The Great Demise: Interbank Market

Understanding the Interbank Market: The Decline of Bank-to-Bank Lending Since the Global Financial Crisis and Its Implications for Financial Stability

Hey guys,

Apologies, Substack didn’t send out the full report earlier today, so here it is.

Going into the depths of the funding markets is an area of the markets one must understand to truly know the mechanics of this great financial system.

Enjoy.

Deconstructing the Interbank Money Market

The interbank lending market, aka interbank money market, is not widely discussed in mainstream finance media. There’s one main reason why in my opinion, it’s deep complexities. The interbank money market is a highly liquid global market where banks and shadow banks can borrow from each other to meet liquidity needs.

Firstly, to understand the structure, importance and changes within the interbank lending market, we must revisit the market crisis of 2008.

The global financial crisis of 2008 highlighted the crucial role of interbank lending markets in the financial system and wider economy. The collapse of large institutions Bear Stearns and Lehman Brothers revealed one thing, in times of crisis the interbank lending market becomes an important channel of contagion. The collapse of two banks instantly shocked the money markets, market rates for lending rallied through the roof whilst transaction volume significantly decreased. As with anything, the level of distress in money markets caused credit supply to the non-financial sector to drop substantially, effectively tightening financial conditions for the wider economy, resulting in the highest levels of unemployment last seen in the 80s and recently during COVID-19.

The consequences for the financial sector was an array of strict, and tough regulations mainly brought upon the banking sector to mitigate the event of another ‘liquidity crisis’.

Regulations such as the Basel III came into effect post-GFC in 2009; its main function was to discourage systemic risk and leverage with markets.

As always, I aim to break down the complex jargon into simple layman’s terms to make reports easily digestible, so let me explain what is meant by systemic risk.

Now, systemic risk is the dark side of having a deeply interconnected financial system. It’s the risk that a problem in one part of the financial system could spread to other parts and financial players causing an '08-like collapse. Contagion risk. A term you should be familiar with.

During the GFC, subprime mortgages were at the heart of the systemic risk, and these unworthy credit instruments were widely adopted by financial institutions, meaning one blow-up led to a widescale blow-up of subprime mortgage portfolios across the street.

What purpose does the interbank funding market serve?

As the name suggests, this market provides immediate access to short-term liquidity requirements.

How?

Through money markets. Money markets offer two forms of lending: secured and unsecured. Secured lending, such as repurchase agreements (repos), is collateralized, while unsecured lending is not.

New regulations have disincentivised banks, especially systemically important banks (SIBs) such as JPM, and Citibank, from lending to each other, leading to a decline in bank-to-bank lending.

As you can interpret from the chart, the collapse of Bear Stears and Lehman sent ripple effects throughout the financial system which systematically changed the risk appetite for interbank lending forever.

On the other hand, the repo market has seen an increase in transactional volume as non-banks absorb the risk banks once took.

“the interbank market plays crucial roles in domestic financial systems because first, central banks intervene in this market to guide policy interest rates, and second, efficient liquidity transfer can occur between surplus and needy banks through a well-functioning interbank market”

— ECB, The interbank market puzzle report

This excerpt highlights the importance of the money market, which central banks use to implement monetary policy. By engaging in repurchase agreements (repos) to inject liquidity or reverse repos to withdraw liquidity, the Federal Reserve plays a significant role in shaping credit conditions via money markets.

Between the two forms of lending (unsecured and secured), the repo market (secured) generates the largest volume of transactions due to its greater liquidity and a wider range of market participants including banks, MMFs, government-sponsored entities (GSEs) and of course lower risk. So when looking deeper at the world of collateral two things are clear, the availability and quality of collateral are vitally important.

Following on, it’s equally important to know what factors affect the availability of collateral and SOFR rates, which is the rate for secured overnight borrowing. From a policy perspective, the Fed’s OMO (Open Market Operations), QE & QT are the main factors which could affect the stability of the interbank market.

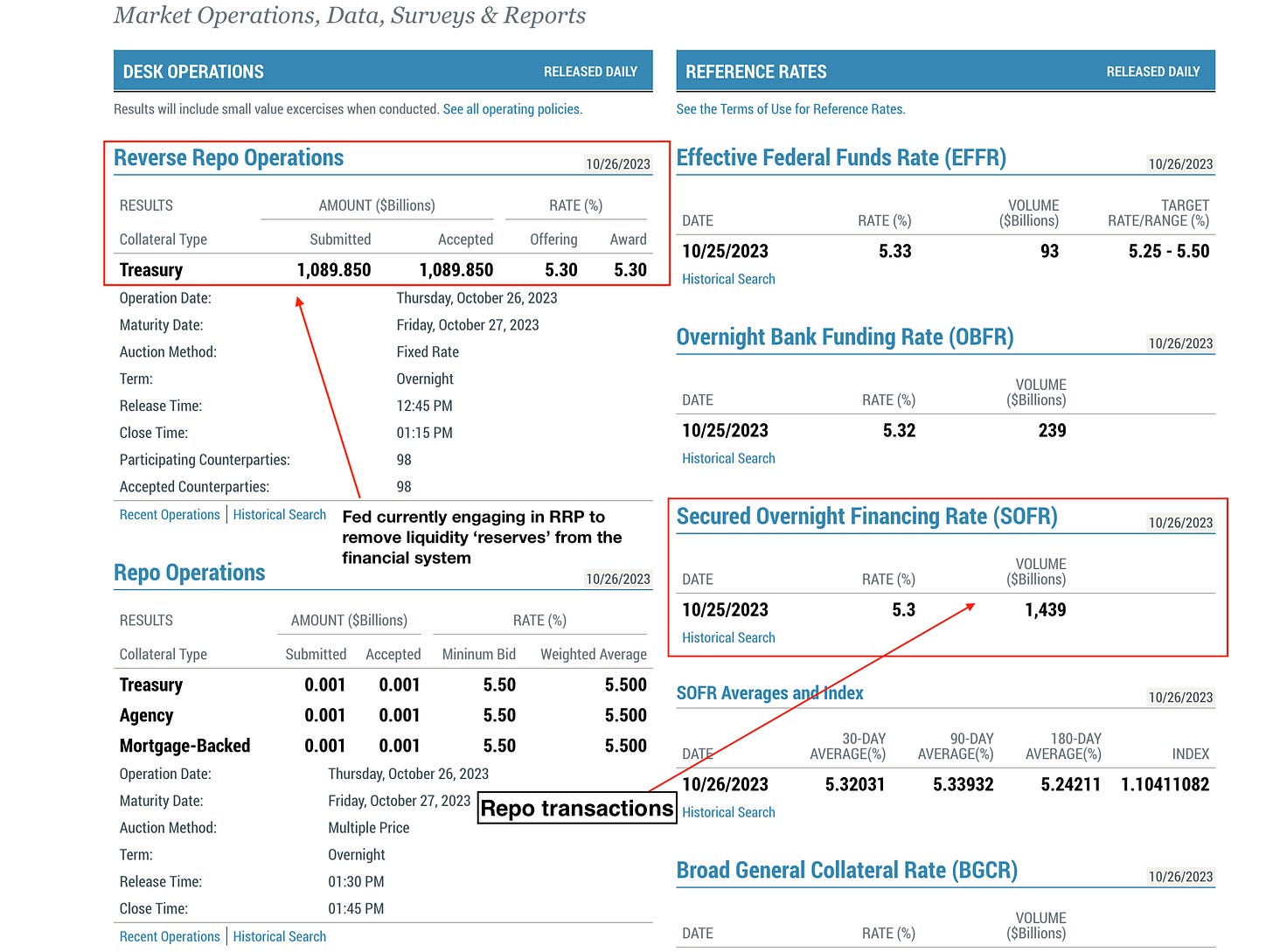

The data dashboard above first signifies the size and depth of the secured overnight funding market (repo market) when comparing the daily volume to that of the OBFR and EFFR, which are both unsecured overnight funding markets.

In the top left corner, I have highlighted the reverse repo operations that the New York Fed has been conducting to reduce liquidity in the financial system as the Fed rolls off securities from its balance sheet as part of its quantitative tightening program (QT). During quantitative tightening programs, the Federal Reserve Bank of New York's market dashboard will typically show the Fed accepting propositions to loan out reserves, as illustrated by the chart above. This is usually where people get slightly confused, as during QT, the aim is to drain reserves not supply them right?

Yes, but a key part of the reverse repo facility is that the money market fund will have to purchase the collateral, usually US treasuries, from the Fed after the duration of the loan at a higher rate— resulting in a net reduction in reserves from the financial system.

From this report, I hope to have explored the progression of the interbank market from the GFC crisis and explained the relationship between monetary policy and the overnight financing rates. As broken down in this report, the extensive regulation has pushed banks away from the lending market to avoid systemic risk whilst attracting the likes of shadow banks. The interbank market has many more moving parts and complexities which I aim to break down for you; as for now, I hope you enjoyed this rather educational insight into the interbank world.

Thanks for reading until the end; as always if you found this report insightful I’d appreciate you sharing this publication with your colleagues, friends and network!

Until next time