifts, aiding in the identification of potential booms and busts.

That’s it for today guys, I hope you enjoyed this piece, a primer into the world of collateral and how this shapes financial markets, risk appetite and asset prices.

The focus will be delivering insightful research, whilst showing you how actionable this material is through trade ideas across all markets. So it’s essential you keep up as we’ll be unveiling more of our trade ideas.