The Global Macro Outlook: Q2 Update

10,000ft view of macro, financial conditions & policy outlooks for DM Central Banks

Hey guys,

It’s Q2.

This report is a deep dive, thanks for your patience.

We take a 10,000ft view on global markets, financial conditions and the dominant macro-trends framing our perspective, as such enjoy our review of:

United States economy

The Europe Update

China’s inflection point

Japan’s positioning

US Economy

Stronger Than You Think

Our economic and market update for the U.S. starts by reflecting on previous narratives that persisted much throughout 2023 and how far off from reality the majority of Wall St and independent analysts were.

Flash back 21 months. The 2s10s yield curve inversion dominated financial headlines, especially on Fintwit. This inversion, often a recessionary signal, sparked a flurry of analysis – myself included. The burning question: What's the lag time? History suggested a downturn was inevitable, especially with a potential 3m/10y inversion looming. But we were wrong.

The U.S. economy defied expectations, demonstrating remarkable resilience. Inflation peaked and then on a sustained downward trajectory, settling near the Fed's 2% target. Remarkably, the unemployment rate remained below 4%. Larry Summers, the former U.S. Treasury Secretary and economic heavyweight, had a different take in the summer of '22. He argued that taming inflation required…

“two years of 7.5 percent unemployment or five years of 6 percent unemployment or one year of 10 percent unemployment”

— Larry Summers, Economist & former U.S Treasury Secretary

The narrative shifted dramatically. Inflation steadily eased, the unemployment market received a boost from a positive immigration flow. Wage inflation cooled, and a resurgence in U.S. supply chains added another layer of positive momentum.

Figure 2 is a measurement used in PMIs to gauge the speed of deliveries from suppliers to customers, reflecting the prevailing trend in how long it takes for businesses to revive their orders from vendors. The Suppliers' Delivery Times Index (SDTI) serves as a key indicator of supply chain health. A reading above 50 suggests faster delivery times for a greater proportion of businesses, signifying reduced backlogs and delays. Conversely, a value below 50 suggests that more businesses are experiencing delays and slower delivery times which clogs up the supply chain from the producer level to the end user.

Since April 2023, both the US ISM manufacturing PMI and Taiwan manufacturing PMI have been on a recovery which has eased inflationary pressures within the U.S. Taiwan’s importance to global trade is significant, as the world’s leading semiconductor manufacturer, Tawainese manufacturers have built a deeply integrated tie into global supply chains, assisting the development of a range of electronic products assembled worldwide. So, slower supplier deliveries from Taiwan have ripple effects across the globe.

Economic Strength Casts Delays for Fed Cut

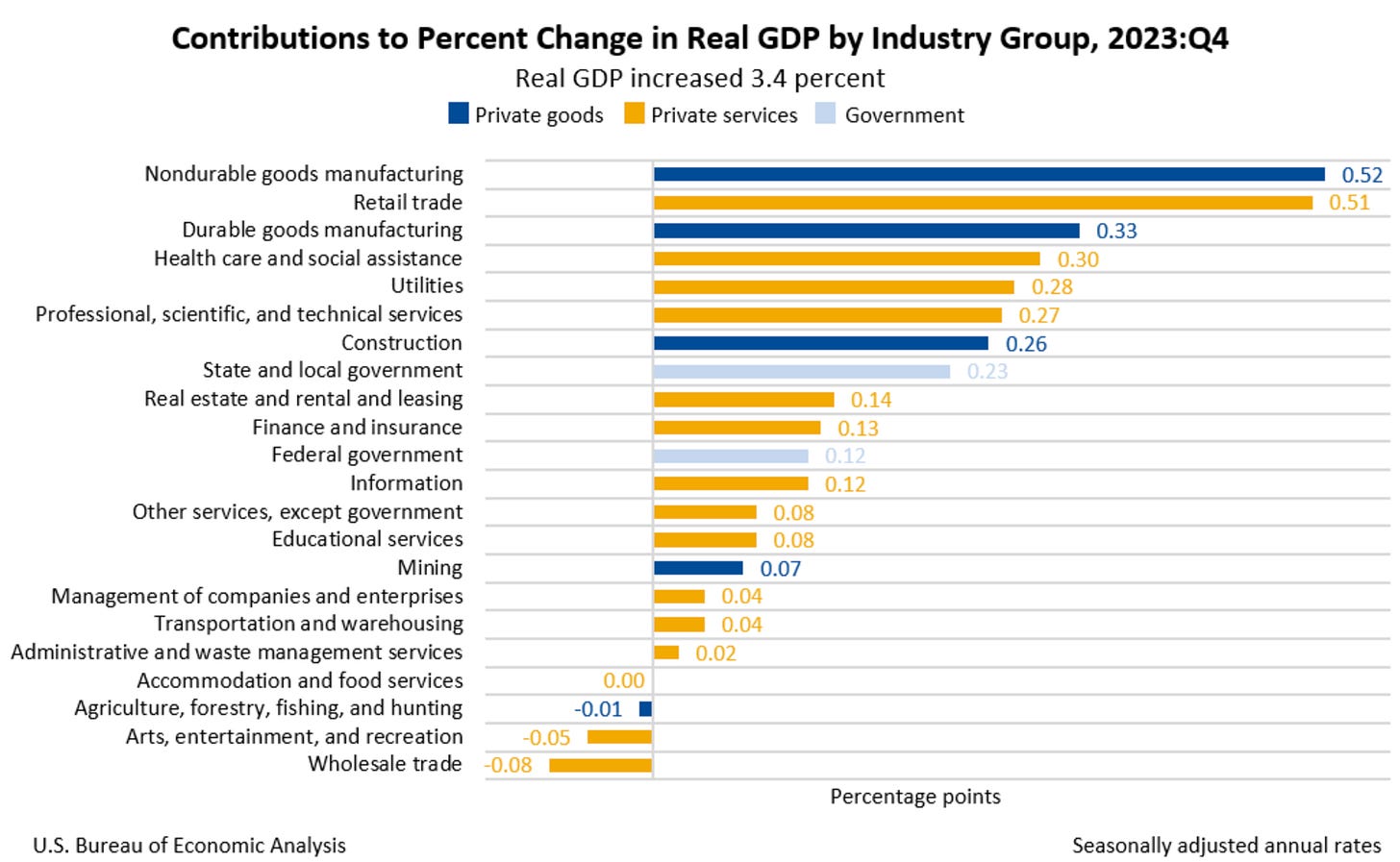

Real GDP growth increased 3.4% in Q4 of 2023, an upward revision from the 3.2% preliminary figure.

One key factor for economic growth that we underestimated, was the significance of fiscal stimulus. The Biden administration embarked on the largest expansion of the fiscal deficit (outside of a recession) in over five decades. This largess has trickled into the real economy stirring up real demand amongst businesses and consumers. When monetary and fiscal policy fail to act in unison you get economic disconnection and disfunction, much of what we’re seeing today.

Economic theory tells us that as inflation rises, interest rates must rise subsequently to curb unsustainable inflation in the economy. As rates increase we expect to see looseness in labor markets, demand for durable goods and liquidity in financial markets dry out. However, what we’ve seen in reality is much of the opposite, demand for durable goods has increased, the labour market has tightened with JOLTS showing a level of excess demand for labor and financial markets have been in a bull market. All whilst rates sit at 5.25%.

Forward Outlook & Potential CRE Headwinds

The Federal Reserve's monetary policy path remains intricate. They must carefully navigate ongoing economic data to mitigate potential inflationary pressures without hindering economic growth by keeping interest rates restrictive for an extended period.

As Figure 4 shows, the market is expecting anywhere between 6/7 cuts for the Fed and its DM counterparts leading into 2026. Much like the second half of 2023, we expect continued US economic dominance with the Fed cuts reducing potential headwinds of economic fragmentation in specific rate-sensitive parts of the economy, namely commercial real estate. Even commercial real estate, as the largest headwind for the US, has a rather limited level of risk for the States, for smaller banks CRE debt makes up c.28% of their assets whilst amongst SIB (systematically important banks, banks with >$250bn) CRE loans only account for 6.5% of assets.

Now, as long as deposit flow remains consistent and controlled this brewing CRE storm will be sustained by these non-SIBs.

Europe Outlook

There’s Hope For Europe

Resilience is one word we could use when discussing Europe, even though they sit in a ‘mild’ recession, the European economy against all odds, has escaped severe economic headwinds ranging from insecurity in energy prices from the Russia-Ukraine war, to struggling manufacturing sector data and weak demand for factory goods.

President Lagarde has been rather persistent in her message of Europe being on the “disinflationary process” and “are making process” but still remains “not sufficiently confident” in the data to cut rates, as said during the ECB press conference on March 7th. According to the ECB

“Headline inflation was projected to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026”

—ECB March 7th Press Accounts

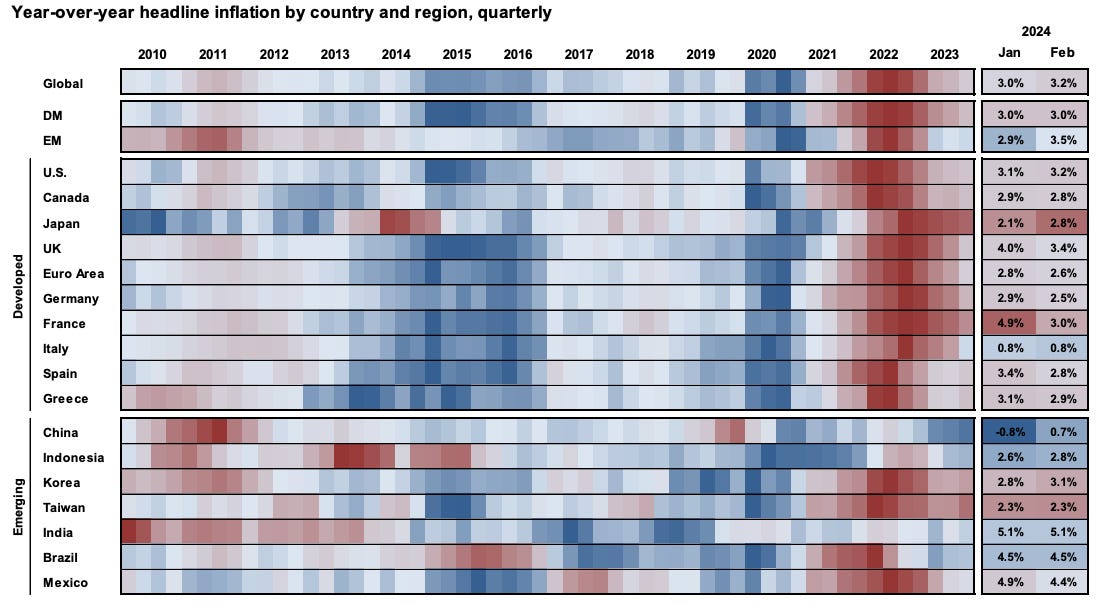

Take a quick scan of global inflation and you’ll notice the disinflationary trend of Euro member countries, countries like France have seen inflation fall from 4.9% earlier in January to 3.0% in February.

Europe has also benefitted from the strong risk-on sentiment in global markets as the BTP-bunds sovereign spread has narrowed significantly from October 2023 when the BTP-bund spread was 210bps, now the spread is 71bps lower.

As a reminder, this spread here acts as a gauge of investor confidence in Italy’s economy, the wider the spread, the less confidence investors have in Italy’s fiscal health. Wider premiums increase fragmentation risks amongst the Euro Area crippling the ECBs ability to effectively steer monetary policy for all members.

The Euro Area composite PMI recovered to the expansionary level of 50.3, the highest level in 10 months. The increase was largely driven by the services sector with stable demand signs seeping through the economy. Unfortunately, weak demand and high energy prices, relative to long-term averages continue to weigh on European industrial activity and output, China’s economic woes aren’t helping Europe’s manufacturing picture, however, our view of China’s economic situation is reaching an inflection point, we outline this viewpoint later in this report.

Currency Outlook:

Neutral/Bearish

Rate differentials continue to weigh in on the Euro as the year unravels; the Euro has traded within a 300 pip range from the year open to now, and as both the ECB and Fed move policy in lockstep I expect further weakness in the Euro relative to the dollar as both normalise policy rates.

With minimal divergence in forward central bank monetary policy for the two economies, the markets are presented with minimal reasons to trade the Euro against its current bearish trend. As it stands we do not see a reason for the Euro to trade above the year open of 1.10 given the current economic standing of the continent. As always, we continue to monitor the data out of the region, so we remain responsive to changes in our perspective and outlook.

China Outlook

Cyclical Upturn Ahead: Cautiously Bullish

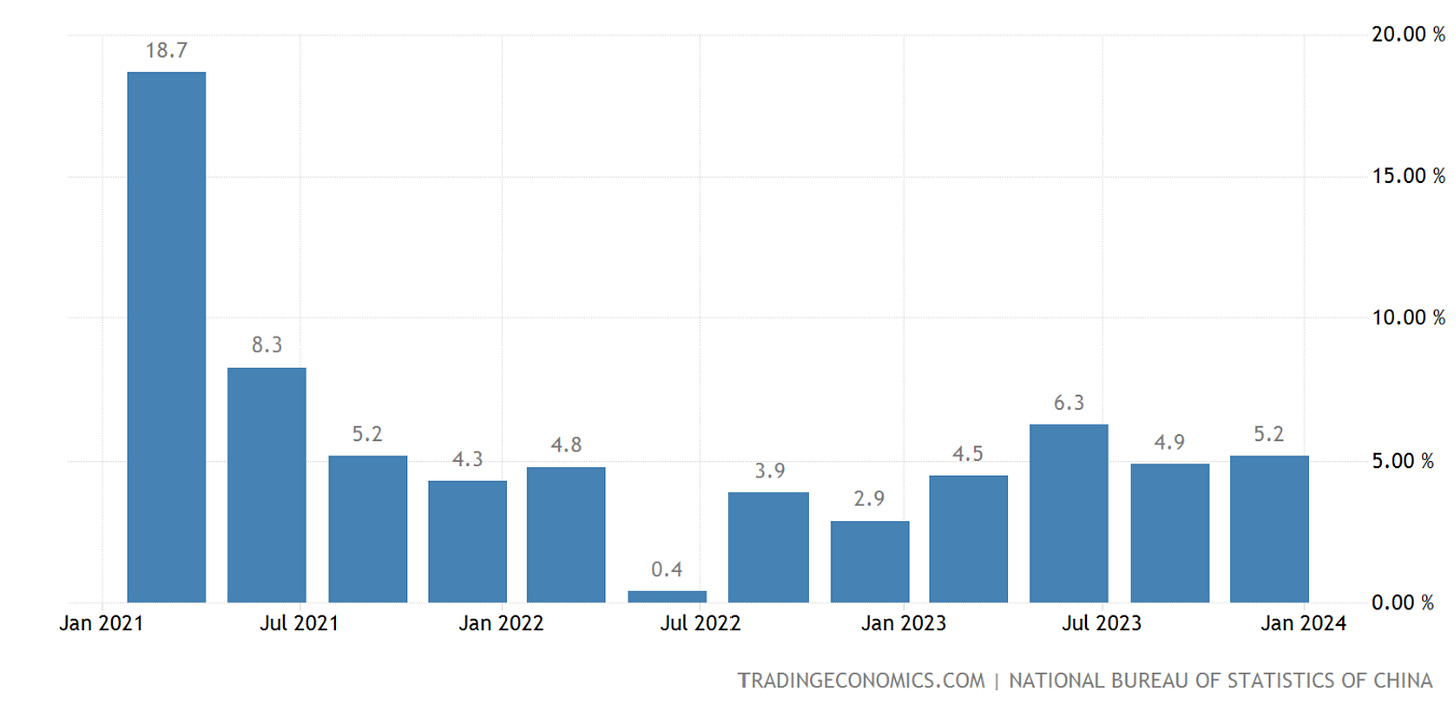

China's near-term economic outlook appears promising, although long-term challenges remain. The economy achieved a respectable 5.2% growth rate in Q4 2024, surpassing the government's target of 5%.

Our analysis suggests the economy may be nearing the bottom of the current cycle. While lacklustre consumer demand, negative foreign direct investment (FDI) flows, and weak capital markets remain key concerns, we observe early signs of a potential turnaround. Specifically, the industrial sector is exhibiting some signs of strengthening.

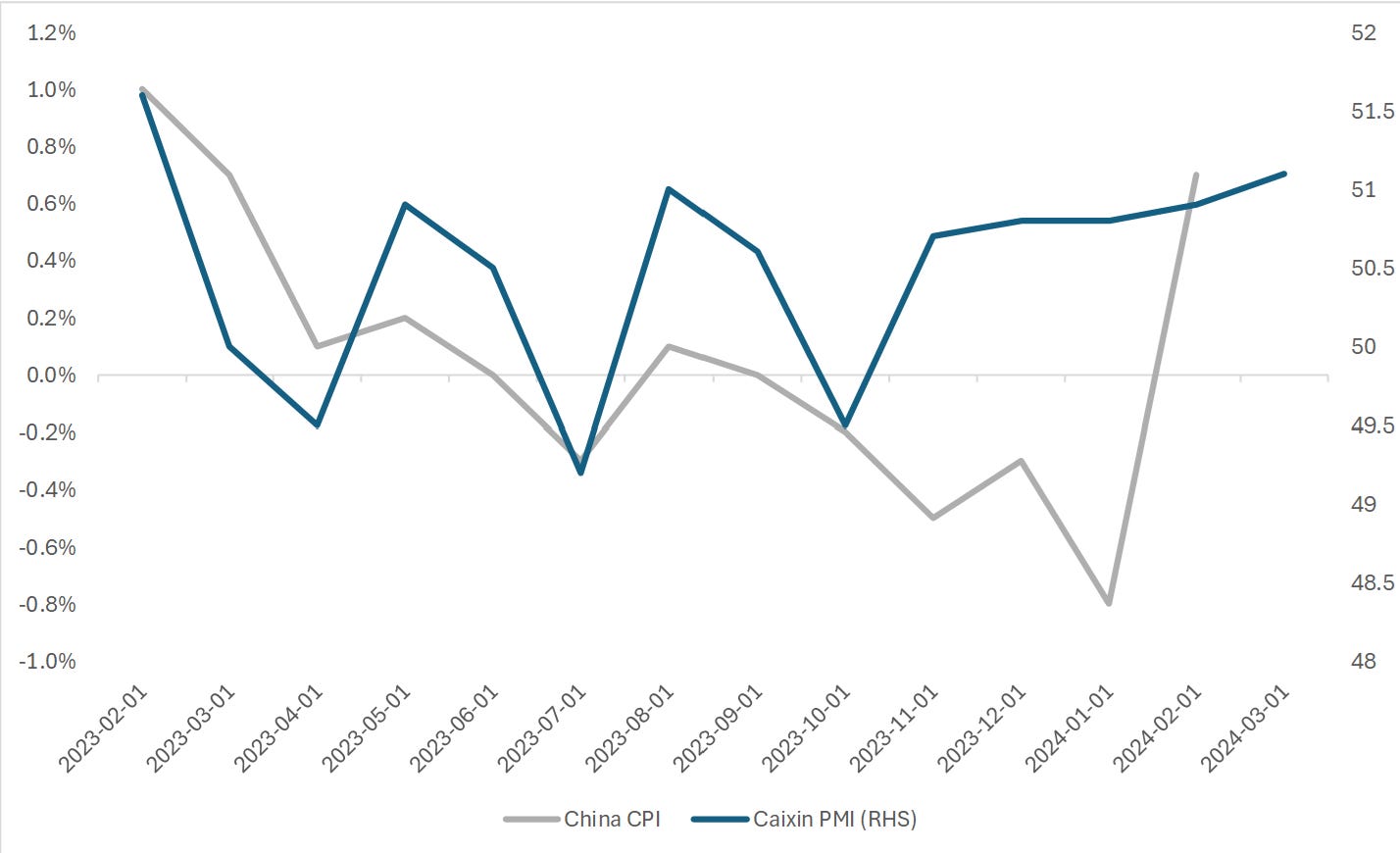

China's recent economic data offers mixed signals. Inflation, which previously dipped into negative territory, has rebounded to 0.7%. This uptick stems primarily from price increases in Education, Culture, and Recreation (3.9%) and Healthcare (1.5%).

On a brighter note, the Caixin PMI, a manufacturing index that better reflects activity among small and medium-sized enterprises (SMEs), continued its upward trend. It rose to 51.1 in March, up from 50.9 in February, indicating expansion in the manufacturing sector.

In addition, the official manufacturing PMI, the measure that encompasses larger and state-owned enterprises, has turned expansionary from 49.8 in February. The main contributors included the production component, which rose from 49.8 to 52.2, and new orders, which jumped from 49.0 to 53, all signalling better prospects for the future.

Capital Flight Poses Headwinds To Capital Market Strength

Instantly your eyes would be drawn to the large decline in PBOC reserves between 2015 and 2017. Foreign exchange reserves fell $512.66bn in 2015 to $ 3.33 trillion, the large decrease in reserves came as the PBOC attempted to stabilise the Yuan after its surprise devaluation that panicked markets. To rejig your memory, on August 11, 2015, the PBOC surprised markets with three consecutive devaluations of the Chinese Yuan (CNY) knocking over 3% off its value.

Investor jitters intensified in 2015 and 2016, leading to a surge in capital outflows. Investors sought the safety of stable currencies, further weakening the Yuan. This triggered concerns that the PBOC was depleting its reserves (bank liquidity) to prop up the currency, adding to the pressure on Chinese markets and fueling a sustained capital flight.

In 2023, we saw a similar decline in reserves as the PBOC once again intervened in the Yuan after it reached a 16-year low. This highlights one of the major challenges facing a potential Chinese economic recovery in 2024: persistent negative sentiment continues to drive capital out of the country.

Another challenge the Chinese government faces is the ever-increasing, off-balance-sheet local government debts. Estimated at 66 trillion outstanding, the local government financing vehicle debt, or LGFV debt, poses a credit risk as local governments are doing everything they could to avoid the default crisis. A crisis, if triggered, would be a GFC-level catastrophe for China.

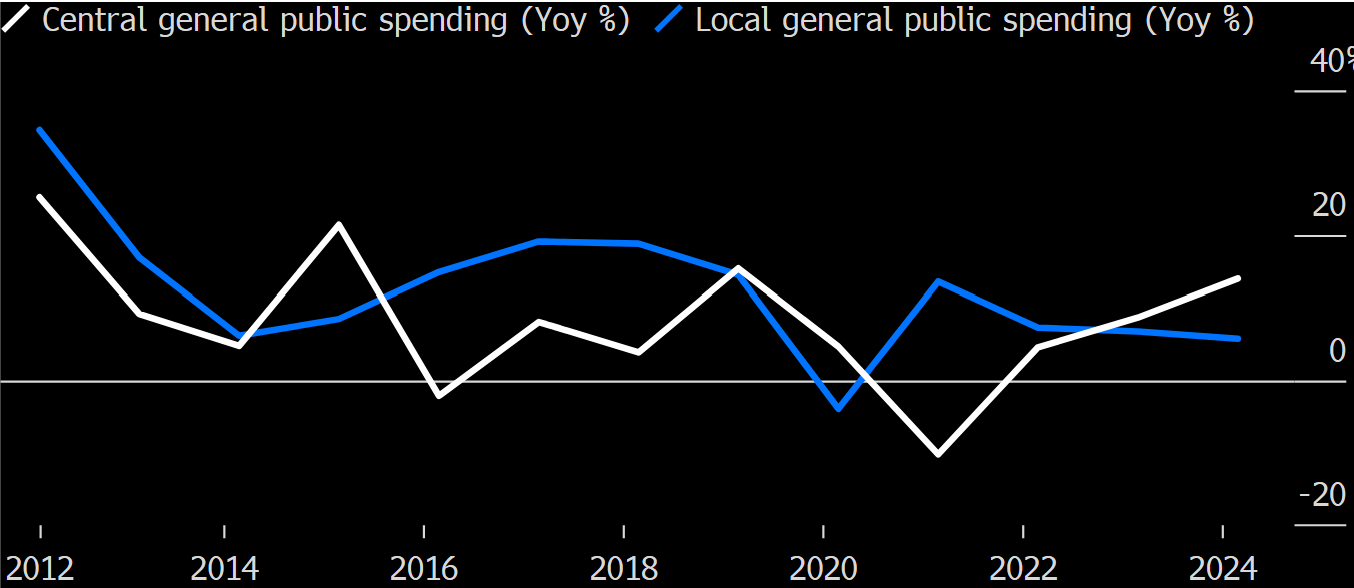

The central government in China is also doing their bit. By swapping the hidden, off-balance-sheet LGFV (Local Government Financing Vehicle) debts into government bonds, they are deemed safer and it is term borrower-friendly. In the first two months of 2024, governments have stepped up their spending to “diffuse“ the LGFV ticking time bomb. Its general public expenditure jumped 14% from a year earlier to 482.8 billion yuan ($66.8 billion) in January and February combined, the fastest pace for the period in five years.

The central bank might be helpful, too. An old speech by President Xi resurfaced recently, saying that “(PBoC may) gradually increase the buying and selling of government bonds“, pointing to the possibility of central banks conducting quantitative easing and absorbing a portion of government debts, possibly to diffuse the hidden debt problem.

This came in stark contrast with the traditional position taken by the Chinese authority, who always dismissed QE for its “moral hazard“ and “reputational impacts on monetary authority“.

At the end of the day, a robust recovery in 2024 hinges on positive developments across several key areas. While encouraging signs in domestic demand, industrial activity, and export growth would be welcome, they alone might not suffice. The focus remains on the CCP to unveil a significant stimulus package that can:

Backstop and put a bandage on the property sector crisis, and subsequently its mounting debt burden

Stimulate economic activity, particularly among Chinese consumers

Japanese Economy

Post-Negative Regime Remains Solid, But There Are Risks

The Bank of Japan has officially ended its YCC policy, while also signalling its intent to continue with a supportive financial environment going forward.

The decision, approved by a vote of 7-2 by the bank’s board, introduces a new policy rate spectrum from 0% to 0.1%, moving away from the prior -0.1% short-term interest rate. Additionally, the Bank has ceased its sophisticated yield curve control strategy, committed to ongoing procurement of long-term government bonds as necessary, and halted its exchange-traded funds’ purchasing program.

Though officials recognise the yen's deviation from fundamental values and have vowed to undertake corrective measures, the currency still hovers near a three-decade nadir.

Expectations for the Bank of Japan to raise interest rates are priced for this October, though the specific timing is still uncertain, and it is expected to be a gradual process to significantly close the country’s broad yield differential with its global counterparts.

Japan Rebound and BOJ Policy

Japanese equities have regained favour within the institutional portfolio, outperforming their Western counterparts. However, the BOJ’s recent hawkish shift towards potential policy normalisation could dampen the expected continued growth in Japanese stocks.

Yen's Two-Sided Impact

The weakening Yen benefits Japanese exporters by making their goods cheaper overseas, but it burdens domestic consumers facing rising import costs. The Ministry of Finance (MOF) has signalled its close watch on the Yen's exchange rate as it floats around the 152.00 level, potentially hinting at intervention around the 152.00-155.00 mark.

Japan's Unique Trajectory

Contrary to traditional economic theory suggesting a weaker currency boosts exports, Japan hasn't seen a significant increase in inflation-adjusted exports. This underscores Japan's unique economic and policy position as a developed market central bank potentially raising rates later this year, while others are embarking on cuts.

Yen Trade Caution

Given the Yen's proximity to previous intervention levels and the uncertainties surrounding MOF intervention, the short Yen trade currently lacks strong conviction, as previously discussed in our reports— crowded trade usually presents minimal alpha.

That’s a wrap for now.

Thanks for getting to the end of this report, a much needed deep dive into markets.

We’ll be doing a currency focused piece for you all next week so stay on the look for the report.

with a country engaging in these intervention isn't it interesting that investors and market participates are still able to negate the facade of these operations if the economy faces serious headwinds. why are these practices engaged if the results are sometimes short lived as oppose to just remaining focused on longer term pivots/ solutions?