The Great Fix of China

China has found itself in a distressed battle fighting to keep the Yuan below 7.300, here's the details

Hey guys,

Check this.

2 weeks left…

The countdown begins.

8 months and 18 days later, I’ve created ‘The Macro Guide For Traders’.

The last macro guide I released ended up reaching over 5,000 people and the feedback from you guys was surreal.

It reached nearly every part of the world.

I know it’s wild…

The release date is September 1st.

So mark your calendars.

The instructions on how to get this guide will be released over the next week.

Oh yeah, it’s free ;)

For those wondering, this doesn’t put a halt in the revamp of the "Four Foundations of MacroFX”, great things take time so rest assured the wait will be worth it.

Lastly, here’s a new blog post discussing the mechanics of QE so check it out!

But onto more pressing information, the PBoC has stepped up its interventions in the FX markets as the Yuan slide continues due to weak Chinese economic data.

The Bubble, The Crisis and The Yuan

Let’s take a step back.

What’s actually going on in China? That’s probably a question many of you don’t have the answer to, so let me explain in simple terms.

Since the start of the year, the economic picture from the communist land has been nothing short of disappointing, but that information is nothing new, so here’s one angle I explored last week with the Pro subscribers.

China’s economy has pivoted, it was once focused, but very dependent, on its export and global trade business in order to drive growth. However, the priority of global trade has slipped down on the country’s focus, with domestic demand becoming the emphasised growth plan.

The issue is the Chinese consumer’s sole focus right now is paying down their balance sheets (personal debt) due to the high levels of household debt accumulated from the housing bubble.

As it stands right now China’s household and corporate debt account for the large majority of Chinese debt. With the likes of Country Garden, China’s largest property developer, and Evergrande Group both stirring the looming housing crisis in China it’s clear that the bubble is bursting. Just this morning Evergrande Group filed for Chapter 15 bankruptcy in New York. If you didn’t know, chapter 15 bankruptcy is a section that allows foreign debtors, in this case, Chinese property firms, to restructure or liquidate their debts in the U.S. It’s designed to help foreign debtors who have assets or creditors in the U.S but are not domiciled in the U.S.

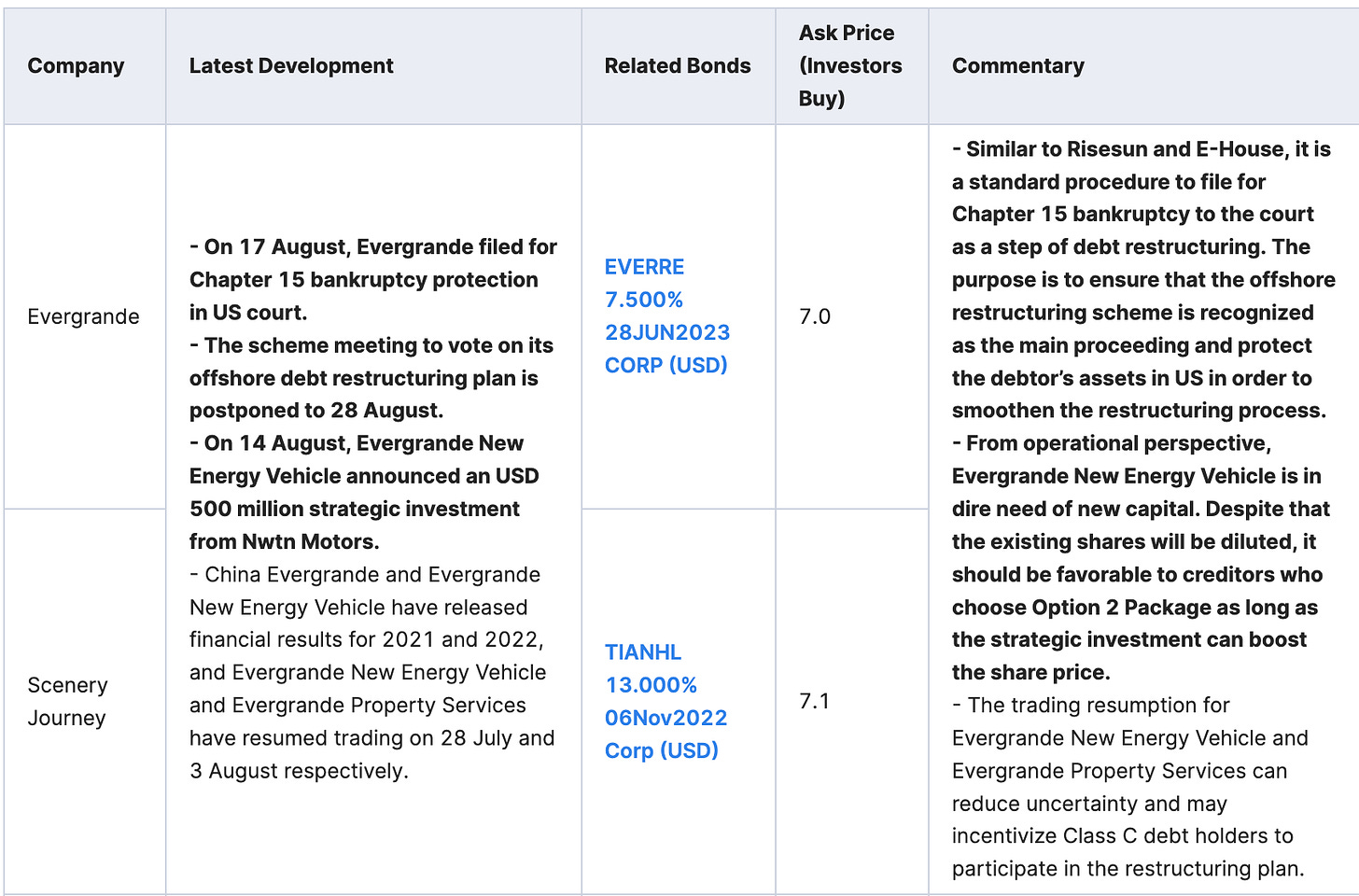

The effect of the looming housing crisis is imminent. Since Evergrande’s collapse, companies accounting for 40% of Chinese home sales have also defaulted, below you can see the bonds and their ask price since defaulting. 7¢ on the dollar!

The result of the defaults has led to countless unfinished homes, home buyers paying for apartments they never received and of course, creditors left holding the bag.

Add to the worries, signs of deflation after the recent -0.3% YoY CPI print and you start to wonder if China’s economy is starting to show similar signs to that of Japan. I believe China has a number of structural issues which can’t be solved by a liquidity pump from the PBoC, but to ignore the fact that China has been, and will most certainly remain the centre of global growth alongside India would be ignorance.

As a consequence of the largely negative data out of Mainland China, the Yuan has suffered a great deal against the dollar. YTD the offshore Yuan has lost just under 6% against the greenback.

The Yuan has two exchange rates, offshore and onshore, here’s the main difference:

The onshore RMB (CNY) has buying and selling restrictions (capital controls)

The PBoC set a daily fix for the CNY, allowing it to trade +/- 2% for that day

This only circulates within Mainland China, hence the name onshore.

The offshore:

Free-floating exchange rate

No buying or selling restrictions

Used in foreign transactions

No central or regulatory control

This morning, the PBoC set its most forceful daily fix for the onshore Yuan at 7.2006, meaning that the Yuan has a soft ceiling at 7.3400 (2% from the central parity rate) if the CNY were to break this level that could warrant further aggressive action from both the PBoC in the form of intervention but also an increased demand for state-owned banks, like Bank of China, to sell more dollars on the spot market in exchange for both onshore and offshore Yuan.

Let’s take a look at the FX market.

This was the result of today’s strong fixing from the PBoC, a significant gap in price. That brings us to the question, what is the immediate future for the Yuan?

Let’s explore this.

For starters, the depreciation of the Yuan is accelerated by higher treasury yields. Higher yields on treasuries lead to a stronger dollar as capital flows to the dollar seeking to benefit from attractive returns. This pulls the dollar higher against its peers and also triggers capital outflows from Chinese markets, Chinese government bonds have experienced consistent capital outflows since Jan ‘22.

As you can see the direct relationship between bond yields and USD/CNH. So what does this mean? Well, next week Thursday Jay Powell heads off to the annual Jackson Hole meeting, where any hints of hawkish comments would result in a surge in bond yields as markets price in higher rates. The second-order effect would mean the PBoC has to step back into the ring with currency markets to defend the 7.37500 threshold which is being cited as the line the sand for the offshore rate.

Chinese markets are in a sticky situation, leaving policymakers and the central bank with a lot to juggle over the next few days, my expectations are for the central bank to implement a tighter central parity rate with state banks stepping up spot purchases of the Yuan.

Over the weekend I’ll personally be keeping an eye on any press releases or whispers of action from the PBoC.

I hope you enjoyed this detailed review of the current crisis.

As always I appreciate your readership.

Thapelo you’re currently the top referrer so a big shoutout to you! I appreciate the support, that goes to Punit and everyone else on the leaderboard as well!

If you’d like to get MMHPro, consider sharing with 3 friends for a month free?