The Great Macro Shift

BOJ Policy Shift and Global Macro: A Turning Point

Hey guys,

Take a minute to disconnect.

Breathe.

In a world where we’re always on the go, always busy, forever short on time, be sure you’re moving 100mph in the right direction.

Here’s a framework I use that revolves around asking myself one simple question.

“Does this task move the needle forward for my goal?”

One question clears it all. Clarity, then speed.

Some of you may need to hear that as we enter Q4, it’s time to close out the show with results.

This week has been a busy week for central banks, with the Fed, BOE, SNB, PBoC, and BOJ all holding rate decisions.

The Pending BOJ Policy Shift

Since the Bank of Japan (BOJ) lifted its yield curve control (YCC) band, by 25bps to +/- 50bps on December 20, 2022, I have anticipated the eventual widening of the YCC band, leading to the removal of the YCC policy tool and a strengthening of the Japanese yen.

That moment is still far from happening but I feel us drawing nearer to the moment.

The Bank of Japan (BOJ) raised its yield curve control (YCC) band to +/- 1.00% in July 2023, following a period of high inflation in Japan in 2022. This led traders around the world to question the YCC cap and the pricing of long-term Japanese government bonds (JGBs). Here’s the back story.

The BOJ has been referred to as the ‘widow-maker’ for decades, as traders who bet on the price of JGBs declining have often been wiped out by huge unlimited BOJ purchases of 10-year JGBs. However, in 2022, and particularly in December, when inflation in Japan hit 4% on a YoY measure, the ‘widow-maker’ trade to short long-end JGBs pinned under the YCC worked once the band was lifted.

As you can see, yields rallied to 0.50% on 10y JGBs as the price on these bonds plummeted; for macro this was huge, signifying an evolving policy from the rather dormant BOJ.

During the Asia session, the BOJ held interest rates at -0.10%, causing USD/JPY to slip to 148.00 against the dollar.

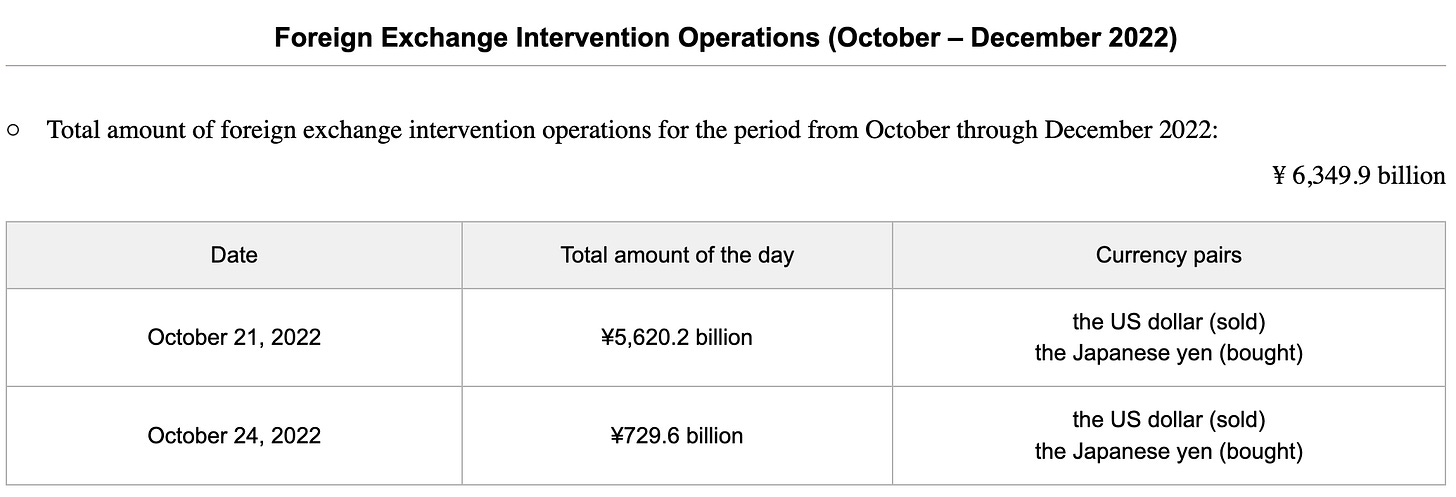

As marked by the grey region, USD/JPY is currently in extremely sensitive territory with the spot price now trading above the level of 145.900 where the MOF (Ministry of Finance) first intervened in the FX market. Earlier this week Japan’s Chief Cabinet Secretary said he “won’t rule out any options for response to FX moves”, consider that a verbal warning to all Yen traders.

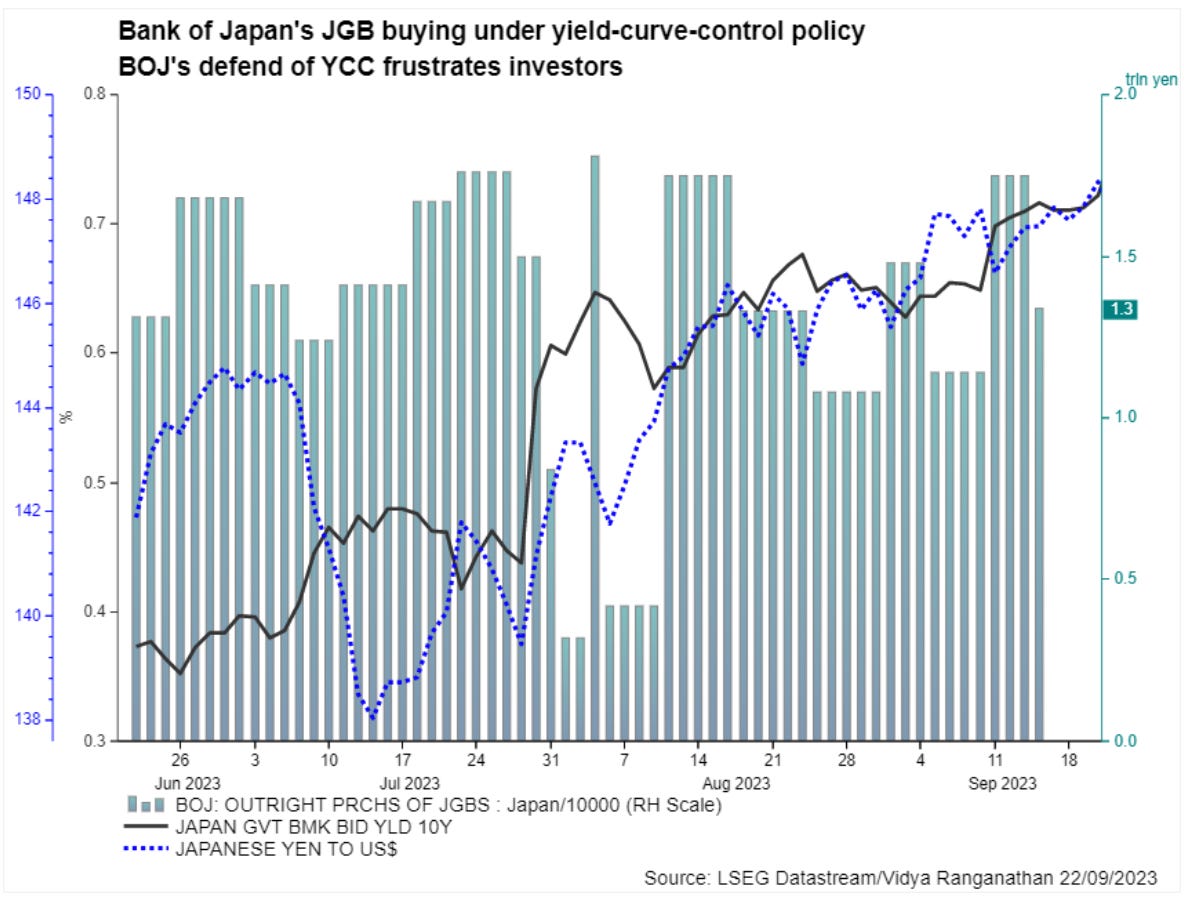

This is the current stance of the BOJ’s JGB purchases under the YCC policy.

The RHS y-axis shows the scale of BOJ outright purchases of JGBs in Yen, the LHS y-axis (in black) represents the yield on 10y JGBs with the blue axis being the spot Yen price. The continual weakening of the Yuan is problematic for the BOJ, but no one truly knows when the BOJ will make a move on policy. During Governor Ueda’s press conference this morning he said providing wage growth and inflation is sustainably above 2%:

“we would consider scrapping YCC and modifying the negative interest rate”

— Governor Ueda, BOJ

This would be dramatic for all markets, FI, FX, and equities, the low rate environment the BOJ created has kept global borrowing costs subdued, namely the risk-free treasury rate. The abandoning of this would result in higher treasury yields as Japanese investors remit invested capital back to domestic markets.

Going forward wage growth and headline Japanese will be on my watchlist to provide colour on how and when the BOJ could potentially scrap the YCC policy, which has shaped global macro for the past decade.

Let’s dive across the pond.

Hold Steady Central Banks, Hold Steady…

The end is pretty much here. 15 months of tightening and it looks like a majority of the central banks around the world have come to an end. Yesterday the Swiss National Bank held rates at 1.75% against expectations of a 25bps hike alongside the BOE which also decided to hold rates at 5.25%.

In my report yesterday for MMHPro clients, I discussed the Fed meeting and the common theme among major central banks that a pause in the tightening cycle is appropriate given the pace and magnitude of this tightening period.

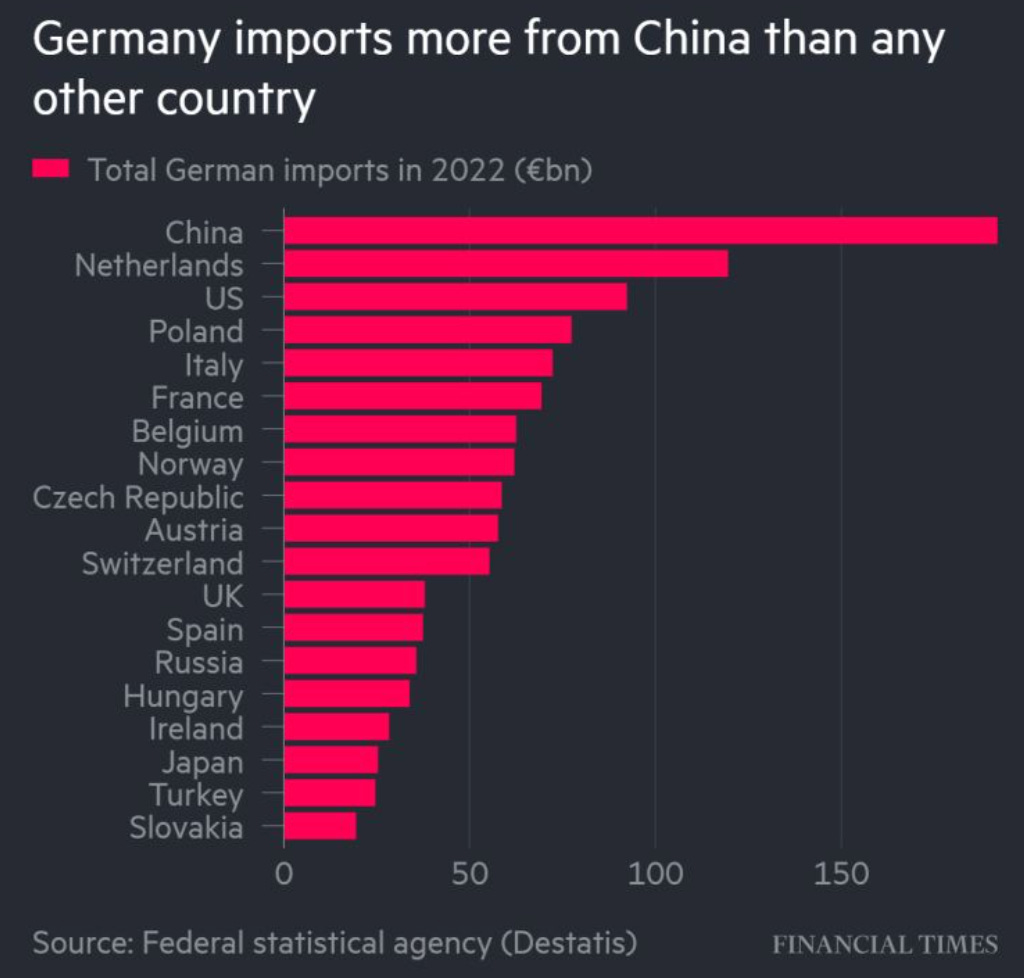

Clear vulnerabilities exist in Europe and the UK, especially in the heart of the Euro Area, Germany. Earlier this week, the German central bank (Bundesbank) warned that German companies must reduce their exposure to China, which is a major cause of the current sour economic mood in Germany. Germany's economy is at risk of being caught in the crossfire of rising geopolitical tensions and China's decoupling from the US, given that over 29% of German companies import essential materials and parts from China. This is a precarious position for an economy that relies heavily on manufacturing and services activity.

This is the interconnectedness of macro. PMI data for France and Germany came out this morning. France’s PMI data contracted to 43 for both manufacturing and services whilst we saw a reasonable rebound in German services PMI data printing a 49.80 figure, although manufacturing remained at concerning levels of 39.8.

For most of us, this is the first major tightening cycle we’ve been old enough to remember meaning there’s a tonne of lessons to be learnt from this period, so if there’s anything you do in this sensitive time within macro make sure to be open to learning, even if that’s through losses.

Thanks for getting to the end of the report.

I hope this macro brief has provided some additional detail on the functions of the BOJ.